- Understanding the Role of Gamification in Banking?

- The Right Place to Implement Gamification Elements in Banking and Finance

- How Gamification Drives Customer Loyalty in Banking

- 1. Engagement: Habit Formation Through Repetition

- 2. Motivation: Instant Validation and Self-Efficacy

- 3. Education: Learning While Earning

- Real Life Use Cases of Gamification in Banking

- Savings & Budgeting: Turning Saving Into a Game

- Onboarding & Product Education: Making Learning Fun

- Credit Score Monitoring: Tracking Progress Like a Game

- Loyalty Programs: Rewards for Using the Bank

- Real-Life Cases Of Banks Implementing Gamification Strategies

- DBS Bank: The AI-Nudge Revolution

- Revolut: The RevPoints Ecosystem

- Monzo: Lifestyle Integration

- Game Changing Benefits of Gamification for Banks and Customers

- More Customer Engagement

- Customer Loyalty and Retention

- Opportunities to Cross-Sell Products

- A More Enjoyable Experience

- Better Financial Habits

- A Sense of Accomplishment

- How to Implement Gamification in Banking: 4 Core Steps of the Process

- Step 1: Identify the Goal of Gamification

- Step 2: Choose the Right Gamification Elements

- Step 3: Develop and Integrate Gamification into Your Platform

- Step 4: Measure, Optimize, and Evolve

- How to Overcome the Challenges of Gamification in Banking

- Trust and Transparency

- Regulatory Scrutiny

- The Sustainability Problem

- What is the Future of Gamification in Consumer Banking

- How Much Does It Cost to Implement Gamification in the Banking Industry

- How Appinventiv Can Help Banks Implement Gamification Strategies

- FAQs

Key takeaways:

- A winning banking gamification strategy isn’t about badges; it’s about using behavioral psychology to form daily financial habits.

- Industry leaders like DBS Bank and Revolut prove the concept works, driving higher savings and millions in user acquisition.

- The cost to implement gamification in banking and financial services ranges between $40,000 and $400,000 or more.

- Gamified elements shift customers from transactional users to emotionally invested partners, significantly lowering churn.

Traditional banking is often seen as transactional, repetitive, and uninspiring. Imagine walking into your local bank to open a checking account, you’re greeted by long queues, paperwork, and little to no incentive beyond a standard interest rate. In an increasingly competitive financial landscape, how can banks break through this monotony and engage their customers?

The solution lies in gamification. Rather than treating banking as a dry utility, banks can weave in game‑like mechanics such as points, milestones, nudges, turning everyday financial tasks into engaging, interactive experiences. When banking becomes interactive, customers don’t just transact, they engage.

A concrete example: DBS Bank (Singapore)’s NAV Planner illustrates how digital financial planning, powered by AI and smart design, can change customer behavior. As of 2022, about 2.8 million customers had used NAV Planner. Around 35% of them (nearly 1 million people) actively engaged with the tool.

Since the bank embedded nudges, planning tools and personalized prompts, the number of customers completing an investment journey reportedly rose four‑fold. Assets under management (AUM) for digitally managed investments also grew by 52% in the period after that feature was launched.

Simply put, the future of finance belongs to those who can make financial health as compelling as a social media feed. Here is how you can make that happen.

Gamifying your banking services is easier than you think. Contact us to find out how we can help you implement engaging financial tools that drive customer loyalty.

Understanding the Role of Gamification in Banking?

Before we dive into the “how,” let’s first know the “why” it matters. Gamification in banking isn’t just about slapping a badge onto a profile. It is the bridge between a user’s intent (e.g., “I should save money”) and their action (actually moving the funds).

To put it simply, gamification brings a sense of purpose and reward to tasks that are usually quite routine. Whether it’s saving money, budgeting, paying bills or managing debt, dealing with day-to-day financial tasks can be mundane.

Solution? By introducing game-like elements, banks can make these tasks more dynamic, interactive, fundable and, most importantly, more rewarding.

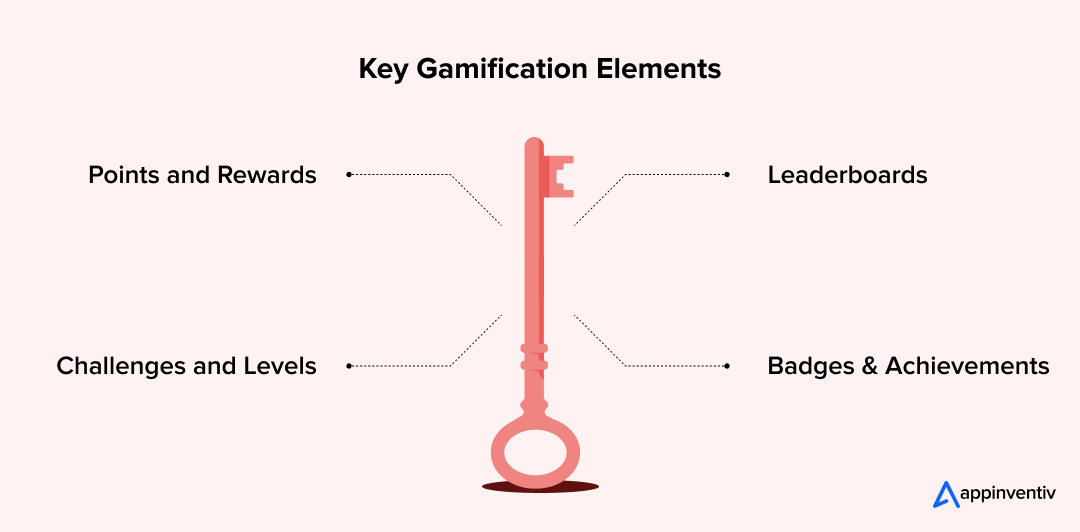

So, what exactly does gamification look like in banking? Let’s break down the key elements that drive this strategy:

Key Gamification Elements

To successfully implement gamification, banks rely on several key elements:

- Points and Rewards: Customers earn points for completing daily tasks, like making regular deposits or setting up automatic transfers. These points can be redeemed for real-world rewards, such as cashback or better interest rates.

- Challenges and Levels: Gamified challenges, such as savings or budgeting goals, encourage customers to take specific actions to achieve milestones and unlock new levels.

- Leaderboards: A ranking system that motivates customers by showcasing how they compare to others. It fosters friendly competition, increasing engagement.

- Badges and Achievements: Similar to video games, banks reward users with digital badges for accomplishing specific tasks, creating a sense of accomplishment.

The Right Place to Implement Gamification Elements in Banking and Finance

Integrating these game mechanics into banking services doesn’t require overhauling everything. It’s about weaving in these elements where they make the most sense. Crucially, these game mechanics are not bolted on; they must be seamlessly integrated into your digital channels such as:

- Mobile Apps: Financial institutions can incorporate gamification in banking apps to introduce savings plans, personalized financial tips, or in-app educational quests that guide users through multiple banking features.

- Loyalty Programs: Banks can introduce tier-based rewards, where customers unlock higher levels of benefits by accumulating points through activities like spending or saving.

- Customer Interactions: Incorporating gamified elements in customer service interactions, such as rewards for timely payments or encouraging the use of additional banking products.

Also Read: Mobile Banking Application Development: A Complete Guide

How Gamification Drives Customer Loyalty in Banking

Gamification in digital banking isn’t just about making things more fun. It’s about creating real connections with customers. When people are engaged with their bank and when they feel involved and rewarded, they’re more likely to stick around. But how does gamification actually keep customers loyal? Let’s dig into it.

1. Engagement: Habit Formation Through Repetition

One of the main challenges banks face is keeping customers engaged. You know how it goes: you check your bank balance once in a while, make a payment here and there, and that’s about it. But what if there was a way to get customers actively involved with their financial health every day?

AI driven banking solutions powered by gamification do just that. When banks introduce game-like elements, like earning points or reaching milestones, customers are more likely to interact with their accounts regularly. A simple task, like setting up automatic payments or saving for a rainy day, becomes something to look forward to because it’s tied to a reward or challenge.

Personalized Savings Goals: A bank might say, “Hey, if you save $200 this month, we’ll reward you with a bonus.” It makes saving feel like less of a chore and more of a game, and who doesn’t want to win something for doing the right thing with their money?

2. Motivation: Instant Validation and Self-Efficacy

We all know how motivating it is to win something. It could be as simple as a small badge or seeing a progress bar fill up. These little victories are enough to keep your customers hooked, and that’s a big part of why gamification works so well in banking.

When a customer successfully completes a financial challenge, such as consistently contributing to an emergency fund, the instant visual feedback, the points, and the digital flair provide a potent hit of dopamine. This feeling of immediate success contrasts sharply with the traditionally delayed gratification of finance.

This continuous positive reinforcement transforms the bank into a reliable source of self-efficacy. The customer thinks: “I am succeeding at my finances, and this bank’s tools are helping me do it.” That emotional recognition is the most durable form of loyalty you can acquire.

3. Education: Learning While Earning

Another major benefit of gamification is how it helps customers learn about banking. Many high-value products, such as IRAs, term life insurance, and structured investments, remain inaccessible and confusing to the average user due to perceived complexity. Gamification lowers this cognitive barrier dramatically.

Instead of reading a PDF on compounding interest, the user completes a short, interactive simulation or quiz that teaches them how to budget, invest, or even improve their credit score.

For instance, you can create mini-quizzes or offer rewards for completing educational content, give them progress bars to show how a credit score improves over time, or level progression to illustrate the journey from basic banking to investment literacy.

This learned knowledge is then immediately reinforced by a small reward, perhaps a temporary interest rate boost on their savings. The more they learn, the more they earn and the more empowered they feel in managing their finances. It’s a win-win.

A great example of this in action is EDFundo, a financial literacy app developed by Appinventiv. EdFundo uses elements to teach young users about personal finance, including budgeting, saving, and investing.

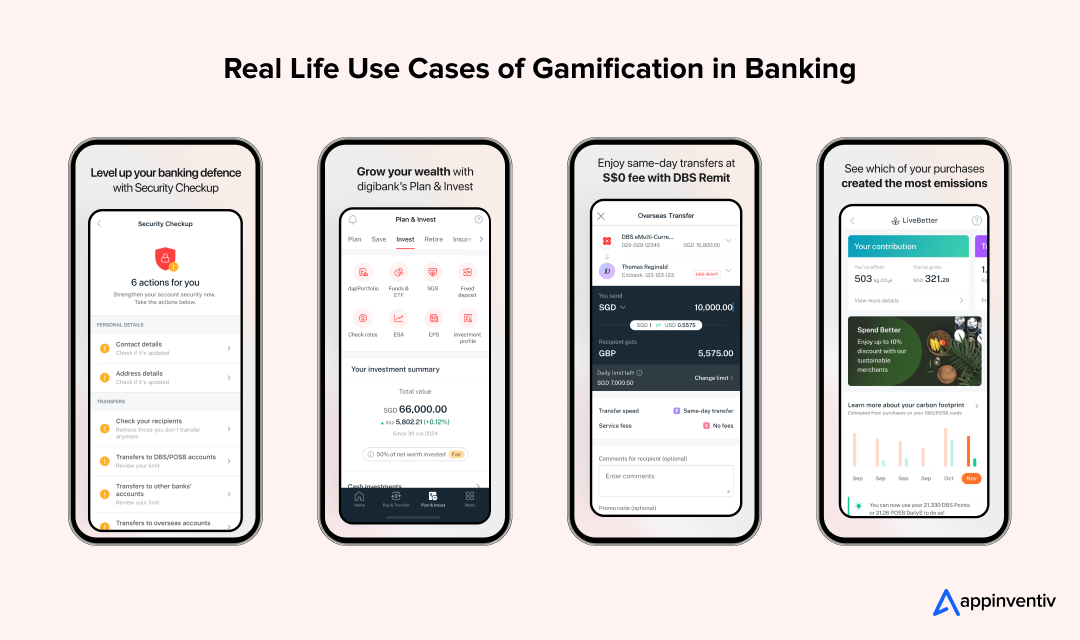

Real Life Use Cases of Gamification in Banking

Gamification in banking isn’t just some trendy buzzword. It’s happening right now, and it’s making a real impact. Banks are using game-like features to turn everyday financial tasks into something more engaging and fun. Let’s look at some real-world examples of how gamification is changing the banking game.

Savings & Budgeting: Turning Saving Into a Game

Saving money has never been all that exciting, right? It usually feels like a task we put off because there’s nothing fun about it. But gamified savings apps? Now, that’s a whole different story. Banks are taking saving and budgeting to the next level by making it feel like a game; and who doesn’t want to play?

Example: Apps like Qapital and Digit use gamified features to make saving feel like you’re unlocking rewards, instead of just stashing away cash for a rainy day. Every time you reach a savings goal, you earn something like a badge, a reward, or maybe just the satisfaction of seeing your balance grow.

These apps even set up challenges where you compete with yourself to hit goals, and the results? Customers end up saving more, simply because they’re having fun doing it.

Onboarding & Product Education: Making Learning Fun

Let’s be honest: onboarding with a new app or service can be intimidating. A lot of times, you just want to get through it as quickly as possible. But what if that onboarding process get into fun and even a little bit rewarding?

Sounds interesting? Well, banks across the globe are gamifying their onboarding and educational content to change that. Instead of reading through dry terms and conditions, customers can earn points or badges for completing tasks like setting up auto-transfers or activating e-statements.

This kind of gamified learning doesn’t just keep things interesting; it ensures customers actually understand how to use the bank’s services, which makes them more likely to stick around.

Example: Chase and Bank of America have added gamified elements to their apps to keep customers engaged during onboarding. These banks aren’t just teaching people how to use their apps; they’re making the process enjoyable and rewarding.

Credit Score Monitoring: Tracking Progress Like a Game

Credit scores are one of those things that everyone checks, but nobody enjoys. It’s a stressful experience, especially when you’re not sure where you stand. But imagine if you could offer your customers the chance to watch their score improve with every positive step they take, like leveling up in a game? It is that silent booster that will level up your app engagements in a jiffy.

Example: Apps like Credit Karma make credit score monitoring feel like a game. Users can see their progress over time with visual cues, like a progress bar or ladder, that fills up as they make smarter financial decisions.

Paying off debt? The score moves up. Keeping credit utilization low? They get a boost. These apps don’t just tell users where their score stands; they show them how to improve it and make the process feel like a win.

Loyalty Programs: Rewards for Using the Bank

Loyalty programs in banking are nothing new, but gamifying them is. Banks are using game-like elements like points, levels, and rewards to make the experience of using their services more exciting.

Example: Revolut’s loyalty program rewards users for everyday spending. Every time they use their card, they earn points that can be redeemed for perks like better interest rates or exclusive offers. It’s not just about earning rewards; it’s about making customers feel like their engagement with the bank is something that’s constantly rewarding them.

And it works. Customers are more likely to use their bank’s services regularly when they know there’s something in it for them.

Real-Life Cases Of Banks Implementing Gamification Strategies

Theory is great, but the real impact comes from how gamification is actually implemented. Let’s dive into how some major banks are using gamification to drive engagement, improve customer experience, and grow their businesses.

DBS Bank: The AI-Nudge Revolution

Singapore’s DBS Bank, often hailed as the “World’s Best Bank” (Euromoney 2025), has mastered AI driven gamification banking. This AI-driven approach doesn’t just add badges or rewards; it analyzes spending patterns and nudges users to save money when they can most afford it.

- The Move: Their app analyzes spending patterns and nudges users to save at the exact moment they can afford it.

- The Result: DBS reported that customers using these personalized nudges saved significantly more compared to those who didn’t. While specific figures are not always publicly available, NAV Planner’s tools have been credited with helping users increase their investment in automated solutions, growing assets under management (AUM) by over 50%.

Revolut: The RevPoints Ecosystem

Revolut has aggressively pushed its gamification in fintech strategy. In June 2024, they rolled out “RevPoints,” a loyalty program that rewards customers not just for spending, but for financial behaviors like setting a budget or using the “spare change” round-up feature.

- The Move: RevPoints rewards users for positive financial behaviors, such as budgeting, saving, and spending wisely. The system uses a point collection approach, allowing users to unlock exclusive perks as they engage with various banking features.

- The Result: The program pulled in 6.6 million users almost instantly. By turning the banking experience into a point-collection meta-game, Revolut posted a record $1.4 billion profit in 2024, proving that engagement pays dividends.

Also Read: How Much Does It Cost to Build A FinTech App Like Revolut?

Monzo: Lifestyle Integration

Monzo, a UK-based neobank, took a different approach to gamification by integrating financial management with lifestyle. In a partnership with fitness apps like Strava, Monzo allows users to link their fitness goals to their financial goals.

- The Move: By connecting banking goals to physical activity, Monzo allows users to set rules like, “Save $5 every time I run 5km.” This innovative gamification connects personal health with financial health, making the process more enjoyable and meaningful.

- The Impact: This weaves banking into the user’s physical lifestyle, making the bank a partner in their holistic well-being. It’s a prime gamification in banking example that show how gamification in finance and banking can live beyond the screen.

Also Read: Cost to develop an app like Monzo: Your financial innovation

Game Changing Benefits of Gamification for Banks and Customers

When banks introduce gamification, it’s not just about giving users something fun to do. It’s about creating a win-win situation where both banks and customers get something out of the deal. Let’s break down the key benefits of gamification in the financial sector

For Banks:

More Customer Engagement

Gamification makes it easier to keep customers coming back. Instead of just checking a balance or making a one-time transaction, customers are now logging in regularly to track their progress, earn rewards, or reach their financial goals.

The more they engage, the more likely they are to stick around. The more they stick around, the more value the bank gets. It’s a proven growth cycle that pays off in the long run.

Customer Loyalty and Retention

Customers tend to stay longer with a brand that rewards them. Banks can capitalize on this tendency and offer them gamified experiences like earning points, unlocking rewards, or leveling up. This will keep customers glued to your brand.

It will give them a reason to keep coming back, and we all know that customer retention is key to unlocking the door of immense opportunities.

Opportunities to Cross-Sell Products

Gamification isn’t just about engagement; it also gives banks the chance to introduce other services. For example, a customer might start by setting up a gamified savings goal, and along the way, the app might encourage them to open a checking account or try a new credit card.

When customers are engaged, they’re more open to exploring additional products. It simply means that banks have more opportunities to grow.

For Customers:

A More Enjoyable Experience

Let’s face it: we all get bored of looking at numbers on a screen. But when you turn managing money into a game, suddenly it becomes interesting. Gamified banking lets customers have fun while doing something productive.

Whether it’s saving, budgeting, or tracking spending, customers get to feel like they’re winning and that’s enough to keep them motivated to stay around.

Better Financial Habits

Gamification helps customers learn and improve their financial habits without the pain of “boring” lessons. It means if you can turn a budgeting class into a fun challenge, you’ve already won.

Gamified apps provide small, interactive tasks, like saving a set amount, completing a challenge, or learning about a new product. As customers work through these tasks, they naturally become more financially literate, and before they know it, they’re making smarter decisions.

A Sense of Accomplishment

Gamification turns day to day banking chores into a series of small victories. When customers complete a financial goal or unlock a new reward, they get that little hit of satisfaction. It’s no different from winning a game.

Those little moments of accomplishment can make customers feel empowered, like they’re in control of their financial future. And when people feel good about what they’re doing, they keep doing it and sticking with the bank.

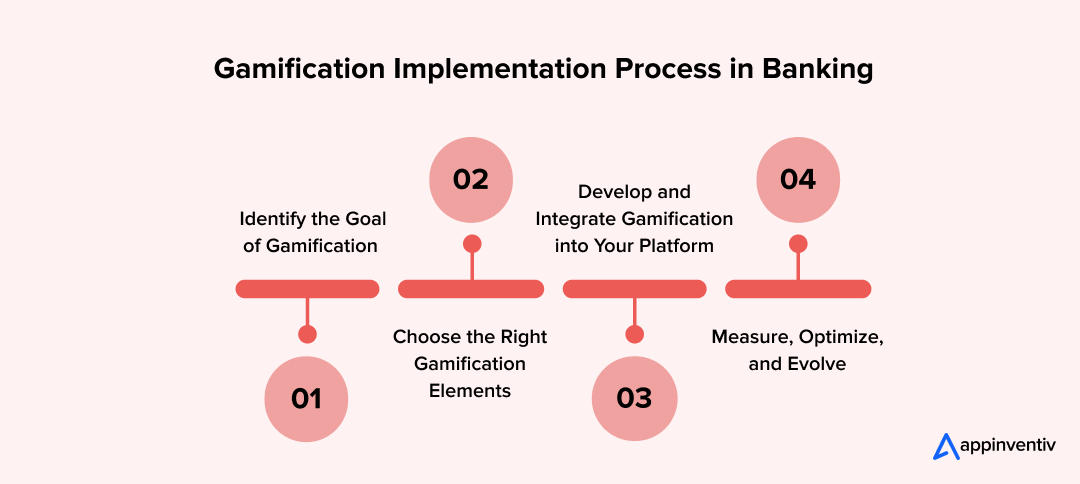

How to Implement Gamification in Banking: 4 Core Steps of the Process

Even though the successful applications of gamification in banking offer numerous advantages, its implementation is not so easy. It is a meticulous process of several steps that requires careful planning, integration, and continuous optimization to ensure it meets all – customer expectations, business objectives and regulatory requirements. To help you get right in this venture, here is a step by step process of implementing gamification in finance and banking:

Step 1: Identify the Goal of Gamification

Before jumping into gamifying your banking services, it’s essential to define the objective. This is a mandatory first step that you can’t afford to ignore. Ask yourself the questions like:

- Do you want to boost savings?

- Increase product engagement?

- Improve customer education?

- Or do you have any other specific idea in mind?

Identifying clear goals helps determine which gamification elements will be most effective.

Step 2: Choose the Right Gamification Elements

The next step is to decide which game mechanics align with your goals. For example,

- If the objective is to improve savings, rewards like points or progress bars might be the best fit.

- If the aim is customer education, quizzes, badges, or interactive challenges could be more appropriate.

- If the goal is customer engagement, leaderboards, milestones, or personalized challenges could work wonders

Remember, the aim of gamification fintech is to enhance the user experience, not complicate it.

Step 3: Develop and Integrate Gamification into Your Platform

Once you’ve successfully taken the above 2 steps, next you need to integrate your chosen elements into your banking platform. Whether it’s within a mobile app, website, or even customer service channels, your implementation strategy of banking gamification features must feel seamless and intuitive. It should add value, not overwhelm the user.

Ensure the gamified features are well-designed, easy to understand, and provide meaningful rewards. Work closely with your development team or a trusted banking software development company to ensure the successful implementation of gamification in banking apps.

Step 4: Measure, Optimize, and Evolve

Implementing gamification in digital banking is not a one-and-done project. After launching the gamified elements, you need to continuously track their performance.

- Are customers engaging more?

- Are they completing the challenges you’ve set up?

- Is your gamification fintech strategy generating any value to your business?

Use AI driven data analytics to see which features are driving engagement and which need adjustments. Continuous optimization is key to keeping the gamification fresh and engaging over time.

How to Overcome the Challenges of Gamification in Banking

The process of any financial software development or the implementation of new elements that can add value to your existing systems is not without its challenges and gamification in digital banking is no exception. The challenges of gamification in banking are real and must be tackled head-on. Here are some proven strategies to overcome the potential pitfalls:

Trust and Transparency

Challenge: If personalization relies on invasive data collection, users will revolt. Security breaches linked to gaming features are lethal to trust.

Solution: Strict compliance adherence such as GDPR and PCI-DSS, is the secret weapon. Always be transparent about why the AI is suggesting a challenge. Use advanced encryption on all behavioral data, treating it with the same vigilance as a financial transfer.

Regulatory Scrutiny

Challenge: Incentives must not promote reckless or unsuitable financial behavior (e.g., incentivizing high-risk trading).

Solution: Every game design must be vetted by a compliance officer. The rewards must primarily reinforce responsible, conservative behavior (saving, prompt payment, budgeting), ensuring ethical alignment.

The Sustainability Problem

Challenge: Novelty fades quickly. A static game dies within a year.

Solution: This is the core reason for robust investment in a dynamic, AI driven gamification banking platform that can automatically analyze cohort saturation and deploy fresh, targeted challenges continuously, ensuring long-term engagement and delivering sustained ROI.

The path to develop an engaging gamified banking platform can have hurdles, but with the right strategy, you can overcome them. Talk to us about your goals and see how we can help you navigate the process smoothly.

What is the Future of Gamification in Consumer Banking

We are rapidly moving past the era of simple point-scoring and entering the age of Predictive Gamification and the Metaverse. It means the future isn’t about rewarding customers after they save; it’s about AI anticipating their behavior before it happens.

Imagine an interface that knows your customers typically overspend on takeout on Friday nights. Instead of a passive notification, your banking app sends you a challenge at 4 PM: “Spend under $30 tonight to unlock a 2x bonus multiplier on your travel points.”

This is hyper-personalization at scale, using Generative AI to create unique “quests” that nudge customers toward financial wellness in real-time, effectively turning your bank into a proactive financial coach that lives in your pocket.

Beyond the screen, the Metaverse is set to redefine what a “bank branch” looks like. Industry leaders like DBS Bank and J.P. Morgan are already experimenting with virtual spaces, but the next wave will go deeper.

We foresee virtual advisory rooms where customers can visualize their investment portfolio as a growing digital city rather than a spreadsheet. If your stocks are doing well, your city thrives; if you are taking too much risk, storm clouds appear. This level of immersion transforms abstract financial data into tangible, emotional experiences, making complex wealth management intuitive for the next generation of digital natives.

How Much Does It Cost to Implement Gamification in the Banking Industry

There is no one-size-fits-all approach to quote the exact cost of implementing gamification in banking. The cost range can vary widely based on several factors like the complexity of features, customization needs, technology stack, and integration with existing systems.

On average, the cost of gamification implementation in the banking industry ranges between $40,000 and $400,000 or more based on your project requirements.

Here is a brief table outlining the estimated cost of gamification implementation in the banking and financial services.

| Complexity Level | Estimated Cost Range (Non-Exhaustive) | Key Components Driving Cost |

|---|---|---|

| Basic (MVP) | $40,000 – $100,000+ | Simple badges/points for routine tasks (e.g., first login, setting a savings goal). Minimal AI driven gamification banking logic. |

| Advanced (Custom Engine) | $100,000 – $200,000+ | Custom loyalty logic engine, personalized challenges based on spending data, tiered reward system, and leaderboards (requires high-end secure development). |

| Enterprise (Full Transformation) | $200,000 – $400,000+ | Deep core banking system integration, advanced AI/ML for dynamic difficulty adjustment and hyper-personalization, full compliance audit, and multi-channel deployment (app, web, branch). |

ROI Impact: Even though the cost of gamification implementation in banking seems substantial, the ROI banks often generate is impressive. On average, banks witness 15-25% increases in customer lifetime value (LTV) and drastically lower acquisition costs. This pays for the initial build many times over.

Also Read: Cost to Build a FinTech App: What You Need to Know

How Appinventiv Can Help Banks Implement Gamification Strategies

Deploying a complex, compliant, and highly engaging gamification in banking solution requires deep FinTech expertise; it’s not a job for a generic software house.

At Appinventiv, we recognize that this strategy requires mastery of both regulatory environments and motivational design. As a specialized banking software development company, our process is engineered to mitigate the challenges while maximizing the benefits.

Our Partnership Model

- Goal-Driven Strategy: We align the entire banking gamification strategy directly to your most pressing KPIs, whether it’s boosting savings rates among millennials or increasing the adoption of self-service investment tools.

- Custom AI Implementation: We engineer a proprietary AI driven gamification banking engine that ensures continuous personalization and sustainability, making sure the initial investment pays dividends years down the line.

- Security and Compliance: Gamification in banking can’t afford to overlook compliance. We embed regulatory compliance into the design phase, guaranteeing that every challenge, reward, and leaderboard is built on an ironclad foundation, protecting both you and your customers.

Why Choose Appinventiv?

With over 300+ banking transformation projects delivered, Appinventiv is a trusted partner for banks looking to implement next-generation solutions. Our 97% client satisfaction rate speaks to our commitment to quality, and our solutions are already impacting 35+ countries globally.

We bring 10+ years of banking domain expertise, which makes us experts in navigating the complexities of banking technologies. So far, we’ve securely processed over 100 million transactions, delivering reliable performance across the board with an impressive 99.90% SLA uptime in core banking apps.

What’s even more impressive? Through automation, we’ve helped banks achieve 40% efficiency gains, helping them reduce costs and streamline their operations.

Case Study: Mudra – Chatbot‑Driven Budget Management Platform

A great example of our expertise is Mudra, which helps millennials take control of their finances. How it works? Mudra uses AI to analyze users’ spending patterns and delivers nudges through a conversational interface. This way, users don’t just track their expenses, they’re actively guided toward smarter financial decisions.

Partner with Appinventiv today. We build the digital architectures that transform transactional customers into loyal, engaged financial partners.

FAQs

Q. Why is gamification important in banking?

A. Gamification in banking is important because it solves the core issue of customer apathy and low engagement. It uses proven psychological mechanics to make complex or tedious financial tasks rewarding and habitual, creating “sticky” digital platforms and dramatically increasing the customer’s investment, both emotionally and financially, in their primary institution.

Q. How to implement gamification effectively?

A. To implement effectively, you must focus on genuine utility tied to core financial goals (e.g., budgeting, paying down debt). Use an AI driven gamification banking system to ensure the challenges are hyper-personalized and avoid simple vanity metrics. The rewards must be financially tangible to the user, not just digital filler.

Q. How to choose a developer for a gamified banking app?

A. Choose a dedicated banking software development company that has deep expertise in FinTech security, global regulatory frameworks, and advanced behavioral design. They must demonstrate a portfolio of successful gamification examples in banking and the capability to build a scalable, maintainable, and dynamically personalizing AI engine, rather than just a static, visually appealing app.

Q. How is gamification revolutionizing digital banking?

A. Gamification in digital banking is revolutionizing the sector by shifting the focus from simply reporting data to actively guiding behavior. It turns the mobile app into a proactive financial coach, demystifying complex products and rewarding responsible actions, thereby accelerating digital adoption and fostering a level of trust and engagement previously unattainable through traditional methods.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Banking Technology Consulting: A Strategic Roadmap for Core Modernization and Guaranteed ROI

Key takeaways: Banking modernization is now a strategic necessity, not a technology upgrade. Most banks lose value due to legacy complexity, fragmented data, and slow compliance response. Structured banking technology consulting delivers measurable gains in cost, stability, and governance. Core modernization succeeds when roadmaps, risk, and regulatory alignment are clearly defined. ROI comes from reduced…

KYC Automation - Benefits, Use Cases, Steps, Tools and Best Practices

Key takeaways: KYC automation cuts verification from days to minutes and keeps checks consistent across teams. AI and ML reduce manual errors, catch risk earlier, and make compliance far easier to scale. Manual KYC drains time, increases cost, and slows onboarding — automation fixes all three. Automated workflows handle spikes in customer volume without compromising…

How to Modernize Legacy Systems in Banking: Key Strategies and Steps

Key takeaways: Legacy systems burn cash and slow things down, so modernization is essential to stay compliant and competitive. Methods like replatforming, refactoring, or a hybrid approach let banks upgrade piece by piece without breaking everything. Tech trends like cloud computing, AI, and blockchain make modernization happen faster, fixing efficiency, customer service, and safety. Banks…