- What Types of Crypto Trading Bots Are Used in Practice?

- How to Build a Crypto Trading Bot? Step-by-Step Process

- Phase 0: Discovery, Scope, and Regulatory Alignment

- Phase 1: Strategy Design and Research

- Phase 2: Prototyping and Backtesting

- Phase 3: Risk and Order Management

- Phase 4: Exchange Integration and Execution

- Phase 5: Forward Testing and Stress Validation

- Phase 6: Production Deployment and Reliability Engineering

- Phase 7: Operations and Continuous Improvement (Ongoing)

- Typical Team Structure

- Why Organizations Invest in Crypto Trading Bots in 2026

- Designing a Production-Ready Crypto Trading Bot Development Architecture

- Crypto Trading Bot Development: Use Cases and Real-World Examples

- 1. Market Making & Liquidity Provision

- 2. Institutional OTC and Proprietary Trading

- 3. High-frequency Arbitrage and Execution

- 4. Retail and Platform Product Features (copy-trading, algos for customers)

- 5. DeFi Execution and On-chain Strategies

- Challenges in the Development of Crypto Trading Bots and How Teams Address Them

- Missed Opportunities During Market Volatility

- Inconsistent Risk Management

- Limited Scalability Across Markets

- Operational Blind Spots

- Security and Compliance Exposure

- The Bigger Risk: Falling Behind

- Production Readiness and Go-Live Criteria for Crypto Trading Bots

- Backtesting Standards That Must Be Met

- Forward Testing and Live Simulation

- Go-Live Deployment Controls

- Operational Readiness Checklist

- Securing Trading Systems and Meeting Governance Expectations

- Protecting Access and Credentials

- ZK-Proofs for Strategy and Compliance

- Code Integrity and Runtime Safety

- Financial Controls and Guardrails

- Regulatory and Contractual Considerations

- Audit Trails and Accountability

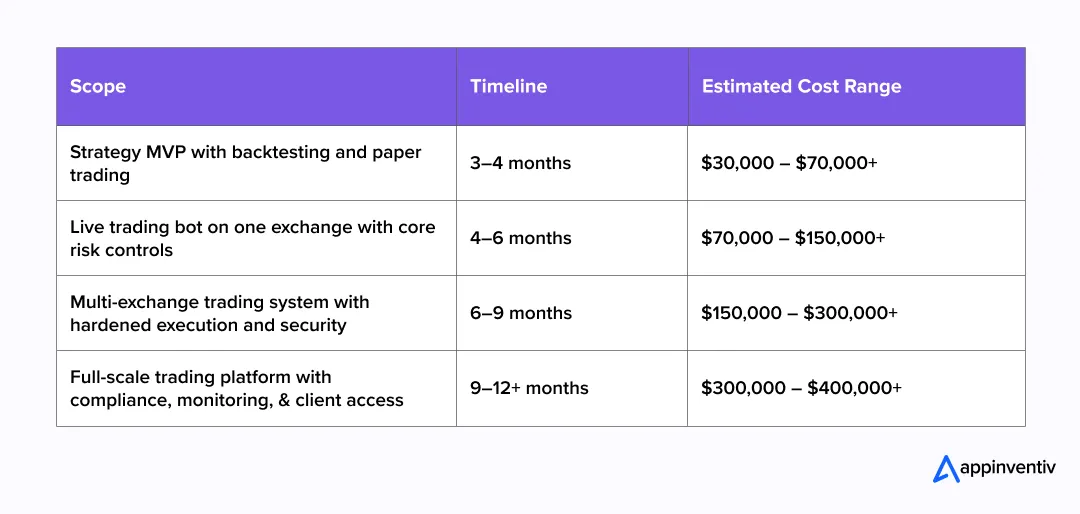

- Crypto Trading Bot Development Cost and Timeline Expectations

- What Drives Development Cost

- Typical Cost and Timeline Ranges

- Ongoing Costs to Plan For

- How to Approach Budgeting

- How Appinventiv Supports Production-Grade Crypto Trading Systems

- Frequently Asked Questions

Key takeaways:

- Crypto trading bot development in 2026 functions as full-scale trading systems, not experimental scripts. They require the same engineering discipline as any financial platform.

- Execution quality drives results more than strategy logic. Latency control, order handling, and risk limits shape real-world performance.

- AI-based strategies work only when supported by reliable data flows, controlled model updates, and strict deployment checks.

- Most failures occur outside the strategy layer. Weak exchange integrations, limited monitoring, and missing circuit breakers lead to avoidable losses.

- Sustainable results come from continuous testing and operations, including backtesting, paper trading, and live performance monitoring.

Crypto trading bots have evolved from niche retail tools to institutional staples. The AI crypto trading bot market is projected to surge from $54.07 billion in 2026 to $200.27 billion by 2035 at a 14% CAGR. These are driven largely by hedge funds and investment firms relying on them for high-volume, algorithm-driven trades.

In 2026, a crypto trading bot is not a side experiment run by a small quant team but a production system operating with live capital. It places real orders, handles real capital, and operates under constant market pressure. When it fails, the impact is immediate and measurable. This shift is forcing teams to rethink how crypto trading bots are designed, built, and operated.

This crypto trading bot development guide focuses on that gap. Not on basic indicators, but on the practical steps required to move from strategy ideas to a production-ready crypto trading system. One that can handle market stress, exchange limits, security constraints, and operational oversight.

The goal is simple, help decision-makers and technical leaders understand what it really takes and how to build a crypto trading bot in 2026.

Build systems that grow with demand.

What Types of Crypto Trading Bots Are Used in Practice?

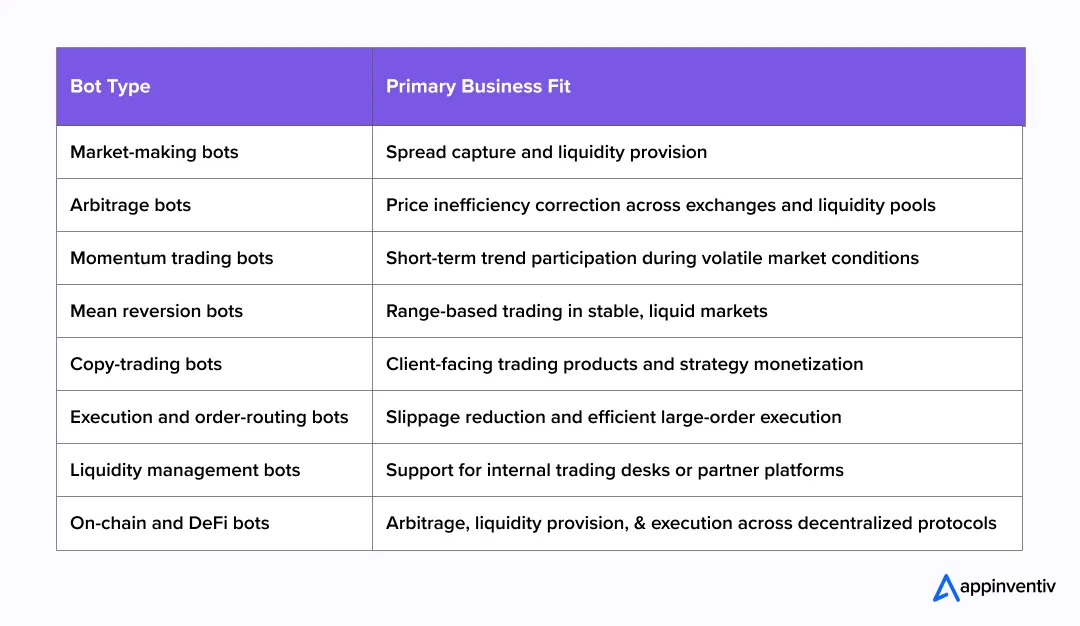

Crypto trading bots fall into a few practical categories, where each type solves a specific trading problem. Choosing the right one depends on capital, risk tolerance, and market access.

Market-making bots

These bots place continuous buy and sell orders to earn the bid–ask spread. They suit teams that can manage inventory risk and operate across liquid markets.

Arbitrage bots

Crypto arbitrage trading bot development company exploits price differences across exchanges or liquidity pools. Speed and reliable execution matter more than complex logic.

Momentum trading bots

These bots trade short-term trends during periods of high volatility. They are simpler to deploy but sensitive to slippage and late signals.

Mean reversion bots

Mean reversion strategies assume that prices revert to an average range. They work best in stable markets with consistent liquidity.

Copy-trading and execution bots

These bots package strategies or execution logic as products for clients. Compliance, reporting, and risk controls are critical here.

On-chain and DeFi bots

These bots operate on blockchains. They handle arbitrage, liquidity provision, and other on-chain strategies. Gas costs and network behavior shape performance.

For on-chain and DeFi bots, survival now depends on Maximal Extractable Value (MEV) protection. In the highly competitive 2026 market, public mempools are predatory; without a “Flashbots-ready” or “MEV-Boost” integration, your bot’s large trades can be “sandwiched” by competitors, leading to instant slippage losses.

A production-grade DeFi bot must use private transaction relays (such as Flashbots or Jito on Solana) to bypass the public mempool. This ensures your orders are sent directly to validators/block-builders, rendering them invisible to front-running bots until they are finalized on-chain.

Each type of crypto trading bot development service caters to a different business goal. Choosing the right design can make your bot an interaction ninja or an efficient execution engine. Most teams start with one, where expansion comes only after stability is proven.

How to Build a Crypto Trading Bot? Step-by-Step Process

Building a crypto trading bot is not a linear task. Decisions made early in the process define how the system behaves months later, when markets are volatile, and capital is on the line.

Teams that succeed follow a structured build approach. Not because it looks neat on paper, but because it reduces failure points in live trading. Each stage addresses a specific risk, be it technical, operational, or financial, that tends to surface only at scale.

The process outlined below reflects how an experienced crypto trading bot development company moves from strategy ideas to systems that can operate reliably in real market conditions in 2026.

Phase 0: Discovery, Scope, and Regulatory Alignment

Every trading bot project starts with constraints, not code.

The first task is to define what the bot is allowed to do. This includes the markets it trades, the assets it touches, and the jurisdictions involved. Even when trading proprietary capital, exchange terms and local regulations shape system design.

During this phase, teams document:

- Trading objectives and capital limits

- Supported exchanges and liquidity sources

- Jurisdiction-specific compliance requirements

- Data sources and retention needs

- Success metrics beyond raw profit

If the bot will be exposed to end users, KYC and AML implications must be addressed early. Retrofitting compliance later often forces architectural changes.

This phase ends with clarity. Everyone knows what the bot should do, and just as importantly, what it should not do.

Phase 1: Strategy Design and Research

Strategy design is where many teams spend too much time, or too little.

The goal here is not to invent something novel, but to select strategies that match the business goal and the available infrastructure.

Common starting points include:

- Market making for spread capture

- Arbitrage across exchanges or liquidity pools

- Momentum-based trading during high volatility

- Mean reversion in range-bound markets

Each strategy must be written as a clear specification. If a strategy includes inputs, decision rules, and exit conditions, it can lead to failure scenarios. If a strategy cannot be explained in simple terms, it is hard to test and harder to operate.

Data requirements, such as historical depth, tick resolution, and order book snapshots, are defined at this stage. Poor data quality leads to misleading results later.

The output of this phase is a strategy document and a backtesting plan, not code.

Phase 2: Prototyping and Backtesting

Only now does development begin. The next question is: how do you set up a crypto trading bot? Teams build a controlled environment to test ideas without risk. This includes:

- A market data collector

- A backtesting engine

- A simulated execution layer

Python is often used at this stage due to the speed of iteration. Libraries for data handling and indicators are common. The focus here is on accuracy, not performance.

Backtests must account for:

- Realistic slippage

- Latency assumptions

- Partial fills

- Transaction costs

Metrics such as drawdown and trade frequency matter as much as net returns. A strategy that looks profitable but behaves erratically under stress is a warning sign.

This phase produces evidence.

Also Read: How to develop a high frequency trading software?

Phase 3: Risk and Order Management

Risk controls are not an add-on, but they are central to the system.

This phase introduces a dedicated risk layer that evaluates every trade before execution. It enforces:

- Position size limits

- Exposure caps per asset

- Trade frequency controls

- Stop conditions

- Emergency shutdown rules

Order management logic is also built here. It handles retries, cancellations, and reconciliation between intended and actual positions.

One rule matters above all others. Strategy code should never bypass risk checks because when this separation breaks, failures cascade quickly.

Phase 4: Exchange Integration and Execution

This is where most production issues appear as each exchange behaves differently. Here rate limits change, error messages are inconsistent, order states are not always final when returned.

Teams build exchange adapters that handle:

- Authentication and request signing

- Rate limit tracking

- WebSocket state management

- Order lifecycle reconciliation

Execution logic must assume things will go wrong, including partial fills, network failures, and out-of-order responses.

Performance tuning starts here. Persistent connections, efficient serialization, and careful retry logic reduce execution delays without increasing risk.

Phase 5: Forward Testing and Stress Validation

Backtests are not enough. Before live deployment, bots run in paper trading mode using real market data. This exposes issues that historical tests cannot catch.

Teams observe:

- Latency under live conditions

- Behavior during sharp price moves

- Response to exchange outages

- Position drift over time

Stress tests simulate extreme scenarios, including flash crashes, sudden liquidity drops, and blockchain reorgs that affect on-chain strategies.

Only strategies that behave predictably here move forward.

Phase 6: Production Deployment and Reliability Engineering

Production deployment focuses on stability. Systems are containerized and deployed across multiple zones, secrets are stored securely, and access is tightly controlled.

Operational monitoring, alerting, runbooks, and controlled rollouts are finalized during production readiness before live capital is enabled.

Phase 7: Operations and Continuous Improvement (Ongoing)

Once live, the bot becomes an operational system where performance is reviewed regularly, strategies degrade over time, market behavior changes, and assumptions expire.

If models are used, retraining schedules are defined, changes are versioned and reviewed, and silent updates are avoided.

Incidents are documented, alerts are refined, and monitoring evolves as the system matures. This phase never ends, as bots that perform well over time are maintained, not just built.

Typical Team Structure

A production-grade bot requires a cross-functional team:

- Trading or product owner

- Quant or strategy researcher

- Backend engineers for execution and integrations

- DevOps or SRE for reliability

- Security specialist

- QA and test automation support

For regulated environments, legal and audit oversight are part of delivery, not an afterthought.

Custom crypto trading bot development in 2026 is a long-term commitment. Teams that approach it as a system, not a script, are the ones that avoid costly surprises and maintain control when markets turn unpredictable.

Appinventiv supports trading platforms with production-ready architecture, smart contract integration, and security-first design.

Why Organizations Invest in Crypto Trading Bots in 2026

Investment in crypto trading bots is driven by control, consistency, and scale. As markets move faster and operate around the clock, manual execution struggles to keep up.

Consistency in execution

Bots follow defined rules on every trade. They do not hesitate or deviate under pressure. This consistency improves execution quality, especially during volatile periods.

Faster response to market changes

Price movements and liquidity shifts happen in seconds. Automated systems react immediately, reducing delays that often lead to slippage or missed opportunities.

Stronger risk discipline

Risk limits, position sizing, and stop conditions are enforced without exception. This removes reliance on manual judgment during high-stress scenarios.

Scalability across markets

Bots can monitor and trade across multiple exchanges and assets at the same time. Growth does not require proportional increases in trading staff.

Operational efficiency and visibility

Developing an AI crypto trading bot reduces manual intervention. Performance, errors, and system health are visible in real time, supporting better oversight and quicker response.

Organizations utilize the benefits of crypto trading bots to create repeatable processes. When built correctly, these systems improve control and reliability as trading activity grows.

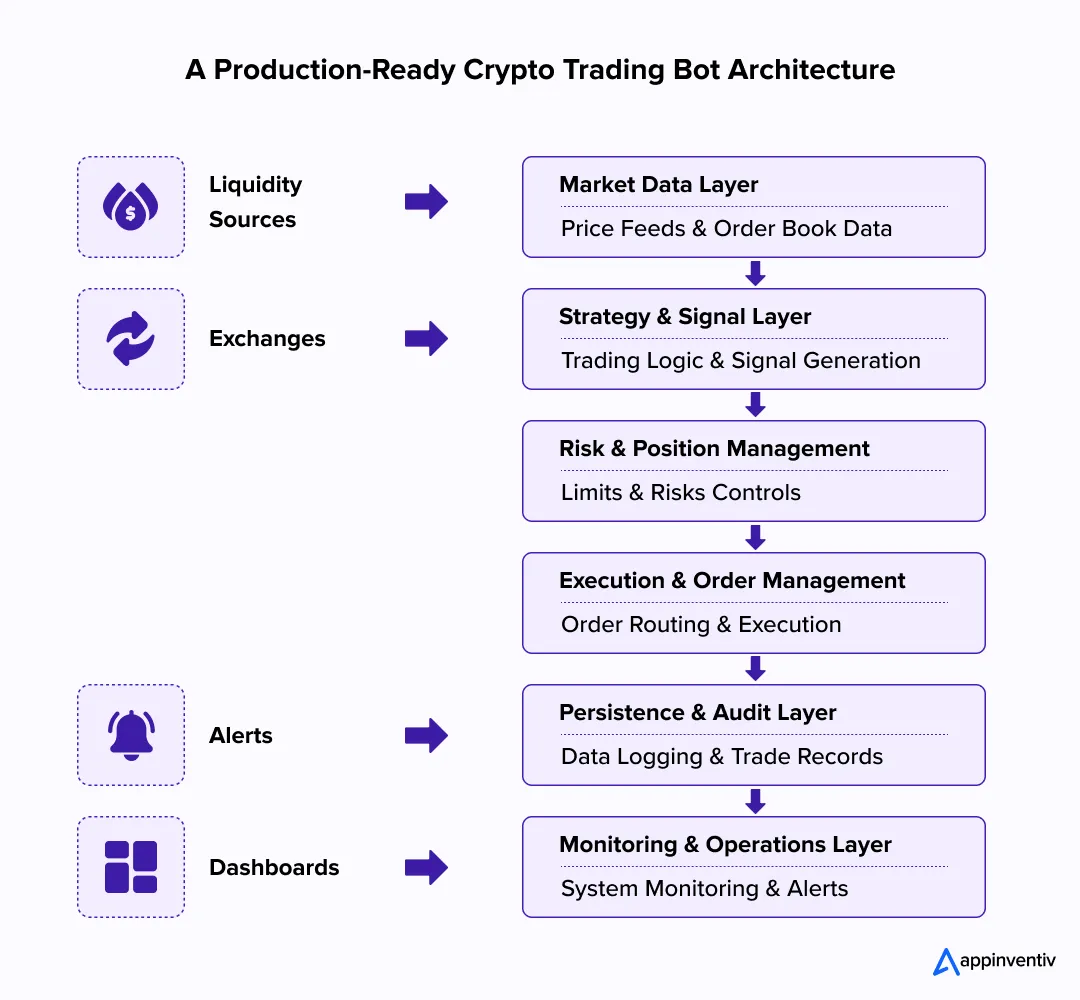

Designing a Production-Ready Crypto Trading Bot Development Architecture

A crypto trading bot’s architecture determines how it behaves under pressure. The diagram below shows a layered system designed to keep responsibilities clear, failures contained, and changes manageable.

Each layer solves a specific problem while blurring these boundaries is where most systems break.

Market data layer

This layer ingests prices, volumes, and order book updates from exchanges and liquidity sources, using WebSockets for live feeds and REST APIs for snapshots and recovery, while ensuring data is validated and time-aligned to avoid downstream decision errors.

Strategy and signal layer

Trading logic lives here and converts market data into trade intent, using either fixed rules or adaptive logic, while remaining isolated from order placement and balance management to keep changes safe and testable.

Risk and position management layer

Every trade request passes through risk checks before execution. This layer enforces position limits, exposure caps, trade frequency controls, and stop conditions. It also owns emergency shutdowns. When markets behave unexpectedly, this layer prevents cascading losses.

Execution and order management layer

This component turns trade intent into orders, handling order types, retries, partial fills, cancellations, and order state tracking until completion. Keeping execution separate from strategy reduces errors when markets or exchanges change.

Exchange integration layer

Each exchange has its own rules, limits, and quirks, and this layer manages authentication, signing, rate limits, WebSocket state, and reconciliation. Reliable integrations are critical, as many production issues originate here rather than in strategy code.

Also Read: Cryptocurrency Exchange App Development Cost

Persistence and audit layer

All actions are recorded. Market data, signals, orders, and fills are logged with timestamps. These records support debugging, performance analysis, and compliance reviews. When something goes wrong, this layer provides the facts.

Monitoring and observability layer

Live systems require visibility, with teams tracking latency, order success rates, balance drift, and overall system health, while alerts remain actionable since silence often indicates missing instrumentation rather than stability.

Operational thresholds, alerting rules, and incident response workflows are defined during the production readiness phase.

Core design principles

The architecture follows one rule above all others: separation of concerns, where strategy logic does not manage risk, execution does not change strategy, and integrations do not bypass controls. This structure makes the system easier to test, scale, and operate.

A clean architecture does not guarantee profits. However, these features of the crypto trading bot ensure that the bot behaves predictably when markets do not.

Crypto Trading Bot Development: Use Cases and Real-World Examples

Below are common business use cases of crypto trading bots, with real examples that show scale or financial outcomes. Each example highlights an operational result you can expect when a bot is built and run correctly.

1. Market Making & Liquidity Provision

Bots quote continuous buy and sell prices to capture the spread and provide depth. This is capital-intensive but steady when done well.

Example: GSR operates large-scale market-making services and reports extensive liquidity provision across hundreds of venues, supporting over a trillion dollars traded in its tracked activity. This scale demonstrates how automated market-making generates continuous revenue from spreads and fees.

Public disclosures and industry analyses show that large market makers rely on automated spread capture as a steady, repeatable revenue source rather than one-off directional bets.

2. Institutional OTC and Proprietary Trading

Firms use automated execution to capture short-term opportunities and manage large orders with minimal slippage.

Example: Cumberland (DRW) reported substantial crypto trading revenue and profit in regulatory filings, illustrating how systematic trading and OTC liquidity services can produce material P&L for trading desks.

For OTC desks, ROI is reflected in improved execution quality, reduced slippage on large orders, and consistent trading margins enabled by automated execution systems.

3. High-frequency Arbitrage and Execution

Bots exploit micro price differences across venues or liquidity pools. Success depends on low latency and tight risk controls.

Example: Wintermute, a prominent algorithmic market maker, reported large revenues in earlier years, showing that automated execution and broad market access can scale into high top-line results when risk is managed carefully.

In practice, returns from these systems come from high trade throughput and tight execution control rather than large per-trade gains.

4. Retail and Platform Product Features (copy-trading, algos for customers)

Trading bots can be productised to expand offerings and create new revenue lines from subscriptions or fees.

Example: Exchanges and brokerages that add algorithmic trading features often see higher trading frequency and customer retention. The direct ROI is operational: more trades, more fees, and reduced support cost per trade.

This model improves lifetime value per user by increasing activity without a proportional rise in operational overhead.

5. DeFi Execution and On-chain Strategies

On-chain bots run arbitrage, MEV-aware strategies, and liquidity provision across DEXs. The technical challenge is resilience to chain reorgs and gas cost swings.

Example: Large market makers and quant teams now run hybrid stacks—off-chain decisioning with on-chain execution—to capture DeFi yield and arbitrage opportunities at scale.

The ROI here comes from automated access to fragmented on-chain liquidity while controlling gas costs and execution risk through disciplined system design.

Also Read: Decentralized Finance (DeFi) – A Business Guide

What do these examples of crypto trading bots mean for ROI?

ROI in automated trading is measured by consistent spread capture, reduced slippage, higher trade throughput, and repeatable P&L attribution. Public figures from market makers show that scale and disciplined execution translate into material revenue.

The result: trading systems that can generate repeatable trading revenue while keeping risk and compliance under control.

Challenges in the Development of Crypto Trading Bots and How Teams Address Them

Crypto markets do not wait, as prices move in seconds and liquidity shifts without warning. This creates structural disadvantages for teams that rely on manual or semi-automated trading.

The absence of a trading bot is not a neutral choice, but it introduces risks that compound over time.

Missed Opportunities During Market Volatility

Human-led trading struggles to react at market speed, as prices often move by the time a signal is identified.

This results in:

- Delayed entries and exits

- Inconsistent execution across markets

- Missed arbitrage windows

Trading bots remove this delay by monitoring markets continuously and acting within defined rules. Execution becomes timely and repeatable.

Appinventiv uses the best practices for crypto trading bot development. It helps teams design systems where speed does not come at the cost of control.

Inconsistent Risk Management

Manual processes rely on discipline, which breaks under pressure.

Without automated controls, teams face:

- Position sizes drifting beyond limits

- Stop conditions applied inconsistently

- Exposure increasing without clear visibility

Bots enforce risk rules without exception, with limits applied every time. No overrides or judgment calls are allowed.

Appinventiv builds risk and position management as independent layers, ensuring safeguards remain active even when strategies behave unexpectedly.

Limited Scalability Across Markets

As trading activity grows, manual oversight does not scale.

Challenges appear quickly:

- Difficulty managing multiple exchanges

- Fragmented visibility across assets

- Rising operational overhead

Crypto trading bot development services centralize execution and monitoring and expansion becomes manageable.

Appinventiv supports this transition by designing architectures that add new exchanges or strategies without rewriting core systems.

Operational Blind Spots

Without automation, visibility is often delayed or incomplete.

Teams struggle with:

- Tracking execution performance in real time

- Identifying latency issues early

- Responding to failures outside business hours

Production-grade bots include monitoring, alerts, and audit trails by default.

Appinventiv treats observability as a core requirement, not an afterthought. Systems are built to surface issues early, when they are easier to fix.

Security and Compliance Exposure

Manual workflows increase the risk of errors through shared credentials, untracked actions, and missing logs.

These gaps raise concerns with:

- Internal audits

- Exchange partners

- Regulatory reviews

AI-based crypto trading bot development introduces structure, with every action logged, access controlled, and behavior traceable.

Appinventiv helps teams design systems that meet AI data governance expectations from the start, reducing rework later.

The Bigger Risk: Falling Behind

Perhaps the biggest challenge is strategic. As markets mature, automation becomes standard. Teams that delay AI adoption for crypto trading bot face widening gaps in execution quality and operational efficiency.

The goal is not to automate everything at once. It is to start with a controlled, well-architected system that can grow over time.

This is where Appinventiv fits in. By guiding teams through strategy selection, system design, and production readiness, we help reduce uncertainty and move automation forward with confidence.

Production Readiness and Go-Live Criteria for Crypto Trading Bots

A crypto trading bot is not ready for live capital because it compiles, backtests well, or runs without errors. Readiness is proven only when the system behaves predictably under real market conditions.

Backtesting Standards That Must Be Met

Backtesting is a screening tool, not a green light.

Results are meaningful only when tests avoid common distortions through out-of-sample data and cross-period validation. Without this, performance metrics reflect curve fitting rather than market behavior.

Slippage and fees must be modeled realistically to avoid misleading returns, and latency assumptions should reflect actual infrastructure rather than ideal conditions. For order-book strategies, snapshot depth and update frequency remain critical.

If a strategy performs well only under perfect assumptions, it is not ready.

Forward Testing and Live Simulation

Before going live, bots should run in paper trading mode using real-time market data. This phase exposes issues that backtests cannot.

Teams observe how the system reacts to:

- Rapid price movements

- Partial fills and delayed confirmations

- Exchange throttling or brief outages

- Balance drift over time

Paper trading should span multiple market conditions, since a few calm weeks are not enough. As a rule, four to eight weeks across varying volatility provides more reliable insight.

Only strategies that remain stable here should progress further.

Go-Live Deployment Controls

Deployment must reduce risk, not introduce it.

Bots should be released gradually, using canary deployments to limit exposure by routing a small portion of capital through the new system. If behavior deviates from expectations, rollback is immediate.

Strategy changes require gating. Parameter updates should be reviewed, logged, and approved. Silent changes are a common source of unexpected losses.

Access control is strict, with production credentials isolated, secrets rotated, and no manual overrides allowed to bypass risk checks.

Operational Readiness Checklist

Before go-live, development teams confirm:

- Monitoring and alerts are active and tested

- Order reconciliation is automated

- Kill switches work under load

- Incident runbooks are documented

- Ownership for the response is clearly assigned

If a failure occurs at 2 a.m., the system should not rely on guesswork.

Production readiness is not about confidence; it is about evidence. Teams that enforce clear go-live criteria trade with control, even when markets do not behave as expected.

Securing Trading Systems and Meeting Governance Expectations

Security and compliance decisions shape how a trading bot is trusted. By exchanges, auditors, and by internal stakeholders. These decisions sit outside the strategy logic, yet they often determine whether a system can run at scale.

In 2026, trading bots operate in an environment where failures are visible and traceable. Weak controls do not stay hidden for long.

Protecting Access and Credentials

API keys are the most sensitive assets in a trading system. If they are exposed, the impact is immediate.

Keys should never be stored in plain text or embedded in code; instead, use secure vaults or managed key services. Access follows least-privilege rules, with trading permissions limited to what the bot actually needs and withdrawal rights disabled unless strictly required.

Key rotation is automated, as manual handling introduces risk. Production credentials are isolated from testing and development environments to prevent accidental misuse

ZK-Proofs for Strategy and Compliance

A common hurdle for 2026 crypto trading bot development is the friction between regulatory transparency and proprietary secrecy. To solve this, advanced systems now integrate Zero-Knowledge Proofs (ZK-Proofs).

By utilizing zk-SNARKs, an organization can prove to a regulator or exchange that their bot is compliant with AML/KYC and risk-exposure limits without revealing the specific trade logic or the underlying proprietary signals. This “Compliance-without-Exposure” model allows institutions to remain audit-ready while keeping their competitive “secret sauce” cryptographically secure.

Code Integrity and Runtime Safety

Security does not stop at credentials.

All trading logic should pass regular code reviews, and third-party libraries should be scanned for known vulnerabilities. Dependencies are pinned to specific versions to avoid unexpected changes.

Runtime signals are used to detect abnormal behavior and policy violations, not to manage day-to-day operations.

Systems track abnormal order patterns, sudden spikes in trade frequency, or behavior that deviates from expected bounds. These signals often indicate bugs or integration issues before losses escalate.

Financial Controls and Guardrails

Governance requires limits that cannot be bypassed.

Trade caps restrict order size, and exposure limits control total risk per asset or market. Circuit breakers pause trading when predefined thresholds are crossed.

These controls act as guardrails that keep the system within safe operating boundaries, similar to how AI guardrails for trading systems define acceptable behavior in automated decision-making.

Regulatory and Contractual Considerations

Compliance requirements vary by region and use case.

If the bot trades proprietary capital only, obligations are lighter. If it supports client trading, additional controls apply. KYC, AML, and reporting requirements must be addressed early.

Exchange agreements also matter. API usage terms, rate limits, and data handling rules influence system design. In some regions, data residency rules affect where logs and market data can be stored.

Ignoring these constraints often leads to rework later.

Audit Trails and Accountability

Every action taken by the bot must be traceable.

Order submissions, cancellations, fills, and balance updates are logged with timestamps. Logs are immutable, they support post-incident analysis, reconciliation, and regulatory review.

Clear ownership is defined. When questions arise, there is no ambiguity about who is responsible for the system and its behavior.

Strong governance does not slow teams down. It creates the conditions under which automated trading can operate with confidence, even as scale and scrutiny increase.

Once live, trading bots behave like long-running systems. They require monitoring, controlled updates, and clear response ownership. Teams that plan for this early avoid reactive fixes later.

Crypto Trading Bot Development Cost and Timeline Expectations

Cost planning for a crypto trading bot often fails because teams underestimate the scope. The question is rarely “how much does a bot cost?” The real question is what level of reliability, coverage, and control the system must support.

In 2026, cost is driven by complexity, not by the idea itself.

What Drives Development Cost

Several factors shape both the crypto trading bot development cost budget and delivery time:

- Number of exchanges and liquidity sources

- Type and number of strategies

- Performance and latency expectations

- Risk controls and exposure limits

- Security standards and audit requirements

- Deployment and monitoring depth

A single-strategy bot used for internal testing looks nothing like a system trading live capital across markets.

Typical Cost and Timeline Ranges

As a planning benchmark, crypto trading bot development typically falls between $30,000 and $400,000+, depending on scope and maturity. These are indicative ranges, not fixed prices.

Lower-cost builds focus on validation. They help teams test strategies and system behavior with limited exposure.

Higher-cost systems support live trading at scale. They include robust exchange integrations, detailed monitoring, strong security controls, and governance features required for long-term operation.

Ongoing Costs to Plan For

Initial development is only part of the total spend. Live trading systems incur recurring costs such as:

- Cloud infrastructure and market data feeds

- Monitoring and alerting tools

- Security reviews and compliance checks

- Ongoing maintenance and strategy updates

Ignoring these costs often leads to rushed fixes later.

How to Approach Budgeting

A phased approach works best, starting with a clearly defined scope and validating performance and stability before expanding when the system proves reliable.

Trading bots reward discipline. Cost overruns usually stem from unclear objectives or shortcuts taken early in the build process.

Clear scope leads to predictable timelines that reduce both financial and operational risk.

Schedule a short technical discussion to clarify the next steps.

How Appinventiv Supports Production-Grade Crypto Trading Systems

Building a crypto trading bot that works in live markets takes more than a strong strategy. It requires disciplined engineering, clear governance, and teams that understand how trading systems behave under stress.

This is where Appinventiv typically adds value.

Appinventiv offers blockchain development services by product and technology leaders who treat automated trading as a long-term capability, not a short-term experiment. The focus stays on reliability, security, and controlled execution from the start.

Our teams bring hands-on experience in Fintech software development services across backend engineering, data pipelines, cloud infrastructure, and applied machine learning. This matters in trading environments where small technical gaps can lead to large financial impact.

Engagements follow a structured approach:

- Early technical discovery to define scope and constraints

- Architecture planning with security and compliance in view

- Phased development with clear testing and go-live criteria

- Ongoing support focused on stability and controlled growth

For decision-makers, this structure reduces uncertainty by defining scope early, setting realistic timelines, and clarifying ownership.

Appinventiv supports that journey with practical engineering, proven delivery, and a clear focus on systems that perform reliably when real capital is at stake. Discuss your crypto trading bot requirement for a structured development.

Frequently Asked Questions

Q. How long does it take to develop a crypto trading bot?

A. The development timelines depend on scope and readiness level.

- A basic bot for strategy testing or paper trading usually takes 3–4 months.

- A live trading bot with risk controls and one exchange integration takes 4–6 months.

- Multi-exchange systems with compliance, monitoring, and security can take 6–12 months or more.

Most delays come from exchange integration and testing, not strategy logic.

Q. What’s the cost to develop a crypto trading bot?

A. The costs vary based on complexity and production standards. In practice, development ranges from $30,000 for a focused MVP to $400,000+ for a full-scale trading system. Higher costs reflect stronger execution logic, security controls, monitoring, and compliance readiness.

The final cost depends on:

- Number of exchanges

- Strategy complexity

- Risk and compliance requirements

- Production readiness expectations

Q. Which APIs are used in crypto trading bot development?

A. Crypto trading bots rely on exchange APIs for market data and order execution. Common integrations include APIs from:

- Binance

- Coinbase Advanced Trade

- Kraken

- KuCoin

Bots also use WebSocket APIs for live data and REST APIs for order execution, account data, and reconciliation.

Q. How do machine learning models improve crypto trading bots?

A. Machine learning helps with pattern recognition, not decision-making alone. Models can assist by:

- Identifying changing market behavior

- Filtering noisy signals

- Adjusting parameters based on recent data

They work best when combined with strict risk controls. Models should guide decisions, not bypass safeguards.

Q. How do you optimize a trading bot for better ROI?

A. ROI improves through execution discipline, not constant strategy changes. Key optimization areas include:

- Reducing latency and slippage

- Improving order handling and retries

- Tightening risk limits

- Regular performance reviews

Stable systems often outperform aggressive ones over time.

Q. Do crypto trading bots need KYC or AML checks?

A. KYC and AML requirements depend on how the bot is used. Bots trading proprietary capital usually face fewer obligations. If the bot supports client trading or custody, KYC, AML, and reporting controls may apply. Regulatory expectations vary by jurisdiction and must be reviewed early.

Q. How will AI regulation impact crypto trading bots?

A. Regulation will focus on transparency, control, and accountability. Trading bots using advanced models may need:

- Clear documentation

- Explainable decision logic

- Human oversight

Systems with audit trails and controlled deployment are better positioned to adapt as regulations evolve.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Decentralized Exchange (DEX) Development: Features, Implementation Cost, and Enterprise ROI

Key Takeaways The development of a decentralized exchange will enable businesses to provide secure and user-controlled trading, improve transparency, and minimize the use of intermediaries. The cost of DEX development can vary depending on the platform's features, the chosen network, and regulatory requirements, and the approximate cost is about $50,000, with higher costs for customization,…

Key takeaways: Dubai's VARA framework mandates strict compliance protocols for blockchain enterprises. To comply with VARA in Dubai, enterprise blockchain systems should use private networks that only approved members can join. Choosing between Hyperledger Fabric, private Ethereum, Corda platforms, etc., significantly impacts long-term scalability, compliance automation, and maintenance costs. Enterprises implementing VARA enterprise blockchain development…

How Much Does It Cost to Build a Crypto Trading App Like Swyftx?

Key takeaways: Swyftx’s Rise: Australia’s top-rated crypto exchange app attracts 1.1M+ users with its easy UX, pro tools, and learning features. Development Costs: A Swyftx-like app development can cost AUD 30K–500K, based on scope and functionality. Crypto Market Momentum: With Layer-2 tech and ETF approvals, the market is booming, and transaction costs are dropping. Winning…