- What is White Label Financial Risk Management Software?

- Factors That Influence the White Label Financial Risk Management Software Development Cost

- Complexity of Features

- Development Stages

- UI/UX Design

- Backend Development

- Third-Party Integration

- Regulatory Compliance and Security

- Platform Selection

- Technology Stack

- Hidden Costs for White-Label Financial Risk Analysis Software Development

- Maintenance Costs

- Hosting Costs

- Marketing Costs

- Legal and Licensing Costs

- How to Optimize Financial Risk Management Solutions Development Costs

- Build an MVP

- Focus on Core Features

- Leverage Cross-Platform Development

- Outsource to Cost-Effective Regions

- How to Make Money from White-Label Financial Risk Management Software

- License Your Software to Other Businesses

- Subscription-Based Model

- Partnerships

- Advertisements

- Financial Risk Management Software Development Process

- Ideation and Planning

- Define Clear Goals

- Design UI/UX

- Develop the Software

- Conduct Testing

- Deploy the Software

- Monitoring and Maintenance

- Partner with Appinventiv for Custom financial risk management software development

- FAQs

Economic uncertainty, volatile financial markets, and cyber threats are at their brutal phase in today’s financial landscape. These complex threats torment businesses across industries, putting them under unimaginable pressure to effectively develop a revolutionary solution to manage financial risk.

In particular, the banking and financial sectors face heightened pressure due to the intricate nature of their transactions and interactions. A failure to come up with a credible savior to manage risk can lead to significant financial losses, legal penalties, and long-term damage to a company’s reputation.

So, what’s your strategy to deal with these challenges and mitigate financial risks? If you are considering building white-label financial risk management software, you are going in the right direction. Such software helps protect crucial business assets, maintain stakeholders’ trust, fortify resilience against evolving cyber threats, and uphold regulatory compliance standards. Why white-lable? A white-label platform can be resold to other businesses that they can tailor to their needs.

But before you jump into the battle, you must know the white-label financial risk management software development cost to make an informed investment.

Typically, the cost to build white-label financial risk management software ranges between $30,000 to $300,000 or more, based on various factors (details later).

Let’s know how much it costs to develop financial risk management software, exploring various factors and other essential elements that influence your investment.

Snag your custom quote now and team up with our dev pros for a crystal-clear breakdown of your project’s cost. Let’s turn your vision into reality!

What is White Label Financial Risk Management Software?

White-label financial risk management software is a custom platform that helps businesses identify, manage, and mitigate risks. This type of software is developed by one company and can be rebranded and tailored by other companies to fit their unique needs. So, you can either use the platform for your operations or sell it as a product to other companies, allowing them to customize the software with their branding color, logo, and features to fit their unique business requirements.

These platforms provide comprehensive tools for assessing, monitoring, and controlling financial risks, such as market fluctuations, credit risks, and operational inefficiencies.

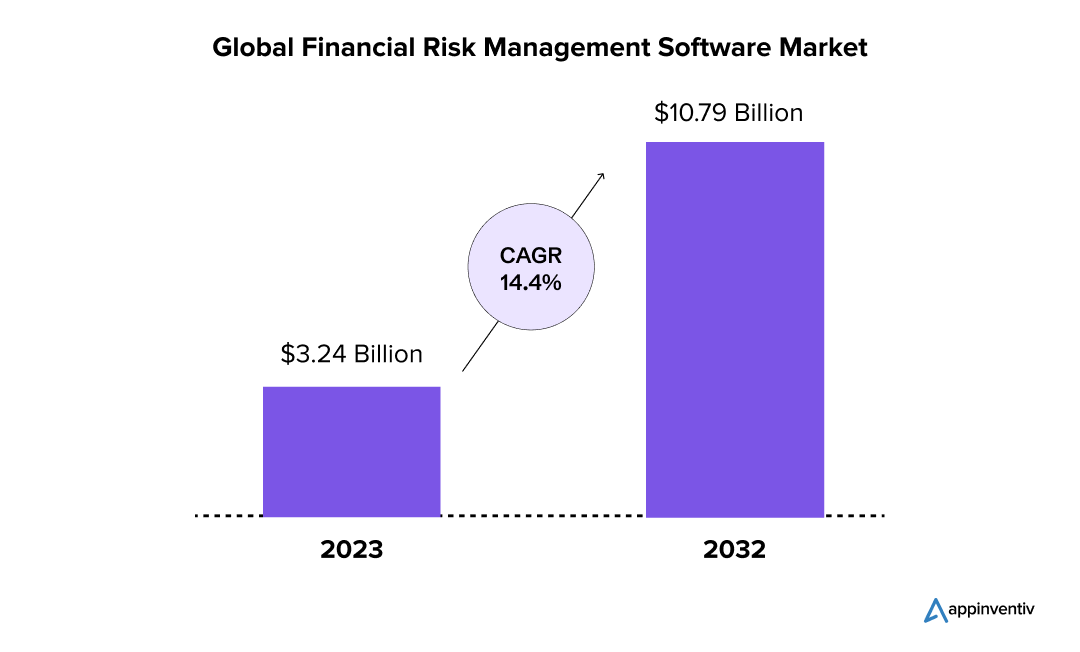

According to Fortune Business Insights, the global market of financial risk management software valued at $3.24 billion in 2023 is projected to reach $10.79 billion by 2032, showing a CAGR of 14.4% from 2023 to 2032.

Factors That Influence the White Label Financial Risk Management Software Development Cost

The cost of developing white-label financial risk management software can vary widely based on several factors. Therefore, to get a clear understanding of the investment involved in building a white-label solution for financial risk management, you must understand these factors first:

Complexity of Features

The number and complexity of the features you want to integrate into your white-label financial risk management software can significantly impact the development cost. For example, a feature-rich advanced software could significantly raise costs but deliver immense value in return.

Here is a table outlining the breakdown of costs and timelines based on the software’s complexity

| App Complexity | Average Cost | Average Timeline |

|---|---|---|

| Simple solution with basic features | $30,000-$50,000 | 4-6 months |

| Medium complex platform with Moderate features | $50,000-$120,000 | 4-9 months |

| A highly complex system with advanced features | $120,000-$300,000+ | 9 months to 1 year or more |

Development Stages

Developing white-label risk management software is a multi-phase process. Each stage of the financial risk management software development lifecycle —planning, design, coding, testing, and deployment—affects the overall development cost. Having a clear understanding of the cost and timeline associated with these stages will help you plan the right budget.

Here is a table outlining the costs, timelines, and activities involved in each stage:

| Development Stage | Cost Range | Timeline |

|---|---|---|

| Planning | $3,000–$15,000 | 2–4 weeks |

| UI/UX Design | $6,000–$30,000 | 4–6 weeks |

| Development | $20,000–$200,000+ | 3–9 months |

| Testing and Launch | $3,000–$20,000 | 2–4 weeks |

| Maintenance | $8,000–$20,000/year | Ongoing |

UI/UX Design

UI/UX design is the life and soul of any software, and a financial risk management platform is no exception. A visually appealing and intuitive UI/UX ensures the software is easy to use and will help user engagement.

| Feature | Impact on Cost | Details |

|---|---|---|

| Basic Design | $6,000 – $30,000 | Simple layouts and fewer interactive elements. |

| Advanced Design | $30,000 – $50,000+ | Custom animations, accessibility features, and user-centric flows. |

Backend Development

The backend is the base of the software that handles the core operational processes such as data processing, analytics, and integrations. Building a robust backend that can scale seamlessly as your business grows requires skilled developers, thus raising costs and timelines.

Third-Party Integration

Financial risk management software requires seamless integrations with other tools and platforms like payment gateways, CRMs, or ERP systems to improve functionality. These integrations significantly increase white-label financial risk management software development costs.

You may like reading: How Does the Fintech and Banking Sector Use APIs?

| Integration Type | Cost Factor | Details |

|---|---|---|

| Simple APIs | $2,000 – $10,000 | Single Payment Gateway |

| Complex APIs | $5,000 – $15,000+ | Multiple APIs, Real-Time Analytics, etc. |

Regulatory Compliance and Security

Compliance is non-negotiable in the financial landscape. Therefore, businesses operating in the financial sector must comply with strict regulations like GDPR and PCI-DSS. Meeting these standards requires adding stringent security features such as data encryption, user access controls, regular audits, multi-factor authentication, and intrusion detection. Adding these security and compliance standards significantly increases the cost of custom financial risk management software development.

| Security Feature | Cost Impact | Details |

|---|---|---|

| Standard Security | $5,000 – $8,000 | Basic encryption and SSL certificates. |

| Advanced Security | $15,000 – $100,000+ | AI-driven threat detection and compliance-grade encryption. |

Platform Selection

Another crucial factor affecting the financial risk analysis software development cost is platform compatibility (iOS, Android, or both). Whether the software is developed for web, mobile, or both, this is a crucial factor impacting the cost of financial services risk management software development.

| Platform | Cost Factor | Details |

|---|---|---|

| Web Only | $30,000 – $100,000 | Browser-based, requiring fewer resources. |

| Web & Mobile | $100,000 – $300,000+ | Includes mobile app development and optimization. |

Technology Stack

The technologies you choose to build the software play a big role in cost determination. For example, The choice of programming languages, frameworks, advanced AI tools, cloud services, blockchain technology, etc. can impact the development costs.

| Technology | Cost Implication | Details |

|---|---|---|

| Traditional Stack | $50,000 – $120,000 | Popular frameworks like React Native, Flutter, PHP |

| Advanced Stack | $120,000 – $250,000+ | AI/ML tools, blockchain, and real-time analytics. |

How to Estimate White Label Financial Risk Management Software Development Cost

The cost of financial services risk management software development typically revolves around two core components: development hours and the hourly rate of FinTech developers.

Here is a basic formula you can use to calculate the overall white-label financial risk management software development cost

| Development Hours × Hourly Rate = Total Cost |

For instance, if financial risk management system software development requires 1,200 development hours at $50/hour, the total investment will be $60,000.

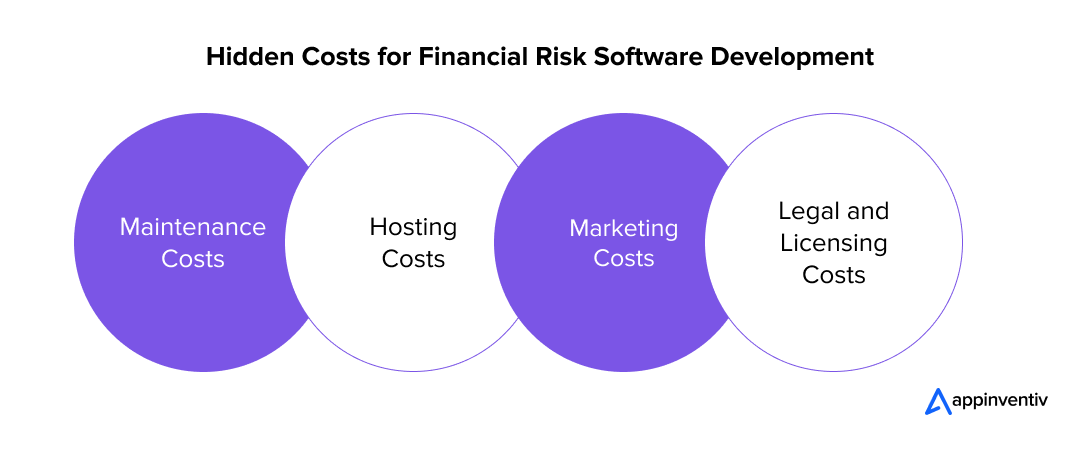

Hidden Costs for White-Label Financial Risk Analysis Software Development

Developing a white-label financial risk management software often involves costs that may not be immediately apparent during initial budgeting. These hidden expenses can significantly impact your overall investment. Here’s a detailed look at these hidden costs and their implications:

Maintenance Costs

Regular maintenance is a critical aspect you can’t afford to ignore, as without proactive maintenance, your platform can quickly become outdated or vulnerable to risks. Regular maintenance keeps your platform up-to-date, secure, scalable, and functional. This involves fixing bugs, improving performance, adding new features, and adapting to changes in the financial ecosystem.

Typically, the cost to maintain software ranges from 15% to 20% of the total development cost annually.

Hosting Costs

For financial software, secure and scalable hosting is non-negotiable. It ensures optimal performance and data protection. However, hosting your financial risk management software on a cloud platform like AWS, Google Cloud, and Microsoft Azure, or dedicated servers, incurs ongoing costs that grow with the business scale.

Hosting your software on a cloud platform or a dedicated server can cost $500 to $5,000 per month, depending on user traffic and data storage needs.

Marketing Costs

Marketing expenses can be significant for businesses planning to resell their white-label solutions. These costs include branding, promotional campaigns, and lead generation to attract clients. Without effective marketing, your platform will fail to gain higher visibility, resulting in a reduced client base and lost sales.

Legal and Licensing Costs

Adhering to financial regulations and obtaining the necessary licenses is a critical yet often overlooked expense. This includes acquiring compliance and certifications to ensure the platform operates within regulatory frameworks.

How to Optimize Financial Risk Management Solutions Development Costs

Building a financial risk management software from scratch requires a significant investment. However, some strategies can help optimize this cost while ensuring a high-quality standard. Not sure what strategies can help you achieve cost efficiency? Worry not. Here are some actionable steps to minimize development costs:

Build an MVP

Begin your custom financial risk management software development with a Minimum Viable Product (MVP). This approach focuses on launching the platform with essential features, reducing initial costs, and enabling you to gather user feedback for iterative improvements.

Focus on Core Features

Identify and prioritize the features necessary for your solution’s core functionality. Avoid adding non-essential features in the initial stages, as they increase development time and costs.

Leverage Cross-Platform Development

Don’t create separate platforms for iOS, Android, and the web. Instead, use cross-platform frameworks like Flutter or React Native. These tools allow you to write a single codebase, taht helps reduce development costs while maintaining high performance.

Outsource to Cost-Effective Regions

Outsourcing development to cost-effective regions can help balance quality and investment. Therefore, consider partnering with a reliable software development company in areas where costs are relatively low but expertise is high.

How to Make Money from White-Label Financial Risk Management Software

Building enterprise risk management software for financial institutions offers various revenue opportunities. You can generate recurring revenue by adopting the right monetization models. Here are some effective ways to make money from your solution:

License Your Software to Other Businesses

One of the most convenient ways to make money from your white-label software is by offering licensing agreements to other companies. Licensing your platform allows other businesses to rebrand and resell it under their name. For this, you can charge a one-time licensing fee or an annual renewal fee.

Subscription-Based Model

Another popular way to monetize white-label software is through freemium and subscription-based pricing models. Under this revenue model, you can offer a basic version of the platform for free and charge a fee for premium features on a monthly or annual basis.

Partnerships

Another way to generate revenue is to form partnerships with other businesses in the financial services industry. You can earn a commission or revenue share by integrating their services into your platform (e.g., offering loans, insurance, or investment services).

Advertisements

You can display relevant ads on the platform and generate income through clicks or impressions. This model works well if your platform has good exposure and a large user base.

The financial risk management market is booming—from $3.68B to $10.79B by 2032. Partner with our expert FinTech developers and make your vision a reality!

Financial Risk Management Software Development Process

Developing enterprise risk management software for financial institutions requires a systematic approach through several stages. Here is an overview of the steps involved in the financial risk management software development process.

Ideation and Planning

Every great software starts with a great idea. So, ideation is the first stage of our financial risk management software development process, where we conduct thorough market research, dive into your business needs, and understand the risk type you want to address.

Define Clear Goals

You must know beforehand What you want to achieve from this software development. Having a clear objective is essential to list must-have features and define priorities. By outlining expectations early on, you can avoid scope creep and ensure the project stays on track.

Design UI/UX

This is the phase where ideas come to life visually. At this stage, we create intuitive and visually appealing wireframes and build prototypes to test workflows and make the user journey as smooth as possible.

Develop the Software

This is where the actual development begins, and action happens. Our tech experts program the outlined features at this stage and evaluate the software to ensure it aligns with your goals.

Conduct Testing

Before you deploy the software in a real-world scenario, you must test it against various parameters of security, functionality, and flexibility to ensure it is free from bugs and other glitches.

Deploy the Software

After the software is tested and quality checked, you can push it live to meet operational challenges and tackle risks. Here, the goal is to ensure a smooth launch with minimal disruptions to workflow.

Monitoring and Maintenance

Going live doesn’t mean the work is done. You must continuously monitor and maintain it to ensure the software performs optimally and evolves with your business needs. Even the best software can fall flat without proper maintenance.

Also Read: A complete guide to financial software development

Seek insight from Mudra — a fintech app built with intuitive features to make money management a child’s play for everyone.

Partner with Appinventiv for Custom financial risk management software development

White label financial risk management software development is not a straightforward process. Building the software of your dreams requires a blend of technical excellence and industry-specific expertise. That is where Appinventiv emerges as your trusted tech savior.

We are a reputed FinTech software development company building tailored solutions that help enterprises identify, assess, and mitigate financial risks with precision.

Our team of 1600+ tech evangelists has delivered around 3000+ successful projects that align with your unique business objectives, ensuring scalability, security, and compliance with industry regulations.

Don’t believe us? Check out our portfolio, which features transformative projects like Mudra, Edfundo, ility, etc., that showcase our expertise in developing innovative white-label and FinTech solutions.

Whether you want to build a feature-rich white-label financial risk management solution from scratch, customize an existing platform with your brand elements, or just want to know white-label financial risk management software development cost, we are your trusted tech partner. We specialize in turning vision into groundbreaking reality, empowering businesses to excel in the digital financial landscape.

FAQs

Q. What is financial risk management software?

A. Financial risk management software is an advanced tool that FinTech developers build to identify and address the risks associated with various financial exposures. Organizations can proactively mitigate potential risks and enhance decision-making by using these solutions. Such software is particularly valuable for banking and financial companies as they face heightened pressure due to the intricate nature of their transactions and financial risks.

Q. What are some common types of financial risk management software?

A. Financial risk management software comes in various forms, each tailored to address specific risk categories. Here are some of the most common types:

- Market Risk Management Software

- Credit Risk Management Software

- Operational Risk Management Software

- Liquidity Risk Management Software

- Compliance Risk Management Software

- Enterprise Risk Management (ERM) Software

- Treasury and Payment Management Software

- Risk Management For Investment Management Software

- Fraud Detection Software

Q. How much does it cost to develop white-label financial risk management software?

A. Typically, white-label financial risk management software development cost ranges between $30,000 to $300,000 or more. However, this is not the final estimate. The actual cost of development varies depending on several factors, including

- The location and expertise of FinTech software development company

- The complexity of financial risk management software features

- The level of UI/UX design

- Platform compatibility and scalability requirements

- Security and compliance needs

- Chosen tech stack and future trends in financial risk management software

Contact us to get a more accurate estimate for white-label financial risk management software development costs tailored to your specific project requirements.

Q. How long does it take to build a FinTech app?

A. The timeline required for financial risk management solutions development ranges between 4 months to 1 year or more, depending on the expertise of FinTech app developers and the complexity of your software.

However, if you want to gain the maximum benefits of financial risk management software, you should not hurry. Give your FinTech developers enough time to build a feature-rich custom solution that can half the risk and double the profit.

Share your project idea with us to get a more precise timeline for your custom financial risk management software development.

Q. How to keep financial risk management solutions development costs within budget?

A. To manage financial risk management solutions development costs, you can follow the below strategies:

- Build a Minimum Viable Product

- Outsource the right development company

- Prioritize must-have features

- Opt for cross-platform development.

To gain an in-depth understanding of these strategies, please refer to the above blog.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Appinventiv Solved Scalability Challenges for FinTech Platforms with 10M+ Users

Scalability is a crucial element in the FinTech sector as it is experiencing phenomenal growth due to the global population's need for streamlined, on-demand security and instant financial services. With the rise in user bases and transaction volume, FinTech applications must manage the growing demand without compromising performance or security, while also providing a pleasant…

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…