- Why FinTech Software Development Has Become a Make-or-Break Decision

- Financial Software Categories: Choosing Your Battlefield

- Core Banking Systems

- Payment Processing

- Lending Platforms

- Wealth Management

- Digital Wallets

- InsurTech Platforms

- Personal Finance Management Platforms

- RegTech Platforms

- Why Smart FinTech Companies Double Down on Software Development

- Cash is Becoming a Relic

- Mobile Has Eaten Traditional Banking

- Traditional Banks Are Losing Ground Fast

- Innovation Opportunities Remain Vast

- Real-Time Financial Insights are Now Non-Negotiable

- Regulatory Compliance is Driving Tech Investment

- API Ecosystems are Unlocking New Business Models

- Speed to Market is Now a Survival Metric

- Key Features Every FinTech Software Must Have

- Advanced Features for Cutting-edge FinTech Solutions

- From Discovery to Deployment: The End-to-End Financial Software Development Process

- 1. Discovery and Requirement Gathering

- 2. Planning and Prototyping

- 3. Software Architecture and Design

- 4. Development and Coding

- 5. Testing and Quality Assurance

- 6. Deployment and Integration

- 7. Post-Launch Support and Maintenance

- How Much Does it Cost to Build Financial Software?

- FinTech Regulations That Businesses Must Comply With

- 1. GDPR

- 2. KYC

- 3. FTC

- 4. PCI DSS compliance

- 5. EFTA

- Custom Financial Software Development Challenges Businesses Must Prepare For

- Finding a Gap

- Planning Out the Features

- Software Security

- Following Compliances

- Leveraging Next-Gen Technologies

- Things to Consider Before Hiring a Financial Software Application Development Company

- Expertise

- Understanding of Compliances

- Price Quote and Delivery Timeline

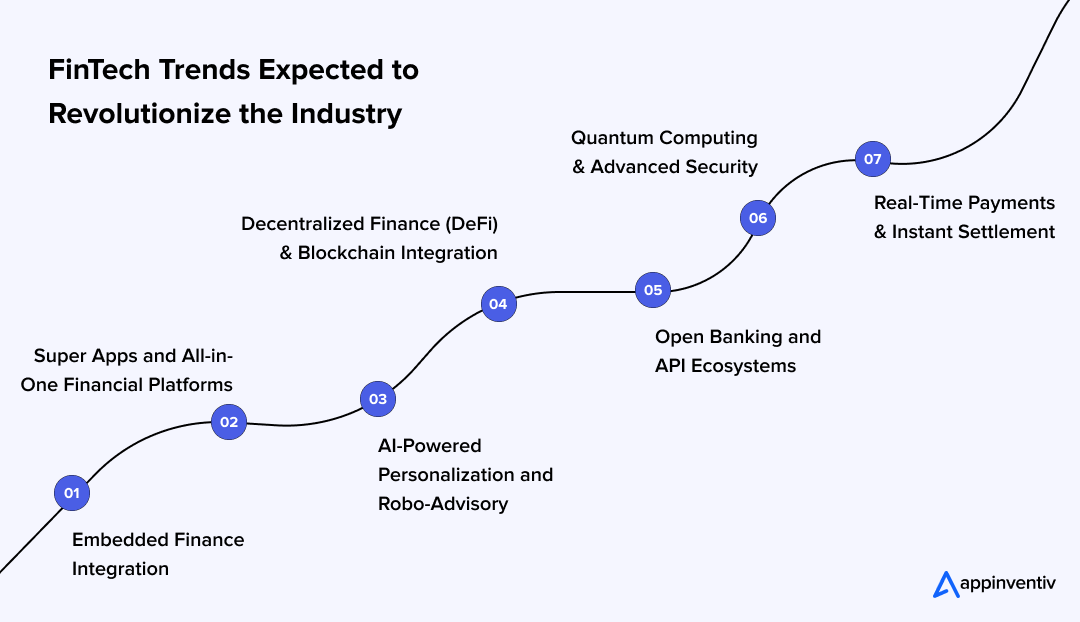

- FinTech Trends Driving the Next Wave of Financial Innovation

- Embedded Finance Integration

- Super Apps and All-in-One Financial Platforms

- AI-Powered Personalization and Robo-Advisory

- Decentralized Finance (DeFi) and Blockchain Integration

- Open Banking and API Ecosystems

- Quantum Computing and Advanced Security

- Real-Time Payments and Instant Settlement

- How Appinventiv Helped a Leading Global Bank Improve Its Customer Retention by 20%

- Why Appinventiv is the Go-To Partner for FinTech Software Development

- FAQs

Key Takeaways:

What You’ll Learn:

- Why custom financial software is critical for FinTech companies looking to scale, stay compliant, and win customer trust.

- The major categories of financial software and how to choose the right one.

- The essential and advanced features that can future-proof your financial software

- The step-by-step process for building financial software, from discovery and prototyping to post-launch maintenance.

- The real development costs of building FinTech software and how factors like complexity, features, and compliance impact your budget.

Stats That Matter:

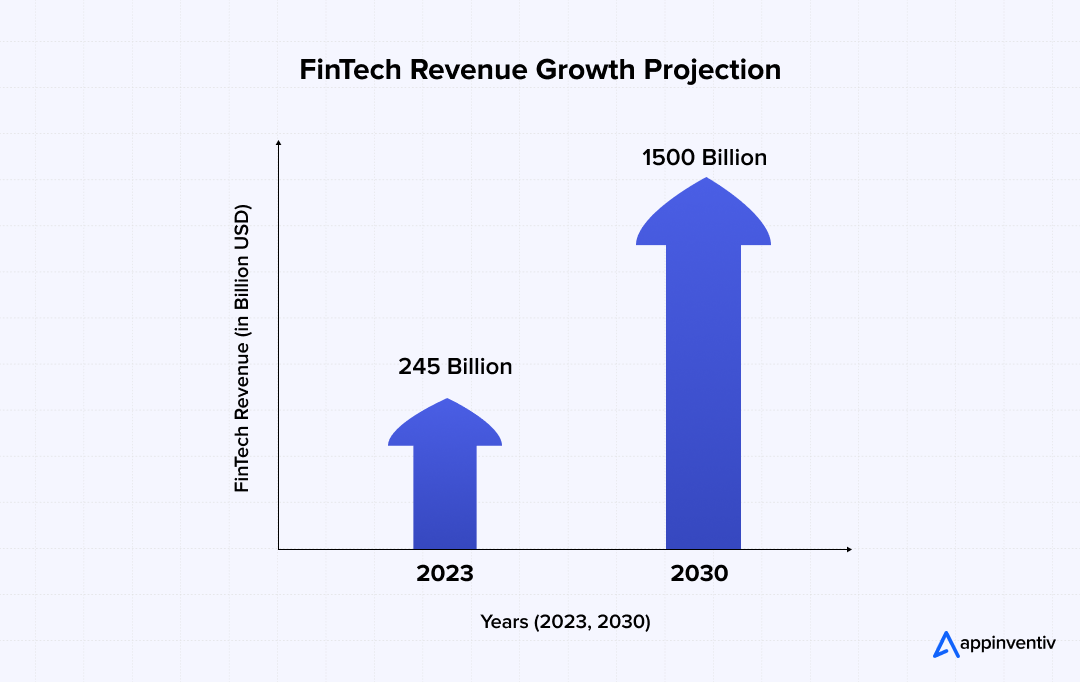

- FinTech revenue is expected to hit $1.5 trillion by 2030 (BCG).

- Digital banking users are projected to reach 80 million by 2028 (Statista).

- By 2026, 90% of finance functions will deploy at least one AI-enabled solution (Gartner).

- The cost of building financial software ranges from $30,000 to $500,000+, depending on app type, complexity, and compliance requirements.

Real Client Outcome:

- Mudra: Appinventiv built an AI-powered budgeting platform for millennials, successfully launched in 12+ countries, transforming personal finance management.

- Leading European Bank: Our smart AI banking solution helped the client achieve a 20% increase in customer retention and a 35% reduction in manual processes.

- EdFundo: Appinventiv developed the world’s first child-focused financial intelligence platform, enabling the startup to secure $500K in pre-seed funding and win the FinTech Startup of the Year award.

Want similar results? → Request a Custom Quote

Remember when you first started your FinTech company? You probably had this vision of revolutionizing how people handle money. Fast forward to today, and you might be dealing with software that crashes during peak hours, customers complaining about slow transfers, and security vulnerabilities that keep you awake at night.

The truth is, this is where many FinTech journeys start to fall apart. Ambitious founders with great ideas get derailed because their financial software development strategy wasn’t built for scale. Meanwhile, their competitors are pulling ahead with systems that actually work when it matters most.

So, what separates the winners from the also-rans? They figured out early that financial services software development isn’t just about writing code. It’s about building a foundation that can handle explosive growth while keeping customers happy and regulators satisfied.

You’ve probably noticed how companies like Stripe, Square, and Revolut seem to make it look easy. Their secret isn’t some magical algorithm – it’s investing in custom financial software that’s designed specifically for their business model and customer base.

This guide breaks down everything you need to understand about custom financial software development. We’ll dig into the real challenges of fintech software development, explore what makes some software successful while others fail, and show you exactly how emerging technologies like AI, IoT and more can give your business a competitive edge.

Whether you’re dealing with banking & financial software development headaches or planning your next software development for financial services project, this roadmap will help you make smarter decisions and avoid the expensive mistakes that derail so many promising businesses.

Whether you’re creating new software or modernizing the systems you already have, we can help you craft powerful, secure, and scalable financial platforms built for tomorrow’s growth.

Why FinTech Software Development Has Become a Make-or-Break Decision

The financial services landscape has changed dramatically over the past five years. What worked in 2019 feels ancient today. Customers who once tolerated slow banking processes now expect everything to happen instantly.

According to a BCG report, FinTech revenue is expected to reach $1.5 trillion by 2030. That’s not just growth – that’s a complete reshaping of how money moves around the world. All this because of advancements in technology that have revolutionized financial systems, driving efficiency, security, and accessibility at an unprecedented pace. From AI and blockchain to real-time payments and open banking, these innovations have redefined how financial services are delivered, meeting the ever-growing expectations of today’s digital-first consumers.

As per Statista, the number of digital banking users is expected to reach 80 million by 2028. This shows just how much people are shifting towards using online banking services for managing their finances. With everything going digital, more and more people are choosing the convenience of managing their bank accounts, making transactions, and getting financial services all from their smartphones and computers. This growth highlights the huge shift towards digital banking and the increasing demand for easy, accessible financial services.

Now, according to Gartner, Inc., by 2026, 90% of finance functions will deploy at least one AI-enabled technology solution. This highlights the growing importance of AI in FinTech as it transforms how financial services are delivered. AI is increasingly being used to enhance decision-making, streamline processes, and improve customer experiences.

Simply put, the message for FinTech leaders is brutally clear: custom fintech software development isn’t a nice-to-have anymore. It’s survival. The companies thriving in today’s market invested heavily in financial software development solutions designed for their specific challenges and customer needs.

Financial Software Categories: Choosing Your Battlefield

Every successful FinTech company started by mastering one specific type of financial software application development before expanding into other areas. Trying to build everything at once is a recipe for mediocrity. Let us help you understand the types of financial software you can develop for your business.

Core Banking Systems

Core banking systems are the backbone of financial institutions, handling account management, transaction processing, and record maintenance with zero room for error. These types of financial software development solutions require expertise in database architecture, real-time processing, and fault tolerance to manage millions of daily transactions while maintaining perfect accuracy. Modern implementations leverage cloud-based infrastructure for automatic scaling, though this demands deep technical knowledge in distributed systems.

Payment Processing

Payment systems are where FinTech companies often make their mark, moving money securely across complex networks of gateways, currencies, and regulatory frameworks. Custom financial software development for payments demands PCI-DSS compliance, advanced fraud detection using machine learning, and seamless integration with dozens of payment methods and international regulations. The technical challenge lies in identifying suspicious transactions in real-time without disrupting legitimate customers.

Lending Platforms

Lending platforms revolutionize traditional credit decisions by using AI and automation to analyze hundreds of data points in seconds, from credit scores to smartphone usage patterns. Financial software application development for lending requires balancing automated decision-making with human oversight for complex cases, while ensuring compliance with varying regulatory requirements across jurisdictions. The software must handle different disclosure requirements, interest rate restrictions, and consumer protection laws efficiently.

[Also Read: How Much Does Loan Lending App Development Cost?]

Wealth Management

Wealth management platforms serve sophisticated investors with real-time market data, advanced analytics, and automated trading capabilities that demand the highest technical standards in fintech software development. These systems must process massive data feeds from multiple exchanges with ultra-low latency while running complex algorithms for robo-advisors and automated trading. The challenge is balancing sophisticated functionality for professional traders with user-friendly interfaces for retail investors.

[Also Read: FinTech in Wealth Management – The Forefront of Financial Transformation]

Digital Wallets

Digital wallets have become a preferred payment method for millions of users, offering fast, contactless transactions across mobile apps, websites, and in-store checkouts. Developing custom financial software for digital wallets requires seamless integration with various payment gateways, QR code systems, and regulatory frameworks like PCI-DSS and AML compliance. The software must deliver airtight security with encryption, tokenization, and biometric authentication while maintaining ultra-fast transaction speeds.

InsurTech Platforms

Insurance-focused financial apps or software simplifies complex underwriting, claims processing, and policy management, delivering faster turnaround and more personalized products. Financial software development for InsurTech must integrate AI-driven risk assessment, document automation, and fraud detection while meeting strict regulatory standards for customer data protection.

Personal Finance Management Platforms

Personal finance management platforms empower individuals to track expenses, manage budgets, automate savings, and gain insights into their financial health. Developing these software demands real-time bank integrations via open banking APIs, intelligent categorization of spending, and user-centric dashboards that simplify complex financial data.

RegTech Platforms

RegTech (Regulatory Technology) solutions are built to automate regulatory reporting, real-time transaction monitoring, and risk management. This type of financial software requires complex rule engines, advanced audit trails, and API-based integrations with banking, trading, and lending systems to stay in sync with ever-evolving regulations.

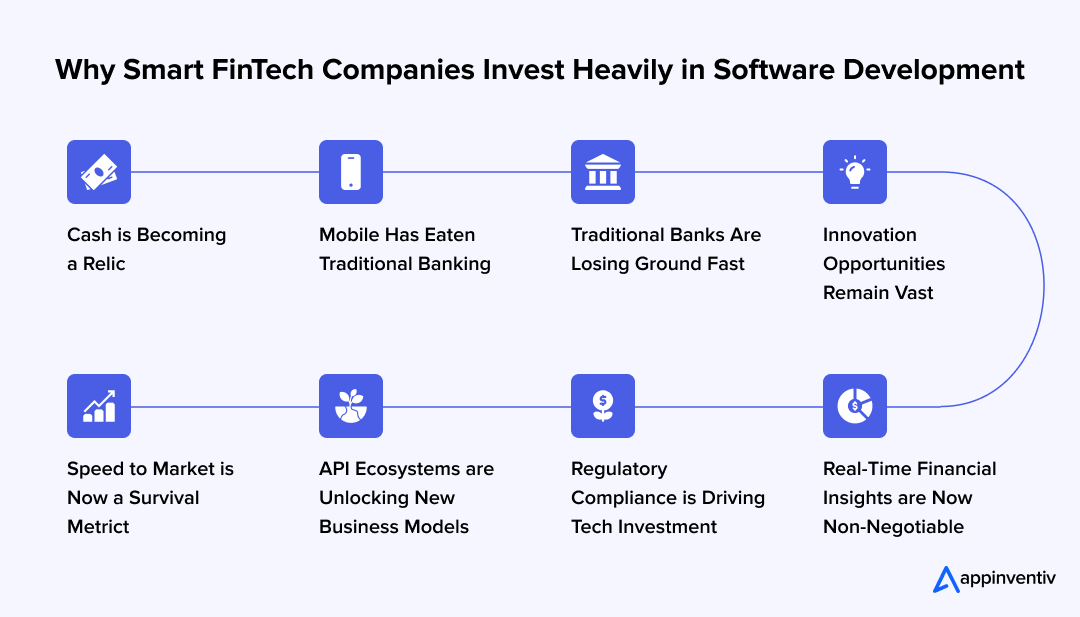

Why Smart FinTech Companies Double Down on Software Development

The business case for investing in financial software development solutions goes beyond keeping up with technology trends. Specific market forces are driving this investment, and understanding them explains why some FinTech companies thrive while others struggle.

Cash is Becoming a Relic

The shift from physical cash to digital payments creates compelling investment opportunities for financial software solutions, with mobile payments experiencing consistent double-digit growth and pandemic-driven adoption accelerating consumer behavior by years rather than months. Companies investing in banking & financial software development can capture significant market share from this migration, particularly as contactless payments transition from optional convenience to customer expectation.

Real Example: PayPal has capitalized on this shift by continuously enhancing its digital payment infrastructure, enabling seamless peer-to-peer, in-store, and international transactions across millions of users globally.

Mobile Has Eaten Traditional Banking

Mobile banking applications have fundamentally shifted from supplementary services to primary customer touchpoints, making investment in custom financial software development essential for market relevance and customer retention. Companies that master financial application development—including touch interfaces, biometric authentication, offline functionality, and cross-platform compatibility—control customer relationships and transaction flows, while those lacking these capabilities face declining market share.

Real Example: Chime, a leading digital bank in the U.S., has grown rapidly by focusing on a mobile-first experience with real-time notifications, biometric security, and fee-free banking, becoming a preferred choice for mobile-centric users.

Traditional Banks Are Losing Ground Fast

Market dynamics favor investment in custom fintech software development as traditional banks lose customers to solutions offering superior user experiences, transparent pricing, and streamlined access to financial services. Newer companies benefit from regulatory frameworks that increasingly support innovation while legacy institutions struggle with outdated systems and compliance burdens, creating market entry opportunities that were previously impossible.

Real Example: Revolut has emerged as a strong challenger to traditional banks by offering transparent multi-currency accounts, real-time spending analytics, and cryptocurrency trading through an agile, cloud-based infrastructure

Innovation Opportunities Remain Vast

The FinTech sector’s relative youth presents substantial opportunities for Fintech software development that addresses inefficiencies in traditional financial processes, creating competitive advantages for companies that identify and solve specific market pain points.

Business lending represents another high-value opportunity where AI in financial software development enables faster credit decisions using alternative data sources, while international remittances constitute a massive addressable market where financial services software development solutions can capture transaction volume through improved speed, cost efficiency, and user experience compared to traditional wire transfer systems.

Budget management software is also emerging as a key growth area, empowering individuals and businesses to plan, track, and optimize their finances in real-time. With rising demand for personal finance apps, this space offers opportunities to create highly personalized, AI-driven tools that help users build better financial habits and achieve long-term financial goals.

Real Example: Appinventiv created Mudra, an AI-driven budget management platform that helps millennials effortlessly plan, manage, and monitor their budgets in real time. By providing intelligent financial insights and spending controls, Mudra has transformed the way young users approach personal finance. The solution has already been launched across 12+ countries, making it a trusted financial companion for the millennial generation.

Real-Time Financial Insights are Now Non-Negotiable

Customers today expect immediate access to their financial data, from transaction alerts to investment performance updates. Financial software development that prioritizes real-time processing and live data synchronization gives FinTech companies a competitive edge in both customer satisfaction and operational efficiency.

Real Example: Robinhood built its reputation by offering commission-free trades with real-time market data and instant balance updates, capturing millions of millennial and Gen Z investors.

[Also Read: How Much Does Robinhood Like Trading App Development Costs?]

Regulatory Compliance is Driving Tech Investment

As financial regulations evolve rapidly, companies need financial software that can automate compliance reporting, transaction monitoring, and fraud detection. Businesses that proactively invest in RegTech solutions reduce risk, speed up onboarding, and avoid costly penalties.

Real Example: Wise uses automated KYC, AML screening, and real-time transaction monitoring to maintain regulatory compliance across 80+ countries while offering low-cost international transfers.

API Ecosystems are Unlocking New Business Models

Open banking APIs and third-party integrations are enabling financial companies to rapidly expand their services and collaborate across industries. Companies that invest in modular, API-first software architectures can easily plug into new markets and distribution channels.

Real Example: Plaid built its FinTech dominance by offering API-based financial data aggregation, enabling apps like Venmo, Robinhood, and Coinbase to securely connect with users’ bank accounts.

Speed to Market is Now a Survival Metric

In today’s fast-paced FinTech environment, businesses that can develop, test, and deploy new features quickly are the ones that capture market share. Companies that invest in agile financial software development and DevOps-driven CI/CD pipelines can innovate faster and respond to market shifts in real-time.

Real Example: Block consistently delivers rapid feature rollouts like contactless payments and cryptocurrency integration, maintaining its lead by leveraging fast, modular software development practices.

Key Features Every FinTech Software Must Have

The process of software development for finance businesses must be backed by the integration of key features to ensure security, usability, and reliability. These features set the foundation for a smooth, scalable operation. Let us look at them below:

| Feature | Description |

|---|---|

| Security Features | Encryption, two-factor authentication (2FA), and biometric authentication protect user data and ensure compliance with regulations like PCI-DSS and GDPR. |

| User Authentication and Authorization | Multi-factor authentication (MFA) and role-based access control (RBAC) secure sensitive information and meet KYC and AML requirements. |

| Data Privacy and Compliance Tools | Tools for GDPR and CCPA compliance, audit trails, and data masking ensure financial software meets privacy regulations. |

| Real-time Processing | Instant transaction updates and live reporting give users real-time data, improving decision-making and customer experience. |

| Integration Capabilities | API support and webhooks enable seamless integration with payment gateways, banking systems, and third-party services, allowing scalability. |

| Customization and Scalability | Customizable workflows and scalable architecture ensure the software grows with the business, adapting to new features and increased demand. |

| User Experience (UX) Design | An intuitive, user-friendly design ensures easy navigation and improves customer satisfaction, crucial for digital banking and payment platforms. |

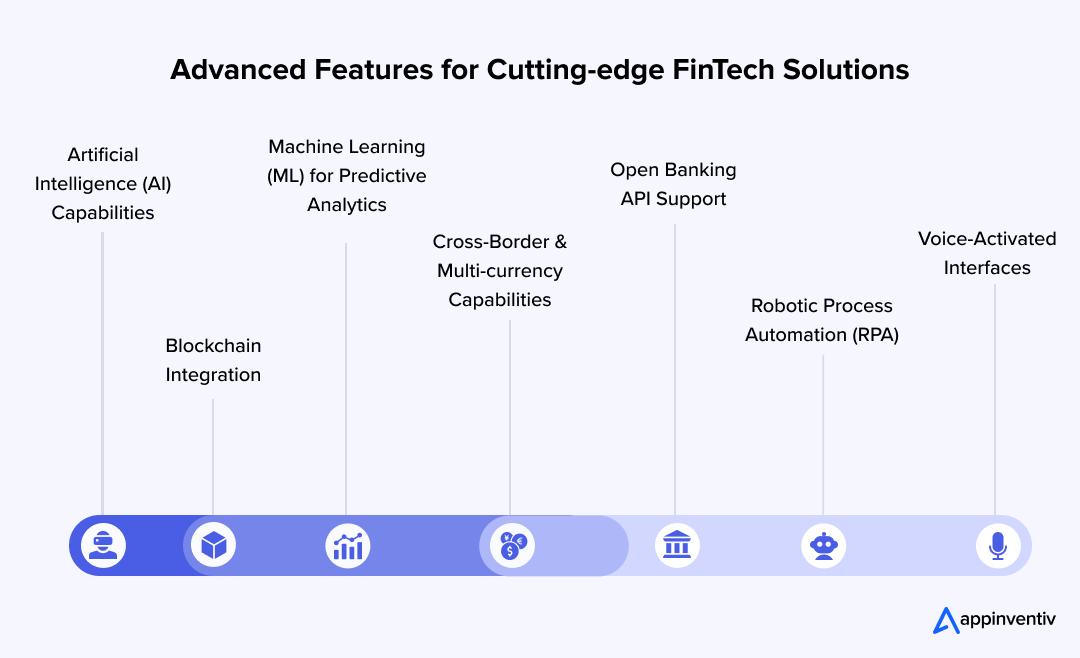

Advanced Features for Cutting-edge FinTech Solutions

These advanced features are designed to enhance the functionality and user experience of financial software, enabling businesses to stay ahead of the competition. Here are some of the advanced features of financial software systems:

Artificial Intelligence (AI) Capabilities

AI automates tasks like fraud detection and customer service, improving security and efficiency. It also allows businesses to offer personalized experiences, reducing costs and enhancing customer engagement.

In financial software, AI can also streamline loan approvals, automate investment advice, and detect transaction anomalies in real-time. Its ability to learn from large datasets helps continuously refine system accuracy and customer targeting.

Machine Learning (ML) for Predictive Analytics

ML enables businesses to predict customer behavior, identify risks, and optimize decision-making. Users benefit from personalized recommendations and more accurate financial insights.

In FinTech, ML models can analyze historical spending, credit patterns, and external data points to anticipate defaults, upsell opportunities, and emerging fraud schemes. The predictive power of ML helps businesses respond proactively rather than reactively.

Blockchain Integration

Blockchain technology in Fintech software ensures secure, transparent transactions and smart contracts, reducing fraud and enhancing trust. It streamlines processes and improves data integrity for both businesses and users.

Beyond crypto payments, blockchain can improve KYC compliance, facilitate decentralized lending, and enhance transaction traceability across multi-party financial ecosystems. Its immutable ledger can significantly reduce reconciliation time and operational disputes.

Open Banking API Support

Open Banking APIs allow third-party developers to securely access financial data, creating new services like personalized advice and alternative lending, which benefit users with more tailored options.

These APIs enable faster customer onboarding, real-time payment initiation, and richer financial dashboards by aggregating multiple bank accounts in one view. Open banking fosters collaboration between banks and FinTechs, driving continuous innovation.

Cross-Border and Multi-currency Capabilities

These features enable seamless global transactions and multi-currency support, making it easier for businesses to expand internationally and for users to manage finances across borders.

They help businesses offer competitive foreign exchange rates, real-time currency conversion, and transparent international transfers. This also simplifies compliance with regional payment regulations and reduces the operational complexities of multi-market expansion.

Robotic Process Automation (RPA)

RPA automates repetitive tasks like data entry and document processing, improving efficiency and reducing errors. Users experience faster service, while businesses save time and money.

RPA in finance can also automate KYC checks, credit report generation, reconciliation processes, and regulatory filings with minimal human intervention. This allows financial teams to focus on strategic work while reducing operational bottlenecks.

Voice-Activated Interfaces

Voice technology allows users to interact with financial software using voice commands, offering convenience and accessibility while enhancing engagement for businesses.

Voice interfaces can support balance checks, transaction summaries, bill payments, and customer service queries with simple verbal instructions. This feature significantly improves accessibility for visually impaired users and is gaining traction in mobile-first FinTech apps.

From Discovery to Deployment: The End-to-End Financial Software Development Process

Building financial software solutions isn’t like creating a typical business app. It requires a completely different mindset. Every line of code needs to be bulletproof and every integration point becomes a potential security vulnerability. Here’s how successful companies actually build financial software that works in the real world:

1. Discovery and Requirement Gathering

This critical phase involves deeply understanding user needs rather than assumptions, consuming at least 20% of the project timeline in financial services software development. Teams must interview actual users, analyze competitor failures, and map every edge case while uncovering hidden regulatory requirements that fundamentally shape system architecture. Technology stack decisions made here determine long-term scalability, making this phase essential for avoiding costly rewrites later.

2. Planning and Prototyping

Financial software development planning goes beyond typical applications by incorporating mandatory security audits, penetration testing, compliance reviews, and banking partner integration testing that can each take weeks or months.

Project plans must account for the unique complexities of handling real money, while prototyping becomes crucial since changing core functionality after development costs 10x more in financial software than other industries. UI/UX designs must work for stressed customers dealing with money problems, not just impress in design reviews.

3. Software Architecture and Design

This foundation-building phase separates scalable financial software solutions from those that collapse under technical debt by prioritizing security and reliability over development speed. Architecture decisions must handle worst-case scenarios like Black Friday shopping volumes, with cloud infrastructure planning focused on uptime when customers need money most rather than just cost optimization.

Real-time processing, API integrations, and data storage solutions require security protocols baked into every system layer since retrofitting security later proves expensive and ineffective.

Modern financial software increasingly adopts microservices architecture, where independent, modular services handle specific business functions like payments, user authentication, or fraud detection.

This design enhances fault isolation, scalability, and faster deployment cycles. Some FinTechs also leverage serverless architectures for event-driven processes like transaction alerts, which optimize resource utilization and reduce latency.

A typical FinTech tech stack might include AWS or Google Cloud for infrastructure, Node.js or Java for backend services, PostgreSQL or MongoDB for databases, and API gateways for seamless third-party integrations. Designing with these architectural choices in mind helps ensure long-term system resilience, agility, and security.

4. Development and Coding

The coding phase in financial software development moves intentionally slower than typical projects because every feature must handle edge cases unique to money-handling applications. Development teams must master payment gateway integrations across dozens of API standards, build user authentication systems balancing security with usability, and create transaction management systems maintaining perfect accuracy while processing millions of simultaneous operations.

Agile development works but requires sprints accounting for additional testing, security reviews, and compliance checks that financial software demands.

5. Testing and Quality Assurance

Financial software solutions require QA processes that go far beyond normal testing by validating money movement accuracy under every possible condition. QA engineers must think like hackers, regulators, and stressed customers simultaneously, conducting functional testing for normal flows plus chaos engineering for external service failures.

Security audits by external firms are mandatory for serious fintech software development projects, often finding vulnerabilities internal teams miss, while performance testing must simulate specific usage spikes during market crashes or viral events.

6. Deployment and Integration

Deploying financial software carries unique stakes since real money is involved from day one, with integration testing often revealing problems invisible in development environments. API integrations with financial institutions require extensive certification processes taking months, while cloud deployment strategies need failover plans, rollback procedures, and monitoring systems detecting problems before customers notice.

The integration phase typically exceeds timelines because financial institutions move slowly with their own security requirements that must be accommodated.

7. Post-Launch Support and Maintenance

Financial services software development continues intensively after launch since financial regulations change constantly, security threats evolve daily, and customer expectations keep rising. Ongoing support means maintaining 99.99% uptime during business hours with procedures for handling security incidents at any hour, while regular updates address new fraud techniques and compliance requirements beyond just feature additions.

Bug fixes require more careful testing than other industries since minor changes can affect money movement, and performance optimization becomes critical as transaction volumes grow from thousands to millions of users.

Off-the-shelf tools can’t fuel exponential growth — but custom-built software can. From core banking platforms to next-gen payment systems, we design every line of code around your unique business model.

How Much Does it Cost to Build Financial Software?

The financial software development cost can range anywhere from $30,000 to $500,000. However, there’s no one-size-fits-all answer because the price depends on several factors. Some of the key elements that influence the cost include the complexity of the software, the features you need, the technology stack, the size of your development team, and the timeline for delivery. Additionally, customization, security features, and compliance with financial regulations can also add to the overall cost.

To give you a clearer picture, here’s a simple formula for estimating the financial software development cost:

Cost = (Development Complexity) + (Features) + (Technology Stack) + (Team Size) + (Compliance Requirements)

- Development Complexity: More complex systems, like real-time payment processing or AI-powered fraud detection, will cost more.

- Features: The number of features you require (like multi-currency support, mobile app integration, or automated reporting) impacts the overall cost.

- Technology Stack: The choice of technologies used for development, including the backend (e.g., cloud infrastructure) and frontend (e.g., React, Angular), will influence the cost.

- Team Size: A larger development team or a team with specialized skills (e.g., blockchain developers or AI experts) can increase the price.

- Compliance Requirements: Meeting the financial industry’s strict regulatory standards (GDPR, PCI-DSS) may require additional features and development time.

Typically, in our experience, the type of application and their subsequent pricing looks something like this –

| Type of Application | Cost of the Application | Reference Application |

|---|---|---|

| Banking app | $50,000 to $300,000 | Monzo |

| Investment app | $55,000 – $65,000 | Acorns |

| Consumer finance | $70,000 – $90,000 | Finch |

| Insurance app | $50,000 and $700,000 | Lumi |

| Lending app | $80,000 – $100,000 | ZestFinance |

| Financial Risk Management | $80,000 – $200,000 | SAS Risk Management |

For more insights into how the budget varies, you can check out our complete guide on- Cost to Build a FinTech App.

FinTech Regulations That Businesses Must Comply With

Irrespective of how expansive or expensive FinTech regulations get, they are necessary for the success of a FinTech application. In addition to helping you avoid hefty fines, compliance adherence helps build trust with users as they interact with your software.

Let’s have a look at the FinTech compliances that you need to address.

1. GDPR

It is one of the EU’s most commonly followed data protection regulations. It dictates how businesses gather, process, and store data of EU users. The fine for not complying with the GDPR rule can go as high as €20 million. Similar regulations like Consumer Data Rights (CDR) and the California Consumer Privacy Act (CCPA) work along the lines of GDPR and should be followed by every FinTech brand.

2. KYC

Know Your Customer is a regulatory requirement every financial firm should adhere to. On the ground level, every financial service provider and bank obliges with it, meaning your business would also need to. KYC aims to verify a user’s identity and risk profile, ensuring minimum instances of money laundering and fraud. Many businesses also use a credit monitoring service to track financial activities associated with clients, further helping to detect and prevent suspicious transactions.

3. FTC

In the US alone, there are multiple compliances that you will have to follow. However, one that you’re most likely to come across is the Federal Trade Commission. For the FinTech domain, there are two of its most relevant regulations – the Gramm-Leach-Bliley Act (GLBA) and the Fair Credit Reporting Act (FCRA).

The GLBA is a regulation that calls for financial software development services institutions to protect customer data and be transparent on how it gets processed. While on the other hand, the Fair Credit Reporting Act (FCRA) covers consumer credit information. This will apply to you if the FinTech app deals with lending or works around processing a user’s credit scores.

4. PCI DSS compliance

PCI DSS is a regulation that governs credit card payments. It ensures that the transactions are processed securely. The standard highlights six areas businesses need when preparing their platform to meet PCI DSS compliance. The non-compliance fees can be between $5,000 to $100,000 to be paid every month.

5. EFTA

The Electronic Fund Transfer Act is governed by the Consumer Financial Protection Bureau, which looks after electronic money transfers via ATMs, POS terminals, and debit cards. This compliance aims to protect users in case of transaction errors like funds getting transferred to the wrong account.

Custom Financial Software Development Challenges Businesses Must Prepare For

A crucial part of establishing a FinTech business empire is to foresee the challenges that it can face and prepare for them. It is how you make your FinTech platform future-ready.

Let’s look into the custom Fintech software development challenges below:.

Finding a Gap

Best product ideas are those which address a problem that the masses are facing. Regarding FinTech, it can get overwhelming to identify which sub-sector to bring under the microscope. At Appinventiv, we advise our clients to look into the most revenue-friendly segments of the industry and enter that. In this case, it would be either digital payment or the second most profitable – personal finance.

Once you have finalized the sector, the second step would be to do market research and identify the blind spots you can explore as a prospective business idea.

Planning Out the Features

As an entrepreneur, you may have a clear vision of the problems you want to solve with your software. However, determining the MVP features that will test the market and make your software stand out from the competition can be daunting. That’s where expert help comes in. With the guidance of professionals, you can ensure that your software has the necessary features to succeed.

Typically, as a leading fintech consulting services provider, an approach we follow when deciding the MVP features is listing the market problem areas and the proposed solutions. From there, we do reverse engineering on preparing the features list.

Typically, an approach we follow when deciding the MVP features is listing the market problem areas and the proposed solutions. From there, we do reverse engineering on preparing the features list.

Software Security

There are ‘N’ number of vulnerabilities that can occur in an application. Making the app hack-proof becomes critical for a sector that deals directly with money and sensitive data. The only solution to this lies in working with a team that follows a security-first development approach; they will not just follow the best practice during development but will also make you a data governance framework to follow as an in-house standard measure.

Following Compliances

There are hundreds of compliances across the world. Finding the ones that you need to address is crucial. Additionally, you must make your app work and features to meet compliance regulations– which can be challenging for uninformed entrepreneurs and developers.

Leveraging Next-Gen Technologies

Adding technologies like Blockchain, IoT, AI, etc., is exciting for any future-forward FinTech business. But the actual incorporation of these technologies is what becomes challenging. After all, you cannot call yourself an AI-powered FinTech firm because you have an AI chatbot. True integration of technologies in any software requires subject matter expertise that only a few in-house developers carry.

Things to Consider Before Hiring a Financial Software Application Development Company

Your success as an entrepreneur depends heavily on the financial software development solutions provider you partner with. The quality of the app and the scale of market readiness it is engineered on will be directly proportionate to the experience of the FinTech development partners.

Here are a few things you can keep in consideration when hiring a FinTech software development company –

Expertise

The first thing you should check when hiring a financial software development agency is their expertise in the model you want to enter. The more aligned they are with your business model, the more they will know the limitations and strengths of entering the space digitally. A validation of this can be gathered from their past works’ reviews, case studies, and testimonials.

Understanding of Compliances

In a data-heavy sector like FinTech, it is critical that financial software consultants should know the compliances inside out. They should know how to build features, run integrations, and design specific to the compliance requirements.

Price Quote and Delivery Timeline

In the search, there will come a time when choosing the right financial industry software development firm would come down to the price they are quoting and the delivery timeline. While it might seem lucrative to go with the agency that is quoting the lowest price and the fastest delivery timeline, tread cautiously and go with a payment gateway software development company that promises quality.

FinTech Trends Driving the Next Wave of Financial Innovation

The FinTech landscape changes faster than most people can keep up with, and what seemed cutting-edge last year might already be yesterday’s news. I’ve been tracking these developments for years, and honestly, some of the shifts happening right now will completely reshape how financial services software development works over the next decade.

Embedded Finance Integration

Embedded finance is turning every software into a potential bank, allowing non-financial companies to offer financial software applications directly within their platforms. Companies like Uber, Shopify, and Amazon now provide lending, payments, and insurance without customers ever leaving their ecosystem. This trend requires sophisticated custom financial software development that can seamlessly integrate banking services into existing user experiences. The technical complexity is enormous, but the market opportunity is even bigger.

Super Apps and All-in-One Financial Platforms

Asian markets proved that customers want everything in one place, and Western fintech software development is finally catching up with super app concepts. These platforms combine banking, investing, shopping, messaging, and lifestyle services into single applications that customers use dozens of times daily.

Building super apps requires robust financial software architecture that can handle massive scale while maintaining security across multiple integrated services. The engineering challenges are significant, but user engagement rates make the investment worthwhile.

AI-Powered Personalization and Robo-Advisory

AI in financial software development has moved beyond chatbots to create truly personalized financial experiences that adapt to individual user behavior in real-time. Modern robo-advisors analyze spending patterns, market conditions, and life events to provide investment advice that rivals human financial planners.

The custom fintech software development required for these systems involves complex machine learning models that process thousands of data points per user. Smart FinTech companies are using AI to create competitive moats that traditional financial institutions struggle to replicate.

Decentralized Finance (DeFi) and Blockchain Integration

DeFi protocols are creating entirely new categories of financial application development that operate without traditional banking intermediaries. Smart contracts now handle everything from lending and borrowing to complex derivatives trading with minimal human oversight.

Banking & financial software development teams are racing to integrate blockchain capabilities that can interact with both traditional banking systems and DeFi protocols. The regulatory landscape remains uncertain, but the technical possibilities are expanding rapidly.

[Also Read: Decentralized Finance (DeFi) – A business guide to understanding benefits, applications and risks]

Open Banking and API Ecosystems

Open banking regulations forced traditional banks to expose their data through APIs, creating massive opportunities for innovative software development for financial services. Third-party developers can now build software that aggregate account data, initiate payments, and provide financial insights using real banking information.

This trend requires expertise in API integration, data normalization, and security protocols. Companies that master open banking integration gain access to customer data that was previously locked away in banking silos.

Quantum Computing and Advanced Security

Quantum computing threatens to make current encryption methods obsolete while simultaneously offering new possibilities for financial software developer teams working on security challenges.

Financial institutions are investing heavily in quantum-resistant encryption and exploring quantum algorithms for portfolio optimization and risk modeling. Finance software development projects now need to consider quantum threats in their long-term security planning. The timeline for practical quantum computers remains uncertain, but the security implications are already driving architectural decisions.

Real-Time Payments and Instant Settlement

Customer expectations for instant money movement are driving massive infrastructure investments in real-time payment systems across global markets. Financial software applications must now handle payment processing that settles in seconds rather than days while maintaining perfect accuracy and regulatory compliance.

The technical complexity of building systems that can process millions of transactions instantly while coordinating with multiple banking networks presents significant software development for fintech challenges. Companies that solve real-time payment processing gain substantial competitive advantages in customer satisfaction and operational efficiency.

To get more insights into the last trends, check out our blog on the – 20 Top FinTech Trends to Look Out For in 2025 & Beyond.

How Appinventiv Helped a Leading Global Bank Improve Its Customer Retention by 20%

Our experts recently partnered with a leading European bank to help modernize their customer experience and banking operations using AI-powered FinTech software. The bank, operating across several countries and in seven languages, wanted to automate complex processes, reduce customer churn, and unlock the true potential of its extensive transactional data.

To enhance customer support, we introduced a multi-lingual AI chatbot across the bank’s web and mobile platforms. The chatbot now seamlessly handles over 50% of customer service requests, including critical actions like reporting stolen credit cards, significantly improving response times and reducing manpower costs.

To tackle the rising churn in the home loan portfolio, we enabled intelligent customer scoring that highlights users most likely to leave, along with the key reasons behind their dissatisfaction. This allowed the bank’s teams to make timely, personalized interventions and ultimately improve customer retention by 20%.

Additionally, we streamlined ATM cash management using machine learning to analyze over 10 million data points, optimizing cash levels across locations. The bank saw a 92% improvement in ATM service levels, a 35% reduction in manual processes, and faster, more data-driven decision-making across its operations.

Why Appinventiv is the Go-To Partner for FinTech Software Development

Building a FinTech product that actually works isn’t something you want to gamble on. We have seen too many promising startups burn through millions because they picked the wrong development partner or tried to cut corners on custom financial software development. The financial services industry doesn’t forgive mistakes, and one security breach or compliance violation can kill your business overnight.

That’s exactly why FinTech founders and decision makers choose Appinventiv when they’re serious about building something that lasts. We’ve been in the trenches with dozens of financial companies, from startups to established enterprises, and we know what separates successful financial software development solutions from expensive failures.

When you’re dealing with payment systems, banking platforms, or lending solutions, you need a team that understands the real-world challenges beyond just writing code. Our FinTech software developers have built systems that process millions of transactions daily without hiccups. They’ve navigated the nightmare maze of banking & financial software development compliance requirements. Most importantly, they’ve learned from the mistakes that sink other projects.

We are a team of 1600+ experts, ISO-certified, and proud Deloitte Technology Fast 50 India Winners in 2023 and 2024. We’ve also been recognized with the Global Spring Award 2024, the Spring 2025 Clutch Award for Elite Chatbot and Android Apps, and we were ranked among the Top 100 Fastest-Growing Companies 2025.

Here’s what makes working with us different: we don’t just implement your requirements and walk away. Our financial software developer experts become invested in your success because we know that fintech software development is a marathon, not a sprint.

Every custom fintech software development project we work on gets designed with the assumption that hackers are actively trying to break it. As a financial software development services provider, our security protocols go beyond industry standards because we know that “good enough” security becomes a competitive disadvantage when customers lose trust.

For instance, we created Edfundo, the world’s first financial intelligence platform that equips children with essential financial management skills from an early age. The platform was able to attract wide market attention, leading to them raising $500K in pre-seed funding and earning them the title of FinTech Startup of the Year, solidifying their position as a pioneer in child-focused FinTech software.

Whether you’re launching something completely new or fixing problems with existing systems, we help you build software development for fintech solutions that actually work in the real world. No marketing fluff, no unrealistic promises – just proven expertise in delivering financial software that scales, stays secure, and keeps customers happy.

FAQs

Q. Why is custom financial software important for FinTech businesses?

A. The challenge with off-the-shelf financial software is that it’s rarely a perfect fit. While it may serve basic needs, when managing millions in transactions and serving thousands of customers, ‘good enough’ simply isn’t sufficient. Here’s why investing in tailored solutions is essential:

- Tailored to Business Needs: Your FinTech company isn’t identical to every other company out there. Custom solutions get built around your actual workflows, not some generic idea of how financial businesses should operate.

- Scalability: When your user base explodes from 10,000 to 100,000 overnight, custom software scales with you instead of breaking under pressure.

- Competitive Advantage: While your competitors are stuck with the same boring features everyone else has, you can integrate cutting-edge AI or blockchain capabilities that actually differentiate your business.

Q. What technologies are used in financial software development?

A. Financial software development demands a technology stack that can support large-scale operations while ensuring robust security and regulatory compliance. The technology decisions you make today will determine whether your platform can thrive under pressure or fail when it matters most..

- AI and Machine Learning: Powers predictive analytics that spot fraud before it happens and creates personalized services that keep customers engaged.

- Blockchain: Delivers secure transactions and smart contracts that eliminate middlemen while maintaining complete transparency.

- Cloud Computing: Provides the scalable infrastructure you need without the massive upfront costs of building your own data centers.

- API Integration: Connects your platform to payment gateways, banking systems, and third-party services that your customers actually use.

- React, Node.js, Java, and Python: The programming languages that experienced financial software developer teams rely on for building both user interfaces and backend systems.

Q. How can financial software development ensure compliance with global regulatory frameworks?

A. Compliance isn’t an add-on you can address after building your fintech software development project. Regulators aren’t concerned with your project timeline or budget—they care about whether your software protects customer data and strictly adheres to industry regulations. Here are the few things to keep in mind:

- Automated Compliance Checks: Smart software monitors GDPR, PCI-DSS, and KYC/AML requirements automatically, catching violations before regulators do.

- Secure Data Handling: Proper encryption, data masking, and access controls aren’t optional – they’re the baseline for any serious financial application development project.

- Audit Trails: Every action gets logged and tracked, so when auditors come knocking, you have the documentation they need.

- Regular Updates: Financial regulations change constantly, and your custom financial software development needs to evolve with them or you’ll face expensive penalties.

Q. How do you manage security in financial software to prevent breaches and data leaks?

A. Security breaches after banking & financial software development aren’t just reputation risks—they can threaten the survival of your business. FinTech leaders who’ve faced major breaches know the true cost in lost trust, financial penalties, and operational disruption. Here’s how we ensure security is never compromised:

- Encryption: Every piece of data gets encrypted whether it’s sitting in your database or traveling across the internet. No exceptions.

- Multi-Factor Authentication (MFA): Passwords alone won’t cut it anymore. MFA adds the extra security layer that keeps unauthorized users out even when passwords get compromised.

- Regular Security Audits: Professional penetration testers attack your software development for financial services platforms regularly to find vulnerabilities before real hackers do.

- Secure Development Practices: Your development team follows secure coding standards from day one, not as an afterthought when security problems surface.

- Compliance with Security Regulations: PCI-DSS, GDPR, and other frameworks aren’t suggestions – they’re legal requirements that finance software development projects must follow to avoid regulatory trouble.

In today’s digital age, having a strong online presence is the key to unlocking the door of business transformation and reaching the target audience. One of the most efficient ways to achieve this is through web app development. Web applications have grown at an unprecedented pace in the past decade, revolutionizing operations across various industries.…

Digital health is no longer a choice, but a necessity for healthcare organizations striving for resilience, efficiency, and improved outcomes. Take, for instance, Amazon’s rebranding of Amazon Clinic to Amazon One Medical Pay‑per‑visit in June 2024. This integration allows users a $29 messaging visit or a $49 video consultation for over 30 common conditions. Additionally,…

AI saves lives, AI prevents data breaches, AI fights court cases, AI performs administrative tasks; AI can do all whatever you imagine. Sounds extravagant, but it is backed by reality. Let’s validate this bold statement by unveiling some real-world examples: AI in healthcare helps mom diagnose daughter’s illness: In 2023, a woman used ChatGPT to…