- What are the Different Types of Mobile Wallet Apps?

- Closed Wallets

- Semi-Closed Wallets

- Open Wallets

- Crypto Wallets

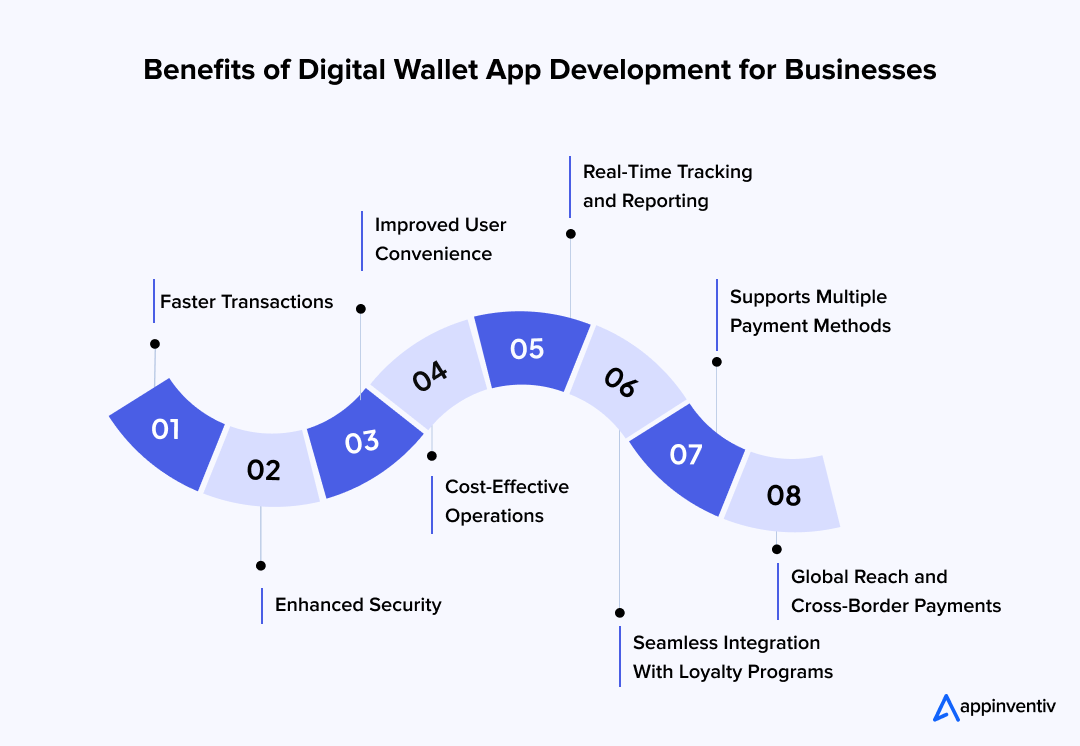

- Advantages of Digital Wallet App Development

- Faster Transactions

- Enhanced Security

- Improved User Convenience

- Cost-Effective Operations

- Real-Time Tracking and Reporting

- Seamless Integration With Loyalty Programs

- Supports Multiple Payment Methods

- Global Reach and Cross-Border Payments

- How Much Does It Cost to Develop A Digital Wallet App?

- Top 12 Features of a Mobile Wallet App

- Transaction History and Notifications

- Transfer Money to/from the Bank Accounts

- Bill Payments

- Management of Virtual Cards

- Contactless Payments Method

- Secure Authentication

- Self-Registration

- Rewards and Discounts

- Analytics-Based Dashboards

- Chatbot

- Multi-Currency Support

- Peer-to-Peer (P2P) Payments

- How to Create a Digital Wallet: A Step-By-Step Guide

- Define Your Product Goal

- Design an Intuitive Interface

- Implement Security Measures

- Develop the Digital App

- Test and Deploy Your App to the Market

- Upgrade and Maintenance

- Technology Stacks Used for eWallet App Development

- Security Compliances for Digital Wallet App Development

- Data Privacy Regulations

- Multi-Factor Authentication

- Secure Data Transmission

- Secure Data Storage

- Protection Against Fraud

- PCI-DSS Standards

- Regular Security Audits and Updates

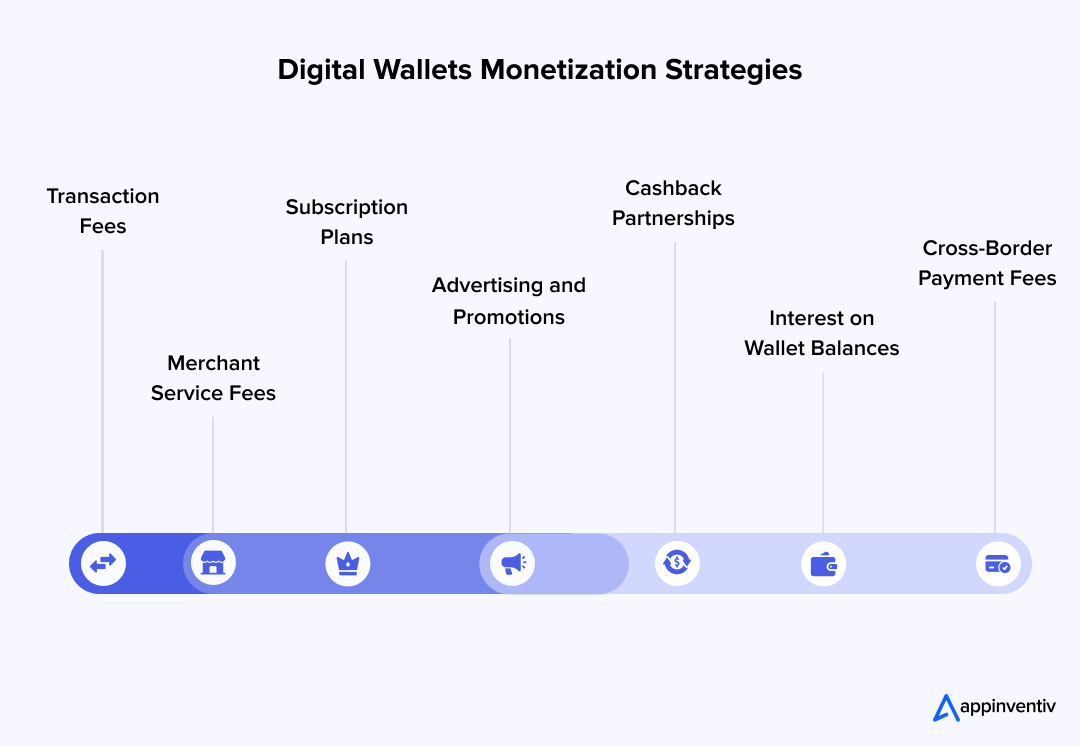

- How Do Digital Wallets Make Money?

- Transaction Fees

- Merchant Service Fees

- Subscription Plans

- Advertising and Promotions

- Cashback Partnerships

- Interest on Wallet Balances

- Cross-Border Payment Fees

- Most Popular Examples of Digital Wallet Apps

- Apple Pay

- Google Pay

- PayPal

- Key Challenges in Developing a Digital Wallet App and How to Overcome Them

- Embark on Your eWallet App Development Journey with Appinvnetiv

- FAQs

Key takeaways:

- Digital wallets are becoming everyday essentials, with nearly 1 in 5 users now going completely cardless.

- Average development costs range from $50K to $100K+, but smart planning can significantly optimize budgets.

- Features like contactless payments, P2P transfers, and real-time tracking are now standard user expectations.

- Monetization opportunities are strong, with wallets earning through transaction fees, merchant charges, and premium services.

- Key development challenges include security risks, regulatory hurdles, complex payment integrations, & real-time processing demands.

With the ever-evolving technology and the increasing adoption of mobile phones, people want everything to be quick, easy, and secure, especially when it comes to managing their finances. It is where digital wallet app development comes into play.

Digital wallets, also known as mWallets and eWallets, have quickly become one of the fastest-growing payment methods, allowing users to make transactions quickly and securely without needing cash or physical cards. Unsurprisingly, digital wallets are a great innovation for a cashless world that makes managing finance a safe and secure option.

According to a McKinsey & Company report, nearly 9 out of 10 consumers in the United States have made some type of digital payment in the past year, hitting a record high of 92%. Digital wallet adoption is rapidly moving beyond in-app and online transactions to in-store purchases, with in-store usage growing from 19% in 2019 to 28% in 2024. This growing channel now represents nearly $10 trillion in annual consumer-to-business spending in the United States. According to the survey, one in five digital wallet users frequently leave home without their physical wallet, choosing to rely solely on digital payment methods for in-store transactions.

So, if you want to tap into this growing market trend, developing a digital wallet app should be your prime vision. Whether you are an emerging startup that wants to contribute to the market that has an exponential growth spectrum in the future or a huge enterprise looking to keep your business competitive, digital wallet development is a lucrative business opportunity for you.

However, digital mobile wallet application development is a complex and challenging process that requires thorough knowledge and careful planning of mobile payment systems. This comprehensive blog will reveal all the essential aspects required to make a successful eWallet. So, let’s dive into types, cost, must-have features, digital wallet app development process, technology stack, security compliance, and other essential factors that make a great mobile wallet for your business.

What are the Different Types of Mobile Wallet Apps?

There are multiple types of eWallets that address specific business models and target users’ needs depending on their device’s operating system and location. For instance, Google Pay is the most popular choice for Android users, while iPhone users consider Apple Pay. Others rely on PayPal as it offers international-level acceptance. Furthermore, Cash App and Venmo work only with a US phone number. We can segment these applications into the below-listed categories of eWallets:

Closed Wallets

These wallets are specially designed for a merchant that sells products or services, allowing users to use the wallet for that particular merchant only. For example, an eCommerce app enables you to store money in the app’s wallet and use it to pay for an item in the cart. Starbucks, a leading multinational chain of coffeehouses, is a good example of a closed wallet.

Semi-Closed Wallets

A semi-closed wallet allows users to use funds in their wallets to make payments for transactions on websites or apps their merchant has partnered with. Paytm can be a great example of a semi-closed wallet.

Open Wallets

Open wallets such as PayPal are used directly in a third-party application or in a bank app to support any type of transaction. It enables customers to send and receive online and in-store payments, transfer funds to their bank account and keep them in their wallet for future use. Open wallets require both receivers and senders to have accounts on the same application.

Crypto Wallets

Cryptocurrency wallets are designed to store, sell and buy cryptocurrencies. These wallets store the public and private keys of users to facilitate transactions over their applications. The best thing about crypto payment wallets is that you can design them as per your specific needs – closed, semi-open or open.

You may like reading: An Ultimate Guide to Blockchain Wallets

Advantages of Digital Wallet App Development

Building a digital wallet app offers businesses and users a faster, safer, and more convenient way to manage payments. Let’s explore the key benefits that make digital wallet app development a smart investment.

Faster Transactions

Digital wallets enable instant payments with just a tap or scan, reducing checkout times and making transactions seamless for both users and merchants.

This speed improves user satisfaction and helps businesses serve more customers in less time.

Enhanced Security

With encryption, tokenization, and biometric authentication, digital wallets offer a higher level of security compared to traditional payment methods, reducing fraud risks.

Sensitive information is never directly shared, making transactions inherently safer.

Improved User Convenience

Users can store multiple cards, IDs, and coupons in one place, eliminating the need to carry physical wallets and offering a smoother payment experience across apps, websites, and stores.

This convenience encourages higher adoption rates and repeat usage.

Cost-Effective Operations

Digital wallets reduce the dependency on cash handling and paper-based transactions, cutting down operational costs for businesses.

It also lowers expenses related to payment infrastructure and physical terminals.

Real-Time Tracking and Reporting

Digital wallets provide real-time transaction history, helping users track spending instantly and offering businesses valuable analytics for better decision-making.

This enables more precise budgeting and marketing personalization based on spending patterns.

Seamless Integration With Loyalty Programs

Businesses can easily link loyalty points, offers, and rewards directly to the wallet, enhancing customer engagement and retention.

It simplifies reward redemption and drives recurring purchases.

Supports Multiple Payment Methods

A digital wallet can support credit/debit cards, UPI, net banking, and even cryptocurrencies, giving users flexibility in how they pay.

This diversity appeals to a wider user base with varying payment preferences.

Global Reach and Cross-Border Payments

Digital wallets simplify international payments, making it easier for businesses to expand globally while reducing currency exchange complexities.

It opens up new markets and supports smooth, frictionless transactions across borders.

How Much Does It Cost to Develop A Digital Wallet App?

The cost to build a digital wallet app varies depending on various factors like features and functionalities it provides, the location of the digital wallet app development agency, the type of app, and so on. On average, eWallet app development costs somewhere between $50,000 and $100,000 or more for more advanced features. To clearly understand your digital wallet app development cost, you should evaluate the following factors:

| Cost Factor | Impact on Cost | Details |

|---|---|---|

| Platform Selection | Low to Medium | Building for iOS, Android, or cross-platform affects development hours. Cross-platform apps can save cost compared to building separate native apps. |

| Core Features | Medium to High | Essential digital wallet app features like user registration, payment gateway integration, multi-currency support, and transaction history. |

| Advanced Features | High | Biometric authentication, QR code payments, real-time notifications, NFC integration, P2P transfers, and AI-based fraud detection significantly add to the budget. |

| Technology Stack | Medium | The selection of frameworks, backend technologies, and third-party APIs can affect both licensing costs and developer rates. |

| Design Complexity (UI/UX) | Low to Medium | Simple user flows cost less, while customized, highly interactive designs increase both cost and timeline. |

| App Testing and Security | Medium to High | Advanced security audits, multi-layer encryption, and rigorous QA cycles are essential for digital wallet apps and require additional investment. |

| Maintenance and Support | Ongoing | Regular updates, feature enhancements, and post-launch security patches, all these maintenance costs typically sums up to 15-20% of the entire budget annually. |

Want to get a more refined estimation of mobile wallet app development cost? Let’s discuss the essential digital wallet app features that majorly contribute to the overall eWallet app development cost.

Top 12 Features of a Mobile Wallet App

A digital wallet app facilitates multiple functionalities allowing users to make transactions, transfer funds, pay bills, recharge mobile phones, store payment information, etc. Therefore, to create a successful and competitive mobile wallet app, you must consider incorporating the features mentioned below during the mobile wallet app development process.

Transaction History and Notifications

Your app should provide users with a detailed history of their transactions, reflecting their past payments and purchases. Also, enable push notifications and email alerts to inform them about their account activities.

Transfer Money to/from the Bank Accounts

Mobile wallets must enable seamless money transfer feature from one bank to another bank account and from eWallet to bank account and vice versa. The process of transferring money in and out of the wallet should be extremely easy, secure, and convenient.

Bill Payments

Your eWallet must facilitate users to pay their utility bills online, such as electricity, gas, mortgages, rents payment, etc. To make it secure and successful, you need to partner with multiple third-party service providers in the category to give users an easy payment option.

Management of Virtual Cards

The wallet application should enable users to save their debit and credit card data ensuring high security practices like PCI-DCC and so on. It should allow people to add money to their wallets through a one-click system. Moreover, users should be allowed to remove or add cards to their lists.

Contactless Payments Method

Contactless technologies like QR codes and NFC are becoming extremely common in retail chains. Considering their growth, it can be very profitable for your digital wallet to facilitate contactless payments in physical stores, making transactions quick, easy, and convenient.

Secure Authentication

Security should be your prime priority when developing a fintech app. Thus, don’t miss out on implementing robust user authentication methods such as PIN generation, fingerprints, facial recognition, and even two-factor authentication. It ensures that only authorized users can access your app.

Self-Registration

To ensure the success and accessibility of your digital wallet for all genres, you should allow the easy self-registration process so that the maximum number of users can enjoy your offerings. Usually, the self-registration process follows the following steps:

- Download the application

- Follow the KYC process

- Confirm registration through OTP

- Set up the password and login

- Link cards

- Add money to the wallet.

Rewards and Discounts

Rewards and discounts are the lucrative aspect of your eWallet that tempt the users to use the app for the maximum of their financial activities, which leads to increased engagement and retention rates.

Analytics-Based Dashboards

The mobile wallet must have a user-centric dashboard that gives detailed information about their spending habits, upcoming bills, etc. You can even introduce a budget management and expense tracking module in the application.

Chatbot

Integrating a chatbot that provides 24/7 support and gives quick responses to all customers’ queries is one of the most remarkable trends in today’s tech-driven world. So, don’t lag behind in leveraging this AI trend. You can go the extra mile and even implement voice search features in the app.

Multi-Currency Support

If your eWallet caters to the global audience’s needs, you must consider offering multi-currency support. This feature enables easy transactions and conversions for international users.

Peer-to-Peer (P2P) Payments

P2P payment is one of the most used digital wallet features that allows users to send and receive money directly to/from their contacts using their eWallets. This feature is particularly useful for splitting bills or paying back friends. PayPal is one of the most quoted examples in this category, with millions of people using it to transact for both personal and professional reasons like paying for outsourcing, etc.

Now that we know the essential features required to build a high-performing eWallet, it is time to know how to build a digital wallet and look into the technology stack that powers such applications.

Also Read: UPI payment app development – A cost and benefit analysis

How to Create a Digital Wallet: A Step-By-Step Guide

Building a secure eWallet comprises the same method as any other mobile app development process, such as UI/UX designing, payment integration, development, deployment, etc. Let’s discover each phase in detail:

Define Your Product Goal

The first step to your digital wallet app development process starts with defining your product goals and specifying what features it will have. For instance, do you want your application to store multiple currencies, transfer money, make payments to merchants, pay bills, or do other activities? Make sure to clearly define your goals before moving on to the next step.

Design an Intuitive Interface

Once you have defined your product goal and features, it is time to create a user-friendly UI/UX design for your mobile wallet app development with which your customers will interact. According to a report, 90% of users lose their trust in an app and discontinue its use due to a poor experience. Hence, creating a visually appealing and easy-to-navigate interface that allows users to access their accounts quickly, transfer funds, and make payments, is essential for successful eWallet app development.

Implement Security Measures

Security is a prime concern when developing a FinTech app, and a digital wallet is no exception. Therefore, you must integrate robust security measures like biometrics to prevent data breaches and reduce the risk of cyberattacks when developing an eWallet.

To gain a deep understanding of how to secure your FinTech app; read our complete guide on Cybersecurity in FinTech.

Develop the Digital App

Now comes the most critical and technical aspect of the process – development. Depending on the UI/UX design and your user base, set up continuous integration and continuous deployment (CI/CD), integrate essential features, and deploy technology stacks to ensure your product behaves as it should.

Test and Deploy Your App to the Market

Before submitting your digital wallet to the app store and bringing it to the end users, thoroughly test it for functionality, security, and usability. It includes testing for bugs, errors, glitches, vulnerabilities, and performance. After testing and iterating the application, it is time to launch your app to the market.

Know How To Upload An App To the Google Play Store?

Upgrade and Maintenance

Digital wallet mobile app development is a one-time job, but ensuring its apt performance as per the market trend is an ongoing process. So, make sure to timely maintain and upgrade your application to keep it up-to-date, active, competitive, and high-performing.

Technology Stacks Used for eWallet App Development

To build mobile-friendly, user-friendly, and secure eWallets, you must integrate the right set of technology stacks into the application. The below table represents some tech stacks used in the digital wallet app development process.

For Payments PayPal, Braintree, Stripe, and PayUMoney

| Category | Tech Stack |

|---|---|

| For Phone Verification | Nexmo |

| For frontend | Angular, CSS, Javascript, and HTML5 |

| For database | HBase, Cassandra, and MongoDB |

| For cloud environment | Salesforce, Google Cloud, AWS, and Azure |

| For push notifications | Push.IO, Amazon SNS, Twilio, Urban Airship |

| For real-time analytics | Hadoop, Apache, and Spark |

| For QR codes | ZBar Code reader |

You can hire digital wallet app developers from a reputed eWallet app development company to build a high-performing app with an essential technology stack and security measures to enhance user experience and ensure ongoing app success.

Let’s make it swipe-worthy, tap-friendly, and totally unforgettable. Your next big app could be just one click away!

Security Compliances for Digital Wallet App Development

To be a successful eWallet company, you must adhere to the essential regulatory compliances as per your country’s specific laws and guidelines. For instance, In the US., there is a gamut of state and federal regulations that specify the modus-operandi of a digital wallet app. Typically when building a digital wallet app, you should follow the below-listed security compliances:

Also Read: PCI Compliant Fintech Application

Data Privacy Regulations

To protect users’ personal and financial data, you should comply with essential data privacy regulations. Some of the most common data privacy compliances are California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR).

Multi-Factor Authentication

It would be best if you implement multi-factor authentication to add a layer of protection to the application. For instance, an iOS app development uses face recognition, pin, and password to validate users’ authentication.

Secure Data Transmission

In the ever-evolving digital world, you must secure data when at rest and in transit. To provide your users with a secure data transmission experience, you should use secure communication channels such as SSL/TLS/VPN to encrypt all data transmissions between the app and the server.

Secure Data Storage

To secure users’ sensitive information and financial data, such as credit card details from fraudulent activity and unauthorized access, you should implement secure storage methods such as encryption and hashing.

Protection Against Fraud

Mobile wallet app development should include features that detect and prevent fraudulent activities such as unauthorized access, transaction monitoring, and suspicious activity reporting.

PCI-DSS Standards

To ensure secure processing of credit and debit card information, your eWallet should comply with payment card industry data security standards.

Regular Security Audits and Updates

With the ever-increasing risk of data breaches and cybercrime incidents, your mobile wallet app should undergo regular security audits to find out any vulnerabilities and implement timely security measures.

By considering these security compliances, you can create a secure and successful eWallet that instills confidence in users.

How Do Digital Wallets Make Money?

Digital wallets are not just convenience tools—they are highly profitable business models when monetized strategically. Most digital wallet apps generate revenue through a combination of transaction-based fees, value-added services, and partnership opportunities. Here are the most common monetization strategies used by digital wallet apps:

Transaction Fees

One of the primary revenue streams for digital wallets is charging a small percentage on each transaction processed through the platform. This can include peer-to-peer transfers, merchant payments, and international remittances. The fee can either be charged to the user, the merchant, or split between both.

Merchant Service Fees

When businesses accept payments via digital wallets, the wallet providers often charge them a service fee. This model works similarly to how credit card companies operate, where the wallet earns a commission on every sale made using their app.

Subscription Plans

Some digital wallets offer premium plans or tiered subscriptions that unlock additional features like faster transfer limits, advanced analytics, fraud protection, or multi-currency wallets. These paid plans create a steady, recurring revenue stream.

Advertising and Promotions

Digital wallets can sell advertising space or offer promotional placements to brands and merchants directly within the app. These can include cashback offers, featured listings, or in-app banners that are highly targeted based on user spending behavior.

Cashback Partnerships

Digital wallets often partner with brands and merchants to offer cashback deals to users. In this arrangement, brands pay the wallet provider for customer acquisition, while users are incentivized to spend more through cashback rewards.

Interest on Wallet Balances

Some digital wallet apps, particularly those integrated with financial institutions, earn revenue by investing idle user balances. While the user’s money is stored securely, the wallet provider can earn interest from the pooled funds.

Cross-Border Payment Fees

Digital wallets that offer international money transfers can earn substantial margins by applying currency conversion fees or additional charges for cross-border transactions, creating an extra revenue stream.

Most Popular Examples of Digital Wallet Apps

The digital wallet realm is getting bigger with each passing year. Many companies like Venmo and PayPal offer digital wallets to manage financial transactions. Additionally, many banks and eCommerce companies integrate digital wallets into their application, fostering contactless payment methods. Here are some real-world examples of digital wallet apps that have gained widespread adoption and recognition.

Apple Pay

With over 500 million user base, Apple Pay has emerged as a leader in the digital wallet space for iPhones, iPads, and Apple Watches. The digital wallet revolutionizes contactless payments by offering a fast, secure, and highly integrated experience across Apple devices. Its biometric authentication and seamless wallet integration make it a preferred choice for millions worldwide.

Google Pay

With 1B+ downloads and 4+ ratings on the Play Store, Google Pay (also known as Google Wallet in some regions) has emerged as a leader in the digital wallet space.This eWallet powers in-app, online, and in-person purchases on mobile devices, enabling users to manage their finances with Android phones, tablets, or watches. Google Pay also handles around 50% of all mobile transactions on Android devices.

PayPal

With more than 434 million users worldwide as of 2024, PayPal serves as one of the most trusted and globally accepted digital wallets, supporting international transactions with almost all types of cards. It is a faster and safer mode to send and receive money, replacing traditional paper methods such as checks and money orders.

The increasing user base of digital wallet apps gives a clear testament to the increasing penetration of eWallets in today’s digital landscape. As the demand for these eWallet development solutions continues to rise, it opens a door of endless opportunities for businesses to capitalize on this burgeoning market trend. So, if you want to leverage this lucrative market trajectory, partner with a trusted digital wallet app development company (like Appinventiv) for all your digital wallet app development needs.

Also Read: How Much Does it Cost to Build a Digital Wallet App Like Payit

Key Challenges in Developing a Digital Wallet App and How to Overcome Them

Building a digital wallet app is complex, as it involves handling sensitive financial data, ensuring seamless payment processing, and meeting strict compliance standards. Understanding these challenges early can help you design better solutions and avoid costly mistakes. Here’s a glimpse into the major challenges in digital wallet app development and their respective solutions:

| Challenges | Solutions |

|---|---|

| Security and Data Protection | Implement end-to-end encryption, two-factor authentication (2FA), and biometric verification to safeguard user data. Conduct regular security audits and vulnerability testing. |

| Regulatory Compliance | Partner with legal experts to ensure compliance with global and regional regulations like PCI-DSS, GDPR, and AML/KYC requirements. |

| User Trust and Adoption | Offer transparent privacy policies, fast customer support, and secure onboarding processes to build trust and encourage adoption. |

| Complex Payment Integrations | Use well-documented, reliable payment gateways and ensure seamless API integrations for various payment methods and currencies. |

| Fraud Prevention | Leverage AI-driven fraud detection, real-time transaction monitoring, and smart alerts to quickly identify suspicious activities. |

| Cross-Platform Compatibility | Develop responsive designs and test across iOS, Android, and web platforms to ensure consistent user experience. |

| Scalability for Growing User Base | Design with cloud infrastructure and microservices architecture to easily scale as the user base expands. |

| Real-Time Transaction Processing | Implement lightweight architectures and real-time synchronization to enable instant payments and balance updates. |

| Cost Management | Prioritize MVP development and use open-source frameworks to manage initial costs without compromising security. |

| Customer Support Integration | Integrate AI-powered chatbots and responsive customer service channels to resolve user issues promptly. |

Embark on Your eWallet App Development Journey with Appinvnetiv

Digital wallet app development is a complex and challenging process, and hiring digital wallet app developers ensures you cover domain complexities, security compliances, tech specialties, and more. Implementation of all these aspects successfully leads to transforming an app vision into a working version. So, don’t hesitate to ask for professional assistance and partner with us to build a successful eWallet.

We, as a leading fintech app development company, have delivered 500+ custom FinTech Solutions for different sectors like finance, eCommerce, healthcare, and so on. For instance, we created a leading financial platform for Bajaj Finserv to transform its merchant onboarding journey digitally. The results – 300+ merchants onboarded and 3 lack+ transactions per day. For another client Mudra, we built a budget management app that helps millennials manage their personal budgeting issues.

Being your trusted tech partner, we help you keep your sensitive data secure and compliant, ensuring that your mWallet adheres to all government regulations and guidelines such as FinCEN, FINTRAC, PSD2, ePrivacy, PCI-DSS, GDPR, PA-DSS, and AML.

Leveraging our 8+ years of experience in software and app development can truly help you build a secure and scalable fintech app. Our dedicated team of 350+ fintech professionals knows what it takes to build an interactive, intuitive app – one that your users will fall in love with, positioning yourself strategically to cater to the evolving needs of modern users.

So, don’t miss the opportunity to be a part of a lucrative market trajectory. Seize the chance and hire digital wallet app developers from our firm to embark on your digital app development journey.

FAQs

Q. What are the key features of a digital wallet app?

A. Digital wallet apps are loaded with a multitude of features to facilitate quick, easy, and secure transactions. Some of the most common features of eWallets are rewards and discounts, self-registration, bill management, secure authentication, chatbots, and multi-currency support. To get a detailed understanding of digital wallet app features, please refer to the above blog.

Q. How long does it take to develop a digital wallet app?

A. The time it takes to develop a digital wallet app varies significantly based on various factors like the app’s complexity, features, platforms, and location of a digital wallet development company. Typically, it takes 3 to 6 months to build a mWallet with basic features and 6 to 12 months or more for a more advanced version.

Q. Which Industries Can Benefit From Mobile Wallet Apps?

A. There is hardly any industry that can remain untouched by the benefits of digital wallets. Retail, Entertainment, BFSI, Automotive, Healthcare, Transport, Consumer Electronics, IT, and Education are some of the most prominent sectors that can benefit from digital wallet app development.

Q. How do I ensure the security of my mobile wallet app?

A. Security is the backbone of mobile wallet app development. Protecting user data and financial transactions should be your top priority from day one. Here’s how you can build a secure app:

- Implement end-to-end encryption for all transactions

- Enable two-factor authentication (2FA) and biometric verification

- Use secure payment gateways with PCI-DSS compliance

- Conduct regular security audits and penetration testing

- Store sensitive data using tokenization or encryption

Q. Can I integrate my digital wallet with existing banking APIs?

A. Yes, you can integrate your digital wallet with existing banking APIs to provide users with seamless financial services. API integration allows your wallet to securely access account balances, transaction history, and payment processing in real time, enhancing user convenience and app functionality. Proper API management, security protocols, and banking partnerships are essential to ensure smooth and compliant integration.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Appinventiv Solved Scalability Challenges for FinTech Platforms with 10M+ Users

Scalability is a crucial element in the FinTech sector as it is experiencing phenomenal growth due to the global population's need for streamlined, on-demand security and instant financial services. With the rise in user bases and transaction volume, FinTech applications must manage the growing demand without compromising performance or security, while also providing a pleasant…

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…