- Understanding the Functions of ERP Finance: Why It Matters, and Who Should Use It

- Benefits of ERP Systems for Financial Management

- Earnings Visibility and Monitoring

- Centralized Account Oversight

- Asset Tracking and Management

- Proactive Risk Management

- Automated Financial Reporting

- Multi-Currency Management

- Simplified Tax Compliance

- Real-time Data Insights

- Data-Driven Decision Making

- Scalability and Business Agility

- ERP Systems Integration in Financial Sectors - A Step-by-Step Process

- Define Clear Financial Goals

- Choose the Right ERP Finance Module

- Customize the System for Finance Workflows

- Plan Data Migration and Integration

- Run Thorough Tests Before Going Live

- Train Your Staff

- Monitor and Maintain the ERP System

- Partner with ERP Integration Experts

- Common ERP Integration Mistakes to Avoid

- How to Choose the Right ERP for Your Financial Industry?

- Ensure Core Functionality

- Check Integration Capabilities

- Look for Robust Analytics

- Evaluate Scalability and Flexibility

- Assess Vendor Reliability

- Understand the Total Cost of Ownership

- Key Challenges in Financial ERP System Integration and How to Overcome Them

- Integration with Legacy Systems

- Data Security Concerns

- User Resistance and Training

- Cost of ERP implementation in the Financial Industry

- Implement ERP in Finance with Appinventiv

- FAQs

“FinTech companies are growing fast, but many are flying blind.”

Despite rapid growth, FinTech companies that cannot efficiently consolidate and leverage their data often face roadblocks to gaining a comprehensive view of their operations and gaining competitive advantages. This data blindness frequently leads to missed insights, compliance risks, and operational inefficiencies.

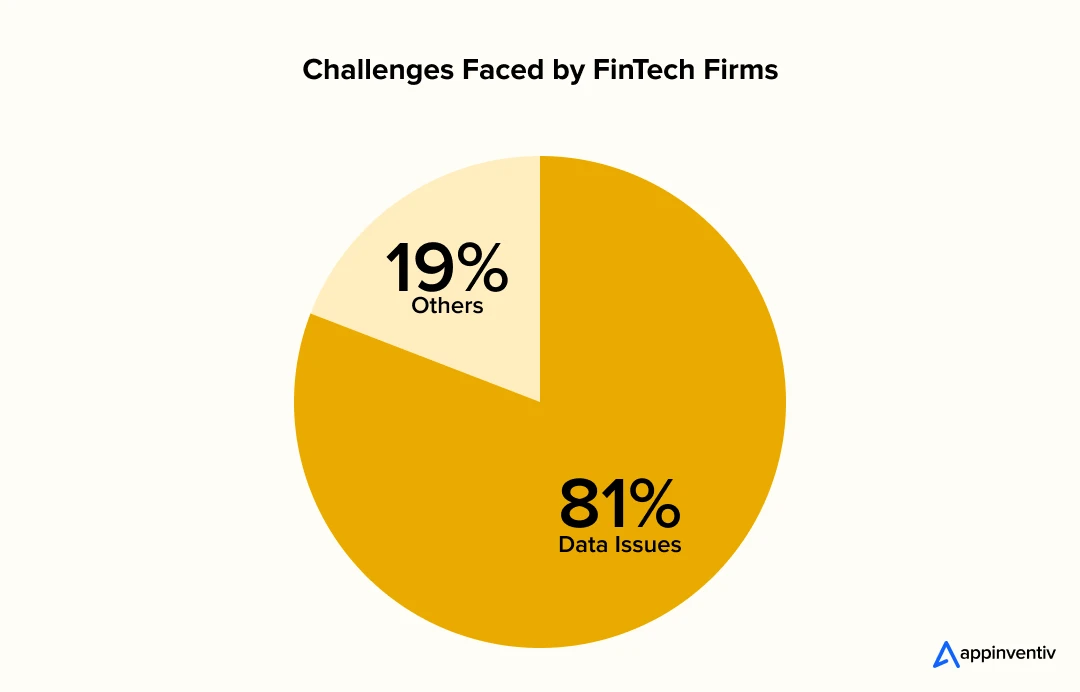

A global survey reveals that 81% of FinTech firms identify data issues as their most significant technical challenge, with 40% unable to connect to customers’ applications, data, or legacy systems (Source: International FinTech).

In an industry where real-time data accuracy, transaction speed, and regulatory compliance are of the utmost priority, operating with fragmented systems is not only inefficient but also risky.

The challenge is not innovation, but coordination. This is where ERP financial systems (Enterprise Resource Planning) come in. This efficient system brings cohesion, transparency, and scalability to FinTech operations.

In this blog, we will explore:

- How ERP finance is revolutionizing the industry with its multiple data-driven benefits.

- How to implement ERP in finance

- What are the potential challenges

- What are the mistakes to avoid while showcasing

- How does this powerful fusion simplify data-driven analytics for enhanced decision-making?

Understanding the Functions of ERP Finance: Why It Matters, and Who Should Use It

ERP finance, a centralized system, enables businesses to manage their core financial functions, such as accounting, budgeting, compliance, reporting, and forecasting, from a unified platform. Unlike traditional systems where data sits in silos and require manual interventions, ERP streamline these processes, offering real-time visibility and data accuracy across departments.

For example, Goldman Sachs implemented ERP systems to streamline global financial reporting and ensure compliance with evolving regulatory standards. This significantly improves internal controls and decision-making efficiency.

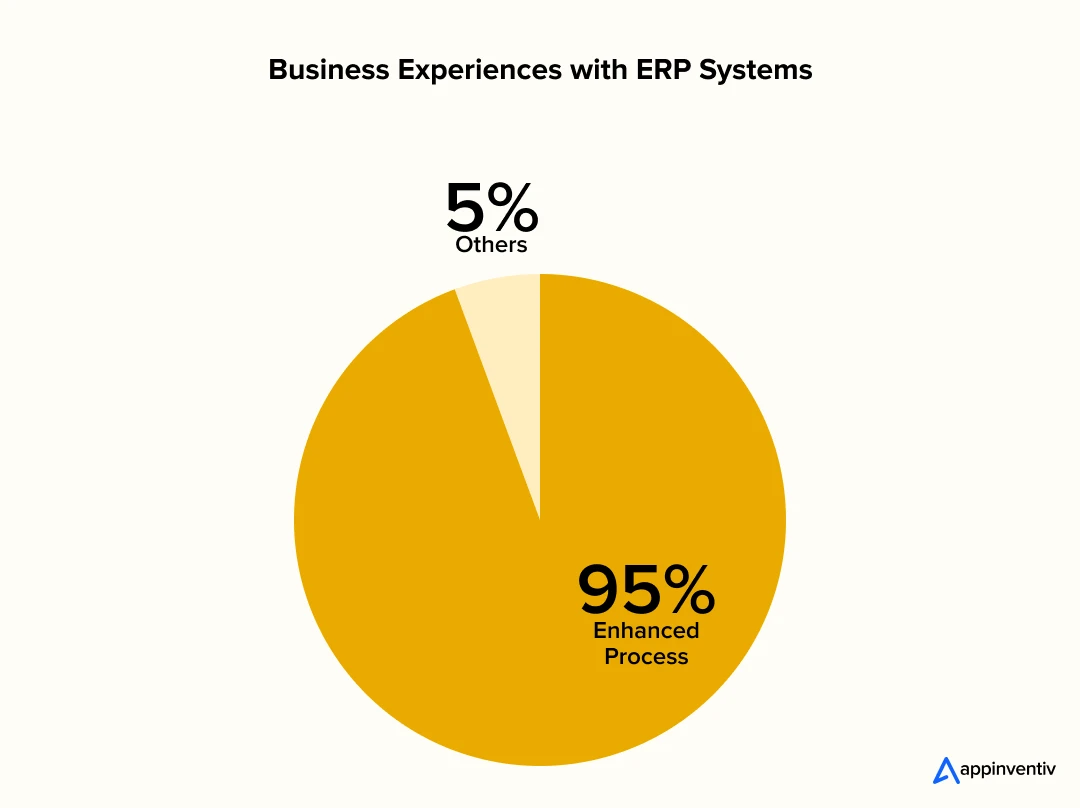

What It Matters: The core benefit of financial management in ERP lies in its ability to transform fragmented financial operations into a connected ecosystem and automate complex workflows. Whether you are a FinTech company looking to automate investor reporting or a global payments enterprise aiming to reduce audit overhead, ERP systems help scale, accuracy, and agility. In fact, 95% of businesses reported improved processes after ERP implementation (Source: Forbes).

Who Needs It? ERP systems integration in financial sectors is a must-have tool for institutions handling large transaction volumes, navigating strict regulatory requirements, or scaling through data-driven strategies. For decision-makers, these systems are indispensable for tracking cash flow, managing risk, and reporting accurately across departments.

Whether you are running a neobank, an online lending platform, or a wealth management service, an ERP finance system is the backbone of your operations. This brings clarity, control, and consistency to every financial decision.

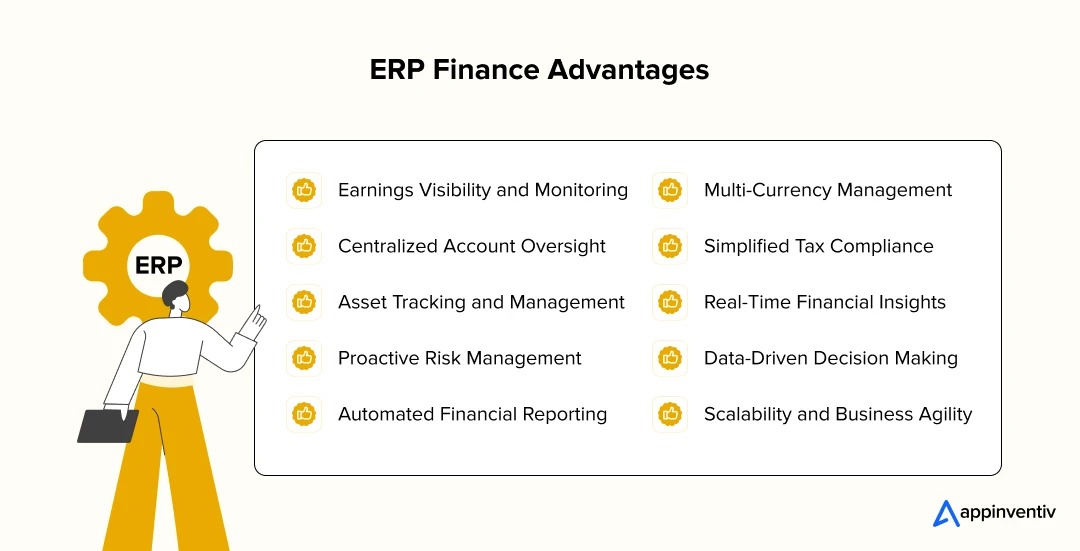

Benefits of ERP Systems for Financial Management

As FinTech businesses experience growing transaction volumes, regulatory pressures, customer demands, and market complexities, having a unified ERP financial system is no longer an option; rather, it has become a dire necessity.

The ERP finance module brings structure, accuracy, and agility to financial operations, enabling companies to make smarter decisions, stay compliant, and scale efficiently. From helping executives monitor earnings to providing real-time data insights, ERP offers many financial benefits. Let’s take a brief look at some of the major benefits of ERP systems for financial management:

Earnings Visibility and Monitoring

In the realm of FinTech, precise ERP financial management is imperative. ERP finance solutions designed for FinTech enterprises offer real-time insight into earnings. Imagine a peer-to-peer lending platform effortlessly tracking interest gains and repayments through a robust FinTech ERP analytics module. This comprehensive ERP financial management system ensures accurate earnings oversight, empowering smarter financial decisions.

Centralized Account Oversight

For FinTech enterprises, maintaining a clear view of accounts is non-negotiable. ERP centralizes account data and effortlessly manages inflows and outflows. Consider a digital wallet app provider ensuring instant balance updates and transaction histories through a streamlined ERP finance module. This level of ERP financial management fosters trust and efficiency.

![]()

Asset Tracking and Management

ERP finance empowers companies in the sector by tracking tangible and digital assets in a structured way. Imagine a blockchain-based lending platform efficiently tracking collateralized digital assets with a robust financial management ERP system. This synergy ensures transparent asset control, elevating trust in the system.

Proactive Risk Management

ERP analytics for financial management acts as a real time risk shield. Consider an algorithmic trading startup investing in ERP financial management software development to analyze market trends. By identifying potential risks in real time, the financial ERP software ensures proactive risk mitigation.

Automated Financial Reporting

The BFSI market thrives on data-driven insights. ERP finance streamlines this with automated report generation. Visualize a robo-advisory firm employing financial management ERP systems to create client-specific performance reports. The outcome? Efficient and personalized reporting, nurturing client relationships.

Multi-Currency Management

With FinTech companies operating across borders, managing multiple currencies has become a necessity of the hour. ERP finance systems make this complexity manageable by seamlessly handling multi-currency transactions in real time. Picture a cross-border payment gateway utilizing an ERP financial management system to automate currency conversions, ensure accurate reporting, and deliver a smoother user experience.

Simplified Tax Compliance

ERP finance software simplifies multi-jurisdictional tax handling. Imagine a digital payment platform utilizing FinTech ERP solutions to calculate and report taxes in various jurisdictions seamlessly. This application of ERP in finance ensures compliance and minimizes errors, allowing businesses to focus on growth.

Real-time Data Insights

ERP financial systems offer FinTech companies instant access to critical financial data. For example, a peer-to-peer lending platform leverages an ERP finance module to track loan application trends, enabling swift adjustments. With up-to-the-moment insights from Financial analytics, companies are empowered to make informed decisions promptly that drive performance and agility.

Data-Driven Decision Making

In the BFSI market, making informed decisions is of paramount importance. ERP finance aids this by providing data-driven insights. Consider a robo-advisory startup using financial ERP systems to analyze investment trends, ensuring clients’ financial goals are met. This ERP and finance synergy elevates decision-making accuracy.

Scalability and Business Agility

FinTech’s rapid evolution demands dynamic finance systems that can keep pace with the evolving trends. ERP in finance and accounting offers this flexibility to adapt quickly as users demand change or scale. For instance, a blockchain-based payment platform embraces financial ERP software to scale effortlessly, adapting to sudden transaction spikes. This ERP finance use case ensures seamless scalability, accommodating future growth and market shifts.

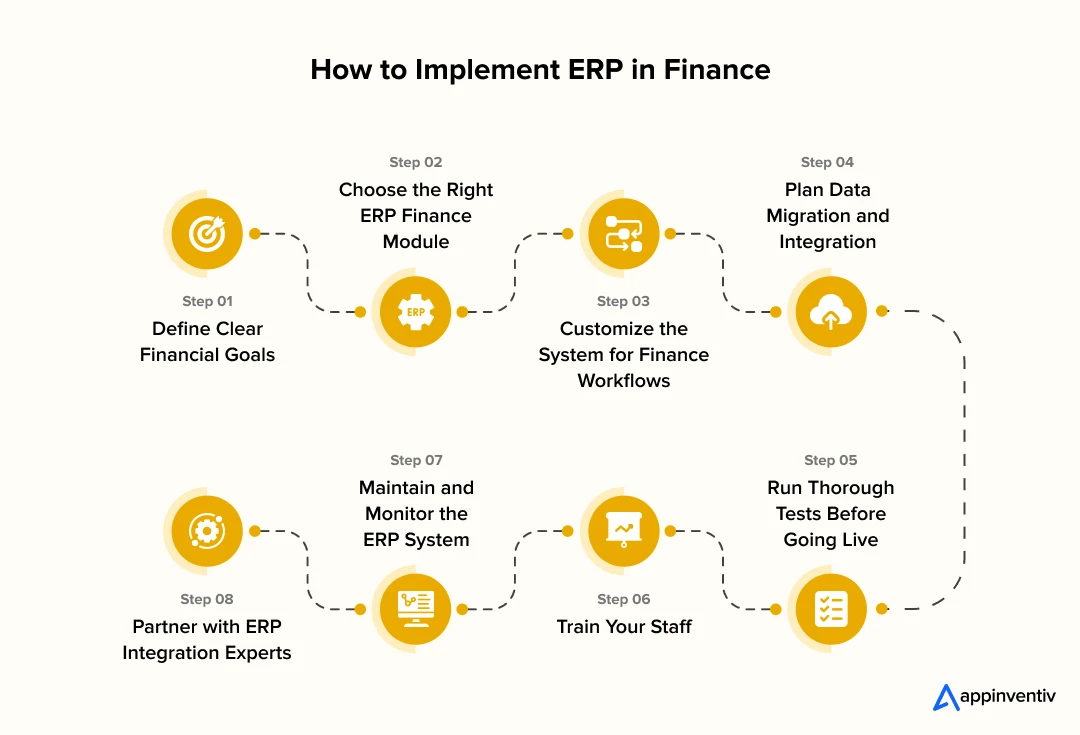

ERP Systems Integration in Financial Sectors – A Step-by-Step Process

The success of your financial ERP system depends on how you implement it. If you know how to implement ERP in finance seamlessly, you can make the magic and scale efficiently. Here are a few factors you should consider while implementing ERP in finance systems.

Define Clear Financial Goals

Before starting the actual financial ERP integration process, you must assess and analyze your comprehensive needs. Start by defining what you are trying to fix or improve. Identify your financial challenges, operational gaps, and goals. Whether improving reporting accuracy, automating compliance, or managing multi-currency transactions, a clear understanding of needs helps shape the right roadmap for ERP implementation.

Choose the Right ERP Finance Module

Not every financial ERP system is suitable for every business. Therefore, before you choose, look for an ERP finance module tailored to your business. Ensure the ERP finance solution you select offers the flexibility to scale, integrates seamlessly, and supports financial compliance out of the box (details provided later).

Customize the System for Finance Workflows

After choosing the best ERP financial systems, now it is time to tailor the product to align it with your specific financial workflows, be it billing, budgeting, forecasting, or tax handling. This step ensures that your financial ERP systems function effectively in your unique economic environment. This includes:

- Set up your financial structure: Define your chart of accounts, business units, and cost centers to reflect your organization’s economic hierarchy.

- Configure key modules: Tailor core ERP modules like financial management, budgeting, forecasting, and billing to support day-to-day operations.

- Align with internal workflows: Map existing finance processes, such as tax handling or expense approvals, into the ERP system to ensure continuity.

- Set role-based access: Define user roles and permissions to control who sees what, protecting sensitive financial data.

- Enable seamless integrations: Connect the ERP with tools such as accounting platforms, inventory systems, or CRM systems to avoid data silos and streamline reporting.

Plan Data Migration and Integration

Seamless data migration is the cornerstone of successful ERP implementation in the financial industry. At this stage, you need to carefully map your existing financial data, like ledgers, transaction histories, and account structures, ensuring it is clean and consistent.

Here is how you can successfully and securely migrate your sensitive data:

- Identify where your financial data lives across platforms and applications.

- Categorize the types of financial data you need to migrate, such as transactions, ledgers, customer info, etc.

- Remove duplicates, correct errors, and ensure data accuracy before transfer.

- Choose a secure and efficient data transfer approach tailored to your ERP setup.

- Perform trial runs to detect and fix potential issues before the final transfer.

- Protect data with contingency measures in case of migration failures.

- Set clear rules for data ownership, quality, and access moving forward.

Run Thorough Tests Before Going Live

Before full deployment, rigorous UAT (unit, integration, and user acceptance) testing is essential to validate the ERP finance system’s functionality, security, and performance. Testing is not just a checkbox; it is your safety net. This step simulates daily financial tasks, such as invoice processing, reconciliation, and reporting, to identify issues early and ensure the system can withstand pressure.

Train Your Staff

Do you know that even the most advanced ERP finance systems in the world can go in vain if users don’t know how to utilize them? Therefore, you must spend time training your teams with real-life scenarios. Make sure they feel confident before the switch flips. This step lays the groundwork for a seamless transition, maximizing the potential of financial ERP software.

Monitor and Maintain the ERP System

The ERP journey does not end at deployment and user training. Ongoing performance monitoring, system updates, and maintenance are critical to ensure sustained value and uninterrupted performance of your financial ERP systems. For instance, monitoring how customer onboarding time improves after implementing the ERP can help validate ROI and uncover future enhancements.

Partner with ERP Integration Experts

The financial ERP integration process is complex and challenging. The process can be even more troublesome if your in-house team lacks tech expertise. But worry not. Here is the catch. You can consider hiring an ERP integration partner. They will help you tailor the solution, integrate the ERP in finance, and avoid costly mistakes. Sometimes, having the right tech partner by your side can make all the difference.

Common ERP Integration Mistakes to Avoid

ERP systems integration in financial sectors is not just about getting the tech in place; rather, it is about getting people, processes, and planning right from the start. However, many organizations trip up on the same avoidable mistakes. Thus, to help you avoid making those costly mistakes, here is a brief table highlighting some common ERP implementation errors:

| Common Mistakes | How It Hurts |

|---|---|

| Not involving stakeholders | Leads to poor adoption and a system that doesn’t meet real user needs. |

| Underestimating complexity | Causes project delays, budget overruns, and rushed decisions. |

| Lack of a clear roadmap | Results in confusion, missed steps, and inconsistent rollout. |

| No dedicated cross-functional team | Gaps in expertise lead to misconfigurations and missed integration issues. |

| Skipping user training | Reduces confidence, slows adoption, and increases support requests post-launch. |

| No post-launch support plan | System issues pile up without timely fixes, lowering long-term ROI. |

Link up with us for a rock-solid, slick-as-hell ERP finance rollout that’ll blow your mind.

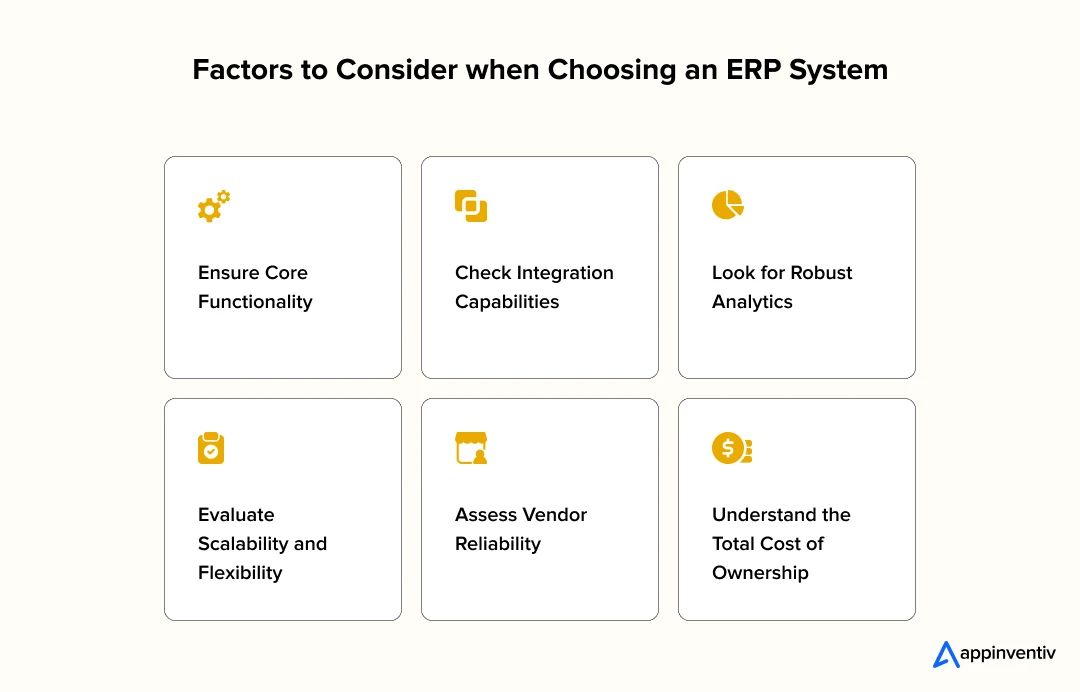

How to Choose the Right ERP for Your Financial Industry?

Choosing the right ERP system for your financial enterprise is the most critical decision that determines the overall success of your efforts invested in the financial ERP integration process. You must look for financial ERP systems that align with your current operational needs and future scalability. If you are not sure how to do it right, here is a breakdown of some critical elements that will help you make an informed choice.

Ensure Core Functionality

The ERP you choose should support essential financial operations like accounting, billing, budgeting, CRM, and inventory management.

Check Integration Capabilities

Ensure that the finance ERP you choose can integrate smoothly with your current tech stack to avoid data silos and workflow disruptions.

Look for Robust Analytics

Opt for financial management ERPs that offer advanced financial reporting, sales analysis, and real-time dashboards capabilities.

Evaluate Scalability and Flexibility

Choose a financial ERP system that can adapt to your business growth, users’ demands, and evolving financial needs.

Assess Vendor Reliability

Count on a reputable and reliable ERP provider known to offer ongoing support and regular updates. Additionally, the provider must have domain expertise in finance.

Understand the Total Cost of Ownership

Find out what the total cost of ownership is, including customization, implementation, and ongoing maintenance.

Also Read: ERP Accounting Software Development – All You Need To Know

Key Challenges in Financial ERP System Integration and How to Overcome Them

Navigating the path of ERP adoption presents both promise and hurdles. As businesses strive to enhance their operations and reap the benefits of streamlined processes, they also encounter challenges that require strategic solutions. Keeping this in mind, here we delve into the key obstacles organizations often face when implementing ERP systems and discuss some effective strategies to overcome these hurdles.

Integration with Legacy Systems

Challenge: Implementing ERP in finance and accounting is not a plug-and-play game. The real challenge lies in aligning diverse legacy systems, such as accounting, payment gateways, and customer data databases, which often operate in silos and lack interoperability.

Solution: The answer lies in a well-planned integration roadmap that treats ERP as part of a broader fintech software integration strategy. If you are not sure how to do it right, collaborate with an ERP for financial services provider and they will simplify the process, ensuring compatibility, minimizing downtime, and unlocking seamless data exchange.

Data Security Concerns

Challenge: Security is non-negotiable in the finance world. Integrating ERP systems introduces new access points and workflows that can put sensitive financial data at risk if not handled properly. For instance, if an investment platform implements ERP without strong security measures, it could become an easy target for data breaches or cyber theft.

Solution: To overcome this pressing issue, implement strong security measures, such as data encryption techniques and multi-factor authentication. Additionally, you must adhere to essential regulatory compliances like GDPR or SOC 2.

User Resistance and Training

Challenge: Transitioning to ERP in finance often encounters a significant issue of user resistance. Employees usually worry about unfamiliar interfaces, disrupted workflows, or increased workloads. This resistance is particularly common in FinTech, where teams often rely on traditional tools.

Solution: To mitigate this issue, comprehensive training tailored to financial ERP software processes is vital. Tailored training sessions, hands-on workshops, and role-based tutorials can help staff understand how ERP benefits them directly.

Cost of ERP implementation in the Financial Industry

There is no one-size-fits-all approach to quote the exact cost of finance ERP implementation. It varies significantly based on various factors such as the organization’s size, software choice, customization complexity, data migration needs, and the features of an ERP for the financial sector.

On average, the cost to implement ERP in finance ranges from $40,000 to $200,000 for small to mid-sized businesses and $200,000 to $500,000 or larger enterprises. Here is a quick breakdown of the variables that influence the cost of ERP systems integration in financial sectors.

| Cost Driving Factors | Average Costs |

|---|---|

| Customization & Integration | $20,000 – $200,000, depending on the complexity and features of an ERP for the financial sector |

| Data Migration | $10,000 – $100,000 |

| Training | $5,000 – $50,000 |

| Consulting & Support | $10 – $300 per hour |

| Ongoing Maintenance | 15% – 20% of the initial implementation cost annually |

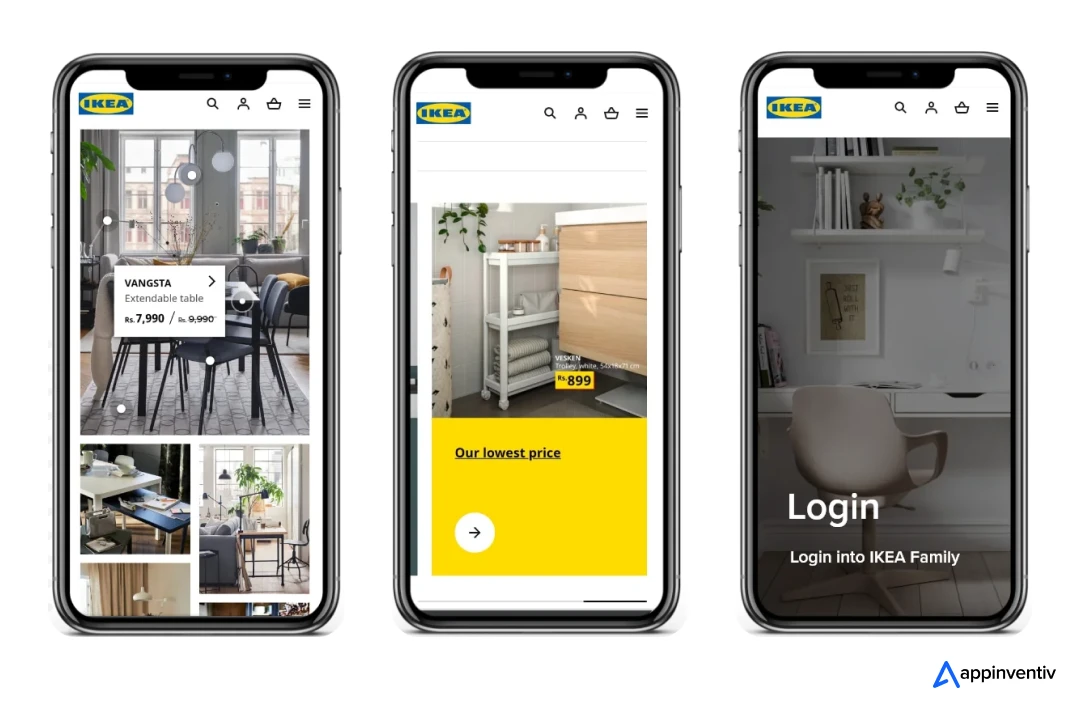

Implement ERP in Finance with Appinventiv

At Appinventiv, we take immense pride in delivering top-notch FinTech consulting services to help you weave the right strategy and roadmap for ERP implementation in the financial industry or your organization. Our mission revolves around empowering businesses to unlock the full potential of their data, driving strategic insights and growth.

Our team of 1600+ tech experts knows the nitty-gritty of successfully implementing ERP in your unique business processes. A great example of this is our collaboration with IKEA, where we helped digitize their entire in-store experience by building an end-to-end ERP-powered shopping solution.

From real-time inventory tracking to seamless checkout, the ERP we implemented streamlined operations while enhancing customer engagement. What’s more? IKEA leverages this ERP system to gather vital customer information, such as email addresses and products they are interested in. This helps the brand redefine its marketing strategies and gain data-driven advantages. This proves how robust ERP implementation can unlock efficiency and scalability for global enterprises.

As the world’s leading provider of ERP services, we are committed to pushing the boundaries of innovation and excellence. So, why wait? Contact us in shaping the future of FinTech data analytics, where possibilities are limitless, and success is data-driven.

FAQs

Q. How can ERP integration improve operational efficiency in financial institutions?

A. ERP finance helps improve operational efficiency by streamlining reporting, automating processes, and enhancing data-driven decision-making. It centralizes financial operations, ensuring accuracy, compliance, and efficient resource allocation, ultimately fostering growth and customer satisfaction.

Q. How do ERP systems handle financial management?

A. ERP financial management tools offer advanced analytics, including real-time financial reporting, automated accounting, budgeting and forecasting, cash flow management, trend forecasting, risk assessment, customer segmentation, and lifetime value analysis. These insights enable FinTech enterprises to anticipate market dynamics, tailor services, detect fraud, and optimize strategies for better financial control, regulatory compliance, and overall performance.

Q. What is the future of ERP in financial analytics?

A. The future of ERP in financial analytics holds exciting prospects. ERP systems will evolve to seamlessly integrate AI and machine learning, enabling predictive and prescriptive analytics. Real-time data processing, personalized insights, and enhanced visualization will become standard, empowering businesses to make proactive, strategic decisions. ERP’s role in optimizing resource allocation and risk management will solidify, reshaping how FinTech enterprises drive growth and stay competitive.

Q. How long does it take to implement an ERP in finance?

A. The timeline required for ERP implementation in the financial industry varies depending on the type, size and complexity of the system being implemented. Typically, ERP implementation timeline in finance can take anywhere from 4 months to 1 year or more.

Q. Which sectors within the finance sector can benefit from ERP solutions?

A. ERP for financial services is a valuable tool for various sectors where precision, compliance, and real-time data are essential. For instance:

- Neobanks rely on ERP financial systems to streamline digital operations and customer onboarding.

- Investment and wealth management firms benefit from real-time analytics and performance tracking.

- Insurance companies use ERP for claims management, policy administration, and financial reporting.

- Lending platforms can automate credit risk assessments and payment schedules.

In short, any financial service that relies on integrated data and process visibility stands to gain significant advantages from ERP systems integration in financial sectors.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…