- Why Financial Wellness Apps are Essential for Businesses

- Improved Employee Productivity

- Increased Employee Retention

- Reduced Financial Stress

- Alignment with Corporate Values

- Stronger Company Culture

- How to Build a Financial Wellness Platform: A Step-by-Step Guide

- Step 1: Defining Your App’s Purpose

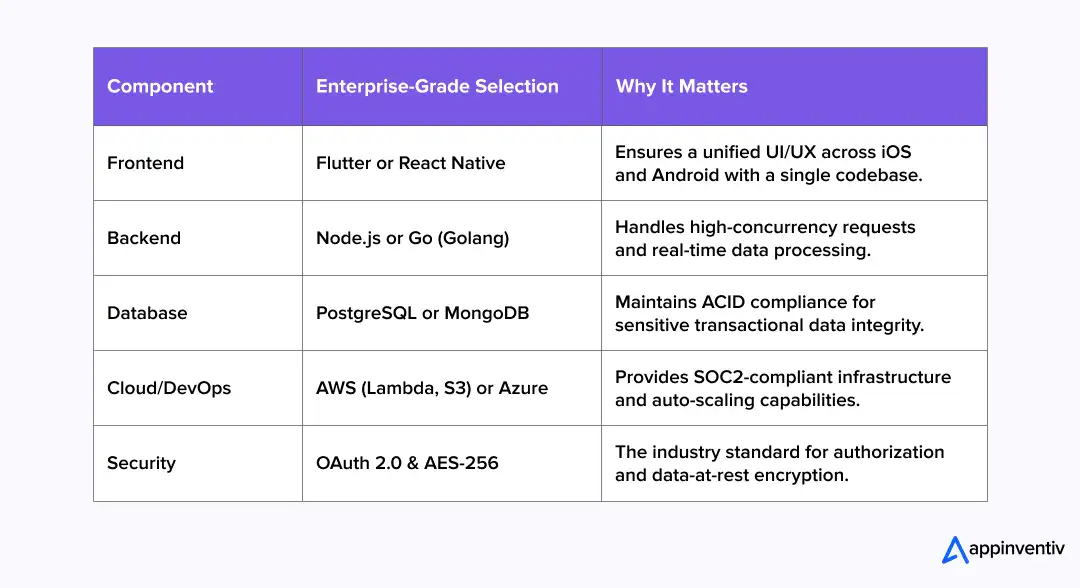

- Step 2: Choosing the Right Technology

- Step 3: Design a Simple and Intuitive User Experience (UX)

- Step 4: Developing Key Features

- Step 5: Ensuring Compliance and Security

- Step 6: Testing, Deployment, and Scaling

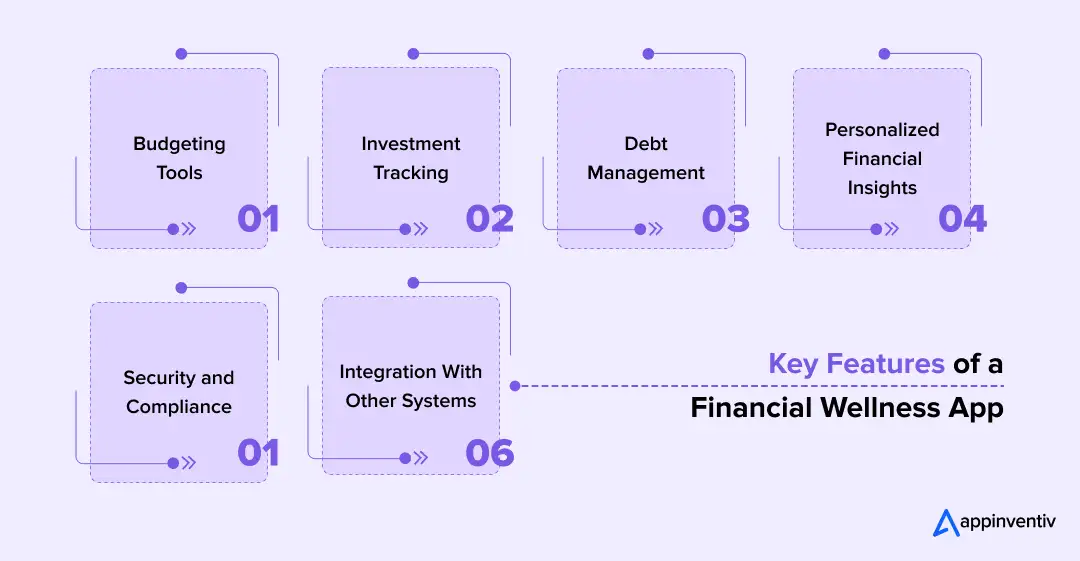

- Key Features of a Financial Wellness App

- 1. Budgeting Tools

- 2. Investment Tracking

- 3. Debt Management

- 4. Personalized Financial Insights

- 5. Security and Compliance

- 6. Integration with Other Systems

- Costs to Develop a Financial Wellness App

- 1. Development Costs

- 2. Customization and Integration

- 3. Ongoing Maintenance

- 4. Total Estimated Cost

- Challenges in Financial Wellness App Development Services

- 1. Data Privacy and Security

- 2. User Adoption

- 3. Integration Complexity

- 4. Scalability

- 5. Cost Overruns

- How Appinventiv Can Help in Enterprise Financial Wellness App Development

- Technical Expertise

- Proven Track Record

- Our Approach

- Frequently Asked Questions

Key Takeaways

- Strategic ROI: Financial wellness apps are no longer “perks”; they are critical tools for reducing financial presenteeism and improving institutional retention.

- Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs.

- Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive employee data.

- Cost Efficiency: Development costs typically range from $35,000 to $400,000+, depending on the integration of AI-driven predictive analytics.

Financial wellness apps are now must-have tools. Businesses that want to support their employees’ financial health need them. These platforms facilitate granular expense orchestration, enabling employees to achieve long-term fiscal stability. They also boost productivity and keep employees around longer.

In the current economic climate, Financial Absenteeism and Presenteeism have become silent ROI killers for the Fortune 500. Developing a financial wellness platform is no longer a peripheral ‘perk’; it is a strategic integration into an organization’s Total Rewards Strategy.

By using AI-driven fiscal coaching, enterprises can mitigate the cognitive load of financial stress on their workforce, which directly correlates with a decrease in healthcare costs and an increase in high-value output.

When you build an AI-powered financial wellness app, you give your team real support. This improves engagement. It sets everyone up for long-term success.

This blog walks you through financial wellness app development. You’ll learn what financial health app features to include. You’ll see how much it costs. We’ll also show you why financial wellness solutions make good business sense for enterprises.

This shows how financial wellness apps can boost retention and productivity outcomes. Appinventiv excels at delivering secure, scalable solutions.

Why Financial Wellness Apps are Essential for Businesses

The financial app market was valued at $1.805 billion in 2025 and is expected to be $5.677 billion in 2035, at a CAGR of 12.14%.

This shows that developing financial wellness applications isn’t just a nice-to-have perk. They’re smart business investments. Companies that offer these tools see the benefits of financial wellness applications. Employee engagement goes up, productivity rises, and overall well-being gets better.

Improved Employee Productivity

Employees who handle their finances well feel less stressed. They stay more focused at work. Financial health app development gives them tools to track spending. They empower workforce fiscal resilience. They can plan ahead. This cuts down on financial anxiety.

Increased Employee Retention

Financial stress is one of the top reasons employees disengage at work. When you build a financial wellness platform, you show your team something important. You care about their financial futures. This leads to higher job satisfaction and turnover rates drop.

Reduced Financial Stress

Financial worries can impact an employee’s mental health. Work performance suffers too. Financial wellness solutions for enterprises offer personalized advice. They provide clear insights. This helps employees take control of their finances. It creates a healthier workforce.

Alignment with Corporate Values

Offering a financial wellness app shows your company cares about its employees. It’s not just about providing a tool but demonstrating something deeper. You value your workforce’s long-term well-being. You care about their security.

Stronger Company Culture

Financial wellness solutions can improve your company’s culture. They create a sense of community. Employees feel supported and valued. This leads to better teamwork and team, morale gets higher.

Investing in an enterprise financial wellness app development does more than improve the employee experience. It improves your business’s bottom line. Happier, healthier employees create better business outcomes.

How to Build a Financial Wellness Platform: A Step-by-Step Guide

Developing a financial wellness application is a smart investment. It can greatly improve your employees’ financial health. It boosts their overall well-being.

This guide takes you through the main steps in financial health app development.

Step 1: Defining Your App’s Purpose

Before you start developing your app, establishing a comprehensive project charter is non-negotiable for aligning stakeholder expectations. You need to define its purpose. This guides your decisions throughout the financial wellness platform development process.

- Identify key objectives: What do you want to help employees do? It could be to save more money, manage debt or plan for retirement.

- Understand user needs: What financial challenges are your employees facing? Whether they need budgeting tips or are looking for investment advice.

- Align with business goals: Make sure the app’s purpose matches your overall business objectives. It could be to improve employee productivity or reduce financial stress.

When you define your app’s purpose, you make sure it delivers real value. It meets your employees’ and the company’s needs.

Step 2: Choosing the Right Technology

Selecting the right technology stack can make or break your app. Security and scalability in financial wellness platforms must be addressed. Your app needs to be efficient. It must be user-friendly and seamless for HCM and Payroll API orchestration.

Choosing the right technology makes sure the app is functional, secure, and meets your enterprise’s needs.

Step 3: Design a Simple and Intuitive User Experience (UX)

User experience decides whether your app will succeed or fail. Build a financial wellness platform that is easy to navigate.

- Clear navigation: Make sure users can easily find what they need. Budgeting tools should be found easily. Account balances should be visible.

- Simplicity: Keep the design clean. Use minimal text. Keep easy-to-understand visuals.

- Personalization: Offer tailored financial advice. Give suggestions based on users’ financial behavior and goals.

An intuitive design encourages constant use. It helps users get the most from the app’s features. This ultimately leads to better engagement and produces better results.

Step 4: Developing Key Features

The core features of your app should focus on one thing. Improving users’ financial health. These features of financial wellness apps need to be solid. They need to be frictionless, high-adoption UX/UI design. Focus on security and personalization.

- Budgeting tools: Give users easy-to-use budgeting features. Give them the option to track income and expenses. Let them set savings goals.

- Debt management: It helps users manage outstanding debt. Offer insights into payment schedules, show interest rates, and provide strategies to clear debt faster.

- Personalized financial advice: Use data to provide tailored financial recommendations. Use trending technologies like AI, ML, and more to track users’ financial behavior.

- Investment tracking: Offer users an option to monitor and track their investments. Provide real-time updates and insights.

Building these financial health app features makes sure the app offers complete solutions. It helps users improve their financial health.

The Generative AI Paradigm in FinTech

At Appinventiv, we also use Retrieval-Augmented Generation (RAG) to provide context-aware financial guidance. By grounding LLMs in the specific financial policies of your organization (e.g., 401k matching rules or HSA limits), the app moves beyond generic advice to provide hyper-personalized fiscal roadmaps. This reduces the burden on your HR helpdesk by automating complex queries regarding employee benefits.

Step 5: Ensuring Compliance and Security

Financial apps deal with sensitive data so meeting security and enterprise compliance rules for financial wellness apps is critical. Your app must meet legal and regulatory standards.

For enterprise-grade solutions, ‘basic security’ is a non-starter. A development partner should prioritize:

- Open Banking Protocols (PSD2/Fdx): To ensure secure, permissioned access to financial data.

- SOC2 Type II & ISO 27001 Readiness: Aligning the app’s architecture with global data residency and privacy laws.

- Zero-Trust Architecture: Ensuring that every data request is verified, significantly reducing the attack surface for potential breaches.

You can make sure the app is safe and reliable for your employees when compliance and security measures are in place.

Appinvenitv’s Expertise

We implement Field-Level Encryption (FLE) to ensure that even if a database is compromised, PII (Personally Identifiable Information) remains unreadable. Furthermore, our integration with OpenID Connect (OIDC) enables seamless Single Sign-On (SSO), allowing your employees to access the platform with their existing corporate credentials without creating new security vulnerabilities.

Step 6: Testing, Deployment, and Scaling

Once enterprise financial wellness app development is complete, it’s time for rigorous testing. After testing, you can deploy it to users, but the process doesn’t end there.

- Testing: Perform thorough testing. This includes functional, security, and user acceptance testing (UAT). Make sure the app works smoothly on all devices and platforms.

- Deployment: Launch the app. Make sure it’s ready for employees to start using. Provide resources like tutorials or offer help guides to assist users in getting started.

- Scalability: As your company grows, the app should grow with it. Keep updating features. Improve them based on user feedback. Follow new financial trends.

When you test thoroughly and plan for scalability, your app will be well-positioned. It will have long-term success.

By following these steps, you can build an AI-powered financial wellness app that can help your employees manage their finances effectively. It contributes to the overall success of your business.

Also Read: Personal Finance App Development: A Step-by-Step Guide

Appinventiv specializes in creating secure, scalable fintech solutions that meet your unique needs and drive long-term employee engagement.

Key Features of a Financial Wellness App

To make sure a financial wellness app delivers real value to your employees, it must have the right features. Here are the must-have components. Consider these for an enterprise financial wellness app development:

1. Budgeting Tools

Employees need clear, easy-to-use budgeting tools. These help them take control of their finances. These tools let users track income, expenses, and savings. This helps them stick to a budget and avoid overspending.

- Real-time tracking of expenses and income

- Automated financial reporting to show spending trends

- Ability to set and monitor savings goals

These tools help employees manage their finances effectively. Stress goes down and financial well-being automatically improves.

At Appinventiv, we’ve built an AI-powered financial wellness app, Mudra, that shows our expertise in building a budget management app.

2. Investment Tracking

Many employees want to grow their wealth through investments. Your app should include features that help them track investments and make smart decisions.

- Monitor stocks, bonds, and other investment assets

- Personalized investment advice based on goals and risk tolerance

- Real-time updates on market changes

This feature gives employees the power to make smarter investment decisions. It helps them build a more secure financial future.

3. Debt Management

Managing debt can be stressful. A good financial wellness app should offer features to help. Users need to understand their debt in order to manage it well.

- Track multiple debts, including credit cards, loans, and mortgages

- Debt repayment calculators to help prioritize payments

- Suggestions for debt reduction strategies

By giving employees tools to manage their debt, businesses can reduce financial stress. This stress impacts performance and boosts productivity.

4. Personalized Financial Insights

An effective app should provide personalized advice. This should be based on individual financial behavior and goals.

- Insights on spending patterns and savings opportunities

- Tips for improving financial health, tailored to each user’s habits

- Alerts and recommendations using AI to help users stay on track with their financial goals

An AI financial wellness app development helps employees make informed decisions. It helps them take active steps toward improving their financial health.

5. Security and Compliance

Financial data is sensitive. A financial wellness app must comply with relevant data protection regulations. It must keep user information secure.

- Strong data encryption and secure login protocols

- Compliance with GDPR, HIPAA, and other local regulations

- Regular audits to make sure data protection standards are met

When you prioritize security and compliance, you make sure your employees’ data is safe. This builds trust in the app.

6. Integration with Other Systems

For the app to be truly effective, it should connect smoothly with other financial tools and platforms.

- Synchronize with bank accounts to automatically track transactions

- Link with payroll and HR systems for automatic salary tracking

- Easy integration with other financial tools, like tax software or savings accounts

This creates a smooth, unified user experience. It helps employees manage their finances in one central location.

Including these features to build a financial wellness platform will make it more useful. It will give your employees the tools they need. They can take control of their financial futures. A well-rounded app can lead to happier, more productive employees. It ultimately drives better business outcomes.

Costs to Develop a Financial Wellness App

When you consider developing a financial wellness application for your business, you need to understand something important. Enterprise leads don’t just want a price; they want a justification for the budget. Below is a breakdown of key cost areas:

1. Development Costs

The cost to develop a financial wellness app depends largely on its complexity. It depends on the features you need.

Basic Features:

A simple app with basic budgeting tools, debt management, and expense tracking may cost between $35,000 to $75,000+.

Advanced Features:

If you want advanced capabilities, expect higher costs. If you build an AI-powered financial wellness app, it costs more. Investment tracking costs more. Personalized insights cost more. In such cases, the cost can range from $100,000 to $400,000 or more.

The more complex the app gets, the higher the development costs. Customization adds to the cost. Integration with existing systems adds to the cost.

2. Customization and Integration

Many businesses need specific features. These are tailored to their unique needs. Maybe you need integration with payroll or HR systems. Maybe you need customized reports for management.

Customization:

For enterprise financial wellness app development, meeting custom requirements can increase cost. For example, integrating with other financial tools or adding specific reporting features can cost anywhere from $10,000 to $50,000.

Integration:

Making sure your app connects smoothly with existing financial systems can add to the cost. Banks need to connect. Payment gateways need to connect. HR software needs to connect. This depends on how complex the integration is.

Customization and integration help create a unique app. It’s tailored to your business needs. But they come with an additional cost.

3. Ongoing Maintenance

Financial health app development is just the beginning. Continuous updates and support are necessary for keeping the app secure and running smoothly.

Maintenance Costs:

Ongoing costs typically range from $10,000 to $50,000 per year. This includes software updates, bug fixes, security patches, and improvements based on user feedback.

Scalability:

As your business grows, you may need to scale the app. More users need to be handled. New features need to be added. This scalability in financial wellness platforms can lead to additional costs as the app is expanded and upgraded.

Investing in long-term maintenance makes sure the app remains secure. It stays functional and relevant as your business needs change.

4. Total Estimated Cost

The overall cost varies as per industry standards and the complexity of your requirements. Developing a financial wellness application can cost $35,000 to $400,000 or more.

The final cost to develop a financial wellness app depends on the features, customization, and integration needed. It also depends on ongoing maintenance and scaling needs.

When you understand these cost factors, you can make informed decisions about your AI financial wellness app development. This makes sure it matches your business goals. It fits your budget. It provides long-term value.

Challenges in Financial Wellness App Development Services

Building a financial wellness solution for enterprises is a valuable investment. But it comes with several challenges. Here are the most common obstacles businesses face and solutions to address them:

1. Data Privacy and Security

Handling sensitive financial data is a top priority. Making sure your app meets regulatory requirements matters. Protecting user information is critical.

Challenge:

Financial data is highly sensitive. Failure to comply with FinTech data protection regulations can lead to breaches, fines, and can damage your reputation.

Solution:

Put strong encryption in place. Use multi-factor authentication. Check compliance for financial wellness apps with GDPR, HIPAA, or other relevant laws. Regular security audits help. Data protection practices will help maintain high security standards.

By focusing on strong security measures, you can make sure employee data remains safe. Your app stays compliant with industry regulations.

2. User Adoption

Even the best financial health app development will not succeed if employees don’t use it. Getting adoption across your organization is a key challenge.

Challenge:

Employees may feel overwhelmed by new technology. They might be reluctant to try another app. Without engagement, the app won’t deliver the intended value.

Solution:

Keep the app simple. Make it intuitive. Provide training sessions. Offer educational resources to show employees how the app can help them. Show them how it helps them manage their finances. Regular communication about the benefits of financial wellness applications matters. Talk about its positive impact on their well-being. This will encourage adoption.

Building a culture of financial wellness within the company can help. Employees need to see the value in using the app consistently.

3. Integration Complexity

A financial wellness solution for enterprises must connect with various systems. Payroll needs to connect. Banking needs to connect. HR platforms need to connect. Making sure everything integrates smoothly can be a big challenge.

Challenge:

Integrating the app with your existing financial systems can be complex. This is especially true when working with different platforms. Outdated systems make it harder.

Solution:

Work with an experienced financial wellness app development company. They make sure the integration is smooth. Select an app platform that offers solid APIs. It should have integration capabilities. Conduct thorough testing. Make sure everything works as expected before launching the app.

Proper planning helps. A flexible development approach can make sure the app integrates smoothly with your existing systems. This ensures cross-platform interoperability.

4. Scalability

As your company grows, the app needs to scale. It needs to handle more users, additional features, and it can’t slow down.

Challenge:

Scaling the app to meet the demands of a growing workforce can be difficult. Changing business needs make it harder. This is especially true if the app wasn’t initially built with scalability in mind.

Solution:

Plan for scalability from the start. Select a cloud-based infrastructure. Use a modular design that allows for easy updates. It should allow for feature expansions. Work with AI financial wellness app development teams that can make sure the app handles increased traffic. It needs to handle data load without performance issues.

Building a scalable app makes sure it remains effective as your business grows. It provides long-term value.

5. Cost Overruns

A financial health app development can sometimes come with unexpected costs. This is especially true if the project scope changes during development.

Challenge:

Unforeseen expenses happen. Additional feature requests come up. Design changes happen. Integration challenges arise. These can push the app’s cost beyond the initial estimate.

Solution:

Set a clear project scope and budget from the beginning. Make sure both internal teams and external developers understand the priorities. They need to understand deadlines. Regular check-ins throughout the financial wellness platform development process can help. This prevents scope creep. It keeps the project on track financially.

By managing the project carefully and controlling costs, you can build the app within budget. You can still meet your business objectives.

Addressing these challenges head-on with the right solutions will help you. Security and compliance for financial wellness apps will be met. It will be widely adopted. It will be smoothly integrated into your business systems.

Generic tools don’t solve enterprise problems. At Appinventiv, we build bespoke fintech solutions that align with your corporate DNA and compliance requirements.

How Appinventiv Can Help in Enterprise Financial Wellness App Development

At Appinventiv, we have extensive experience in custom FinTech app development. We develop secure, scalable financial wellness apps for enterprises. Our team brings deep technical expertise. These are built specifically to meet the unique needs of businesses.

Technical Expertise

With years of experience in app development, we specialize in building a financial wellness platform that connects smoothly with existing business systems. Our team is skilled in using advanced technologies. This includes AI and blockchain. We create secure, user-friendly apps. These prioritize both functionality and data protection.

Proven Track Record

We’ve successfully developed financial wellness apps for leading enterprises. The financial wellness solutions examples include apps like:

- Edfundo (a UAE-based financial literacy and money management app)

- Mudra (an AI-based budget management application).

We focus on key features. We know budgeting tools, debt management, personalized financial advice, and investment tracking matter. Our solutions are designed to give users a smooth experience. They maintain high levels of security and compliance.

Our Approach

We understand the challenges that come to build an AI-powered financial wellness app. We’re here to help. From defining your app’s purpose to making sure smooth integration with existing systems, our team works closely with you throughout every step in financial health app development. Our agile development process makes sure your app is delivered on time and within budget. It’s delivered to your exact specifications.

Partnering with Appinventiv will offer a team committed to delivering the highest security standards, scalability, and user engagement for your financial wellness app.

Ready to build your financial wellness app? Let us help you turn your vision into reality.

Frequently Asked Questions

Q. How much does an AI-powered financial wellness platform development cost?

A. The cost of AI financial wellness app development can range from $35,000 to $400,000 or more. This depends on

- how complex the features are

- integration needs

- level of customization required

Adding advanced AI features costs more. Personalized financial advice costs more. Investment tracking costs more. These can increase the overall cost.

Q. What’s the end-to-end process to build a financial wellness app for enterprise users?

A. Several key steps in financial health app development include:

- Defining the app’s purpose: Understand your business goals and employee needs

- Choosing the right technology: Select platforms and tools that provide security, scalability, and integration with existing systems

- Designing the user experience (UX): Focus on simplicity and ease of use

- Developing core features: Add tools like budgeting, debt management, and personalized financial insights

- Ensuring compliance and security: Protect sensitive financial data and comply with regulatory standards

- Testing, deployment, and scaling: Conduct thorough testing and make sure the app can scale as your business grows

Q. How do I ensure compliance and data security in a financial wellness application?

A. To make sure compliance and data security in a financial wellness app, you should:

- Put strong encryption in place. Use multi-factor authentication to protect sensitive data.

- Make sure the app meets relevant legal and regulatory standards. These include GDPR, HIPAA, or PCI-DSS.

- Regularly audit the app’s security measures. Update them to address new threats.

- Work with experienced developers. They understand the complexities of data protection in the financial industry.

This approach will make sure your app is secure and compliant. It protects your users’ financial data. It protects your business reputation.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…