- The Current Challenges of Traditional Portfolio Management

- Differences Between Traditional and AI Portfolio Management

- How Does AI in Portfolio Management Work?

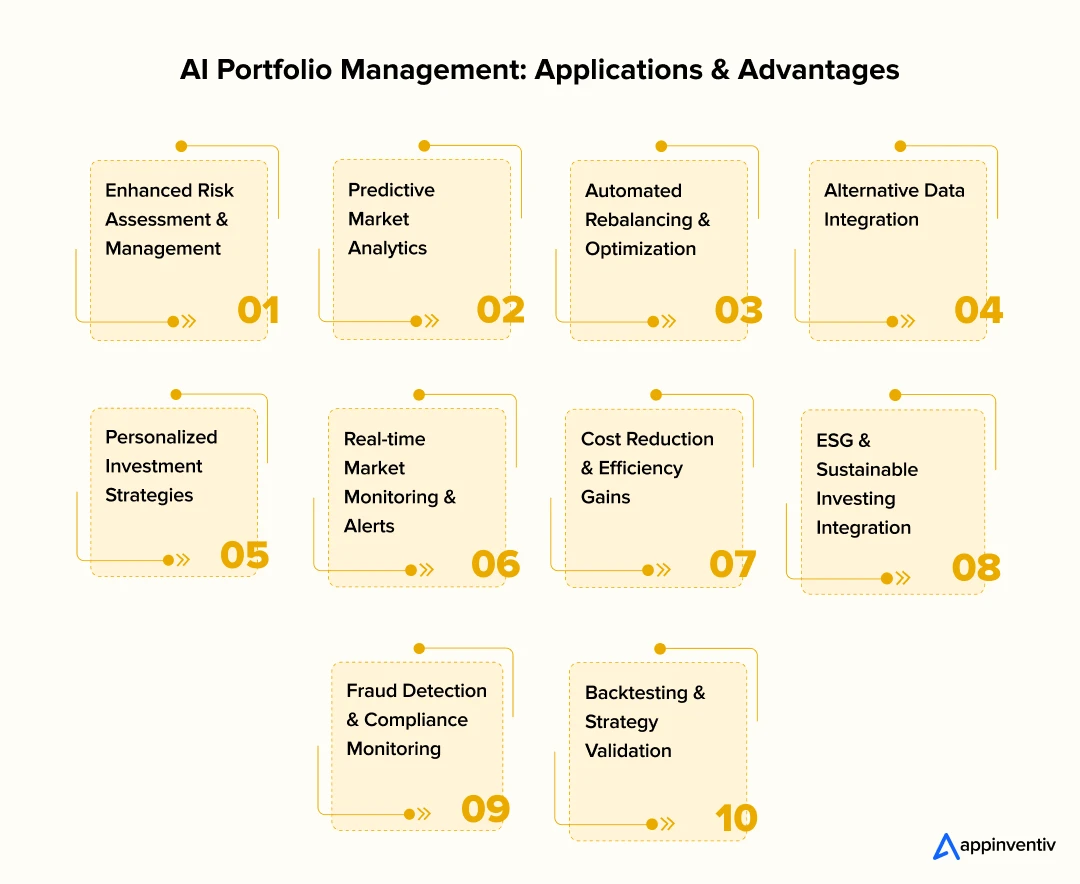

- 10 Revolutionary Benefits and Use Cases of AI Portfolio Management

- 1. Enhanced Risk Assessment and Management

- 2. Predictive Market Analytics

- 3. Automated Rebalancing and Optimization

- 4. Alternative Data Integration

- 5. Personalized Investment Strategies

- 6. Real-time Market Monitoring and Alerts

- 7. Cost Reduction and Efficiency Gains

- 8. ESG and Sustainable Investing Integration

- 9. Fraud Detection and Compliance Monitoring

- 10. Backtesting and Strategy Validation

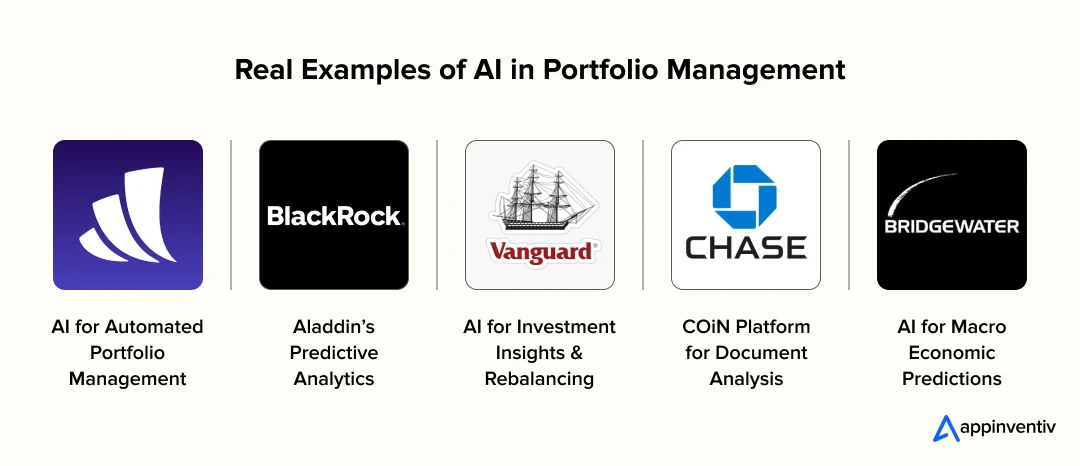

- Real-World Use Cases of AI in Portfolio Management

- Wealthfront – AI for Automated Portfolio Management

- BlackRock – Aladdin’s Predictive Analytics

- Vanguard – AI for Investment Insights and Rebalancing

- JPMorgan Chase – COiN Platform for Document Analysis

- Bridgewater Associates – AI for Macro-Economic Predictions

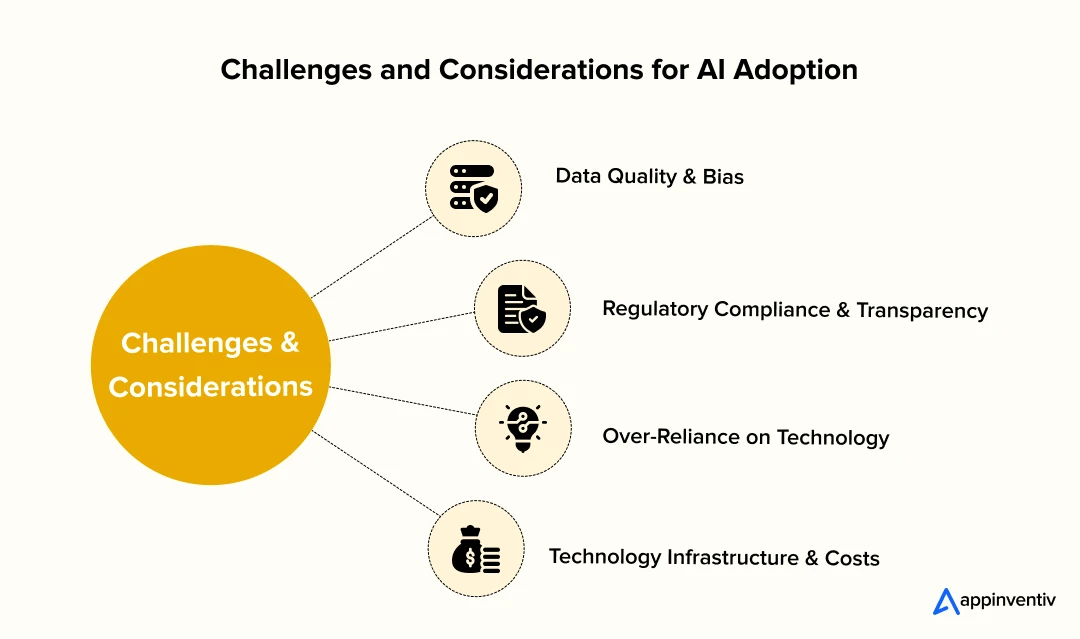

- Challenges for AI Adoption & How to Overcome Them

- Data Quality and Bias

- Regulatory Compliance and Transparency

- Over-Reliance on Technology

- Technology Infrastructure and Costs

- The Future of AI in Portfolio Management

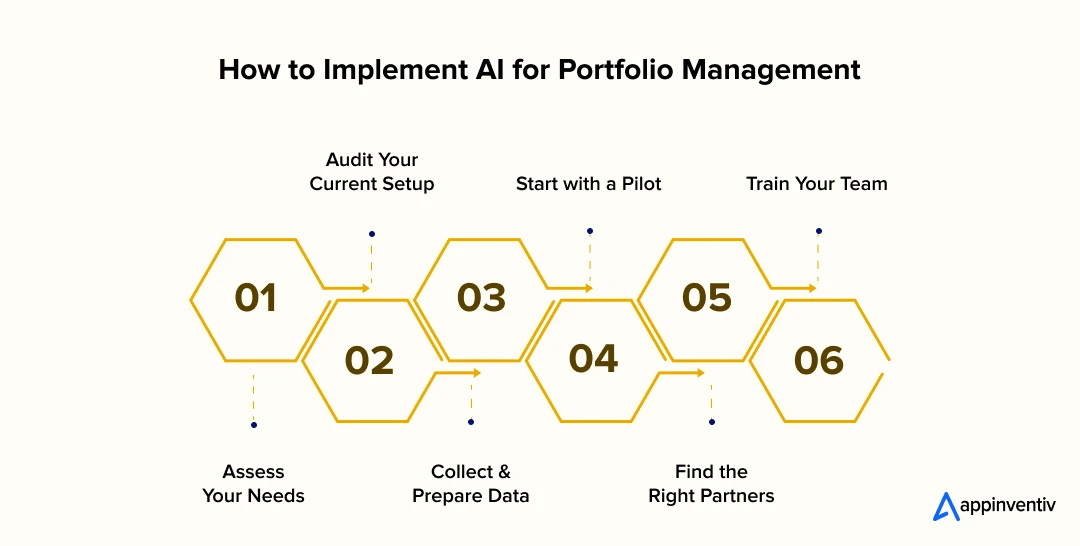

- How to Implement AI for Portfolio Management: A Phased Approach

- Enter into the New Era of Smart Investing with Appinventiv

- FAQs

Key takeaways:

- AI for portfolio management helps overcome the big problems of traditional methods, like data overload and slow response times.

- The benefits of AI in portfolio management are huge, ranging from smarter risk assessment and predictive analytics to automated portfolio rebalancing.

- These powerful AI tools aren’t just for big firms—robo-advisors are making advanced investment strategies accessible to almost anyone.

- While the technology is incredible, challenges like data quality and regulatory compliance need to be addressed for a smooth and successful rollout.

- The future of AI portfolio management is a collaboration between humans and AI, working together to achieve even better results.

Remember the old-school picture of a portfolio manager? Piles of paper, a dozen flashing screens, and a gut feeling guiding every big choice. That image is now more of a memory than reality. The world of investing moves too fast for those old methods. In this new landscape, AI portfolio management isn’t just a nice-to-have; it’s a dire necessity. It’s what keeps firms competitive.

Let’s picture this: It’s 2 AM on a Tuesday, and while you’re sleeping, your investment portfolio is being monitored, analyzed, and optimized by sophisticated algorithms processing thousands of data points per second. This isn’t science fiction—it’s the reality of modern AI portfolio management.

The financial world is going through a massive change. AI is leading the charge. A 2024 report from Grand View Research highlights this. It shows the market for artificial intelligence asset management is set for a massive $17,007.5 million value by 2030. This growth shows that companies aren’t debating whether to use AI anymore. They’re focused on how to use it right now.

This blog post will walk you through 10 key benefits and real-world examples. You’ll see how AI is truly revolutionizing portfolio management. From smarter risk management to hyper-personalized strategies, it’s all changing for the better.

Tap into this thriving market with our AI development services

The Current Challenges of Traditional Portfolio Management

Traditional methods and their constraints often fail to meet the speed and precision required in today’s fast-paced financial markets. Here are some key challenges faced by portfolio managers:

Data Overload: For years, portfolio management was a mix of hard data, human instinct, and historical trends. It worked, but today’s market has pushed it to its limits. The amount of data is overwhelming. We’re talking about everything from real-time market feeds to alternative data like social media posts and even satellite images. Traditional portfolio analysis tools or a manual approach can’t possibly keep up.

Speed and Precision: Another big problem is the need for speed. In an age of high-speed trading, a few seconds can make or break a trade. Traditional portfolio analysis, with its slow, manual processes, just can’t compete. This is where the difference between traditional and AI-based methods becomes obvious.

Differences Between Traditional and AI Portfolio Management

Traditional Portfolio Management: Traditional portfolio management faces mounting pressures. Market volatility increases daily. Data volumes explode exponentially. Client expectations soar for personalized, responsive service. Human portfolio managers, despite their expertise, struggle with these mounting challenges. They process limited information sets. They work within business hours. They make decisions based on historical patterns and intuition.

AI Powered Portfolio Management: The power of AI in investment management is clear: it processes vast data, finds hidden patterns, and acts with a speed and accuracy no human could ever match. AI transforms how we think about investing entirely. It shifts portfolio management from reactive to proactive. From intuitive to data-driven. From limited to limitless. This is completely reshaping how we manage and grow portfolios.

Think about what becomes possible. Machine learning algorithms analyze millions of data points instantly. Natural language processing extracts insights from news and reports. Predictive analytics forecast market movements with increasing precision.

But here’s what excites me most—AI doesn’t just automate existing processes. It enables completely new investment approaches. Personalized strategies scale to millions of clients. Alternative data sources unlock hidden insights. 24/7 monitoring never sleeps.

This revolution goes deeper than simple efficiency gains. We’re witnessing the birth of entirely new investment capabilities. The firms that embrace this change will dominate. Those that don’t will struggle to survive.

To help you give a broad overview of limitations related to traditional methods and perks of AI-powered portfolio management solutions, here is a brief comparison table between the two:

| Feature | Traditional Portfolio Management | AI-Based Portfolio Management |

|---|---|---|

| Data Analysis | Manual and prone to human bias. | Automated, using massive, complex data sets in real-time. |

| Speed | Slow, with decisions made periodically. | Instantaneous, with actions executed in real-time. |

| Risk Assessment | Based on past volatility and correlations. | Predictive, finds complex patterns that aren’t obvious. |

| Personalization | Uses broad categories for a “one-size-fits-most” approach. | Hyper-personalized, based on detailed individual data. |

| Cost | High due to time-consuming, manual processes. | Lower operational costs through automation. |

| Bias | Influenced by human emotion and cognitive biases. | Objective and data-driven. |

In short, AI is solving the old problems of speed and scale. This makes it clear why so many firms are now building automated portfolio management systems.

How Does AI in Portfolio Management Work?

Here’s a detailed step-by-step explanation of how AI in management operates:

- It Gathers and Prepares a Ton of Data: The first thing an AI does is to collect a huge amount of information. This isn’t just stock prices. It includes everything from financial reports to news headlines, and even things like satellite photos of shipping ports. It cleans up all this data so it’s ready to be used.

- It Finds Hidden Patterns: Next, the AI’s algorithms get to work. They analyze all that data to find connections and trends that a human would likely miss. For example, it might figure out that certain words in a news article often predict a stock’s movement.

- It Gives Smart Recommendations: Based on those patterns, the AI provides insights. It might suggest a specific stock is undervalued or predict a rise in market volatility. These aren’t just guesses; they are data-backed conclusions.

- It Takes Action: The AI can then act on its own conclusions. It might automatically rebalance a portfolio to keep it on track. It can even execute trades in a fraction of a second when conditions are just right.

- It Manages Risk: All of this works together to manage risk. The AI constantly watches the portfolio and the market. It can run simulations to show how a portfolio would handle a crisis. This gives a manager a much clearer picture of potential risks.

Now that we know the role of AI in investment management and how it works, let’s uncover its multifarious applications and advantages.

10 Revolutionary Benefits and Use Cases of AI Portfolio Management

The future of an AI-driven world is not coming; it’s already here. Smart firms are capturing massive advantages right now. Let’s dive in and discover how. Here are 10 ways AI portfolio management is transforming the investment landscape, with real-world use cases and examples that showcase its power.

1. Enhanced Risk Assessment and Management

Benefit: Traditional risk models are often slow and based on past data. AI changes this entirely. It can evaluate risk in real-time across countless assets. It sees hidden relationships and market movements that a human might miss. This gives managers a much clearer picture of potential dangers.

Use Case: AI algorithms can analyze market volatility and correlations in a continuous loop. They look at how different asset classes react to various events, predicting potential ripple effects before they happen. This proactive approach to risk is a game-changer.

Example: JPMorgan’s LOXM system is a perfect example. This AI-driven trading algorithm learns from market conditions. It works to minimize the impact of large trades, helping to manage execution risk with incredible precision.

Also Read: AI in Risk Management: Key Use Cases

2. Predictive Market Analytics

Benefit: Forecasting market trends has always been a blend of art and science. AI tips the scales toward science. Machine learning models can process vast amounts of data to predict market movements with surprising accuracy.

Use Case: AI can perform sentiment analysis on news articles, social media, and analyst reports. By combining this with technical indicators, it can forecast trends before they become obvious to everyone else.

Example: BlackRock’s Aladdin platform uses powerful predictive analytics. It helps portfolio managers model how different market scenarios might impact their holdings, giving them a strategic edge in volatile markets.

3. Automated Rebalancing and Optimization

Benefit: Manually rebalancing a portfolio is a tedious and time-consuming process. It’s often done infrequently. AI automates this, ensuring a portfolio stays aligned with its goals without any errors and human intervention.

Use Case: AI continuously monitors the portfolio. When market shifts cause the asset allocation to stray from its target, the system automatically buys and sells assets to bring it back in line. This constant optimization is impossible with traditional methods.

Example: Robo-advisors like Betterment and Wealthfront have made automated rebalancing mainstream. The firm uses AI and ML algorithms to keep client portfolios optimized and on track toward their long-term financial goals.

4. Alternative Data Integration

Benefit: Investment decisions used to rely on a limited set of traditional data. Today, there’s a huge world of non-traditional or “alternative” data. AI is the only way to make sense of this information.

Use Case: AI can analyze satellite imagery of parking lots to estimate a retail company’s sales. It can also analyze credit card transaction data or social media sentiment to gain unique insights into consumer behavior.

Example: Many hedge funds now use satellite data to predict commodity prices. By tracking crop health or shipping container volumes, they get a real-time advantage over firms relying on traditional reports.

5. Personalized Investment Strategies

Benefit: One-size-fits-all investing is a thing of the past. AI creates tailored portfolios based on an individual’s unique profile, income, investment capabilities, risk tolerance, and goals.

Use Case: AI-driven questionnaires and behavioral analysis can assess an investor’s personality and financial situation. It then builds a portfolio that is perfectly suited to their specific needs and adapts as their life changes.

Example: Vanguard’s Personal Advisor Services uses a hybrid model. AI handles the complex data and portfolio construction, freeing up human advisors to provide personalized guidance and build strong client relationships.

Also Read: AI for Investing: Key Benefits & Practical Use Cases

6. Real-time Market Monitoring and Alerts

Benefit: The market never sleeps, but a human manager does. AI provides continuous, 24/7 market surveillance. It instantly flags significant events, preventing managers from being caught off guard.

Use Case: An AI system monitors a portfolio for deviations from its target performance. It can also watch for major news events or sudden market movements and send instant alerts to a manager.

Example: Goldman Sachs’s Marcus platform uses AI to provide these monitoring capabilities. It gives investors the peace of mind that their portfolio is being watched at all times, with alerts for anything that requires immediate attention.

7. Cost Reduction and Efficiency Gains

Benefit: Manual, repetitive tasks are expensive, time-consuming, and prone to human error. AI automates these tasks, drastically cutting operational costs, saving tim,e and improving efficiency.

Use Case: Automated trade execution and portfolio management tasks reduce the need for a large team of back-office staff. This allows firms to operate more leanly and pass the savings on to clients.

Example: Major asset management firms have achieved significant cost savings by using AI to automate compliance checks, data entry, and report generation, freeing up human staff for higher-value work.

8. ESG and Sustainable Investing Integration

Benefit: ESG (Environmental, Social, and Governance) investing is a top priority for many investors. AI simplifies the complex process of integrating these factors into a portfolio.

Use Case: AI can analyze corporate sustainability reports, news, and public disclosures to generate objective ESG scores. This helps managers build portfolios that align with an investor’s values without a manual, time-consuming review.

Example: MSCI’s ESG rating systems are powered by AI. The technology analyzes a huge amount of data to provide clear, consistent ESG ratings that investors can use to make informed decisions.

9. Fraud Detection and Compliance Monitoring

Benefit: The financial industry is heavily regulated. AI for fraud detection enhances security and ensures compliance by monitoring for unusual activities that could indicate fraud.

Use Case: AI uses pattern recognition to detect unusual trading activities. It can flag transactions that don’t fit a normal profile, helping to identify potential insider trading or market manipulation in real time.

Example: Financial institutions like HSBC and ING use AI systems to scan millions of transactions daily. The systems can detect and flag suspicious patterns, protecting the firm and its clients from fraudulent activities.

10. Backtesting and Strategy Validation

Benefit: Before you put a new investment strategy into play, you need to know if it works. AI lets you test new strategies quickly and thoroughly against historical data.

Use Case: AI can run thousands of simulations in minutes. It can perform complex analyses to show you how a strategy would have performed under all sorts of past market conditions. This gives you a high level of confidence before you risk any real money.

Example: Platforms like QuantConnect are perfect for this. They let users backtest their trading strategies on historical data. This helps them refine their ideas without risking real capital. It’s a great way to validate a strategy before it goes live.

Now that we have talked enough about AI’s applications and advantages in portfolio management in the FinTech world, let’s zoom out and look at the big picture of AI’s use cases in portfolio management. We’ll explore how major players in the financial industry are integrating AI on an institutional level to transform their operations and redefine what’s possible in portfolio management.

Real-World Use Cases of AI in Portfolio Management

The examples below move beyond a single application to show how a platform or an entire firm can be built on an AI-first approach. These case studies demonstrate the scale, depth, and value that artificial intelligence portfolio management brings to the table. They show how the technology is not just a feature, but a foundational element of modern finance.

Wealthfront – AI for Automated Portfolio Management

Wealthfront is the face of the modern automated portfolio management system. It uses AI to build and manage diversified portfolios of low-cost funds. It automatically rebalances to keep the allocation on target. It even offers automated tax-loss harvesting. This system constantly watches the market and makes tiny adjustments that a human couldn’t handle. This model shows the true power of an AI-managed portfolio.

BlackRock – Aladdin’s Predictive Analytics

BlackRock’s Aladdin platform is the backbone of institutional investing. It’s a single system that handles portfolio management, risk, and trading. Aladdin uses powerful predictive analytics to help clients understand their portfolios from every angle. It can simulate everything from a sudden interest rate hike to a geopolitical crisis. This helps firms be proactive, not reactive, and build a resilient AI investment portfolio.

Vanguard – AI for Investment Insights and Rebalancing

Vanguard is well known for its index funds, but its use of AI is quietly revolutionary. Its Personal Advisor Services uses AI tools for portfolio management to support human advisors. The technology handles complex data analysis and repetitive tasks. This frees advisors to focus on building client relationships. The AI also rebalances portfolios and gives real-time insights, keeping investments aligned with long-term goals.

JPMorgan Chase – COiN Platform for Document Analysis

JPMorgan Chase’s COiN (Contract Intelligence) platform is a great example of a targeted AI for portfolio management solution. It uses machine learning services to analyze thousands of legal documents and loan agreements. This task used to take lawyers endless hours. The AI finds key clauses, automates due diligence, and reduces human error. It’s a powerful example of AI in human resource optimization in portfolio management.

Bridgewater Associates – AI for Macro-Economic Predictions

Bridgewater Associates, one of the world’s largest hedge funds, has long been a pioneer in quantitative investing. They use a highly systematic, AI-driven approach to make predictions about the macro-economy. Their AI systems analyze a huge amount of data to develop investment ideas. This systematic process, driven by an advanced automated portfolio management system, helps them spot global opportunities and risks. This is the heart of their artificial intelligence investment management strategy.

Contact our AI experts and start building intelligent, scalable, and accessible AI portfolio management systems today.

Challenges for AI Adoption & How to Overcome Them

The benefits of AI for portfolio management are clear, but implementing it has its challenges. Firms need to be careful to ensure a successful transition.

Data Quality and Bias

- Challenges: AI models are only as good as the data they’re trained on. If the data is bad or biased, the decisions will be flawed. For example, a model trained only on data from a stable market might fail in a volatile one.

- Solutions: Firms must invest in solid data governance. They need to ensure data is clean, accurate, and relevant. They should also use diverse datasets and constantly monitor models for bias.

Regulatory Compliance and Transparency

- Challenges: The financial industry is heavily regulated. AI models can be complex and hard to explain. Regulators are increasingly demanding transparency. This “black box” problem is a big roadblock.

- Solutions: Firms should focus on building explainable AI (XAI) systems. These models can show a clear reason for their decisions. This meets regulatory needs and builds trust with clients.

Over-Reliance on Technology

- Challenges: There’s a risk in trusting an AI-managed portfolio completely. The system’s smartness heavily hinges on its programming. It often fails to handle a truly unprecedented event.

- Solutions: A hybrid approach is often best. AI can handle the number-crunching and routine tasks. Human managers can provide the strategic oversight, judgment, and personal touch that technology can’t replicate.

Technology Infrastructure and Costs

- Challenges: Building or buying a sophisticated AI portfolio management platform is a big investment. It takes a lot of time, money, and talent. For smaller firms, the initial costs can be too high.

- Solutions: Start small. A phased approach makes it more manageable. Begin with one AI portfolio management use case, like automating a back-office task. Then, scale up over time. Partnering with specialized AI development services can also help cut costs and speed up the process.

The Future of AI in Portfolio Management

The revolution in artificial intelligence portfolio management is just getting started. We’re still in the early innings of what becomes possible. We can expect even bigger changes ahead.

- Quantum computing represents the next major breakthrough coming fast. Quantum algorithms will solve portfolio optimization problems that seem impossible today. Imagine optimizing allocations across thousands of securities while considering millions of constraints simultaneously. Large institutional portfolios could achieve truly optimal construction rather than approximations.

- Reinforcement learning gets more sophisticated every month. These systems learn from market interactions continuously. Unlike supervised models that rely on historical data, reinforcement algorithms adapt to changing conditions and discover novel strategies.

- Advanced natural language processing will understand complex financial documents like humans do. Earnings calls, regulatory filings, and research reports become fully comprehensible to AI. These insights go far deeper than current keyword approaches.

- Federated learning lets institutions collaborate on AI development while protecting sensitive data. Multiple firms can contribute to model development without sharing proprietary information. This creates more robust models for everyone.

- IoT data analytics provides real-time economic insights. Smart city sensors, industrial devices, and consumer electronics generate data streams that inform investment decisions. This real-time monitoring offers unprecedented business intelligence.

- Regulatory frameworks will evolve to support innovation while ensuring protection. Clearer guidelines for AI use in financial services are coming. Requirements for transparency and bias testing will become standard practice.

The next decade brings AI ubiquity in portfolio management. We might see things like generative AI creating new investment ideas. Or quantum computing solves complex optimization problems in seconds. Human managers will focus on strategy, client relationships, and oversight rather than routine analysis. Successful firms combine AI capabilities with human expertise effectively. This shows that the impact of AI for portfolio management will only continue to grow.

How to Implement AI for Portfolio Management: A Phased Approach

Getting AI portfolio management up and running needs careful planning. Most firms jump in too fast and crash hard. Smart companies start with clear assessment frameworks. For firms ready to adopt AI in investment management, here is a step-by-step approach to implementing AI for portfolio management:

- Assess Your Needs: Look at your current operations. Where are the pain points? Where could AI make the biggest difference? This helps you identify the most impactful AI benefits in portfolio management.

- Audit Your Current Setup: Check technology infrastructure, data quality, and staff readiness. Identify gaps before spending a dime. Prioritize use cases that deliver quick wins without major complexity.

- Collect and Prepare Data: Data readiness matters most. Clean, comprehensive datasets fuel successful AI implementation. Many firms discover their data isn’t AI-ready. Fix this first, or nothing else works properly.

- Start with a Pilot: Phase your rollout carefully. Start small with specific applications like risk monitoring or automated alerts. Prove value quickly to build momentum. This lets you test the technology and measure its results before a full-scale rollout.

- Find the Right Partners: You don’t have to do it alone. Partner with an experienced AI development services provider. Their expertise prevents common pitfalls while you focus on core investment capabilities.

- Train Your Team: AI is a tool, and its success depends on the people who use it. Staff worry AI will eliminate their jobs. Clear communication about enhancement versus replacement reduces resistance. Thus, invest time and money in training your team. A good change management plan will help everyone embrace the new technology and develop AI skills.

Enter into the New Era of Smart Investing with Appinventiv

The traditional world of portfolio management is being completely reshaped by AI. The slow, manual processes are being replaced by the speed and efficiency of AI portfolio management. The benefits are clear and compelling, from better risk assessment to hyper-personalization and more.

At Appinventiv, we understand this shift. Being a leading provider of AI services and solutions, we specialize in delivering next-gen custom AI platforms for portfolio management, tailored to our clients’ needs. Our approach goes beyond basic automation. We create comprehensive AI portfolio management solutions that integrate seamlessly with existing systems. We believe the future of investing is a partnership between human creativity and AI intelligence. We’re here to help you build it.

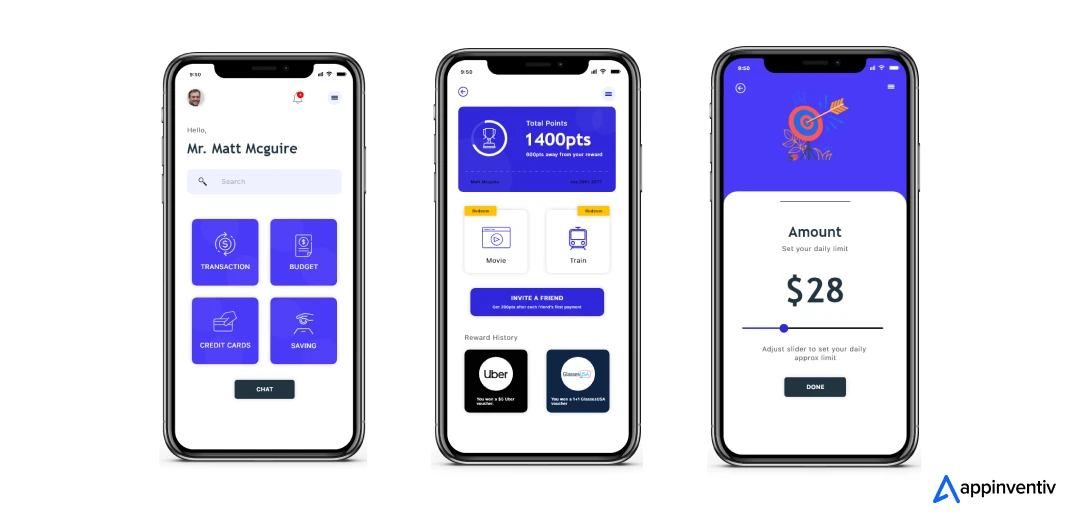

In our 10+ years of industry experience, we have delivered our 3000+ successful projects and upgraded over 500 legacy systems with the power of AI. For instance, we developed Mudra, an AI-powered budget management platform that helps users analyze spending habits, set financial goals, and get real-time recommendations. The platform showcases our competence to create AI-driven financial tools.

Whether you want to develop an automated portfolio management system or integrate AI tools for risk management into your existing setup, our team of 1600+ tech wizards is here to help.

The future of portfolio management belongs to firms that can effectively leverage AI’s power while maintaining human insight and judgment. With the right tech partner and approach, AI portfolio management can transform your investment capabilities, reduce operational costs, and deliver superior outcomes. The question isn’t whether AI will transform portfolio management; it already is. The question is whether your firm will lead this transformation or follow from behind. The time to act is now.

FAQs

Q. How do AI algorithms optimize portfolio risk?

A. AI algorithms optimize risk by analyzing tons of real-time data. They find hidden, complex relationships and risk factors that traditional models miss. They also continuously monitor the market and simulate scenarios. This allows for proactive adjustments, which is a key part of AI in risk management for portfolio management.

Q. Can AI fully replace human portfolio managers?

A. No, AI cannot fully replace human managers. While AI portfolio management is great at data and automation, human judgment, empathy, and client-specific understanding are essential. The future is a hybrid model where AI enhances human capabilities, not replaces them.

Q. How does AI help manage different types of portfolio risks?

A. AI helps by offering a complete, multi-faceted approach.

- For market risk, it uses predictive analytics to forecast trends and manage portfolios.

- For credit risk, it can analyze borrower data with more accuracy.

- For operational risk, it automates compliance and fraud detection.

- For technology risks, it monitors system vulnerabilities and performance in real-time.

- For liquidity risk, it forecasts asset demand and market depth.

- For model risk, it continuously validates and updates AI models against new data.

- For currency risk, it analyzes global economic indicators to predict exchange rate fluctuations.

- For concentration risk, it identifies and quantifies over-exposure to specific assets or sectors.

- For regulatory risk, it monitors for changes in regulations and flags non-compliant activities.

- For Black Swan risk, it runs extreme event simulations and stress tests.

- For interest rate risk, it predicts the impact of rate changes on a portfolio’s fixed-income assets.

- For systemic risk, it analyzes interdependencies across financial markets to detect potential domino effects.

This holistic strategy is a core AI benefit in portfolio management.

Q. How is AI revolutionizing project management?

A. AI is revolutionizing project management by automating tasks like scheduling and resource allocation. AI-powered tools can analyze project data to predict delays or roadblocks, so managers can act proactively. This increases efficiency and boosts project success rates.

Q. How can AI enhance portfolio management strategies?

A. AI can enhance portfolio management strategies by providing real-time data analysis, enabling predictive analytics, automating rebalancing, and integrating alternative data. This leads to more dynamic, responsive, and personalized strategies.

Q. How is AI transforming investment management?

A. AI is transforming investment management by making it more efficient, reducing costs, and enabling a new level of personalization. It’s shifting the focus from manual work to strategic thinking and client relationships, reshaping the entire industry through artificial intelligence investment management.

Q. What are some common AI techniques used in portfolio management?

A. Common techniques include machine learning for predictive modeling, natural language processing (NLP) for analyzing. The best AI tools for portfolio management depend on a firm’s needs. Some well-known examples are BlackRock’s Aladdin, robo-advisors like Betterment and Wealthfront, and backtesting platforms like QuantConnect. They offer a range of capabilities from risk analysis to automated trading.

Q. What should investors consider when choosing an AI portfolio system?

A. Investors should consider the system’s transparency, its track record, its fee structure, and how it handles risk. It’s also important to understand the level of human support available and how the system aligns with their personal goals and risk tolerance.

Q. What are the benefits of AI in portfolio management?

A. The benefits of AI in portfolio management are numerous, such as:

Smarter Risk Analysis: AI identifies hidden risks and correlations that human analysts might miss, providing a more comprehensive view of potential threats.

Superior Forecasting: It uses machine learning to predict market trends by analyzing diverse data, including news and social media sentiment.

Automated Portfolio Adjustments: AI can automatically rebalance portfolios in real-time, removing human emotion and errors.

Access to New Data: It can process unconventional data sources like satellite images and credit card transactions to uncover unique investment insights.

Personalized Investing: AI tailors investment strategies to each individual’s risk tolerance and financial goals, offering a custom approach.

Operational Efficiency: By automating routine tasks, AI saves time and money, allowing portfolio managers to focus on more value-driven tasks.

Q. What to Look for in an AI Portfolio Management System?

A. Here is a checklist for making sure you are using the best AI portfolio tools

- Data Integration: Can the system connect with your existing platforms and data sources?

- Predictive Accuracy: Does it leverage advanced analytics to improve forecasting?

- Customization: Can it adapt to your specific investment strategies and client needs?

- Automation Features: Does it support automated rebalancing, trading, and reporting?

- Compliance & Security: Is it built to meet regulatory standards and protect sensitive data?

- User Experience: Are insights presented in an intuitive, actionable format?

- Scalability: Can the system grow with your business?

Q. How can you address responsible AI and ethical considerations?

A. As AI digs deeper into portfolio management, responsible use becomes critical. This includes:

- Establishing robust governance frameworks to ensure AI systems are used ethically and transparently.

- Regularly monitoring for algorithmic bias to avoid unfair outcomes.

- Ensuring data privacy and security, especially when handling sensitive client information.

- Building explainable AI models so investment decisions can be clearly justified to clients and regulators.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Real Estate Chatbot Development: Adoption and Use Cases for Modern Property Management

Key takeaways: Generative AI could contribute $110 billion to $180 billion in value across real estate processes, including marketing, leasing, and asset management. AI chatbots can improve lead generation outcomes by responding instantly and qualifying prospects. Early adopters report faster response times and improved customer engagement across digital channels. Conversational automation is emerging as a…

AI Fraud Detection in Australia: Use Cases, Compliance Considerations, and Implementation Roadmap

Key takeaways: AI Fraud Detection in Australia is moving from static rule engines to real-time behavioural risk intelligence embedded directly into payment and identity flows. AI for financial fraud detection helps reduce false positives, accelerate response time, and protecting revenue without increasing customer friction. Australian institutions must align AI deployments with APRA CPS 234, ASIC…

Agentic RAG Implementation in Enterprises - Use Cases, Challenges, ROI

Key Highlights Agentic RAG improves decision accuracy while maintaining compliance, governance visibility, and enterprise data traceability. Enterprises deploying AI agents report strong ROI as operational efficiency and knowledge accessibility steadily improve. Hybrid retrieval plus agent reasoning enables scalable AI workflows across complex enterprise systems and datasets. Governance, observability, and security architecture determine whether enterprise AI…