- What Is High Frequency Trading (HFT)?

- Development Process / Phases

- Discovery & Strategy Definition

- System Architecture & Infrastructure Design

- Prototype / Minimum Viable Strategy (MVS)

- Core Module Implementation

- Testing, Optimization & Tuning

- Backtesting & Forward Testing

- Deployment & Live Launch

- Monitoring, Maintenance & Enhancement

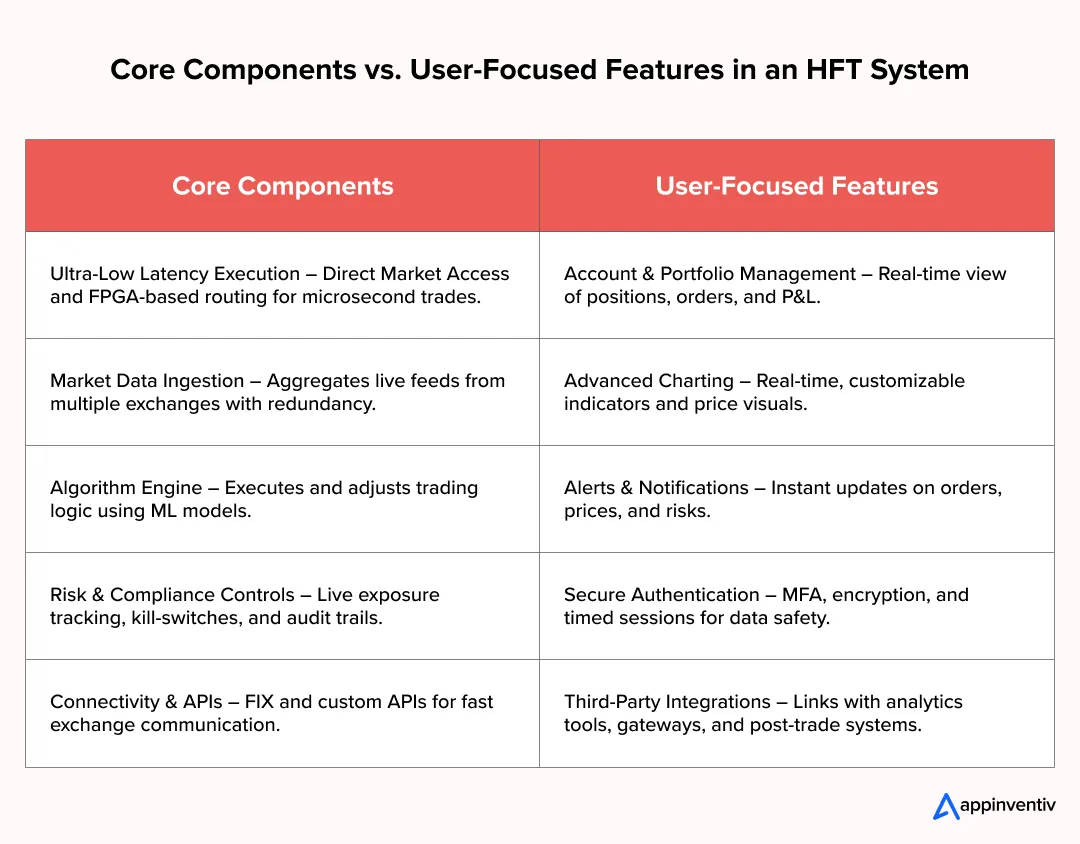

- Key Components & Feature Set to Have in Your HFT System

- Ultra-Low Latency Execution & Order Routing

- Market Data Ingestion & Processing

- Algorithm / Strategy Engine

- Backtesting & Simulation

- Risk Management & Controls

- Connectivity & API Management

- Monitoring, Analytics & Dashboarding

- Security, Compliance & Auditing

- Administration & Support Tools

- User-Focused Features Your HFT Platform Should Have

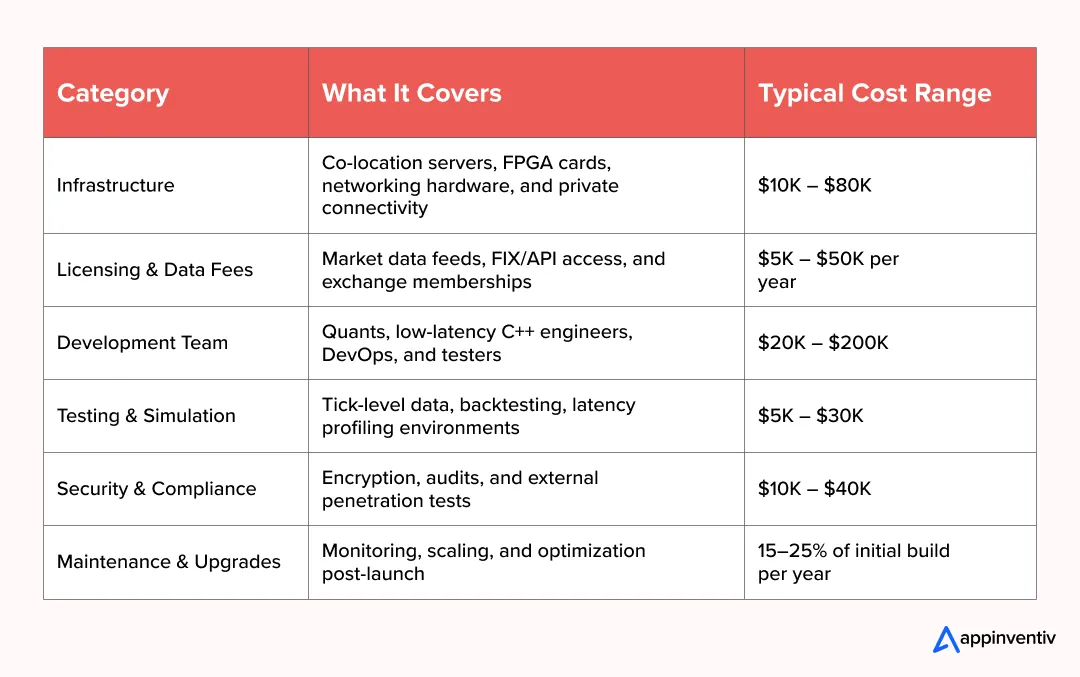

- Cost Breakdown & Budget Drivers

- Major Cost Categories / Drivers

- Rough Cost Ranges / Scenarios

- Recurring Costs

- Cost Optimization Strategies

- Key Risks, Challenges & Mitigation Strategies

- Latency & Performance Overhead

- Market Volatility & Regime Shifts

- Regulatory & Compliance Risks

- Security Threats & Data Integrity

- Model Overfitting & Strategy Decay

- Infrastructure Failures & Downtime

- Best Practices & Differentiators

- Co-location & Ultra-Proximity Hosting

- Kernel Bypass & Network Optimization

- FPGA & Hardware Offload

- Time Synchronization (PTP & GPS)

- Microservice Architecture for Modularity

- Canary Deployments & Real-Time Rollbacks

- Explainability & Strategy Interpretability

- Continuous Integration for Quant + Dev Pipelines

- Monitoring, SLAs & Real-Time Dashboards

- Real Life Examples Of HFT In Use

- 1. Virtu Financial: Turning Volatility into Opportunity

- 2. Jump Trading: Building Speed on Smarter Foundations

- 3. Jump Trading: When Speed Meets Scrutiny

- 4. The Latency Wars — Innovation at the Edge of Physics

- 5. The Rise of AI-Infused HFT Systems

- What These Examples Reveal

- Timeline & Time-to-Market Estimate

- Phase 1: Discovery & Strategy Definition (4–6 weeks)

- Phase 2: Architecture & Infrastructure Setup (6–8 weeks)

- Phase 3: Prototype / Minimum Viable Strategy (8–10 weeks)

- Phase 4: Core Module Development (12–16 weeks)

- Phase 5: Testing, Optimization & Tuning (6–8 weeks)

- Phase 6: Pilot / Sandbox Launch (4–6 weeks)

- Phase 7: Full Production Rollout (4–8 weeks)

- Why Partner with Appinventiv

- FAQs

- Q. How much does it cost to develop a high-frequency trading platform?

- Q. How long does it take to develop high-frequency trading software?

- Q. Should you build or buy an existing HFT platform?

- Q. How do you ensure security in HFT software?

Key takeaways:

- Build process, not just code: HFT success = a staged roadmap (discovery → architecture → MVS → core build → test → launch → monitor) where decisions are validated with real latency and risk data at every step.

- Architecture beats hype: Deterministic low latency comes from co-location, kernel bypass/FPGA, clean market-data pipelines, and explainable strategy logic—not flashy UIs.

- Budget with eyes open: End-to-end builds typically land between $40K–$400K, plus recurring spend for data, hosting, maintenance, and audits; smart phasing and open-source blocks keep costs in check.

- Speed + discipline = resilience: Biggest risks are latency drift, regime shifts, compliance slips, security gaps, and downtime—mitigate with kill-switches, dynamic risk limits, real-time monitoring, and canary rollouts.

- Time-to-market you can trust: A production-grade platform usually takes ~9–15 months; the teams that win pair rapid iteration with governance, turning microseconds into durable advantage (and easier scale later).

Every microsecond shaved off execution latency can translate to millions in trading profits. In high-frequency trading (HFT), that isn’t an exaggeration — it’s the reality shaping today’s financial markets. Across major developed markets, algorithmic and high-frequency strategies together now drive roughly 60%–75% of equity trading volume, reshaping how speed, automation, and liquidity drive advantage.

For firms pursuing High-Frequency Trading Software Development, the focus is shifting from raw speed alone to disciplined engineering, reliability, and compliance. That’s why many teams kick off with custom HFT software development plans aligned to their exact strategy mix and latency targets, often culminating in a production-grade High-frequency trading platform development roadmap.

This race for speed has turned trading floors into data centers, where software decides who wins the trade. As markets fragment across exchanges and dark pools, firms that can connect those micro-moments faster — using low-latency architecture and predictive analytics — dominate price discovery and execution.

The challenge, however, runs deeper than performance. As the Bank for International Settlements notes, modern market microstructures demand real-time surveillance, adaptive risk management, and auditable trading flows to maintain fairness and stability. Furthermore, increasing compliance obligations under frameworks like MiFID II and SEC Rule 15c3-5, and the process of building a compliant, high-speed trading backbone becomes as much about governance as it is about code.

That’s why understanding the complete high frequency trading software development process is critical. In this blog, we’ll walk through exactly how to build high frequency trading system capabilities: the process, the architectural foundations, the must-have features, the cost factors, and the best practices that separate successful systems from the rest.

By the end, you’ll have a clear, realistic view of what it takes to engineer a high-performance trading platform that thrives in today’s algorithmic markets — built for speed, reliability, and compliance.

Ready to build your high-frequency edge?

What Is High Frequency Trading (HFT)?

High-Frequency Trading, or HFT, is essentially trading at machine speed. It’s a specialized branch of algorithmic trading built to execute thousands of buy or sell orders in microseconds — faster than a blink, faster than any human could possibly decide. While algorithmic trading automates strategies, HFT pushes that logic to the edge, where every nanosecond matters.

These systems thrive on speed, data, and precision. They rely on co-located servers placed close to exchange data centers, optimized network routes, and hardware tuned to cut latency down to microseconds. Strategies like market making, statistical arbitrage, and latency arbitrage dominate this space by exploiting tiny price gaps across exchanges before they disappear.

Unlike HFT vs traditional trading software narratives that emphasize UI and workflows, developing high-frequency trading systems centers on deterministic timing, resilient connectivity, and auditability by design.

According to McKinsey, algorithmic and high-frequency strategies together now account for over 70% of equity trading volume in major markets. That dominance has reshaped the landscape — adding liquidity and tightening spreads but also intensifying the race for faster infrastructure and smarter algorithms.

What sets HFT apart from standard trading systems is its design philosophy. It’s not built around human intuition or long-term strategy. It’s engineered for machine-level reflexes, where every component — from network cable length to code optimization — decides who wins the trade.

Development Process / Phases

Building a high-frequency trading (HFT) system isn’t a single project — it’s a sequence of precise, high-stakes engineering sprints. Each phase of the high frequency trading software development process adds a new layer of speed, intelligence, and reliability. While every firm’s approach differs, most follow HFT software development stages like this:

Discovery & Strategy Definition

Everything begins with clarity. Before a single line of code is written, the team defines what they’re trying to achieve — the business goals, the markets to trade in, and the risk appetite they’re willing to carry.

This stage involves close collaboration between quantitative analysts, traders, and system architects. The quants bring hypotheses — say, a statistical arbitrage model that exploits price inefficiencies between two exchanges. Meanwhile, engineers define latency and throughput targets, such as “execution under 100 microseconds” or “processing 500,000 messages per second.”

This phase ends with a technical blueprint and hypothesis validation plan, setting expectations on what success should look like.

System Architecture & Infrastructure Design

Once the goals are clear, the attention shifts to architecture. To build a high frequency trading system, the skeleton (architecture) you choose supports everything else. This step is part engineering, part economics. Teams decide whether to build on dedicated hardware, leverage cloud infrastructure, or take a hybrid route..

Pure on-prem setups deliver the lowest latency, but come with higher costs for co-location and maintenance. Cloud setups offer scalability, but even micro-delays in virtualization can break an HFT system’s rhythm. Some firms blend both — hosting strategy engines near exchanges, while using cloud servers for analytics and storage.

Network design is equally critical. Engineers plan redundant routes, failover nodes, and data-center placements to ensure continuity. Each system module — data ingestion, order routing, risk management — is defined as a separate, testable component.

Deliverable at this point? A complete infrastructure blueprint with clear latency budgets for every hop in the pipeline.

If your HFT roadmap includes broader investment functionality, see how successful trading ecosystems are structured in our guide on building an investment platform for real-world scaling and compliance.

Prototype / Minimum Viable Strategy (MVS)

Think of this as the first flight test. The team builds a bare-bones prototype, usually for one exchange and one trading strategy. The goal isn’t profit — it’s proof that the architecture can handle real-time loads and meet latency targets.

This early version tests connectivity, feed handling, and order routing, validating that messages travel through the entire pipeline with minimal friction. Quants start feeding mock data or small live streams to observe how fast the engine reacts and whether the system remains stable.

At this point, the deliverable is a validated latency pipeline and a working model of the trade execution loop.

Core Module Implementation

With the foundation tested, the team moves to building the core components — the modules that make up the trading engine:

- Market Data Ingestion Layer to collect and process quotes from multiple exchanges

- Order Management System (OMS) to handle submissions, cancellations, and fills

- Strategy Engine that runs the trading logic in real time

- Risk & Compliance Modules to monitor exposure and enforce limits

Each module integrates with external systems through APIs or exchange-provided FIX connections. Low-level coding optimizations — memory pinning, thread parallelization, and efficient I/O handling — start here.

The output of this phase is a fully functional trading core that can communicate with real markets, though usually still in a restricted or simulated environment.

To explore how APIs can streamline market data flow and order execution beyond HFT, read our post on FinTech APIs and how they’re transforming financial interoperability.

Testing, Optimization & Tuning

In HFT, testing never really ends. This stage is where the team pushes the system to its limits. Engineers run unit, integration, and latency profiling tests to spot bottlenecks.

If a single function call or database lookup slows things down, it’s rewritten or moved into faster memory. Threads are pinned to specific CPU cores, and garbage collection is minimized. Even network cables get measured and trimmed to optimize signal flow — that’s how granular tuning becomes.

Deliverable: a system tuned for minimal jitter, predictable performance, and consistent sub-millisecond responsiveness.

Backtesting & Forward Testing

No algorithm goes live blind. The backtesting phase replays historical market data tick by tick to evaluate strategy behavior under different conditions — bull runs, flash crashes, and flat markets.

Once backtests are promising, teams run forward or “paper” trading, executing real-time simulated orders in live markets. This helps uncover issues that only appear under production-like latency and network conditions.

The aim isn’t to guarantee profits — it’s to ensure the system’s logic holds up in the real world, with no unexpected behaviors or runaway loops.

Deployment & Live Launch

After months of testing, the system is ready to face the markets. But even then, launches are cautious. Deployment usually follows a staged rollout — first to a sandbox environment, then to live trading with limited capital, and finally to full-scale execution.

Some firms use canary or blue-green deployment strategies, running two identical systems side by side — one live, one shadowing — to compare outcomes and catch anomalies instantly. Real-time dashboards display latency, throughput, and execution success metrics throughout the rollout.

The deliverable here is a live, monitored trading system operating safely under production loads.

Monitoring, Maintenance & Enhancement

Once the system is running, maintenance becomes a continuous cycle. Market behavior shifts daily, and even minor software updates can affect latency or model performance.

Operations teams monitor system health, trade anomalies, and latency spikes round-the-clock. Quants refine models, while developers push incremental updates and patches through automated CI/CD pipelines.

Over time, new strategies, asset classes, or markets are added — each one tested with the same rigor as the first. Security patches, compliance updates, and infrastructure scaling ensure the system evolves safely without downtime.

The final outcome: a trading engine that learns, adapts, and scales — capable of surviving the world’s fastest markets without missing a beat.

Key Components & Feature Set to Have in Your HFT System

High-frequency trading software isn’t a single program — it’s a tightly wired ecosystem where every millisecond counts. Each component plays its part in sensing market shifts, executing orders, managing risk, and keeping everything stable under enormous pressure.

Let’s look at the Core components of HFT software development and the Key Features of High-Frequency Trading Software, and how the right tech stack for HFT software development enables deterministic latency.

Ultra-Low Latency Execution & Order Routing

At its core, HFT is a race against time — and the stopwatch is measured in microseconds. Traders use Direct Market Access (DMA) to send orders straight to an exchange, skipping every possible middle layer. Smart order routers constantly scan dozens of venues to find the best match before prices move.

To win this race, firms co-locate their servers inside exchange data centers, reducing signal travel to a few meters of cable. Many also use FPGA boards and custom network cards that process data directly in hardware, cutting delays to a bare minimum. The top players are already clocking round-trip latencies below 100 microseconds — that’s faster than a camera flash.

Market Data Ingestion & Processing

Speed means little without clean, live data. HFT systems handle massive information flows from multiple exchanges — price quotes, order books, and trade ticks — through feed handlers built to digest thousands of updates every second.

This data is normalized and aggregated in memory, with duplicates and out-of-sequence packets filtered out instantly. When a feed drops or lags, the system switches to a backup in real time. Everything runs through lightweight frameworks designed to move information faster than traditional databases ever could.

Algorithm / Strategy Engine

This is where the brain of the operation sits. The strategy engine takes in market data, runs calculations, and fires orders — all within a fraction of a second. These algorithms follow patterns like market making or statistical arbitrage, identifying small price gaps and acting before anyone else notices.

Some newer systems blend in machine learning or reinforcement models, allowing the algorithm to tweak its behavior as markets shift. It’s like giving the system a short-term memory — one that learns when to be aggressive and when to hold back.

Our blog on stock trading app development provides a deep dive into how trading platforms are built end-to-end, which complements the discussion of core modules like the OMS and strategy engine.

Backtesting & Simulation

Before any strategy goes live, it’s tested like an aircraft engine — again and again. Developers replay years of historical tick-level data to see how it performs across calm and volatile markets. They run Monte Carlo simulations and stress tests that mimic real-world chaos: flash crashes, sudden rate hikes, or liquidity droughts.

The aim isn’t perfection — it’s survival. A good HFT strategy must hold up when the market behaves badly.

Risk Management & Controls

In HFT, things can go wrong very fast. That’s why risk management isn’t an afterthought — it’s built right into the trading core. Systems track exposure, leverage, and position limits live, in microseconds.

If something breaks protocol — say, an order floods the market or a strategy spirals — kill-switches and circuit breakers shut it down instantly. Some firms even use AI-based anomaly detection to catch unusual behavior before humans do.

Connectivity & API Management

An HFT platform talks to dozens of exchanges at once — equities, derivatives, even crypto. It uses FIX and proprietary APIs to place and cancel orders at high speed, often routing through latency-aware layers that constantly adjust to the fastest available path.

This connectivity must be rock-solid. A small network delay can mean a missed opportunity or a costly fill. So every connection is monitored, timed, and tuned continuously.

Low-latency routing depends heavily on network throughput and physical interconnects. To understand this further, check our breakdown of interconnection bandwidth in trading systems and how it shapes HFT performance.

Monitoring, Analytics & Dashboarding

Once the system is live, the work doesn’t stop. Engineers watch detailed dashboards showing latency, trade success ratios, and error counts in real time. Every order, rejection, or delay leaves a trace in an audit log.

If the system slows down by even a few microseconds, alerts trigger instantly. These analytics help teams spot issues before they snowball — and give quants data to refine their models for the next round.

Security, Compliance & Auditing

Speed doesn’t excuse recklessness. Every high-frequency setup operates under strict security and regulatory standards. Communication channels are encrypted, user access is controlled through role-based permissions, and every action is logged for compliance audits. All this combined makes the backbone of security and compliance in HFT software.

Global rules like MiFID II and SEC 15c3-5 require detailed order trails and built-in safeguards. For most firms, that means designing security and compliance directly into their architecture, not adding them after launch.

Administration & Support Tools

Finally, there’s the control room — tools that let teams deploy, pause, and adjust strategies without touching raw code. Version control and rollback systems make it safe to push updates during trading hours.

Redundancy is everything. If one server fails, another takes over instantly. Automated recovery scripts and mirrored environments keep the trading engine alive, even under heavy load.

When all these layers (data, strategy, execution, and safety) work together, you get what traders call a “tight loop”: a system that sees, decides, and acts before the market moves. That’s the essence of high-frequency trading software development — precision built into every single microsecond.

User-Focused Features Your HFT Platform Should Have

Speed gets you into the market. But features keep your traders there.

A truly successful high-frequency trading platform blends raw performance with a seamless user experience — giving traders precision, control, and confidence in every click. Here’s what that looks like in practice.

- Account and Portfolio Management

Traders need a clear, real-time view of what’s happening — open positions, profit and loss, order history, and portfolio exposure. A unified dashboard that tracks all this in one place helps users react quickly and stay in control.

- Advanced Charting

Every millisecond matters, and so does every pixel. Offer interactive, real-time charts with customizable indicators, heatmaps, and multiple timeframes. The goal is to help traders visualize market behavior — not just watch it.

- Alerts and Notifications

The market doesn’t wait, so your users shouldn’t either. Build instant notifications for order fills, price movements, or margin calls. Whether through email, push alerts, or in-app updates, these help users act the moment something changes.

- Secure User Authentication

Trust begins with security. Use multi-factor authentication, encrypted credentials, and timed session controls to protect accounts without slowing users down. Safety should feel invisible but absolute.

- Third-Party Integrations

No trading platform lives in isolation. Seamless connections with data providers, FIX gateways, analytics dashboards, and post-trade systems turn your HFT solution into a flexible ecosystem rather than a closed box.

In short: The true test of a high-frequency trading system isn’t just speed — it’s how effortlessly traders can use that speed. When you pair cutting-edge performance with intuitive, secure, and intelligent features, you don’t just build software.

You build the kind of platform traders never want to leave.

Cost Breakdown & Budget Drivers

Building a High-Frequency Trading (HFT) system is both a financial and technical commitment. Costs vary widely depending on latency goals, exchange access, and team expertise — typically ranging between $40,000 and $400,000 for a complete build.

The goal isn’t to build the cheapest system, but one that performs reliably, scales smoothly, and complies with evolving financial regulations. Estimating the cost to develop high frequency trading software depends on connectivity scope, market data choices, and the complexity of hardware offload.

Major Cost Categories / Drivers

Every HFT setup has a few big spending anchors — infrastructure, data, people, and compliance. Understanding where the money goes helps balance speed and sustainability right from the start.

Rough Cost Ranges / Scenarios

Not all trading firms start at Wall Street scale. A focused MVP might target one exchange and a few strategies, while a mature setup could span multiple markets with dedicated hardware acceleration.

| Setup Type | Description | Estimated Budget |

|---|---|---|

| MVP / Small-Scale Build | One exchange, basic algorithm, partial co-location | $40K – $80K |

| Mid-Tier / Multi-Exchange System | Multi-market access, order routing, risk dashboards | $100K – $250K |

| Enterprise-Grade Platform | Full redundancy, FPGA tuning, custom low-latency stack | $300K – $400K+ |

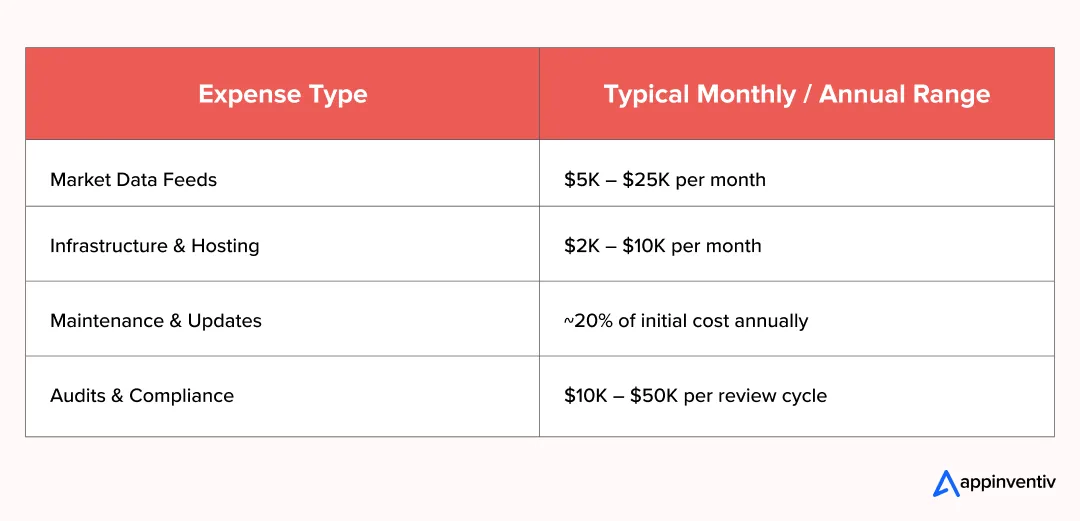

Recurring Costs

Even after launch, HFT systems carry ongoing costs — mostly tied to data, hosting, and compliance. These recurring investments keep the system fast, compliant, and operational around the clock.

Skipping these can cost far more later — every microsecond saved or risk mitigated is an ROI multiplier.

For further detail on cost-drivers in fintech software in general, see our guide on the cost to build a fintech app which provides benchmark pricing across feature sets.

Cost Optimization Strategies

Not every HFT project has to start at Wall Street scale. Smart budgeting often matters more than big spending.

- Blend Open-Source and Proprietary Tools: Libraries like QuickFIX, Redis, or ZeroMQ can handle much of the messaging and data flow without license fees.

- Adopt a Hybrid Setup: Keep the trading engine co-located for speed but run analytics and reporting in the cloud. This hybrid model can trim costs by 30% or more.

- Build Exchange Partnerships: Many exchanges offer discounted hosting or connectivity rates to long-term or high-volume participants.

- Expand in Phases: Start small — one market, one strategy. Once the setup proves stable, scale gradually.

- Continuous Optimization: Latency improvements aren’t just technical wins — they’re cost wins too. A few microseconds saved can recover more value than weeks of coding effort.

To put things in perspective, infrastructure and compute are increasingly expensive across industries. McKinsey estimates that companies will need to invest nearly US $6.7 trillion globally in data center infrastructure (for AI and traditional workloads) by 2030 to meet growing computational demand.

While that’s broader than just HFT, it underscores how resource-intensive, capital-intensive computing infrastructure is becoming — making the cost dimension of low-latency trading all the more real.

Key Risks, Challenges & Mitigation Strategies

Running a high-frequency trading platform is like flying a jet through turbulence, you can’t slow down, but you can’t lose control either. The risks come fast and from every direction, markets shift, hardware misfires, and algorithms behave in ways you didn’t expect.

The challenges in HFT software development span latency drift, infrastructure failures, compliance obligations, and evolving threat surfaces.

The trick isn’t to avoid risk; it’s to build systems that can absorb it without falling apart.

Latency & Performance Overhead

Every HFT team knows this pain: a new release is rolled out, everything looks fine, until execution delays spike by 20 microseconds. Suddenly, you’re behind competitors who got there first.

Latency isn’t a single issue; it’s hundreds of tiny ones. Maybe it’s a cache miss, a noisy neighbor process, or a driver that doesn’t play well with your NIC. Fixing it means tuning every layer — from the code that handles messages to the cables in the rack.

Most firms rely on FPGA boards for ultra-fast logic execution and use RDMA to send data directly between systems without OS interruptions. Some bypass the Linux kernel entirely with custom user-space drivers to squeeze out a few extra microseconds. Even so, the real victory is stability. Predictable latency matters more than raw speed. Markets reward consistency, not chaos.

Market Volatility & Regime Shifts

Markets don’t crash politely. They swing without warning. Volatility spikes, spreads widen, and strategies that worked yesterday start bleeding. We’ve seen it during the COVID crash and again during sudden rate changes when algorithms simply couldn’t keep up.

Smart systems have fallback modes for these moments. When volatility crosses a set threshold, aggressive strategies slow down or shut off automatically. Circuit breakers step in, limiting exposure before panic sets in.

Some setups even use real-time volatility signals or macro feeds to sense when the market mood is changing — shifting to conservative trading modes before things go off the rails. The goal isn’t to predict chaos, but to survive it.

Regulatory & Compliance Risks

In HFT, regulators don’t care how fast you are, they care how accountable you are. Rules like MiFID II or SEC 15c3-5 require firms to keep complete order trails, manage quote-to-trade ratios, and prevent runaway algorithms. Meeting the bar for security and compliance in HFT software means pre-trade risk checks, throttles, and nanosecond timestamping built-in.

The problem? When you’re firing thousands of orders per second, keeping track of every one is a massive technical task. Miss a single audit log and you risk fines or a temporary trading ban.

That’s why compliance isn’t a manual process anymore. Firms now run real-time compliance engines that watch orders as they’re sent. If a strategy breaches limits or sends too many cancellations, it throttles activity automatically. All events are timestamped, sometimes to the nanosecond, and stored securely for audits. The idea is simple: automate honesty before someone else enforces it.

Security Threats & Data Integrity

High-frequency platforms are tempting targets. Attackers don’t need to steal money directly, all they need to do is slow you down. A well-timed DDoS attack or spoofed data feed can cause just enough delay to make your system lose its edge.

Defense starts with segmentation, keeping trading networks isolated from the rest of the world. Connections are encrypted end-to-end, and user access is locked behind strict roles. Real-time monitoring tools flag unusual behavior, whether it’s a flood of cancel messages or a sudden burst of latency from an unknown source.

The biggest threat, though, often comes from the inside, a misconfigured script or a fatigued developer pushing code into production. That’s why top firms separate environments completely: development, testing, and trading never share the same doorway.

Model Overfitting & Strategy Decay

Even brilliant strategies have an expiration date. Markets evolve, liquidity patterns shift, and yesterday’s alpha becomes today’s noise. Overfitting or designing a model that only works on historical data, is the silent killer here.

Teams fight it by testing across unseen data and running live “paper trades” before real deployment. When models start drifting, they’re retrained, recalibrated, or simply retired. Some firms keep what they call a “strategy graveyard” — a collection of once-great algorithms that fell out of sync with the market. Studying those failures often teaches more than the successes.

The mindset here is humility: no model stays perfect, so you build the process to catch failure early.

Infrastructure Failures & Downtime

In HFT, downtime isn’t measured in minutes, it’s in lost trades. A network switch fails, a power supply burns out, or a process crashes mid-session, and every second offline costs money.

Resilient systems are designed assuming things will break. Critical components run in active-active clusters so that if one fails, another takes over instantly. Everything, from order gateways to data feeds has a redundant twin ready to step in.

Data centers are equipped with dual power feeds, hot-swappable hardware, and even geographically separate backups in case of regional outages. The system is constantly monitored, heartbeat signals check every module’s health, and if something stops responding, it restarts automatically.

The key isn’t perfection, it’s recovery speed. The best systems stumble and get back up before anyone even notices.

In high-frequency trading, risk never disappears. You just learn to move faster than it does. The strongest enterprises don’t rely on luck or flawless code, they rely on discipline, redundancy, and the humility to expect things will go wrong. Because in a world measured in microseconds, survival isn’t about speed alone; it’s about resilience that never pauses.

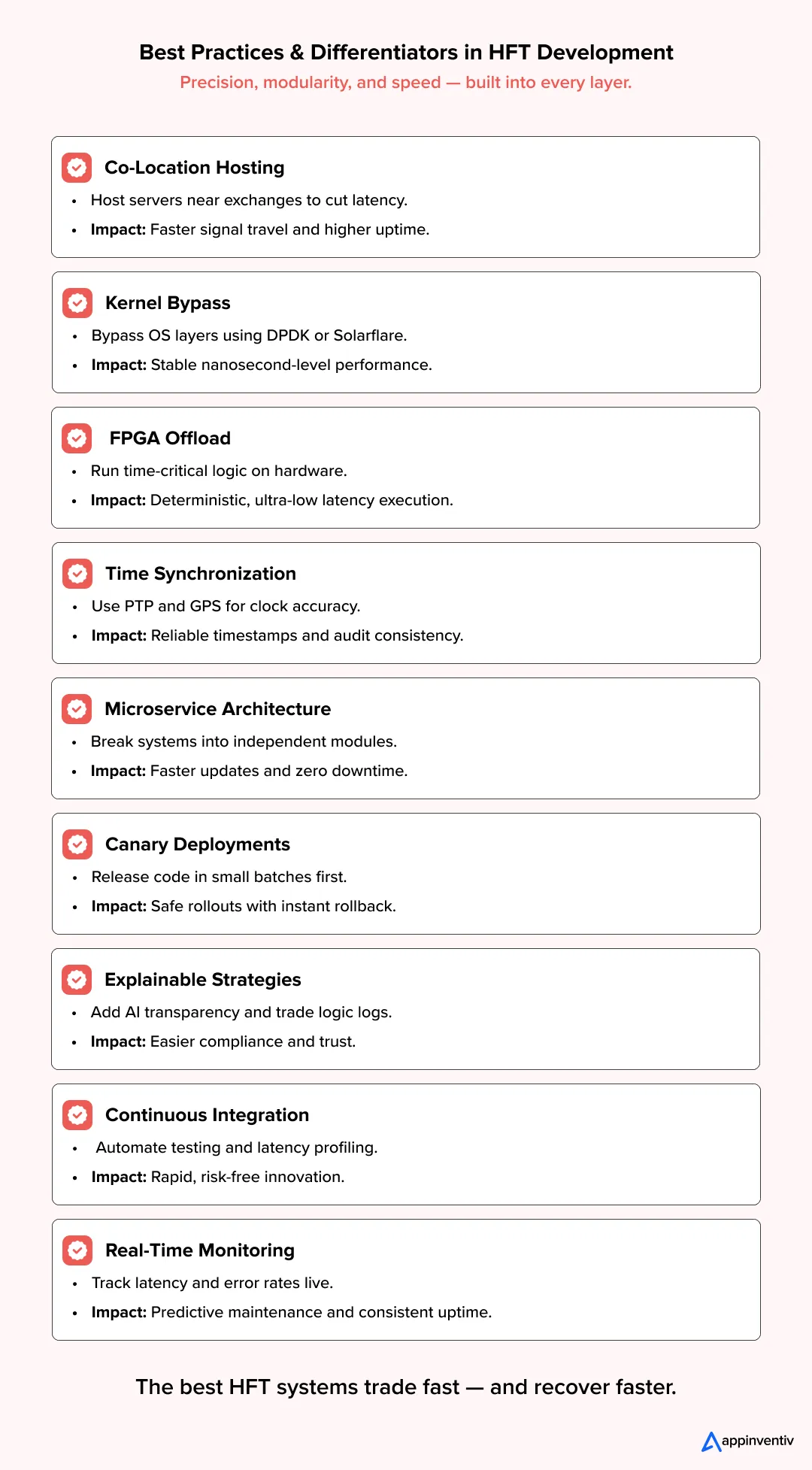

Best Practices & Differentiators

At the cutting edge of high-frequency trading, the difference between a good system and a great one lies in execution discipline. The fastest firms aren’t just optimizing code — they’re engineering entire ecosystems for precision, modularity, and predictability. Expert HFT software developers align hardware offload, kernel bypass, and real-time observability to keep latency deterministic.

Below are some of the practices that consistently separate the top performers from the rest.

Co-location & Ultra-Proximity Hosting

Every extra meter of cable adds latency, and in trading, latency is a lost opportunity.

- Firms host servers inside or next to exchange data centers for near-zero signal travel time.

- Redundant co-location sites in different zones prevent outages and allow quick failover.

- Private fiber connections reduce packet loss and ensure consistent network performance.

Kernel Bypass & Network Optimization

Operating systems are too slow for nanosecond decision-making.

By using kernel bypass frameworks like DPDK or Solarflare, trading systems bypass the OS entirely, letting applications talk directly to the network card. This removes queuing delays and context switching, improving consistency.

- Helps maintain predictable latency under load.

- Reduces CPU overhead and jitter in message delivery.

FPGA & Hardware Offload

For the most latency-sensitive parts of trading, software alone isn’t enough.

FPGAs (Field-Programmable Gate Arrays) process data at hardware speed — ideal for tasks like feed parsing, order book updates, and tick-to-trade logic.

- CPUs handle complex calculations and risk filters.

- FPGAs handle deterministic, time-critical workflows.

This hybrid model provides the best of both worlds — flexibility with uncompromising speed.

Time Synchronization (PTP & GPS)

In markets where orders fire hundreds of times per second, clock drift is dangerous.

- Precision Time Protocol (PTP) and GPS synchronization keep all systems aligned within microseconds.

- Ensures reliable audit trails, compliance accuracy, and debugging clarity.

- Prevents mismatched timestamps that can distort analytics and risk reporting.

Microservice Architecture for Modularity

Monolithic trading platforms used to be the norm — until firms realized how much downtime one bug could cause.

Modern systems use a microservice architecture, where each module (data ingestion, risk checks, order management) runs independently.

- Enables faster debugging and safer updates.

- Keeps systems operational even if one service fails.

- Allows quants and developers to work in parallel without blocking each other’s updates.

Canary Deployments & Real-Time Rollbacks

Even the best release can misbehave in production.

That’s why HFT firms deploy code like surgeons — in stages.

- New releases are first deployed to a canary node or a limited trading cluster.

- Metrics such as latency, order rejection rates, and execution speed are tracked instantly.

- If anomalies appear, the system automatically rolls back to the previous stable version.

This process ensures innovation never comes at the cost of uptime.

Explainability & Strategy Interpretability

Regulators and internal risk teams demand transparency — not mystery.

Every trading decision should be traceable.

- Strategies now include AI explainability layers, logging what triggered an order and why.

- Helps in post-trade analysis, compliance audits, and debugging unexpected behavior.

In a world where “black box” algorithms invite scrutiny, interpretability has become a differentiator.

Continuous Integration for Quant + Dev Pipelines

Trading platforms evolve daily — both in code and strategy. The safest way to move fast is to automate testing at every step.

- Continuous Integration (CI) pipelines now include strategy validation and latency profiling before deployment.

- Every change — whether by a quant or an engineer — goes through simulation and regression tests automatically.

This blurs the line between research and production, making system evolution both safer and faster.

Monitoring, SLAs & Real-Time Dashboards

Once live, the system’s stability depends on visibility. Engineers track performance through dashboards that look more like mission control than finance software.

- Custom SLAs define acceptable latency and uptime for each subsystem.

- Real-time dashboards show throughput, error rates, and tick-to-trade latency.

- Alerts trigger automatically when values drift from the norm.

Monitoring isn’t reactive; it’s the early warning system that keeps trades safe before users even notice an issue.

The bigger picture: the best-performing environments for High-frequency trading platform development emphasize reliability as much as speed. When you move into custom software development, this guide gives insight into how bespoke engineering approaches differ from off-the-shelf stacks.

Real Life Examples Of HFT In Use

High-frequency trading doesn’t usually make the front page — unless something unusual happens. Whether it’s a performance surge, a new technology breakthrough, or regulatory heat, each story reveals how these systems really behave under pressure.

Below are a few real-world examples that showcase what modern HFT firms are doing right — and where the challenges still lie.

1. Virtu Financial: Turning Volatility into Opportunity

When market conditions turned turbulent, Virtu Financial’s trading systems demonstrated why resilience matters more than raw speed. The firm reported a 104% rise in trading income, reaching around $544 million, while net income climbed to over $176 million.

- Why it worked: Virtu’s globally co-located infrastructure and dynamic liquidity algorithms allowed it to capitalize on volatile spreads without losing control.

- Technology layer: Operates across 235+ exchanges with low-latency data routing and predictive modeling.

- Performance insight: Maintains sub-millisecond order execution while adapting automatically to market swings.

- Lesson learned: Market chaos doesn’t punish prepared systems — it rewards them. Robust infrastructure and disciplined risk logic are what make volatility profitable.

2. Jump Trading: Building Speed on Smarter Foundations

Jump Trading’s latest technology partnerships show how the future of HFT depends as much on data science as on execution speed. The firm integrated high-performance data storage systems from DDN to support AI-driven quant models.

- Why it matters: HFT firms are shifting from simply chasing latency to optimizing how fast they can process and act on new data.

- Technical shift: Combines AI workloads for signal training with FPGA-driven hardware for sub-millisecond trading.

- Impact: Faster model retraining and lower data-to-decision latency.

- Lesson learned: Speed is evolving. The next advantage isn’t only about transmitting orders faster — it’s about learning and reacting faster than everyone else.

3. Jump Trading: When Speed Meets Scrutiny

Jump’s rapid expansion across traditional and crypto markets also brought a new kind of challenge — regulatory exposure. Its subsidiary, Tai Mo Shan Ltd., reached a $123 million settlement with the U.S. Securities and Exchange Commission (SEC) over misleading claims related to digital asset stability, marking a key enforcement action tied to the collapse of algorithmic stablecoins.

- What it showed: Technical excellence can’t shield a firm from reputational risk.

- Takeaway: Algorithmic transparency and auditability are no longer optional. They must be embedded into system architecture from day one.

- Lesson learned: The new arms race isn’t only for speed — it’s for credibility

4. The Latency Wars — Innovation at the Edge of Physics

Reports surfaced that firms like Jump Trading and Virtu Financial were experimenting with shortwave and optical data routes to send trading signals faster than standard fiber networks.

- The claim: Firms leveraged private or experimental communication paths to reduce latency by a few microseconds — enough to gain a competitive edge.

- Why it matters: Even with all the digital innovation, the physical layer — the cables, airwaves, and routing paths — remains a major frontier in trading performance.

- Lesson learned: The quest for speed now crosses into physics and telecommunications, forcing firms to navigate not just technology, but ethics and regulation too.

5. The Rise of AI-Infused HFT Systems

High-frequency trading (HFT) is evolving beyond speed. The new frontier is intelligence — systems that can sense, adapt, and decide when not to trade.

A Reuters analysis (2024) notes that leading trading firms are increasingly embedding artificial intelligence into their infrastructure to process real-time data, identify subtle market shifts, and make faster, more measured execution decisions. AI isn’t just helping algorithms act quicker — it’s teaching them to recognize when to pause, reducing overtrading and improving long-term stability.

- Trend: Machine learning models are being used to detect market conditions and automatically adjust trading intensity, giving firms more control during volatile sessions.

- Technical approach: Many HFT setups now pair GPU-based inference engines with FPGA execution hardware, allowing AI models to run in parallel without affecting latency.

- Impact: These systems deliver more consistent performance and steadier profit curves — a sign that the future of trading isn’t just about being the fastest, but about trading with intelligence and restraint.

What These Examples Reveal

Each of these cases — Virtu’s adaptability, Jump’s dual-edge expansion, and the AI-driven investing across trading floors — highlights a clear shift in how modern HFT operates. The goal is no longer to be the fastest trader in the room; it’s to be the most informed, predictive, and resilient one.

Looking ahead, the Future Trends in HFT Software Development point toward smarter throttling, data-local AI inference, and capital-efficient scaling — including new pathways on how to monetize high frequency trading software via cross-asset execution services, licensing of simulation frameworks, and managed latency products.

Speed still wins battles — but insight, compliance, and design discipline win wars.

Timeline & Time-to-Market Estimate

Building a high-frequency trading (HFT) platform is never a straight line. It’s part engineering project, part research experiment — and every milestone comes with its own lessons, fixes, and late-night tests.

While each firm’s journey looks a little different, most production-grade systems move through a clear sequence of phases that together take around 9 to 15 months.

What really determines the pace isn’t just coding — it’s how quickly teams can validate ideas, test them safely, and tune for performance without cutting corners.

Phase 1: Discovery & Strategy Definition (4–6 weeks)

This is where the groundwork is laid and expectations get calibrated.

- Teams define what the system needs to achieve — market type, asset class, and trading horizon.

- Quant researchers start shaping the first hypotheses, testing simple ideas against historical data.

- Engineers identify target latency, throughput, and which exchanges or co-location facilities to integrate with.

- Risk and compliance folks step in early to outline guardrails and audit requirements.

At this stage of developing high-frequency trading systems, the goal isn’t to write code, it’s to agree on what success looks like.

Deliverables: A system blueprint, latency goals, and initial infrastructure plan.

Common delay: Unclear business goals or changing requirements. A two-week buffer here usually saves months later.

Phase 2: Architecture & Infrastructure Setup (6–8 weeks)

Once the concept is greenlit, the heavy planning begins.

- Engineers select between bare metal servers, hybrid cloud, or FPGA integration.

- Networking experts design low-latency topologies, redundancy layers, and failover routes.

- Security teams set up authentication, logging, and encryption baselines.

- DevOps creates pipelines for continuous integration and automated testing.

This phase feels slow but it’s the backbone of everything that follows.

Deliverables: Infrastructure diagrams, test environments, and early CI/CD pipelines.

Watch out for: Hardware delivery delays or waiting on co-location approvals. Keep parallel workstreams running.

Phase 3: Prototype / Minimum Viable Strategy (8–10 weeks)

The first working version comes to life — usually small, fragile, and exciting.

- A single strategy (often market making or simple arbitrage) is built and connected to one exchange.

- The team builds feed handlers, order execution logic, and tick-level data simulation.

- Backtesting frameworks are connected to see how the system behaves under pressure.

This is where you start measuring end-to-end latency and identifying slow spots.

Deliverables: A basic but functional loop — data in, trade out — with early benchmarks.

Buffer: Plan for extra time debugging API mismatches and feed inconsistencies.

Phase 4: Core Module Development (12–16 weeks)

Once the prototype is validated, the team expands it into a production-grade engine.

- Add real-time market data ingestion, smart order routing, and risk management modules.

- Integrate multiple exchanges and protocols (FIX, REST, WebSocket).

- Build internal dashboards for latency monitoring and compliance logs.

- Fine-tune resource management: thread optimization, caching, and I/O balancing.

This phase is the most demanding — parallel teams work on quant models, data pipelines, and API connectivity simultaneously.

Deliverables: Full working modules ready for testing.

Biggest challenge: Managing dependencies across teams without blocking progress.

Phase 5: Testing, Optimization & Tuning (6–8 weeks)

Now the real work begins — making the system reliable and fast.

- Run unit tests, regression suites, and live data simulations.

- Identify latency bottlenecks through kernel bypass, CPU pinning, and memory tuning.

- Perform stress testing under real-time feeds to validate throughput and recovery behavior.

- Tune everything until microseconds become predictable, not lucky.

Deliverables: Verified latency metrics and stable simulation results.

Buffer: Add 2–3 weeks for performance fine-tuning — it’s never perfect on the first try.

Phase 6: Pilot / Sandbox Launch (4–6 weeks)

This stage feels like live trading but with guardrails.

- The system connects to production exchanges in a shadow or limited-capital mode.

- Real trades are monitored with strict limits and rollback mechanisms.

- Teams track slippage, error rates, and unexpected behaviors in real time.

Deliverables: Production-ready candidate with validated live metrics.

Common risk: Exchange throttling or latency drift under volume — prepare a fallback node and auto-restart logic.

Phase 7: Full Production Rollout (4–8 weeks)

Once stable in pilot, it’s time to scale.

- Connect additional exchanges and deploy multi-strategy execution.

- Roll out high-availability clusters, disaster recovery plans, and monitoring dashboards.

- Expand risk parameters and capital allocation gradually.

- Conduct post-launch audits to ensure compliance and security integrity.

Deliverables: Fully operational HFT ecosystem.

Risks: Last-minute hardware failures or compliance holds; keeping a 10–15% resource buffer helps absorb surprises.

Why Partner with Appinventiv

High-frequency trading demands more than just speed — it demands precision engineering, airtight security, and systems built to perform under real market stress. That’s where Appinventiv brings real value.

As a leading Fintech Software Development Company, Appinventiv has helped global enterprises and startups alike build scalable, compliant, and high-performance trading ecosystems. Whether it’s High-Frequency Trading Software Development, algorithmic execution platforms, or digital infrastructure for exchanges — we focus on delivering solutions that combine speed with resilience.

Our in-house software developers work closely with quant teams, data engineers, and compliance specialists to design systems optimized for low latency, fault tolerance, and continuous uptime. From architecture to deployment, every product we build is benchmarked for performance, compliance, and adaptability.

If you’re ready to turn your trading vision into a real, production-grade system, Appinventiv is your technology partner for the next leap forward in finance – talk to us today.

FAQs

Q. How much does it cost to develop a high-frequency trading platform?

A. There’s no one-size-fits-all number. For most teams, the cost to develop a high-frequency trading platform sits somewhere between $40,000 and $400,000. The difference comes down to how advanced your system is — things like exchange connectivity, real-time data processing, or FPGA acceleration can move the budget up fast. If you’re going for a custom setup, working with a team that specializes in custom HFT software development helps make sure your investment turns into real, measurable speed and reliability instead of just fancy tech.

Q. How long does it take to develop high-frequency trading software?

A. A serious HFT build usually takes around 9 to 15 months from start to launch. The early stages are about research, modeling, and architecture — the later months go into testing and fine-tuning. It’s not the kind of software you rush. Every phase needs time to validate latency, stability, and compliance. The best-performing systems are usually the ones that were given space to evolve and get every microsecond right.

Q. Should you build or buy an existing HFT platform?

A. That depends on your goals. Buying an existing HFT platform gets you moving faster, but you’ll hit limits when you need custom strategies or tighter latency control. Building your own system gives you freedom — to experiment, to optimize, to grow. Many firms start small with ready-made frameworks, then move to their own infrastructure once they know what works. Partnering with a reliable stock trading app development company can help you balance both — speed of setup and freedom to scale later.

Q. How do you ensure security in HFT software?

A. Security in HFT isn’t just about keeping hackers out — it’s about protecting your trades, data, and uptime every second. A good system is built with end-to-end encryption, secure APIs, strict user access, and real-time threat monitoring. Regular audits and compliance checks are a must too. The smartest move is to bring in a Fintech Software Development Company that designs for security from day one — not as something to patch later.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…