- Why Risk Visibility Has Become a Board-Level Priority in Australia

- Types of Risk Management Software Australian Enterprises Can Leverage

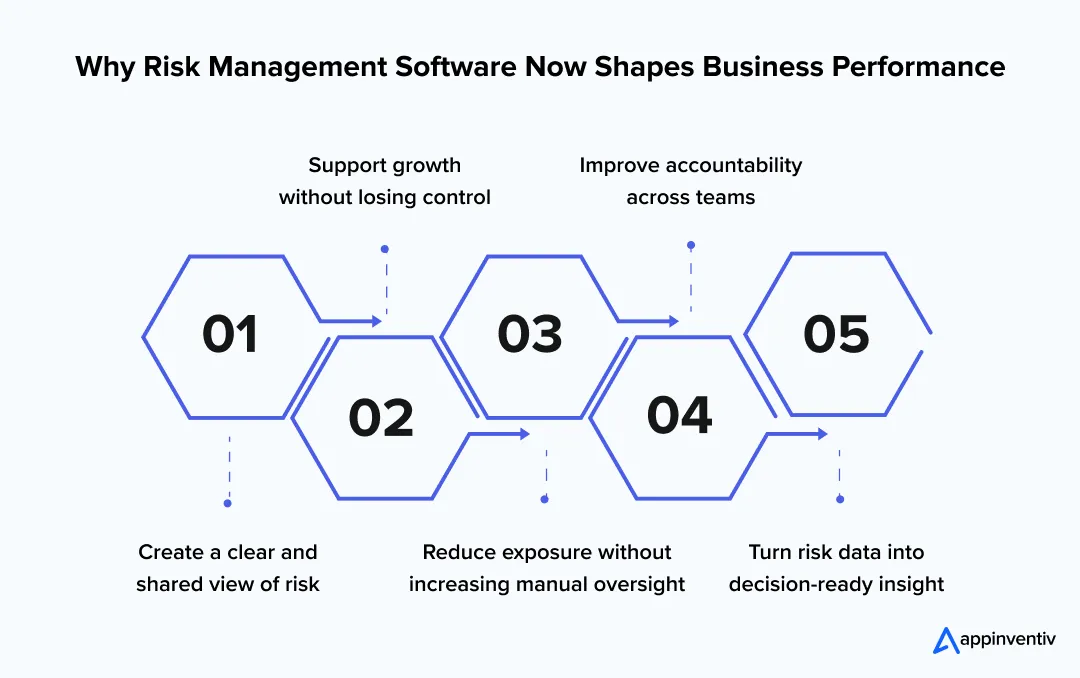

- Understanding the Benefits of Risk Management Software for Australian Businesses

- Create A Clear And Shared View Of Risk

- Reduce Exposure Without Constant Manual Effort

- Support Growth Without Losing Control

- Improve Accountability Across Teams

- Turn Risk Data Into Usable Insight

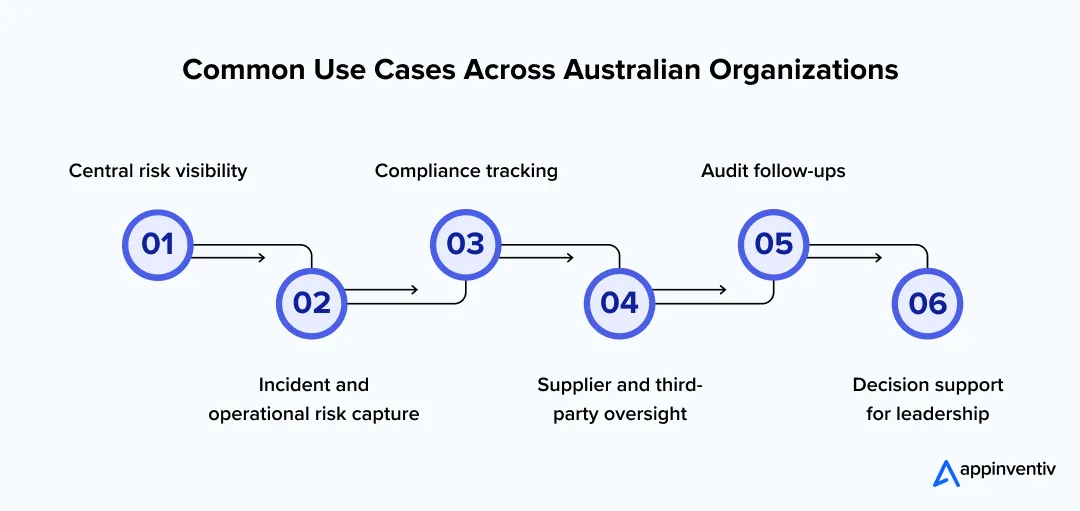

- Where Risk Management Systems Show Their Value in Australian Organizations

- Central Risk Visibility

- Compliance Tracking

- Incident And Operational Risk Capture

- Supplier And Third-Party Oversight

- Audit Follow-Ups

- Decision Support For Leadership

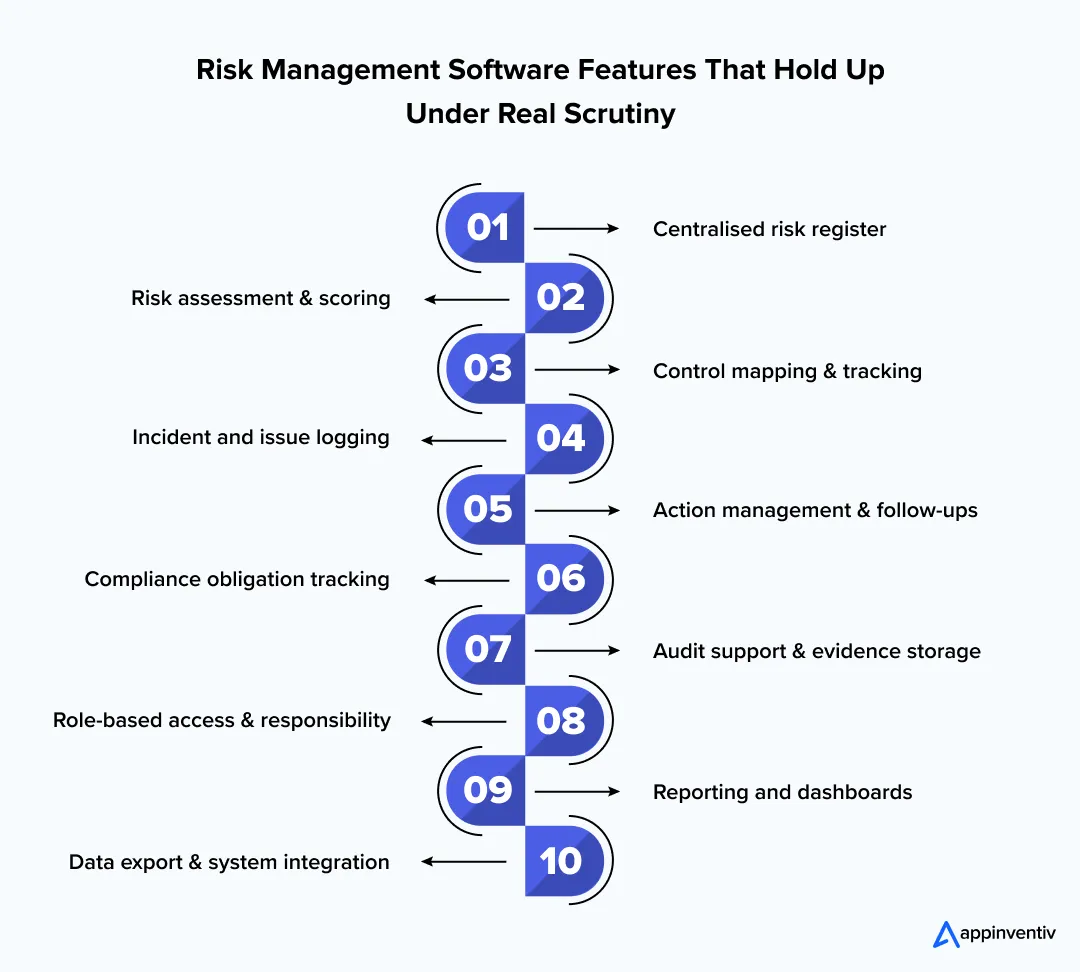

- Features That Decide Whether Risk Management Software Actually Works

- Capabilities That Matter When Risk Management Reaches Enterprise Scale

- Understanding the Cost of Building Risk Management Software in Australia

- Typical Cost of Risk Management Software Development in Australia

- Ongoing costs businesses should plan for

- What organizations typically gain:

- How to Develop Risk Management Software in Australia: Understanding the Process

- Business Discovery And Australian Risk Context Alignment

- Risk Workflows And System Mapping

- Architecture And Governance Design

- User Experience And Practical Usability Design

- Core System Development And Business Integrations

- Testing Against Real Regulatory And Operational Pressure

- Deployment And Controlled Rollout

- Monitoring And Continuous Improvement

- Scaling With Business Growth And Regulatory Change

- Managing Development Challenges That Often Surface Mid-Project

- System Integration Complexity

- Security And Governance Expectations

- Budget Pressure And Shifting Scope

- User Adoption And Behaviour Change

- Data Migration And Business Continuity

- Measuring ROI From Risk Management Software in Australian Organizations

- Where The Return Actually Comes From

- Typical Payback Timeline In Australia

- What ROI Looks Like In Practice

- The Real Measure Of Value

- Future Shifts That Will Redefine Risk Management in Australia

- Risk Systems Will Move From Monitoring To Intervention

- Continuous Signals Will Replace Periodic Reviews

- Risk Visibility Will Extend Beyond The Organization

- Responses Will Be Triggered By Events, Not Reports

- Technology Will Fade Into The Background

- Why Australian Organizations Choose Appinventiv for Risk Management Software

- FAQs

Key takeaways:

- Risk management in Australia has become a daily governance priority, not a periodic compliance task.

- Fragmented tools slow decisions; connected systems restore visibility and control.

- The right software choice depends on organisational fit, not feature volume.

- ROI comes from avoided risk, cleaner audits, and time saved, not direct revenue.

- Costs vary by scope, scale, and integrations, with ongoing investment required.

- Future systems will focus on early signals, real-time action, and quiet reliability.

Risk management in Australia is no longer a back-office function. For enterprise leaders, it has become a daily operational concern shaped by APRA oversight, ASIC expectations, industry audits, and growing exposure across digital, supply chain, financial, and compliance risks. What once lived in static registers and spreadsheets now needs to operate in real time across teams, systems, and jurisdictions.

Most organizations are not struggling because they lack risk awareness. They struggle because their tools cannot keep up. Risk data sits across disconnected systems. Controls are tracked manually. Reporting cycles lag behind actual exposure. When leadership asks simple questions about risk posture or compliance readiness, the answers take days instead of minutes. That gap is where risk management software in Australia starts becoming a strategic discussion rather than a purely technical one.

For Australian businesses, this challenge is intensified by local realities. Regulatory requirements vary across industries like banking, construction, healthcare, mining, and energy. State-level obligations add another layer of complexity. Many teams rely on generic software for risk management that was never designed around Australian governance models or local reporting expectations. As organizations grow, these limitations surface quickly.

This is why more leaders are turning to enterprise risk management software that aligns with how their organizations actually operate. Not as a compliance checkbox, but as a connected system that links risk identification, assessment, controls, audits, and reporting into a single, consistent view. When implemented properly, risk management systems in Australia help leadership move from reactive issue handling to confident, informed decision-making.

In this guide on how to develop risk management software in Australia, we break down what the process looks like in real operating environments. From defining scope and architecture to understanding development cost and long-term ROI, the focus stays on the decisions Australian organizations must get right early. No abstract frameworks. Just a practical view of building software that stands up to regulatory scrutiny and real operational pressure.

If your teams are still managing exposure across spreadsheets, legacy tools, or disconnected systems, it may be time to rethink the foundation.

Why Risk Visibility Has Become a Board-Level Priority in Australia

Risk in Australian organizations no longer sits quietly in reports reviewed once a quarter. It shows up in regulatory reviews, supplier disruptions, cyber incidents, and operational breakdowns that move faster than traditional controls can respond to. Leadership teams are being held accountable not just for identifying risk, but for demonstrating how it is actively monitored and managed day to day.

This pressure cuts across industries. Banks and insurers face ongoing APRA scrutiny. Construction and infrastructure firms operate under heightened safety and delivery risk. Healthcare and energy organizations manage strict compliance obligations while relying on complex digital systems. Add third-party vendors, remote teams, and cloud platforms into the mix, and risk becomes harder to contain within isolated processes.

The shift in investment patterns makes this clear:

- Organizations want live risk data instead of static registers

- They need early signals, not post-incident explanations

- They expect clear ownership across teams, not risk sitting with one function

As a result, Australian businesses are reassessing the systems that support these decisions. Generic tools built for broad markets struggle to reflect local governance, reporting expectations, and operational nuance. Purpose-built risk management software gives leadership a clearer line of sight into exposure, controls, and accountability, without waiting for audits to surface issues.

The real question facing Australian organizations is not whether risk will increase. It is whether their systems are built to reveal it early enough to act with confidence.

Types of Risk Management Software Australian Enterprises Can Leverage

Risk does not show up the same way in every Australian business. A bank worries about regulatory breaches and capital exposure. A construction firm worries about site safety, contractors, and delays. A healthcare provider worries about compliance, data access, and clinical risk. Trying to manage all of this through a single generic tool usually creates more confusion than clarity.

That is why many organizations stop looking for “one platform that does everything” and start looking at systems that support specific risk responsibilities. The goal is not complexity. It is fit. When the system matches how teams already work, risk management becomes easier to maintain and easier to trust.

Below are the most common types of risk management software used across Australia, and how organizations use them in real settings.

| Type | What it supports | How it is used day to day |

|---|---|---|

| Enterprise risk management systems | Oversight of strategic and operational risks | Leadership teams track key risks, assign owners, and review changes before issues escalate |

| Compliance risk management software | Regulatory and policy obligations | Teams map laws, standards, and internal policies to controls and review gaps before audits |

| Audit and risk management software | Internal audits and assurance activity | Audit teams plan reviews, record findings, and follow up on actions without chasing emails |

| Operational risk tools | Incidents, failures, and near misses | Teams log events as they happen and identify patterns that lead to repeat problems |

| Supply chain risk management software | Vendor and dependency risk | Procurement teams assess supplier reliability, continuity risk, and contract exposure |

| Industry-specific risk systems | Sector-driven risks | Construction, healthcare, and energy firms manage safety, asset, or compliance risks tied to their operations |

What is changing in Australia is not the need for risk management. That has always existed. What has changed is the expectation that systems should reflect reality. Leaders want visibility without digging through reports. Teams want clarity without extra admin. Regulators want consistency without manual workarounds.

Choosing the right type of system is less about features and more about alignment. When the software fits the organization, risk management stops feeling like a parallel task and starts becoming part of how decisions are made every day.

Understanding the Benefits of Risk Management Software for Australian Businesses

Most Australian organizations manage risk across far more moving parts than they realise. Operational risk, compliance risk, vendor risk, financial exposure, and audit obligations often sit in different tools, owned by different teams, reviewed at different times. Nothing breaks loudly. Instead, gaps grow quietly until an audit, incident, or regulatory question brings them into focus.

This is why risk management software development in Australia is increasingly treated as core infrastructure, not a support function. Businesses are no longer trying to document risk after the fact. They are building systems that help them see, prioritise, and act before issues escalate. When risk management is embedded into daily operations, it stops slowing decisions down and starts strengthening them.

Below is what risk management software actually changes at a business level.

Create A Clear And Shared View Of Risk

When risks are tracked in spreadsheets, emails, and siloed tools, leadership rarely sees the full picture. Risk management systems in Australia bring risks, controls, and ownership into one place. Teams work from the same information. Reviews become faster. Decisions are made with confidence instead of assumptions.

Reduce Exposure Without Constant Manual Effort

Many risks grow because they are checked too late. Compliance gaps, control failures, and operational issues often surface during audits rather than before them. Compliance risk management software helps teams monitor obligations continuously, reducing last-minute fixes and audit stress.

Support Growth Without Losing Control

As organizations expand, risk does not scale evenly. New vendors, locations, systems, and regulations introduce complexity that manual processes cannot handle. Enterprise risk management software in Australia allows businesses to grow while keeping visibility over what matters, without multiplying reports or review cycles.

Improve Accountability Across Teams

Risk ownership often fails because it is unclear. Who is responsible? What needs action. When it is due. Audit and risk management software makes accountability visible. Actions are tracked. Follow-ups are clear. Risk stops living with one function and becomes shared responsibility.

Turn Risk Data Into Usable Insight

Every incident, control review, and audit finding tells a story. Software for enterprise risk management helps leadership spot patterns early, whether in supply chains, operations, or compliance areas. Decisions shift from reactive fixes to informed prevention.

Where Risk Management Systems Show Their Value in Australian Organizations

Risk management software is not adopted because a policy says it should be. It gets adopted when existing ways of working start to fail. Usually quietly at first. A missed control. A delayed response. A question from a regulator that takes too long to answer.

In Australia, those moments are becoming more common. Organizations are operating under tighter scrutiny, with more moving parts and less tolerance for uncertainty. When risk management systems move into daily use, their value becomes obvious in how people work, not in how reports look.

Below are the areas where these systems are actually used, and why they matter.

Central Risk Visibility

In many organizations, risk information sits with different teams, using different formats. That works until leadership needs a clear view quickly. Central systems exist to remove that friction. They standardise how risks are logged, scored, reviewed, and escalated, so leaders are not relying on stitched-together summaries.

Real example: Commonwealth Bank oJUf Australia has spoken publicly about strengthening enterprise-wide risk oversight after regulatory scrutiny. Central risk frameworks support consistent reporting to senior management and the board, especially across large and complex operations.

Compliance Tracking

Compliance work often fails because it is treated as periodic. Regulations change. Guidance shifts. Obligations accumulate. When tracking is manual, gaps tend to appear late. Software helps by keeping obligations visible and linked to controls, rather than buried in documents.

Real example: AustralianSuper operates in one of the most tightly regulated sectors in Australia. Public disclosures show a strong emphasis on structured compliance and risk processes to manage APRA obligations across funds, administration, and member services.

Incident And Operational Risk Capture

Small incidents matter. Near misses matter more than most teams realise. But they are easy to dismiss if they are logged inconsistently or reviewed in isolation. Systems help by capturing these events early and showing patterns over time.

Real example: Sydney Trains uses formal incident reporting frameworks to record safety events and operational disruptions. Consistent tracking supports learning across the network and reduces the chance of repeat failures.

Supplier And Third-Party Oversight

Many Australian businesses rely heavily on suppliers they do not fully control. Problems often surface only after disruption occurs. Risk systems help teams assess vendor exposure upfront and review it regularly, instead of reacting after the fact.

Real example: Woolworths Group has publicly discussed supplier risk and continuity planning, particularly across food and logistics partners. Structured risk reviews support stability across a nationwide supply chain.

[Also Read: How Much Does It Cost to Build a Retail Delivery App Like Woolworths in Australia]

Audit Follow-Ups

Audits lose value when findings are not closed properly. The same issues appear year after year because actions are not tracked clearly. Software helps by keeping ownership, deadlines, and progress visible to everyone involved.

Real example: AGL Energy operates under strict regulatory oversight. Public reporting highlights the importance of internal audit and risk processes to manage compliance obligations across assets and operations.

Decision Support For Leadership

Risk data is only useful if it reaches decision-makers in time. Static reports prepared after the fact rarely change outcomes. Systems that surface trends early allow leaders to act before issues become expensive or public.

Real example: BHP integrates risk considerations into board and executive decision-making. Public disclosures show risk frameworks being used to guide capital decisions, operational priorities, and regulatory engagement.

Features That Decide Whether Risk Management Software Actually Works

Most risk management systems do not fail because they lack features. They fail because they do not fit how risk is handled in real organizations. Too many steps. Too many fields. Too much manual effort to keep the system alive. When that happens, teams stop using it properly and risk slipping back into emails, spreadsheets, and side conversations.

Good risk management software does the opposite. It reduces friction. It makes ownership clear. It helps people act, not just document. When the system works well, it fades into the background. When it does not, everyone feels the strain during audits, incidents, or regulatory reviews. Below are the core risk management software features that help with real Australian operations.

Centralised risk register

A single place to record and review all identified risks across the organization. Each risk includes a clear description, impact, likelihood, owner, and current status. This removes version confusion and ensures leadership sees one consistent view of exposure.

Risk assessment and scoring

Allows teams to assess risks using defined criteria rather than subjective judgement. Scoring models can reflect how the organization evaluates severity and likelihood, helping prioritise what needs attention first instead of treating all risks equally.

Control mapping and tracking

Links risks to the controls that reduce them. Teams can see which controls exist, who owns them, and how effective they are. When controls are missing or weak, gaps become visible early rather than during audits.

Incident and issue logging

Captures incidents, near misses, and control failures as they happen. Each issue can be linked back to related risks and controls, making root cause analysis practical instead of retrospective guesswork.

Action management and follow-ups

Tracks remediation actions with clear owners and deadlines. Progress is visible, overdue items stand out, and nothing relies on reminder emails to stay alive. This is where accountability actually takes shape.

Compliance obligation tracking

Stores regulatory and internal policy obligations in one place and links them to controls and evidence. This helps teams stay aligned with Australian regulatory expectations without scrambling during reviews.

Audit support and evidence storage

Keeps audit findings, supporting documents, and responses connected to the risks and controls they relate to. Audits become easier to manage because information is already structured and traceable.

Role-based access and responsibility

Defines who can view, edit, approve, or close items. Risk ownership becomes explicit. Teams know what they are responsible for, and leadership can see where accountability sits.

Reporting and dashboards

Provides clear views for different audiences. Operational teams see actions and incidents. Risk teams see trends. Executives see exposure and movement over time. Reports support decisions rather than just filling folders.

Data export and system integration

Allows risk data to be shared with other systems such as finance, audit, or reporting tools. This prevents duplication and keeps risk management connected to the wider business instead of isolated.

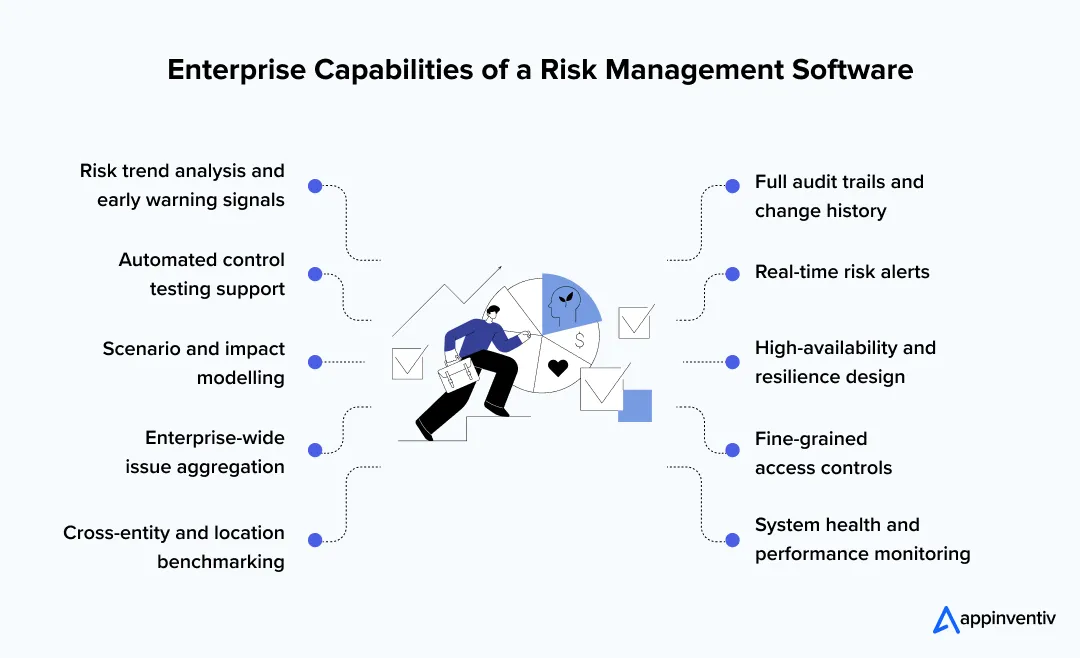

Capabilities That Matter When Risk Management Reaches Enterprise Scale

As organizations grow, the difference between risk software that “works” and software that truly supports leadership becomes obvious. Enterprise environments introduce more regulators, more systems, more third parties, and more consequences when something goes wrong. At that stage, basic tracking is no longer enough.

Software for enterprise risk management is defined by how much complexity it absorbs quietly. These capabilities allow organizations to stay in control as operations expand, without adding friction for teams or slowing down decisions.

Below are the advanced capabilities Australian enterprises typically require once risk management becomes part of daily governance, not an annual exercise.

Risk trend analysis and early warning signals

Enterprise risk systems look beyond static registers. They surface patterns across incidents, control failures, and near misses over time. This helps leadership see where exposure is building before it becomes visible through losses, audit findings, or regulator attention.

Automated control testing support

Manual control testing does not scale. Advanced systems support scheduled reviews, evidence collection, and status tracking so control effectiveness is assessed continuously rather than rushed before audits.

Scenario and impact modelling

Enterprise decision-making often involves trade-offs. This capability allows teams to model how changes in operations, suppliers, regulations, or systems could affect overall risk exposure. It supports informed decisions instead of reactive ones.

Enterprise-wide issue aggregation

In large organizations, issues rarely exist in isolation. Advanced platforms connect related incidents, audit findings, and compliance gaps across business units. This prevents teams from treating symptoms separately when they stem from the same root cause.

Real-time risk alerts

Instead of waiting for periodic reviews, the system flags unusual activity, repeated failures, or missed actions as they occur. Alerts are based on thresholds set by the organization, allowing early intervention rather than late escalation.

Cross-entity and location benchmarking

For organizations operating across regions or subsidiaries, consistency matters. This capability allows leadership to compare risk posture, control effectiveness, and issue resolution across entities, without relying on subjective reporting.

Full audit trails and change history

Every update matters in regulated environments. Advanced systems automatically log changes to risks, controls, actions, and access. This creates a reliable record for internal reviews, external audits, and regulator engagement.

High-availability and resilience design

Risk systems must remain accessible during incidents, not go offline when pressure peaks. Enterprise platforms are designed for continuity, ensuring data remains available and recoverable during outages or disruptions.

Fine-grained access controls

As teams grow, access needs to stay disciplined. Advanced role-based controls ensure users see and act only on what they are responsible for, reducing the chance of errors or misuse.

System health and performance monitoring

Enterprise systems are monitored continuously. Performance issues, integration failures, or data delays are detected early, often before users notice. This protects confidence in the system and the decisions based on it.

Understanding the Cost of Building Risk Management Software in Australia

When organizations plan risk management software development in Australia, the biggest mistake is treating cost as a one-time decision. You are not buying a tool. You are building a system that must support regulatory scrutiny, audits, and operational decisions year after year. The real cost comes from how well that system holds up as the organization grows and compliance pressure increases.

The technology foundation plays a role, but it is not the main driver. What matters more is scope. How many risk types you track. How many teams are involved? How deeply the software needs to integrate with existing systems. A simple setup looks very different from enterprise risk management software in Australia used across regulated operations.

Thus, before diving into the answer to the question: how to develop risk management software in Australia, businesses must first understand what it shall cost them.

Typical Cost of Risk Management Software Development in Australia

Most businesses fall into one of the following brackets:

- Basic risk management system

AUD 60,000 to AUD 120,000

Suitable for organizations moving away from spreadsheets. Covers a central risk register, basic risk scoring, action tracking, and standard reports. - Mid-scale or growing organization system

AUD 150,000 to AUD 300,000

Supports multiple risk categories, compliance tracking, audit workflows, role-based access, and integration with internal systems. Common for organizations implementing an enterprise risk management system across departments. - Enterprise-grade risk management platform

AUD 400,000 and above

Designed for regulated or complex organizations. Includes detailed audit trails, board-level reporting, scalability across entities, and long-term governance support.

Ongoing costs businesses should plan for

Risk management software development cost in Australia does not stop after launch. Ongoing spending keeps the system reliable, secure, and compliant.

- Annual maintenance and support

15 to 20 percent of the initial build cost

Covers updates, regulatory changes, security patches, and performance improvements. - Cloud hosting and infrastructure

AUD 1,000 to AUD 5,000 per month

Varies based on user volume, data retention, uptime requirements, and reporting load. - Training and onboarding

AUD 20,000 to AUD 50,000

Covers risk owners, compliance teams, and leadership users. This reduces incorrect usage and incomplete data. - System integrations

AUD 30,000 to AUD 100,000

Depends on the number of systems involved, such as audit tools, reporting platforms, identity management, or operational software.

What organizations typically gain:

Most businesses do not measure ROI from risk management software in direct revenue. The return shows up in avoided cost and reduced exposure.

- Fewer repeat audit findings

- Faster regulatory responses

- Lower incident-related disruption

- Less time spent compiling reports and chasing updates

Australian organizations often see value within 18 to 24 months, especially where manual risk processes were creating delays or compliance pressure. The real benefit is confidence. Leadership knows where risk sits and can act before issues become expensive or public.

Building software for risk management is not about choosing the cheapest option. It is about investing once in a system that supports governance properly, instead of paying repeatedly for gaps, fixes, and missed signals.

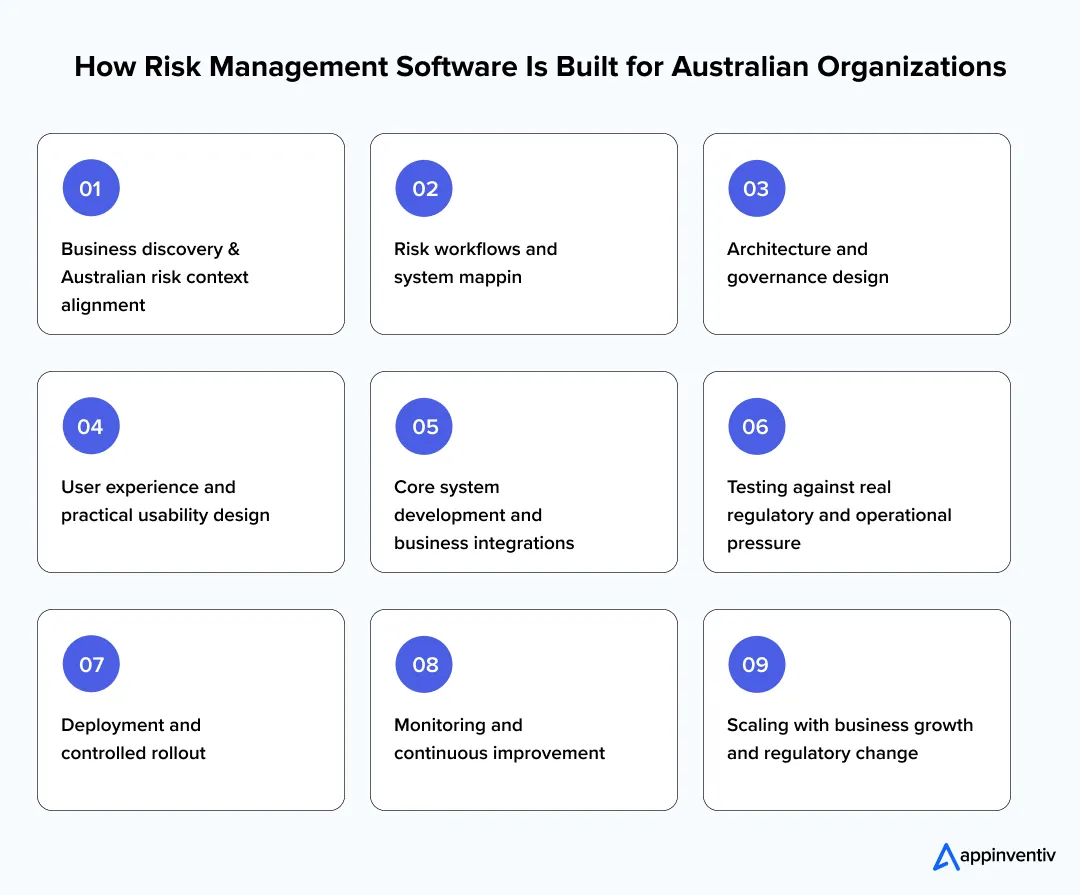

How to Develop Risk Management Software in Australia: Understanding the Process

Building risk management software is not about speed. It is about fit. In Australia, where boards, regulators, and auditors expect clarity and traceability, the development process matters as much as the system itself. Shortcuts taken early usually reappear later as audit issues, control gaps, or reporting delays.

A well-structured approach keeps the software working quietly in the background, supporting governance instead of competing with it. Below is the process to build Risk Management Software in Australia that holds up under real scrutiny.

Business Discovery And Australian Risk Context Alignment

This stage focuses on how risk is handled in practice across Australian organizations. Conversations include executive leadership, risk and compliance teams, internal audit, and operational heads. Attention is given to APRA and ASIC expectations where applicable, WHS obligations, industry-specific regulations, and board reporting requirements common in ASX-governed environments. The aim is to ground the system in real regulatory and operational pressure points, not policy language alone.

Risk Workflows And System Mapping

Once context is clear, existing workflows are mapped as they actually operate. How risks are raised. How incidents escalate. Where approvals slow down. Where accountability blurs. Australian organizations often manage risk across states, entities, or subsidiaries, so exceptions and handovers are mapped carefully. This prevents the system from forcing uniformity where local compliance or operational differences exist.

Architecture And Governance Design

This phase defines how the system will behave under audit and regulatory review. Data structures, access rules, audit trails, retention policies, and reporting logic are locked in before development begins. Australian data residency, security standards, and availability expectations are addressed here, especially for organizations operating under APRA CPS 234 or similar governance frameworks.

User Experience And Practical Usability Design

Risk software is only useful if people use it consistently. Screens are designed around real tasks, not theoretical flows. Australian teams often juggle compliance alongside operational work, so interfaces are kept simple and purpose-driven. The focus stays on clarity, fewer clicks, and clear ownership rather than visual polish.

Core System Development And Business Integrations

The system is built around core risk functions: registers, assessments, controls, incidents, actions, and reporting. Integrations are added for tools commonly used across Australian enterprises, such as identity systems, audit platforms, and reporting tools used for board and regulator packs. Business rules are embedded so risk handling stays consistent across teams and locations.

Testing Against Real Regulatory And Operational Pressure

Testing reflects Australian realities. Missed reviews. Late approvals. Conflicting updates across business units. End-of-quarter and end-of-year reporting cycles. Scenarios are tested to ensure the system holds up during audits, regulatory requests, and operational disruptions, not just during normal use.

Deployment And Controlled Rollout

Launch is planned carefully to avoid disruption. Data migration is validated. Roles are assigned based on governance responsibilities. Training is delivered by function, not in generic sessions. Many Australian organizations run parallel systems briefly to protect continuity before fully switching over.

Monitoring And Continuous Improvement

Once live, usage patterns and feedback are monitored closely. Regulatory updates, policy changes, and organizational shifts are expected in Australia, so the system is refined through controlled releases rather than rushed changes. This keeps risk management aligned with evolving obligations.

Scaling With Business Growth And Regulatory Change

As organizations expand into new regions, entities, or risk areas, the system must adapt without rework. A well-built risk management platform supports growth while maintaining consistency in reporting, accountability, and audit readiness. It grows quietly, without becoming another governance burden.

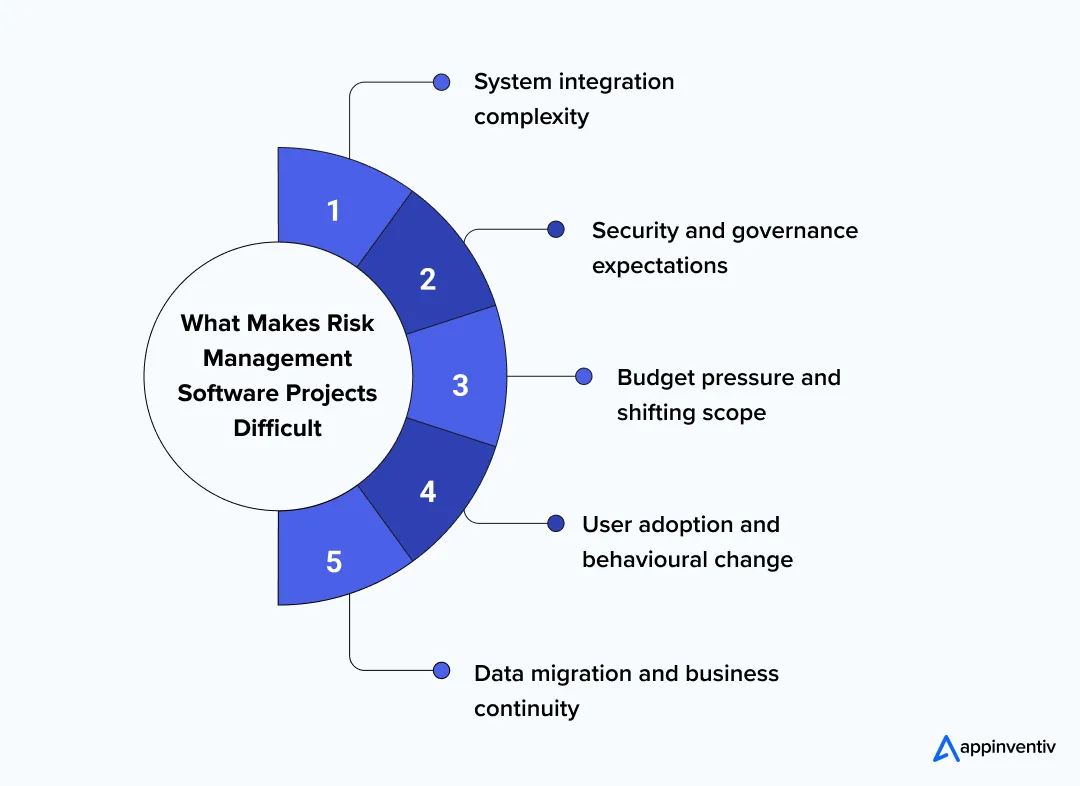

Managing Development Challenges That Often Surface Mid-Project

Understanding how to build a risk management system is only half the work. The harder part is navigating the challenges that appear once development begins. These issues rarely show up on day one. They emerge gradually, often after decisions feel locked in and timelines are already committed.

Being clear about the challenges with risk management software development early helps leadership teams set realistic expectations and work with delivery partners who can address them before they turn into delays or rework.

System Integration Complexity

Risk management tools and techniques rarely operate in isolation. They often need to connect with audit tools, identity systems, reporting platforms, operational software, or data sources owned by different teams. Older systems add another layer of complexity when they lack modern interfaces or consistent data structures.

The challenge is not building integrations. It is maintaining them without breaking workflows every time one system changes.

A well-planned approach usually involves clear integration boundaries, standard interfaces, and early decisions on which systems are sources of truth. Without this, risk data becomes fragmented again, defeating the purpose of the system.

Security And Governance Expectations

Risk management systems hold sensitive information. Incident details. Control weaknesses. Audit findings. Access needs to be controlled carefully, and activity must be traceable. At the same time, the system cannot be so restrictive that teams avoid using it.

This balance is often underestimated. Security needs to support governance, not slow it down.

Projects that handle this well define access rules early, log all changes automatically, and design interfaces that allow people to complete tasks quickly without bypassing controls.

Budget Pressure And Shifting Scope

Risk management projects often start with a narrow focus and expand as stakeholders see what the system can do. New reporting needs appear. Additional teams want access. Regulatory requirements evolve. If scope is not managed carefully, timelines stretch and costs climb.

Clear prioritisation is critical. Successful teams agree early on what must be delivered first and what can wait. Changes are handled through structured review rather than informal requests that accumulate unnoticed.

User Adoption And Behaviour Change

Risk software does not fail because it lacks features. It fails because people do not use it consistently. This is especially true when the system feels like extra work layered on top of existing responsibilities.

Adoption improves when users are involved early, screens reflect real tasks, and training is delivered in practical terms rather than policy language. Systems that fit daily work routines face far less resistance.

Data Migration And Business Continuity

Moving existing risk data into a new system is rarely clean. Records may be incomplete, inconsistent, or outdated. At the same time, organizations cannot afford long periods where risk tracking stops or becomes unreliable.

Careful cloud migration planning reduces disruption. Parallel runs, phased transfers, and validation using real data help ensure continuity. Testing with live scenarios matters more than theoretical checks.

Now that you have understood how to develop risk management software in Australia, now it’s time to look at what that investment delivers once the system is live and embedded into daily operations. This is where attention shifts from design and delivery to outcomes, confidence, and long-term value.

We can help you fix the foundation.

Measuring ROI From Risk Management Software in Australian Organizations

Return on investment in risk management is rarely about direct revenue. Australian organizations do not build these systems to make money faster. They build them to avoid loss, reduce exposure, and regain time that was previously spent reacting instead of deciding.

The ROI becomes visible in quieter ways. Fewer late nights before audits. Shorter regulator response cycles. Fewer repeated issues showing up under different names. And far less time spent stitching together reports for boards, auditors, and executives.

Where The Return Actually Comes From

Most Australian organizations start seeing value once manual risk work begins to disappear.

Reduced regulatory and audit cost

Structured systems reduce repeat audit findings, remediation rework, and last-minute evidence collection. Over time, this lowers advisory spend and internal effort tied to regulatory reviews.

Lower operational disruption

Earlier visibility into incidents, control failures, and emerging risks reduces the likelihood of large operational interruptions. Small issues are addressed before they turn into expensive problems.

Time recovered across teams

Risk, compliance, audit, and operational teams spend less time chasing updates, reconciling versions, and preparing reports. That time shifts back to analysis and decision support.

Faster executive and board decisions

When risk data is current and trusted, leadership does not wait for clarification. Decisions move faster because the information gap disappears.

Improved accountability without added headcount

Clear ownership and tracked actions reduce reliance on follow-ups and reminders. Organizations often avoid adding risk or compliance headcount simply to manage coordination.

Typical Payback Timeline In Australia

Most Australian organizations begin seeing tangible value within 12 to 24 months, depending on scale and starting maturity.

Smaller organizations usually feel the impact through time saved and cleaner audits. On the other hand, larger or regulated organizations see value through reduced exposure, smoother regulator engagement, and fewer repeat issues.

The biggest gains appear where risk was previously fragmented across tools, teams, or spreadsheets.

What ROI Looks Like In Practice

ROI in risk management is not a single metric. It shows up as:

- Fewer audit findings year over year

- Shorter regulator response times

- Lower incident recurrence

- Reduced manual reporting effort

- More confident board-level conversations

After you have understood how to implement risk management software in Australia, the return is cumulative. Each avoided issue compounds over time.

The Real Measure Of Value

The strongest signal of ROI is confidence. Leadership knows where risk sits. Teams know what they own. Regulators see consistency instead of correction. When that happens, risk management stops being defensive work and starts supporting better judgement across the organization.

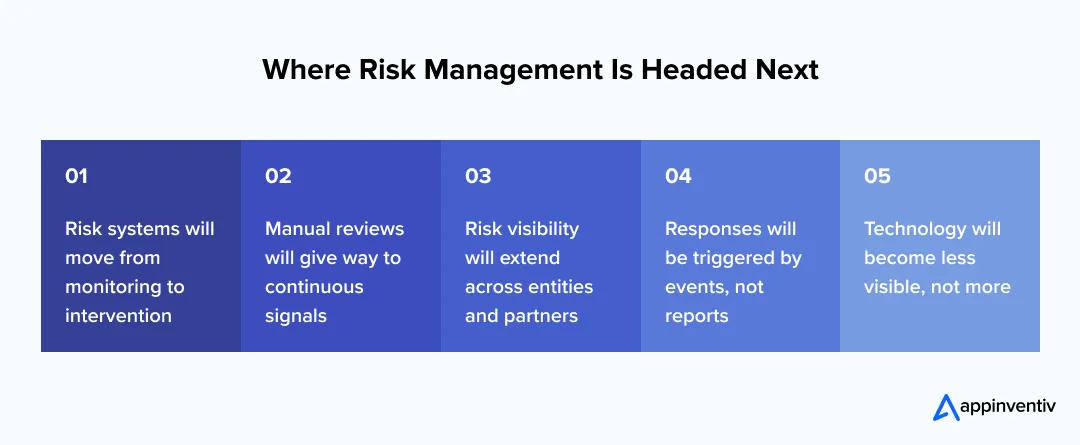

Future Shifts That Will Redefine Risk Management in Australia

Risk management is no longer evolving in small increments. It is being reshaped by regulatory intensity, digital dependence, and the speed at which issues now surface. What felt adequate five years ago already struggles under today’s scrutiny. Boards expect faster answers. Regulators expect clearer evidence. Operations expect systems that keep up without constant manual effort.

The way organizations manage risk will continue to change, whether leadership plans for it early or reacts later. These shifts are already visible across Australian enterprises.

Risk Systems Will Move From Monitoring To Intervention

Risk tools have traditionally focused on recording and reporting. That is changing. Systems are starting to guide action, not just document exposure. Instead of showing what happened last quarter, they will increasingly prompt what needs attention today.

This shift matters in Australia, where delayed responses often carry regulatory consequences. Systems will flag missed actions, emerging patterns, or control weaknesses early enough for teams to act before escalation occurs. Judgment will still sit with people, but systems will increasingly shape where attention goes first.

Continuous Signals Will Replace Periodic Reviews

Annual or quarterly risk reviews are losing relevance. Too much changes in between. organizations are moving toward continuous signals driven by activity, not calendar cycles. Missed controls, repeated incidents, or delayed approvals will surface as they happen.

This approach aligns better with Australian regulatory expectations, where evidence of ongoing oversight carries more weight than retrospective explanations. Risk becomes something that is watched continuously, not revisited occasionally.

Risk Visibility Will Extend Beyond The Organization

Risk no longer stops at internal boundaries. Third parties, vendors, service providers, and partners now play a direct role in operational resilience. Future risk systems will treat external dependencies as part of the same picture, not a separate assessment.

Australian organizations are already feeling this shift, particularly where outsourcing, cloud platforms, or supply chains are involved. Visibility across internal and external exposure will become standard rather than exceptional.

Responses Will Be Triggered By Events, Not Reports

The focus is moving away from static reports toward event-driven action. A delayed remediation. A repeated incident. A control that quietly stops being followed. Systems will increasingly respond in real time, prompting escalation or review without waiting for scheduled meetings.

This change reduces reliance on memory, emails, and informal follow-ups. It also reduces the chance that issues grow unnoticed simply because reporting cycles have not yet caught up.

Technology Will Fade Into The Background

The most effective risk systems will not demand constant attention. They will support work quietly. When things run as expected, the system stays out of the way. When something drifts, it speaks up clearly and early.

For Australian organizations under constant governance pressure, this is the real goal. Technology that supports judgement without becoming another layer of process. When risk management works well, it does not feel like software at all. It feels like clarity.

Why Australian Organizations Choose Appinventiv for Risk Management Software

We hope this blog has helped you understand how to develop risk management software in Australia and every other aspect related to it. Now, businesses must understand that Appinventiv is not a generic software vendor. We work with organizations that treat risk management as core governance infrastructure, not an administrative layer. Our teams build systems designed to operate under regulatory scrutiny, organizational complexity, and real operational pressure. That approach matters in Australia, where expectations around transparency, traceability, and accountability are high.

Our delivery model is shaped by long-term thinking. As leading software developers in Melbourne, we support Australian organizations across regulated industries where systems must stand up to audits, board reviews, and evolving compliance requirements. With distributed engineering teams and experience delivering enterprise-grade platforms globally, we combine scale with local understanding rather than offering one-size-fits-all solutions.

When you hire our developers to engage in risk management software, they start with how decisions are actually made. They will look at how risks are identified, how issues are escalated, how controls are reviewed, and how reporting flows to leadership. That operational understanding guides the architecture, workflows, and governance design of the system. Features follow processes, not the other way around.

Our teams place strong emphasis on alignment with Australian regulatory expectations. This includes clarity around access controls, audit trails, data handling, and reporting structures that support engagement with regulators, auditors, and boards. The goal is not just to build software that works, but software that holds up when scrutiny increases.

If you are looking to strengthen your risk management foundation rather than replace one tool with another, we are ready to have that conversation. Get in touch with us now!

FAQs

Q. How to choose the right risk management software solutions provider in Australia?

A. For Australian businesses, choosing a provider is less about who offers the longest feature list and more about who understands the environment you operate in. The right partner should be able to support governance, scale, and regulatory scrutiny over the long term, not just deliver a tool. When assessing providers, businesses typically look for:

• Demonstrated experience working with Australian regulatory and governance frameworks

• Ability to tailor risk management software solutions to existing workflows rather than forcing change

• Strong focus on data security, access control, and audit traceability

• Capability to support integrations, future growth, and ongoing maintenance

• Willingness to engage with leadership, risk, compliance, and operations teams together

Q. How can a risk management system improve compliance and security?

A. Compliance and security improve when risk oversight becomes continuous instead of reactive. A well-designed system helps organizations stay ahead of issues rather than responding after gaps are exposed. In practice, this improvement comes from:

• Bringing regulatory obligations, controls, and supporting evidence into one structured system

• Creating clear audit trails that show who did what and when

• Reducing dependence on manual tracking that often leads to missed updates

• Enforcing role-based access so sensitive information is protected

• Identifying weaknesses early, before audits or regulator reviews surface them

Q. What are the advantages of developing the best risk management software in Australia?

A. Software designed with Australian organizations in mind tends to align better with local governance expectations and operational realities. Businesses often see advantages because these systems are built to reflect how risk is reviewed, reported, and challenged locally. The benefits usually include:

• Better alignment with Australian regulatory and board oversight requirements

• Easier handling of state-level and industry-specific compliance obligations

• More consistent reporting for executives, boards, and auditors

• Reduced effort and disruption during regulatory engagement

• Greater confidence that the system reflects local risk practices

Q. What is the future of risk management software in Australia?

A. The direction is clear. Risk management is moving away from periodic reporting and toward early visibility and action. Australian organizations are already seeing this shift take shape through:

• Continuous monitoring replacing quarterly or annual reviews

• Broader visibility across suppliers, partners, and third parties

• Event-driven alerts instead of static reports

• Deeper integration with operational and governance systems

• Tools that support judgement without adding unnecessary process

Q. When does it make sense for enterprise leaders to invest in custom risk management software?

A. Custom investment usually becomes relevant when existing tools start limiting visibility or slowing decision-making. Leaders tend to reach this point when:

• Risk oversight spans multiple business units or entities

• Regulatory scrutiny increases and audit effort keeps growing

• Manual reporting consumes significant leadership and team time

• Off-the-shelf tools cannot scale with operational complexity

• Confidence in risk data starts to weaken at board level

Q. How should enterprise leaders measure success after implementing a risk management system?

A. Success is rarely about how often the system is used. It shows up in outcomes and behaviour over time. Leaders typically assess value by looking at whether the system has led to:

• Fewer repeat audit findings and delayed remediations

• Faster and clearer responses to regulators and internal stakeholders

• Stronger ownership and follow-through on risk actions

• Less manual effort spent compiling reports and chasing updates

• More confident and informed executive and board-level discussions

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

The ROI of Strategic Insurance Technology Consulting for Legacy Modernization

Key takeaways: Insurance technology consulting delivers ROI only when modernization is tied to real workflows, not system replacement. Most legacy modernization failures stem from weak ROI definition and tracking, not from technology limitations. The strongest returns come from reduced operational friction, faster change cycles, and tighter claims and underwriting control. Delaying modernization incurs hidden costs…

Key Takeaways Use a scorecard-driven RFP and a technical assessment to compare vendors on capability, compliance, and delivery risk. Local partners provide regulatory and cultural alignment; hybrid teams often pair that with offshore cost efficiency. Start with a scoped pilot or MVP, milestone-based contracts, and clear IP/SLAs to reduce procurement risk. Require demonstrable security controls,…

A Strategic Framework for Proof of Concept Software Development

Key takeaways: Most enterprise PoCs fail due to a lack of decision clarity, not technical feasibility or innovation potential. A disciplined PoC framework reduces delivery risk before budgets, teams, and timelines are committed. Enterprise-grade PoCs validate feasibility, compliance, and scale assumptions under realistic operating constraints. Clear success metrics and governance turn PoCs into reliable inputs…