- Understanding the Australian App Funding Landscape

- Snapshot of App Funding Avenues in Australia

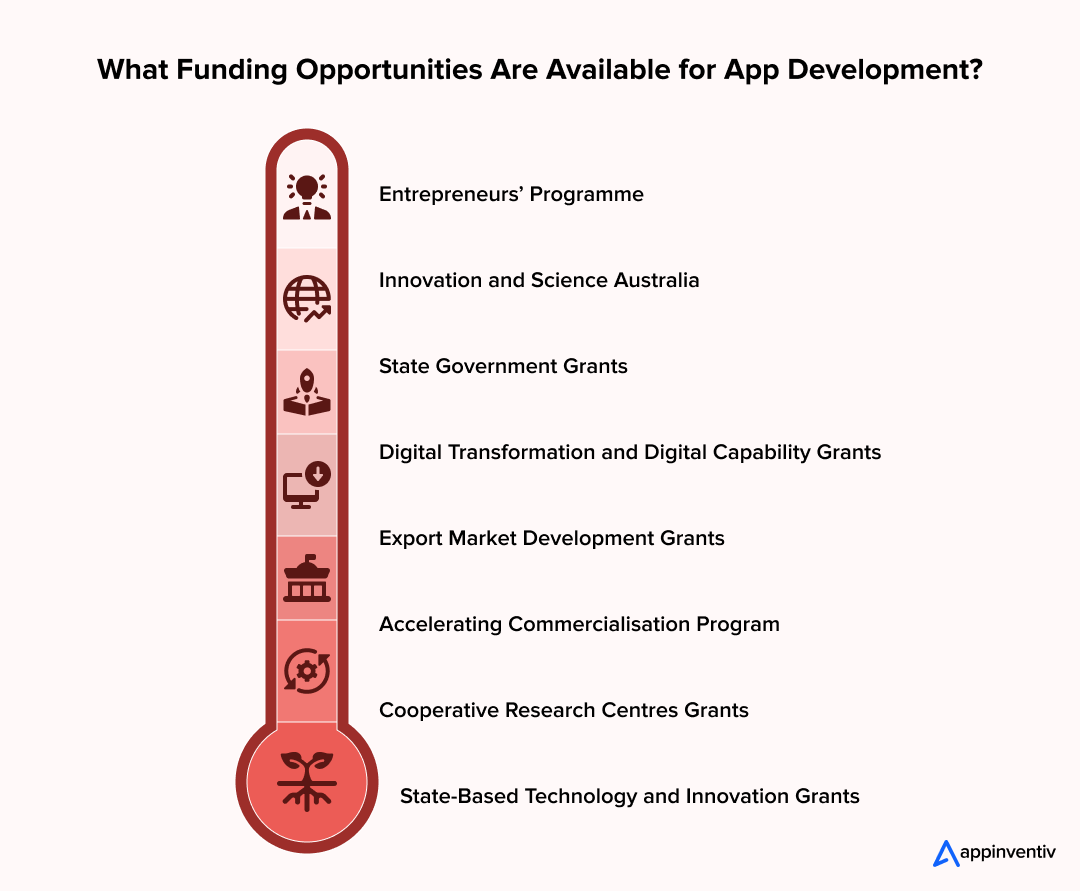

- What Funding Opportunities Are Available for App Development?

- Cooperative Research Centres (CRC) Grants

- Entrepreneurs’ Programme

- Innovation and Science Australia (ISA) Aligned Grants

- State Government Grants

- Digital Transformation and Digital Capability Grants

- Export Market Development Grants (EMDG)

- Accelerating Commercialisation Program

- State-Based Technology and Innovation Grants

- The Role of Australia's R&D Tax Incentive in App Funding Strategy

- Core Stages of App Funding in Australia: From Validation to Growth

- Pre-Seed Stage: The Idea & Validation Phase

- Seed Stage: From Idea to MVP

- Series Rounds (A, B, C, etc.)

- Late-Stage Growth

- Best App Funding Strategies in Australia

- How Investors in Australia Assess App Funding Readiness

- Common App Funding Challenges & How to Avoid Them

- Underestimating the True Cost of App Development

- Over-Reliance on a Single Funding Source

- Poor Alignment Between Product Vision and Funding Milestones

- Missing Out on Eligible R&D Benefits

- Weak Financial Governance and Documentation

- Constant Scope Changes Without Funding Reassessment

- Delaying Monetisation and Revenue Planning

- Raising Capital Too Early or Too Late

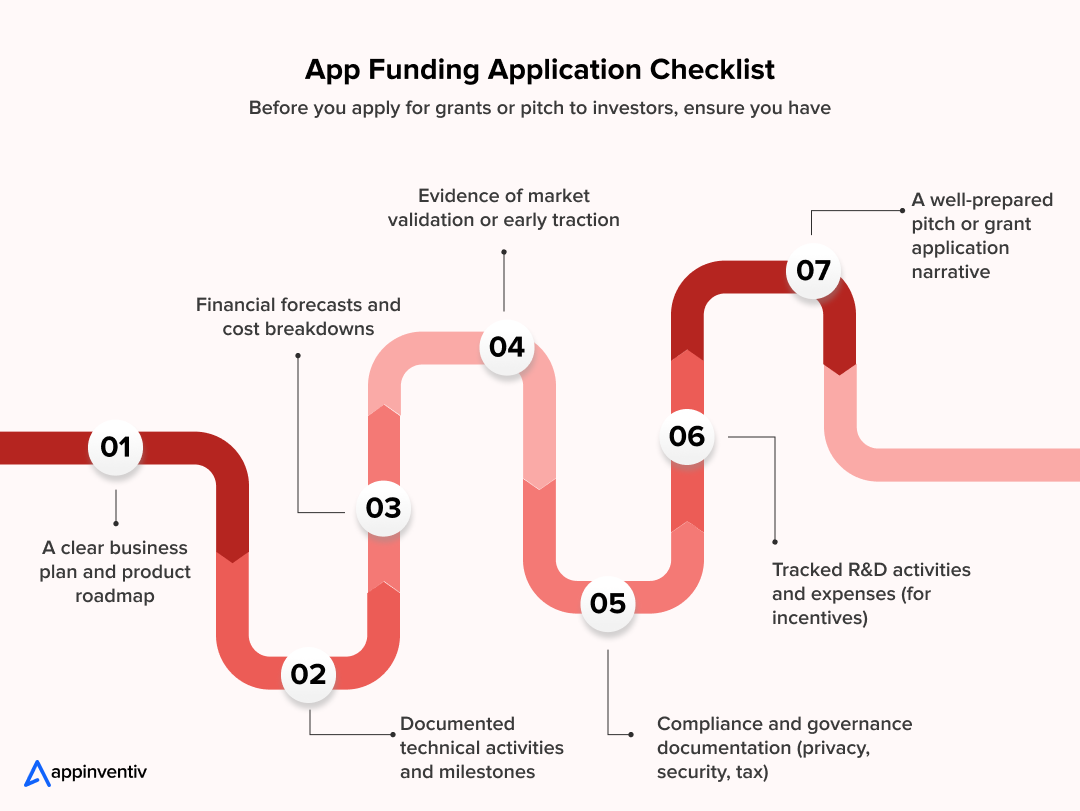

- How to Build a Sustainable App Funding Strategy in Australia

- Determine Eligibility

- Align Funding With Product Lifecycle, Not Just Launch Costs

- Leverage Australia’s Innovation-Friendly Funding Ecosystem

- Treat R&D Spend as a Strategic Asset

- Build Governance and Financial Controls Early

- Connect Funding Decisions to Commercial Outcomes

- Plan for Change, Not Perfection

- Improve your Chances of Securing App Funding with Appinventiv

- FAQs

Key takeaways:

- App funding in Australia prioritises structure over speed, with investors focusing on execution clarity, governance readiness, and capital discipline.

- Funding strategies must evolve with the product lifecycle, aligning capital to validation, scale, and long-term delivery needs to avoid dilution and funding gaps.

- Public funding and private capital work best when layered deliberately, supporting execution and risk management rather than replacing commercial discipline.

- The R&D Tax Incentive improves runway when planned early, strengthening capital efficiency without adding compliance or investor risk.

Raising capital for digital products in Australia is rarely about speed. It is about structure, proof, and timing. Unlike markets that reward aggressive growth narratives, mobile app funding in Australia is shaped by capital efficiency, governance maturity, and commercial clarity.

For Australian entrepreneurs and technology leaders seeking funding for an app, the challenge is not access to capital. It is navigating when to raise, from whom, and for what purpose. Australian investors expect disciplined execution before capital deployment, not retrospective explanations after funds are committed.

This blog breaks down the core stages of app funding in Australia, explains how businesses combine multiple funding paths without creating unnecessary dilution or governance risk and outlines practical steps to secure app funding.

Also Read: Appinventiv’s Role in Raising $950 Million in Funding for Clients

Validate your product architecture, execution roadmap, and funding strategy before you enter investor or grant conversations.

Understanding the Australian App Funding Landscape

Australia’s app funding environment is supported by significant public investment and structured funding programs designed to reduce innovation risk and support commercial execution. At a federal level, total government investment in research and development is projected to reach $15.1 billion in 2025–26, reflecting a sustained commitment to innovation-driven growth.

State governments complement this with targeted initiatives aimed at early product development and commercial readiness. For example, the NSW MVP Ventures Program provides grants ranging from $20,000 to $75,000, with up to $3 million allocated annually.

Snapshot of App Funding Avenues in Australia

| Funding Support | Key Stat / Benefit | Targeted Stage |

|---|---|---|

| R&D Tax Incentive | Up to 43.5% tax offset on eligible R&D spend for smaller entities | Ongoing product development |

| MVP Ventures (NSW) | $20k–$75k grants, up to $3M annually | Early product development |

| Federal R&D Investment | $15.1B projected R&D spend (2025–26) | National innovation ecosystem |

| Export Market Development Grants (EMDG) | Up to 50% reimbursement of eligible export expenses | International expansion |

What Funding Opportunities Are Available for App Development?

App funding in Australia is supported by a mix of private capital and structured public funding, each serving a distinct role at different stages of product maturity. The challenge is not identifying options, but understanding which funding opportunities reduce delivery risk and which one will suit their project goal.

Cooperative Research Centres (CRC) Grants

CRC Grants support industry-led research collaborations between businesses, researchers, and institutions.

They are particularly relevant for:

- AI-driven apps in Australia

- Data-intensive platforms

- Deep-tech or R&D-heavy digital products

Why it matters

CRC funding enables businesses to share R&D costs, access specialised expertise, and accelerate innovation without carrying the full financial burden alone.

Entrepreneurs’ Programme

The Entrepreneurs’ Programme is a federal initiative that helps Australian businesses improve competitiveness and commercial readiness through a mix of targeted funding and advisory support.

Typically supports:

- Commercial execution and operational maturity

- Business capability building and governance improvement

- Market validation and go-to-market readiness

- Collaboration with industry and advisory partners

Why it matters

This program is well suited for businesses transitioning from build to scale, where structured execution, financial discipline, and commercial alignment become more critical than experimentation.

Innovation and Science Australia (ISA) Aligned Grants

Funding pathways aligned with Innovation and Science Australia (ISA) focus on research-led innovation, industry collaboration, and long-term productivity outcomes.

App projects with:

- Complex technical development

- Cross-industry or sector-wide impact

- Strong research or data-driven components

are more likely to align with these programs.

Why it matters

ISA-aligned grants support ambitious, technically sophisticated app initiatives that contribute to broader economic or industry transformation.

State Government Grants

In addition to federal funding, state and territory governments offer their own grant programs aligned with local economic and industry priorities, including technology and digital innovation.

These grants often support:

- Execution and capability building

- Industry pilots or proof-of-concept initiatives

- Region-specific innovation objectives

Why it matters

State-based grants can be highly targeted and complementary to national programs, making them valuable for businesses operating within specific regional or industry ecosystems.

Digital Transformation and Digital Capability Grants

Digital-focused grants are periodically launched to strengthen the nation’s digital capabilities and accelerate the adoption of modern technologies like AI in Australia.

They typically support apps that enable:

- Digital transformation initiatives in Australia

- Operational efficiency improvements

- Regulatory or compliance modernisation

Why it matters

Digital grants work best as opportunistic, non-dilutive funding support that supplements core capital, rather than replacing a primary funding strategy.

Export Market Development Grants (EMDG)

The Export Market Development Grants program provides up to 50% reimbursement for eligible export-related expenses for new and developing exporters.

This is especially relevant for:

- Apps targeting international users

- SaaS platforms expanding beyond Australia

- Businesses investing in overseas marketing, localisation, or distribution

Why it matters

EMDG supports post-launch growth and global expansion, an area often underfunded once initial development capital is exhausted.

Accelerating Commercialisation Program

The Accelerating Commercialisation initiative supports businesses bringing novel and innovative products, services, or processes to market, including digital platforms and apps.

It typically supports:

- Market validation and customer pilots

- Product testing and refinement

- Activities that prepare the app for domestic or global market expansion

Why it matters

This program bridges the gap between successful development and market-ready scale, making it highly relevant for technically proven apps that need commercial traction.

State-Based Technology and Innovation Grants

Beyond federal programs, state governments across Australia offer their own technology, innovation, and AI-focused grants, often with different eligibility criteria and funding priorities.

These grants often support:

- Early-stage product development

- Pilot programs

- Industry-specific digital innovation

Why it matters

State-based grants can be easier to access, faster to approve, and highly targeted, making them a valuable complement to national funding programs.

The Role of Australia’s R&D Tax Incentive in App Funding Strategy

For app companies investing in technically complex or experimental development, the Australia R&D Tax Incentive can play a meaningful role in the funding mix. While not a direct funding round, it can influence cash flow and runway during development-heavy phases.

The incentive is designed to support eligible research and development activities where technical uncertainty exists, and systematic experimentation is required. For app businesses, this often applies to novel architectures, complex algorithms, or innovative platform capabilities.

From a funding perspective, the R&D Tax Incentive in Australia is typically used to:

- Offset eligible development expenditure

- Reduce pressure to raise capital prematurely

- Improve capital efficiency during build phases

It is often discussed alongside an R&D grant in Australia, though the two operate differently. Grants are competitive and milestone-driven, while the tax incentive is linked to eligible expenditure and compliance.

Aussie innovators frequently study R&D tax incentive examples to understand how similar app companies structure eligible activities, documentation, and governance. The forward-thinking businesses treat this as a structured process, not a retrospective exercise.

Used correctly, the incentive complements private capital. Used poorly, it creates risk. It should support a funding strategy, not replace one.

Also Read: How to Get Investors For Your Mobile App Startups? Steps, Cost & Types

Structure your product roadmap and documentation to support eligibility for Australia’s R&D Tax Incentive without introducing compliance risk.

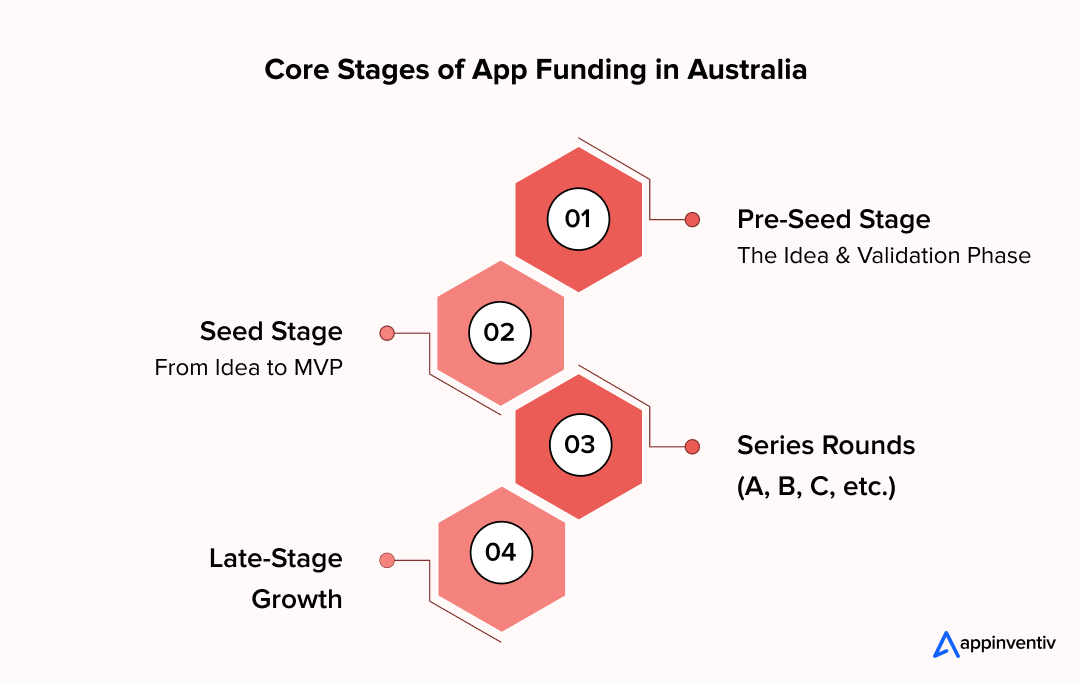

Core Stages of App Funding in Australia: From Validation to Growth

Securing app funding in Australia follows a staged progression rather than a single capital event. Each phase serves a distinct purpose, with different expectations around risk, execution maturity, and governance. Understanding what each stage is designed to validate helps businesses raise capital at the right time, on the right terms.

Pre-Seed Stage: The Idea & Validation Phase

This stage is typically self-funded through founder capital, bootstrapping, or early customer revenue. The focus is on validating the problem, proving delivery discipline, and avoiding overbuilding before market signals are clear. Credibility is formed here, and mistakes often compound later.

Seed Stage: From Idea to MVP

Seed funding usually comes from angel investors or early institutional capital and is closely tied to product clarity and early traction. Investors look for a well-defined roadmap, disciplined capital use, and ownership of technical decisions rather than aggressive growth projections.

Series Rounds (A, B, C, etc.)

At this stage, funding decisions are driven by metrics such as retention, revenue predictability, and scalability. Earlier choices around dilution, documentation, and execution quality directly influence valuation, control, and investor confidence.

Late-Stage Growth

Late-stage funding focuses on expansion, market leadership, and operational resilience. Strategic alignment, governance maturity, and repeatable execution models matter more than experimentation at this stage, as capital is deployed to scale proven systems rather than validate ideas.

Also Read: What Type of Mobile Apps Will Tech Investors Fund in 2024?

Best App Funding Strategies in Australia

There’s no single best way to fund an app in Australia. Successful businesses typically combine multiple funding strategies over time, aligning each option with the product’s maturity, risk profile, and capital needs. What matters most is choosing funding sources that support execution without introducing avoidable dilution, governance risk, or delivery pressure too early.

The table below outlines the most common app funding strategies used in Australia and how they typically apply.

| Funding Strategy | What It Is | How It Works | Best Used When |

|---|---|---|---|

| Bootstrapping | Funding the app using personal savings or operating revenue | Businesses retain full control and self-fund development | Early validation, proving execution discipline |

| Friends and Family | Capital from personal networks with informal terms | Small amounts raised to support early build or testing | Bridging early gaps before structured funding |

| Angel Investors | Individuals, often experienced founders or professionals, investing personal capital | Equity investment, commonly via syndicates | MVP stage with clarity on problem and roadmap |

| Venture Capital | Institutional investors focused on high-growth companies | Larger equity rounds tied to scaling milestones | Proven traction, repeatable growth, strong governance |

| Crowdfunding | Raising funds from a large number of contributors | Equity or reward-based funding via online platforms | Consumer apps with strong market appeal |

| Debt Financing | Borrowed capital that must be repaid with interest | Loans or credit facilities without equity dilution | Predictable revenue and cash flow stability |

| Accelerator Programs | Structured programs offering funding and mentorship | Small equity stake in exchange for capital and support | Early-stage apps needing execution guidance |

| Grants | Government or state-backed non-dilutive funding | Funding tied to eligibility and compliance criteria | Offsetting development costs without dilution |

How Investors in Australia Assess App Funding Readiness

Australian investors tend to take a risk-first, execution-led view when assessing app funding readiness. Rather than backing ideas alone, they look for evidence that product, capital, governance, and compliance decisions are already aligned.

Clear ownership of technical decisions, realistic delivery timelines, disciplined capital use, and early attention to regulatory obligations such as the Australian Privacy Act, the Australian Privacy Principles (APPs), and baseline cyber standards like ISO 27001 or SOC 2 carry more weight than aggressive growth projections.

Funding readiness is also judged by how well past decisions scale forward under scrutiny. Investors evaluate whether the app architecture can grow without rework, whether costs are traceable, whether data handling and security controls meet Australian expectations, and whether documentation would withstand due diligence or audit review.

Teams that treat execution quality, governance, and compliance as cumulative assets rather than late-stage fixes are consistently viewed as lower-risk and more investable in the Australian market.

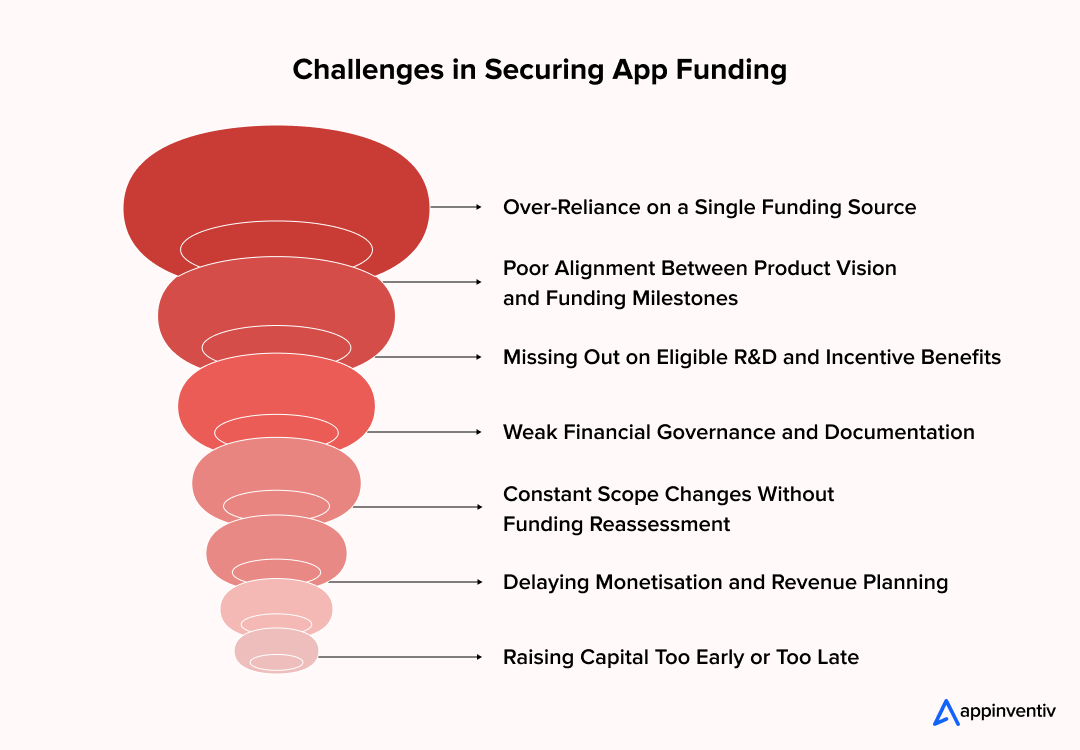

Common App Funding Challenges & How to Avoid Them

Even with access to grants, incentives, and private capital, many Australian businesses struggle to sustain app funding beyond the early stages. The challenges are rarely about a lack of ideas. More often, they stem from planning gaps, misaligned expectations, or execution blind spots. Understanding these issues early can prevent costly setbacks.

Underestimating the True Cost of App Development

Many businesses budget primarily for MVP development costs while overlooking long-term expenses such as continuous feature enhancements, security updates, compliance requirements and ongoing maintenance.

How to avoid it?

Build a funding model that spans at least 18 to 24 months, factoring in post-launch costs. Treat the MVP as a starting point, not the finish line.

Over-Reliance on a Single Funding Source

Relying solely on investor funding, grants, or internal cash flow increases risk. Any delay, rejection, or shift in priorities can stall development entirely.

How to avoid it?

Adopt a diversified funding mix that may include internal budgets, government incentives, private capital, and early revenue reinvestment. This reduces dependency and improves financial resilience.

Poor Alignment Between Product Vision and Funding Milestones

A frequent challenge is raising funds without clearly mapping them to delivery milestones. This leads to overspending early and funding gaps later.

How to avoid it?

Tie funding tranches directly to product outcomes such as feature releases, market validation, or scalability milestones. This creates accountability and ensures capital is deployed with intent.

Missing Out on Eligible R&D Benefits

Many Australian businesses either assume they are ineligible for R&D incentives or fail to structure development work correctly to qualify.

How to avoid it?

Plan R&D eligibility from the discovery phase. Maintain technical documentation, track experimentation, and separate qualifying development activities early. This ensures innovation spend can potentially be recovered and reinvested.

Weak Financial Governance and Documentation

Lack of structured financial tracking often becomes a major barrier when project managers seek follow-on funding, audits, or compliance approvals. Common issues include inconsistent cost categorisation, limited visibility into feature-level spend and insufficient documentation for incentives or grants.

How to avoid it?

Implement governance frameworks early with clear cost allocation, forecasting, and audit-ready documentation. Strong financial hygiene builds investor and regulator confidence.

Constant Scope Changes Without Funding Reassessment

Feature creep is common in growing products, but frequent scope changes without revisiting funding assumptions can quickly drain budgets.

How to avoid it?

Introduce structured change management. Every significant scope adjustment should trigger a funding impact review, ensuring budgets remain aligned with delivery priorities.

Delaying Monetisation and Revenue Planning

Some businesses postpone revenue strategy discussions until after product maturity, assuming funding will carry the product long enough.

How to avoid it?

Integrate monetisation thinking early, even if revenue comes later. Early revenue signals strengthen funding conversations and reduce long-term dependency on external capital.

Raising Capital Too Early or Too Late

Timing mistakes are one of the most expensive funding errors Australian businesses make. Raising too early often leads to undervaluation, while raising too late creates cash pressure and weak negotiating power.

How to avoid it?

Align fundraising with validated milestones, not ideas alone. Clear traction, technical proof, or market signals strengthen valuation and reduce urgency-driven decisions.

Get clarity on when to raise, how much to raise, and which funding paths align with your product stage.

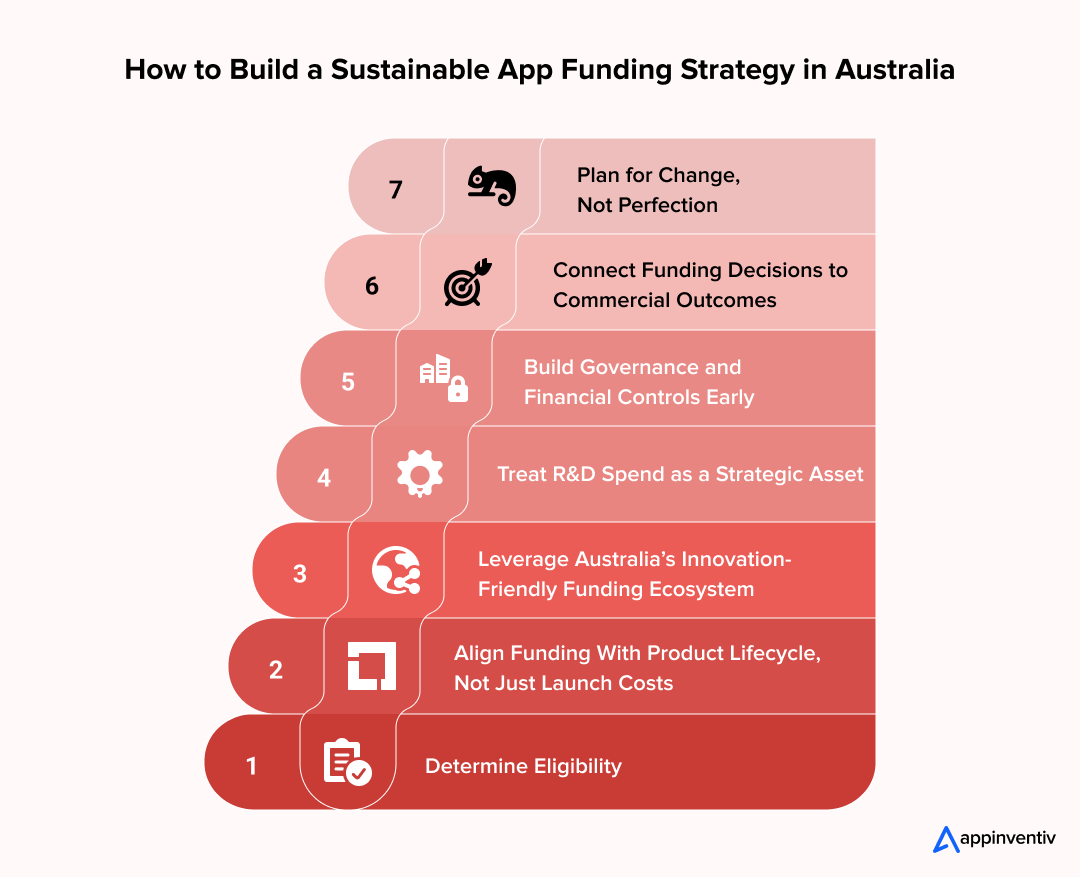

How to Build a Sustainable App Funding Strategy in Australia

Building a sustainable app funding strategy in Australia requires more than securing one-off capital. It’s about designing a funding model that supports long-term product evolution, compliance, and commercial viability while reducing financial risk at every stage of growth.

Here’s how mature Australian businesses and product-led managers approach it.

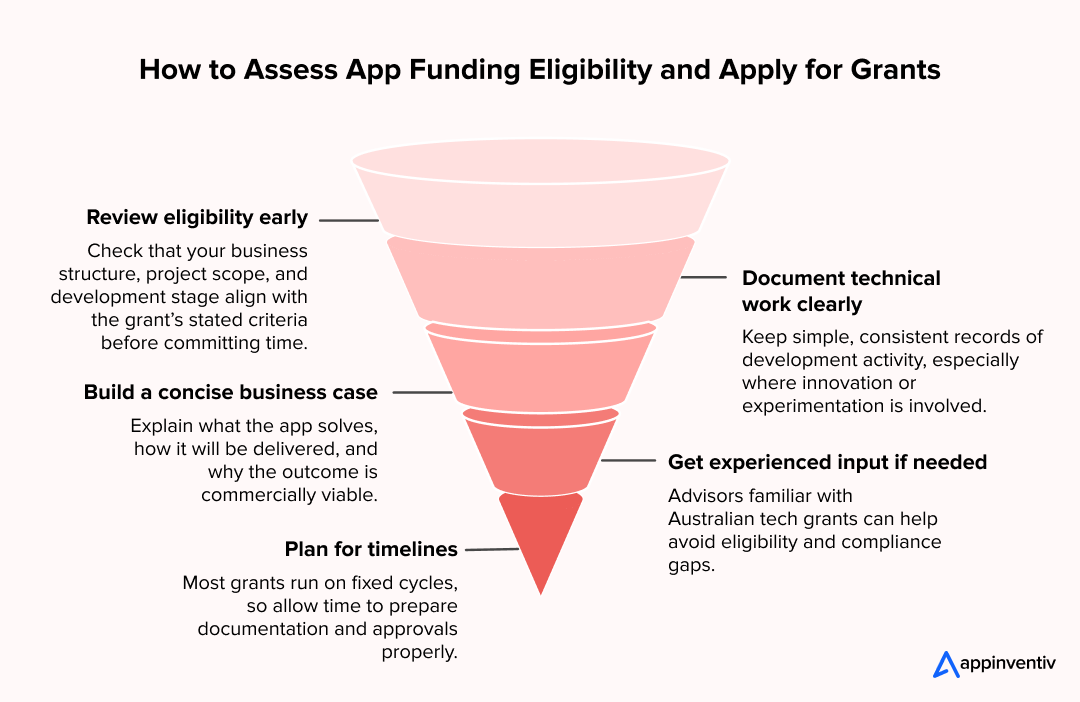

Determine Eligibility

The first step is to clarify whether the app adheres to the country’s regulatory and compliance criteria set by bodies such as the Australian Taxation Office (ATO), covering:

- Assessment of technical work against recognised R&D activity criteria

- Early consideration of data handling, security, and regulatory obligations

- Clear separation between eligible development activity and routine delivery work

Taking this step early helps ground funding decisions in realistic, compliant assumptions and reduces friction as the app moves toward later funding stages.

Align Funding With Product Lifecycle, Not Just Launch Costs

Effective app funding in Australia starts with mapping capital to how the product will actually evolve, not just to initial build or launch expenses. Funding plans should be structured across the full product lifecycle, including:

- Discovery and validation

- MVP development and initial market entry

- Iterative development and feature expansion

- Security, compliance, and platform upgrades

- Ongoing optimisation and technical debt management

When funding is aligned to these stages from the outset, capital supports delivery momentum instead of reacting to pressure points. As many product leaders observe, “Cash flow problems don’t kill apps, misaligned planning does.

Leverage Australia’s Innovation-Friendly Funding Ecosystem

Australia offers a unique advantage compared to many global markets: government-backed innovation support alongside private capital. A sustainable strategy blends multiple sources rather than relying on a single funding channel.

Typical funding layers include:

- Internal capital or operating budgets

- Government-backed incentives tied to innovation and R&D

- Private investment or strategic partnerships

- Revenue reinvestment from early traction

This blended approach improves resilience and reduces dilution or over-dependence on external investors.

Treat R&D Spend as a Strategic Asset

In Australia, eligible app development work can often qualify as R&D activity when it involves technical uncertainty, experimentation, or novel engineering outcomes.

When planned correctly:

- R&D costs are tracked from day one

- Development decisions are documented with compliance in mind

- Innovation spend contributes directly to future funding recovery

This mindset shifts development from being a pure cost centre to a recoverable investment, strengthening cash flow and extending runway without slowing delivery.

Build Governance and Financial Controls Early

Sustainability is as much about control as it is about capital. Investors, boards, and auditors increasingly expect clear governance around product funding.

Strong strategies include:

- Transparent cost allocation across features and milestones

- Clear separation of R&D vs non-R&D spend

- Forecasting models tied to delivery velocity

- Audit-ready documentation for incentives and grants

These controls reduce funding risk, improve credibility, and make future capital raises significantly easier.

Connect Funding Decisions to Commercial Outcomes

Sustainable funding strategies are outcome-led, not budget-led. Every major funding decision should be linked to a measurable business result, such as:

- Reduced time to market

- Improved customer acquisition or retention

- Operational efficiency gains

- Long-term platform scalability

This approach ensures that funding fuels growth, not just development activity. As the industry often puts it, “Capital follows clarity.” When the business case is clear, funding becomes far easier to justify and sustain.

Plan for Change, Not Perfection

Market conditions, regulations, and customer needs evolve. A sustainable app funding strategy in Australia is flexible by design, allowing teams to:

- Reprioritise features without financial shock

- Adjust development pace based on performance

- Respond to compliance or security changes quickly

Resilience, not rigidity, is what keeps app funding viable over the long term.

Also Read: How To Raise Funding For Your Startup App Company?

Align technical execution, governance, and funding milestones to reduce dilution and improve valuation outcomes.

Improve your Chances of Securing App Funding with Appinventiv

Securing app funding in Australia is rarely just about the idea. It’s about execution clarity, technical credibility, and financial readiness. This is where a mobile app development company in Australia, like Appinventiv, adds measurable value. We help Aussie businesses build products that are not only market-ready but also funding-ready, with delivery discipline aligned to what investors, grant bodies, and strategic partners expect.

With 10+ years of APAC delivery experience, we have delivered 3,000+ digital products across 35+ industries, supported by a global team of 1,700+ technology experts.

This depth of execution enables us to design app architectures, development roadmaps, and documentation frameworks that stand up to technical, financial, and due-diligence scrutiny.

Our work consistently supports funding outcomes because we focus on:

- Scalable, future-ready app architectures

- Milestone-driven development aligned with funding stages

- Clear cost traceability and technical documentation

- Compliance-aware engineering that builds investor confidence

This approach has helped us build long-term partnerships, reflected in a 78% repeat client base, driven by sustained delivery outcomes rather than one-off builds.

Proven funding outcomes from Appinventiv-backed products include:

- Edamama: We helped Edamama build a scalable, user-centric eCommerce platform that could raise $5 million in funding.

- JobGet: Our tech experts developed JobGet, a high-performance job marketplace, and helped the company secure $52 million in Series B funding.

These results weren’t driven by pitch decks alone. They were built on robust engineering, disciplined execution, and funding-aligned product strategy.

So, if your goal is to secure app funding in Australia, partnering with us can be a wiser move. We build apps in Australia with capital readiness, scalability, and long-term value in mind from day one, not trying to retrofit your product after funding conversations have already started.

FAQs

Q. What is app funding and how does it work?

A. App funding refers to the capital required to design, build, launch, and scale an application. In Australia, app funding typically comes from a mix of sources such as internal budgets, government grants, tax incentives, private investment, and revenue reinvestment.

Rather than being a one-time event, app funding works best as a stage-based strategy, where capital is raised or allocated in alignment with product milestones like MVP development, market validation, and scaling. This reduces risk and improves capital efficiency.

Q. How do you get funding for your app idea?

A. Securing funding for an app idea depends on how far the concept has progressed. Early-stage ideas often rely on bootstrapping, founder capital, or early grants, while validated ideas can access government programs, investors, or non-dilutive incentives.

Successful businesses focus on:

- Building the types of apps for funding in Australia

- Clearly defining the problem the app solves

- Demonstrating technical feasibility or early traction

- Aligning the app with funding eligibility criteria

- Matching funding type to the app’s maturity stage

A well-structured plan matters more than the idea alone.

Q. How much funding do you need to build an app?

A. There is no fixed number, as app funding requirements vary based on:

- App complexity and feature scope

- Platform choice (iOS, Android, web, or cross-platform)

- Security, compliance, and integration needs

- Ongoing maintenance and scaling plans

In Australia, businesses should plan funding not just for development, but for post-launch costs such as updates, infrastructure, and optimisation.

Q. What technical factors influence app funding decisions?

A. Funding decisions are heavily influenced by technical considerations, including:

- Architecture scalability and future readiness

- Level of technical uncertainty or innovation involved

- Data security, privacy, and compliance requirements

- Quality of documentation and development planning

Q. What is the R&D Tax Incentive in Australia, and how does it help?

A. The R&D Tax Incentive is an Australian government program designed to encourage innovation by offsetting eligible research and development costs.

For app development, it can help by:

- Reducing the effective cost of technical experimentation

- Improving cash flow through tax offsets or refunds

- Supporting ongoing product innovation rather than one-off builds

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Step-by-Step Guide to Digital Tipping Platform Development for Australia: Features, Costs & ROI

Key takeaways: Digital tipping is now a system-level decision Once tips move through digital payments, they intersect with payroll, reporting, and workforce trust. Informal handling does not scale. Sector-specific design determines success Cafés, restaurants, hotels, delivery services, and franchises each require different allocation logic and operational controls to reflect how work is delivered. Cost reflects…

Building a Future Ready Real Estate Platform in Qatar for Vision 2030

Key Takeaways Future-ready real estate platforms in Qatar are treated like infrastructure, not apps. They’re built to last, with strong data, clear governance, and room to adapt as policies and projects evolve. Off-the-shelf tools work only until complexity shows up. Once approvals, compliance, and multiple stakeholders are involved, custom platforms usually hold up far better.…

Investing in the Future: Why Arabian Education App Development is Surging

Key Takeaways: Education apps in the Arabian region are no longer stopgap solutions. They’re becoming part of how learning actually runs day to day. Schools, universities, and governments are choosing platforms that scale quietly and fit real teaching routines. The apps that succeed focus on stability, integration, and usability rather than packed feature lists. Most…