- Payit App: How It Works and Why It’s Different from Other Digital Wallets

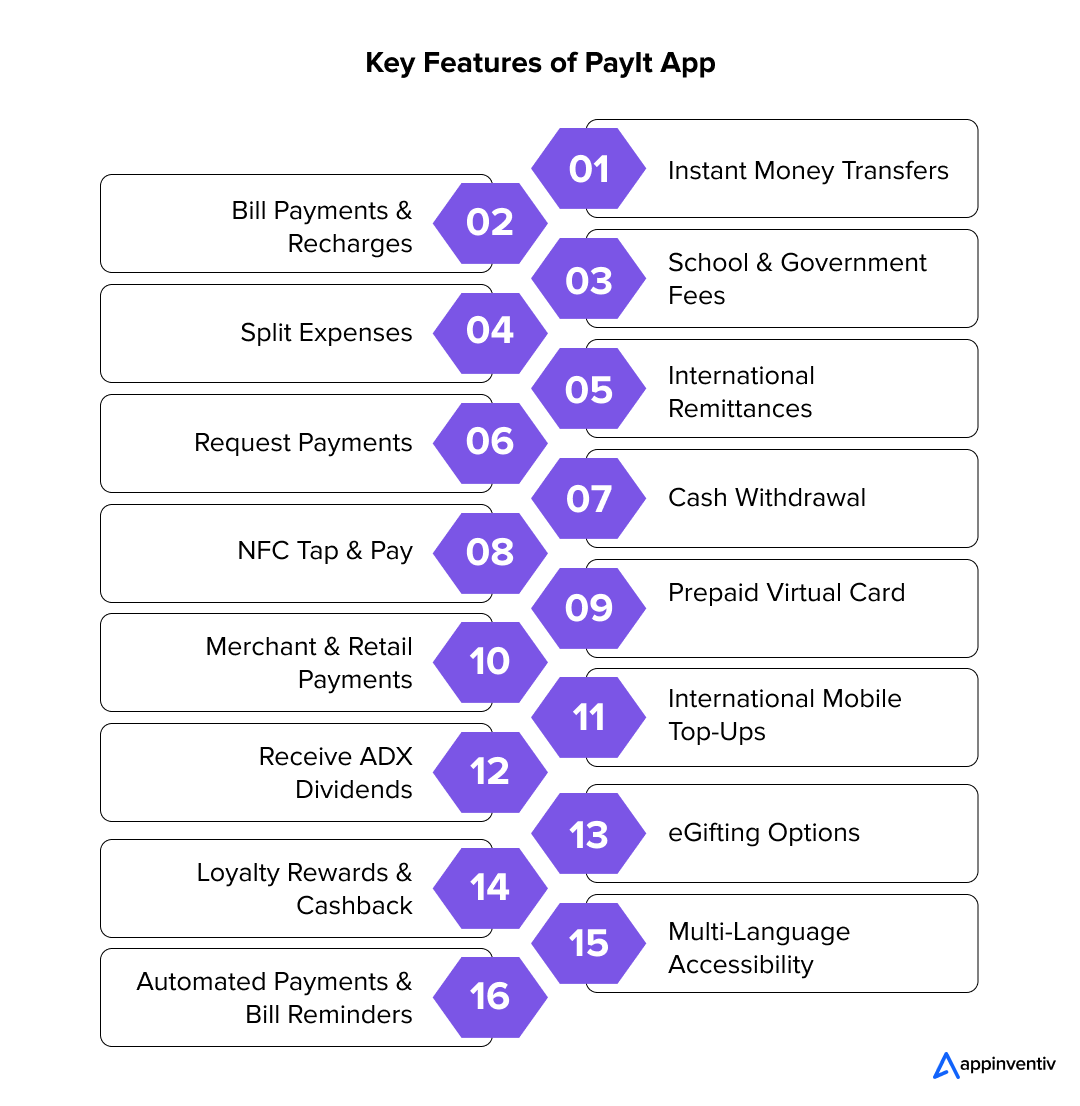

- Top User-Centric Features of a Digital Wallet App Like Payit

- Cost to Build a Digital Wallet App like Payit in the UAE

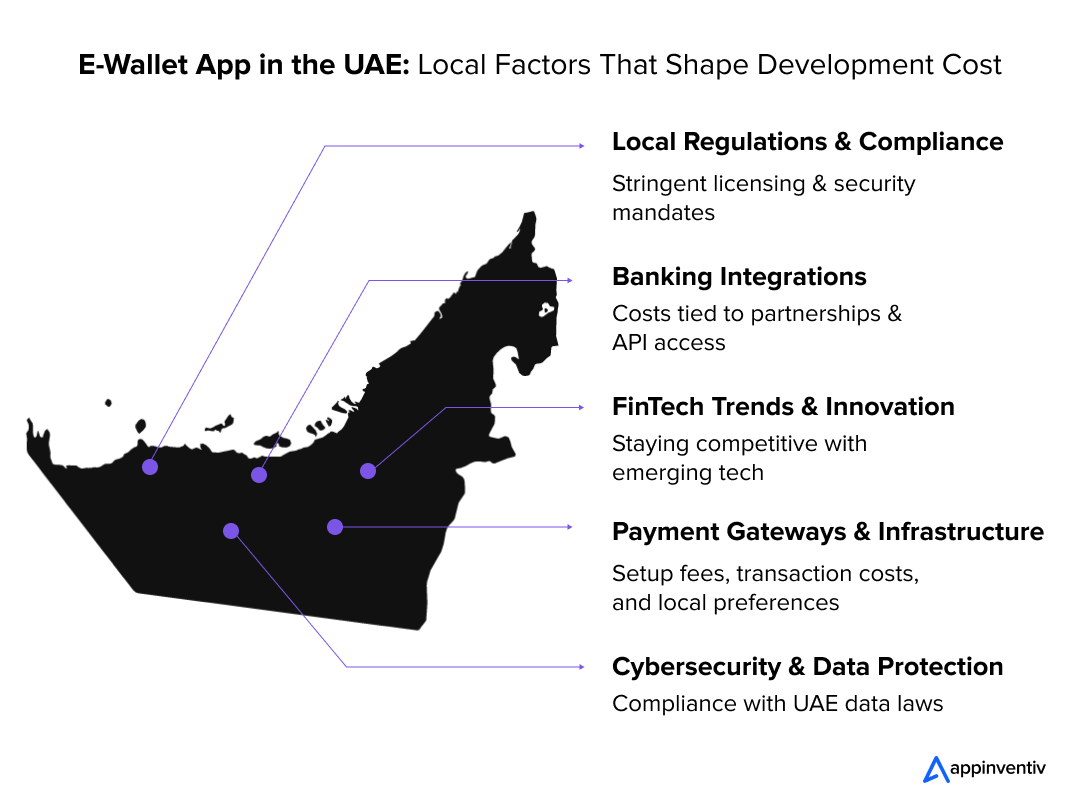

- Factors Affecting e-Wallet App Development Cost in the UAE

- Core Features & Development Costs

- Platform & Tech Stack

- Regulatory Compliance & Licensing

- Security & Fraud Prevention

- Ongoing Maintenance & Scalability

- Hidden App Development Costs of Payit

- App Maintenance

- App Hosting

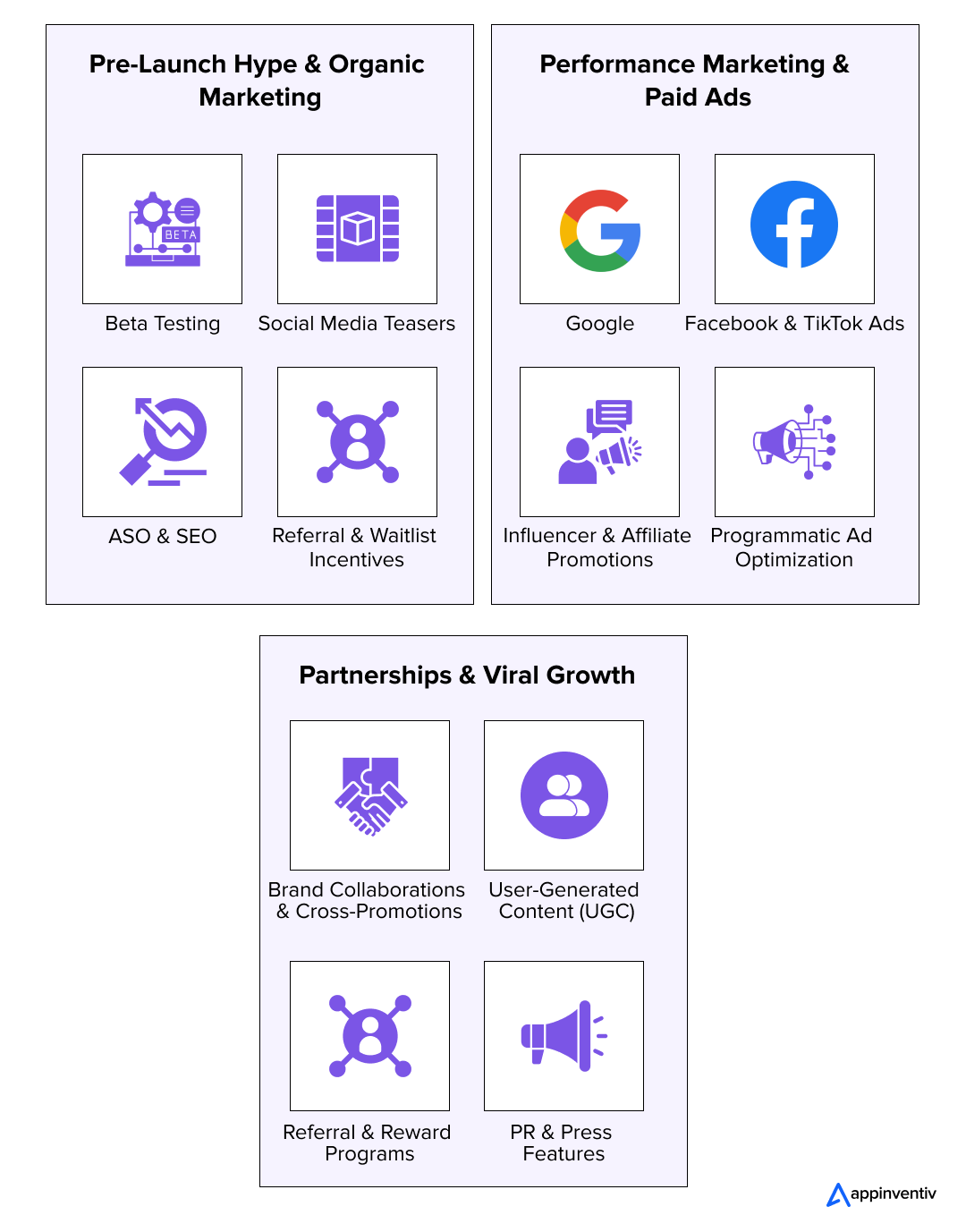

- App Promotion & Marketing

- Legal & Licensing Fees

- Ways to Optimize App Development Costs for a Digital Wallet Like Payit

- Launching an MVP for Quick Market Validation

- Prioritizing Core Payment Functionalities Initially

- Leveraging Cross-Platform Development for Cost Savings

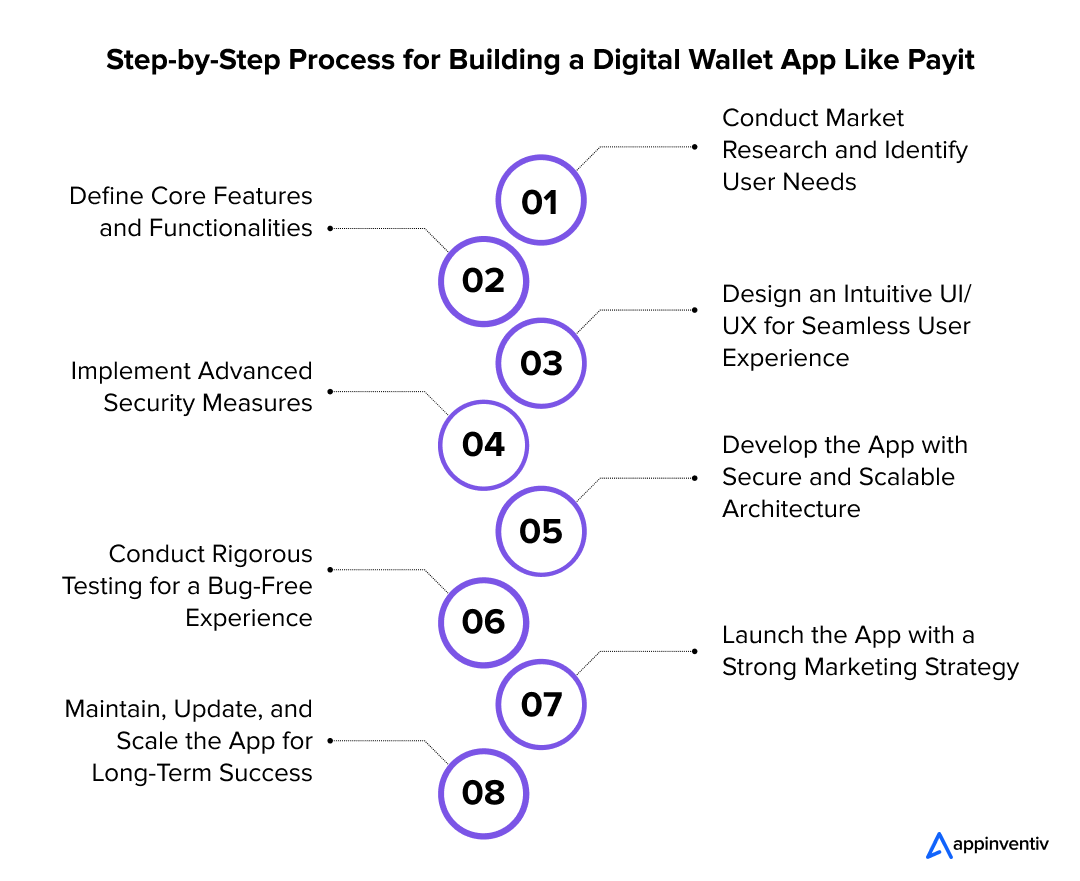

- Steps to Develop a Digital Wallet App Like Payit

- Conduct Market Research and Identify User Needs

- Define Core Features and Functionalities

- Design an Intuitive UI/UX for Seamless User Experience

- Implement Advanced Security Measures

- Develop the App with Secure and Scalable Architecture

- Conduct Rigorous Testing for a Bug-Free Experience

- Launch the App with a Strong Marketing Strategy

- Maintain, Update, and Scale the App for Long-Term Success

- Ways to Build a Superior Digital Wallet App than Payit

- Enhanced UI/UX Design

- Utilization of Advanced Features

- Implementation of Advanced Technologies

- How Payit App Generates Revenue: Key Monetization Strategies

- Transaction Processing Fees

- Government Service Contracts

- Funding & Expansion Strategy

- Value-Added Services (VAS)

- Develop a Seamless Digital Wallet App Inspired by Payit with Appinventiv UAE

- FAQs

- Q. How much does it cost to build an e-wallet app like Payit?

- Q. How long does it take to develop a digital wallet app?

- Q. What should I consider when choosing a digital wallet app development company in the UAE?

- Q. How can I optimize digital wallet app development costs?

Did you know that over 90% of UAE residents use digital payments, with mobile wallets experiencing a 35% year-on-year growth? (Source: Expatica). As cash transactions continue declining, FinTech solutions like Payit by First Abu Dhabi Bank (FAB) drive the country toward a fully cashless economy. With government-backed initiatives like UAE Vision 2031 promoting digital transformation, businesses that fail to embrace mobile payments risk losing relevance in an increasingly digital-first market.

For businesses, investing in a digital wallet isn’t just about convenience—it’s about staying competitive and tapping into a rapidly expanding industry. Consumers today demand fast, secure, and frictionless payment solutions, and a well-designed digital wallet can boost customer retention, increase transaction volume, and open new revenue streams.

So, what is the cost to build a digital wallet app like Payit in the UAE?

The cost specifically ranges from AED 90,000 to AED 550,000 ($50,000 to $300,000), depending on several factors such as features, security measures, compliance requirements, and development complexity.

In this blog, we will explore:

✅ What is Payit, and how does it work?

✅ What sets it apart from other digital wallets?

✅ Key features of a digital wallet app

✅ Factors influencing development costs

✅ Hidden costs and ways to optimize them

✅ Steps to develop a digital wallet app

✅ Monetization strategies for digital wallet apps

Let’s dive in!

Stay Ahead in the Cashless Revolution – Build Your Digital Wallet Today!

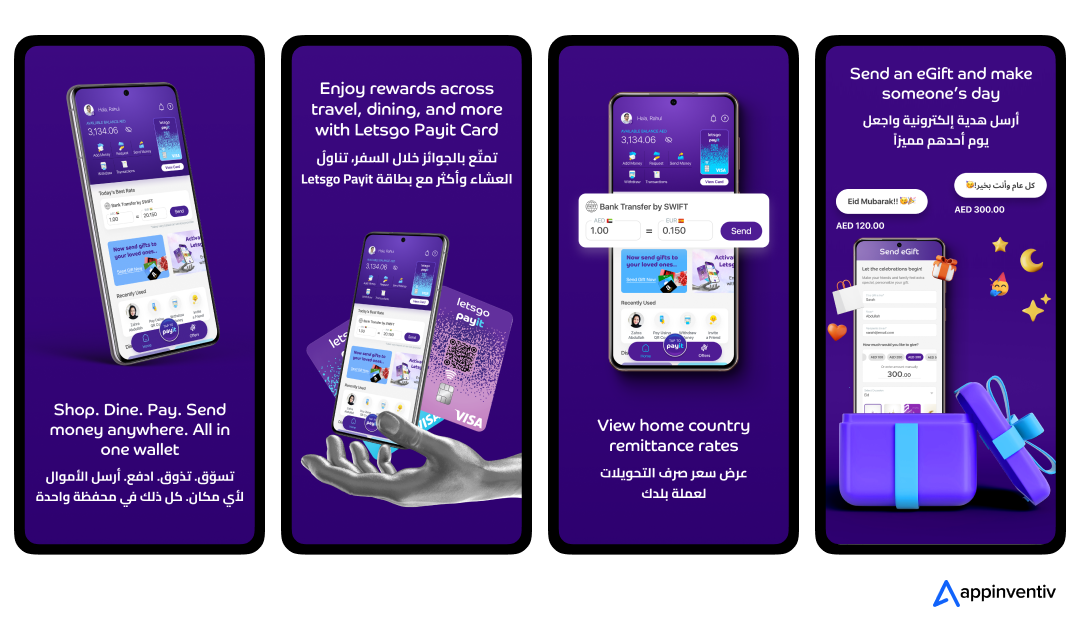

Payit App: How It Works and Why It’s Different from Other Digital Wallets

Payit is a fully digital wallet app launched by First Abu Dhabi Bank (FAB) in the UAE, offering a cashless and card-free way to manage everyday financial transactions. Designed for individuals and businesses, it allows users to send and receive money, pay bills, shop online, make in-store payments via QR codes, and split expenses with friends without needing a traditional bank account. Signing up is quick and hassle-free, requiring an Emirates ID and mobile number, making it accessible to many users, including those without a UAE bank account.

What sets Payit apart from other digital wallets are:

- Its comprehensive range of services and ease of use.

- It supports instant peer-to-peer transfers, international remittances, and government and utility payments.

- It provides a prepaid virtual card for secure online shopping.

- The app also offers cashback, discounts, and promotions, making transactions more rewarding.

With multi-language support, seamless merchant integrations, and a strong focus on financial inclusion, Payit delivers a secure, convenient, and rewarding digital payment experience tailored for UAE residents and businesses.

Top User-Centric Features of a Digital Wallet App Like Payit

Implementing intuitive features is essential in improving the functionality and convenience of digital wallet apps like Payit, enabling seamless and efficient transactions. They provide users with a secure, accessible, and hassle-free way to manage their financial activities. Here are some key features that make Payit a trusted option for digital payments:

1. Instant Money Transfers: Send and receive money effortlessly between Payit users for fast, cashless transactions.

2. Bill Payments & Recharges: Quickly settle utility bills, telecom recharges, and other regular payments within the app.

3. School & Government Fees: Securely pay for educational expenses, government charges, and other service-related fees.

4. Split Expenses: Easily divide bills with friends, family, or colleagues for shared costs like dining or travel.

5. International Remittances: Use trusted remittance partners with competitive exchange rates to send money abroad seamlessly.

6. Request Payments: Generate QR codes or payment links to effortlessly receive money from individuals or businesses.

7. Cash Withdrawal: Access cash by withdrawing money from Payit at partner ATMs and select retail locations.

8. NFC Tap & Pay: Make contactless payments at supported POS terminals for a seamless checkout experience.

9. Prepaid Virtual Card: Securely shop online or subscribe to digital services using a virtual Visa or Mastercard linked to Payit.

10. Merchant & Retail Payments: Pay at partner stores, eCommerce websites, and in-person via QR codes or direct checkout options.

11. International Mobile Top-Ups: Recharge prepaid mobile numbers worldwide directly through the app.

12. Receive ADX Dividends: Investors can collect their Abu Dhabi Securities Exchange (ADX) dividends straight into their Payit wallet.

13. eGifting Options: Send personalized digital gifts as instant money transfers for special occasions.

14. Loyalty Rewards & Cashback: Unlock exclusive offers, cashback deals, and discounts from partner merchants.

15. Multi-Language Accessibility: Designed to cater to the UAE’s diverse population with multi-language support.

16. Automated Payments & Bill Reminders: Schedule recurring payments and receive reminders to avoid missing due dates.

Cost to Build a Digital Wallet App like Payit in the UAE

The cost of developing a digital wallet app like Payit in the UAE typically falls between AED 100,000 and AED 550,000 (approximately $30,000 to $300,000). This covers essential digital wallet app development cost factors such as UI/UX design, backend development, security features, compliance with financial regulations, and third-party API integrations.

The final cost varies depending on the app’s complexity, the technology stack used, and the level of customization required to meet specific business objectives.

However, to estimate the final cost, it is necessary to follow a structured approach. One commonly used formula is:

Total Cost = (Development Hours × Hourly Rate) + 15-20% contingency for unforeseen expenses.

This approach ensures that additional costs, such as security enhancements, scalability improvements, and advanced features like AI-powered fraud detection or blockchain-based transactions, are considered.

Factors Affecting e-Wallet App Development Cost in the UAE

To build a digital wallet app like Payit requires a strategic balance between features, security, and cost efficiency. While initial costs may be high, the long-term benefits of a custom-built, compliant, and scalable digital wallet ensure business success in the UAE’s growing FinTech market. Let’s check out some of the top factors affecting the cost to build a digital wallet app like Payit in the UAE:

Core Features & Development Costs

Core Features & Development Costs

Digital wallet apps require robust features like user registration, KYC verification, fund transfers, QR code payments, and bill payments. Each feature impacts the digital wallet app development cost in the UAE based on complexity, security requirements, and integration needs. Multi-currency support, ML-driven fraud detection, and blockchain-based transactions enhance security and user convenience but increase costs.

Additional features like loyalty rewards, split payments, and virtual cards can differentiate the app from competitors and improve user retention. The more complex and innovative the features, the higher the investment required for development and testing.

Here’s a structured table explaining the total estimated e-wallet app development cost in the UAE:

| App Type | Estimated Cost in AED | Estimated Cost in USD | Key Features |

|---|---|---|---|

Basic Digital Wallet App | AED 100,000 – AED 250,000 | $50,000 – $120,000 | – User registration & KYC verification – Standard fund transfers & QR code payments – Basic UI/UX design – Fundamental security features (encryption, 2FA) – Limited third-party API integrations |

Advanced Digital Wallet (Like Payit) | AED 250,000 – AED 550,000 | $150,000 – $250,000 | – Multi-currency transactions – AI-powered fraud detection – Bill payments, split transactions & virtual cards – Intuitive UI/UX with interactive elements – Regulatory compliance (AML/KYC, PCI DSS) – Enhanced security (biometrics, real-time monitoring) |

Enterprise-Grade Digital Wallet | AED 550,000+ | $300,000+ | – Custom backend for scalability – Blockchain-based secure transactions – AI-driven financial analytics & insights – Cross-border payments & forex support – Cloud infrastructure for global operations – Enterprise-level security & regulatory compliance |

Platform & Tech Stack

Choosing between native (iOS/Android) or cross-platform (Flutter, React Native) significantly affects budget and development time. Native apps provide superior performance, security, and UI/UX optimization but require separate codebases, increasing mobile wallet app development costs in the UAE.

On the other hand, cross-platform development reduces initial costs and speeds up deployment but may need additional fine-tuning to meet UAE FinTech regulations. The backend infrastructure, database architecture, cloud hosting, and payment gateway integrations are crucial in determining the cost of building an e-wallet app in the UAE.

Also Read: How to Hire Cross-Platform App Developers

Regulatory Compliance & Licensing

To ensure financial security and consumer protection, operating a digital wallet in the UAE requires adherence to Central Bank regulations, PCI DSS standards, and AML/KYC laws. Acquiring licenses, implementing multi-layered security protocols, and ensuring data privacy compliance add to the expenses of e-wallet app development in Dubai.

Additionally, businesses may need legal consultations and periodic audits to maintain compliance. Non-compliance can lead to financial penalties, app restrictions, or even suspension, making regulatory adherence a non-negotiable factor in the overall cost to develop an app like Payit.

Security & Fraud Prevention

Since digital wallets deal with highly sensitive financial data, implementing advanced security measures is crucial. Features like biometric authentication (fingerprint, facial recognition), AI-driven fraud detection, end-to-end encryption, and two-factor authentication (2FA) significantly enhance security but increase costs.

Compliance with ISO 27001 and GDPR-like data protection measures ensures secure transactions and prevents data breaches. Fraud detection models based on machine learning and real-time anomaly detection are essential to counter cyber threats and unauthorized access.

Ongoing Maintenance & Scalability

Beyond the initial development, a digital wallet app requires continuous updates, bug fixes, security patches, and compliance adjustments to meet evolving regulations and user expectations. Scaling the app to support more users requires upgrading cloud infrastructure, optimizing databases, and integrating advanced analytics to monitor performance.

Typically, maintenance costs range up to 20% of the initial digital payment app development cost in the UAE annually. Investing in AI-powered automation for customer support (chatbots) and predictive analytics can enhance efficiency while minimizing long-term operational costs.

Hidden App Development Costs of Payit

To create an app like Payit, it is important to consider the unseen expenses. Several hidden costs can arise beyond the initial budget, impacting the overall project expenses. This can significantly affect the overall cost due to the complexities of creating secure, scalable, and user-friendly platforms. Let’s have a look at those.

App Maintenance

Ensuring Payit operates seamlessly requires continuous maintenance, including frequent bug fixes, performance optimizations, and security updates. Regular enhancements help improve user experience and keep up with technological advancements.

Additionally, proactive monitoring is essential to identify and resolve potential system issues before they affect users. Since maintenance is an ongoing process, it adds to the long-term operational cost to develop a digital wallet app like Payit beyond the initial app development.

App Hosting

As a digital wallet handling financial transactions, Payit depends on secure and high-performance cloud hosting services to store user data and process payments. Cloud providers such as AWS, Azure, or Google Cloud charge based on storage, bandwidth usage, and security measures.

| App Hosting Strategies | Benefits |

|---|---|

| Choose the Right Hosting Type |

|

| Freemium Model with Cloud Hosting |

Examples: Canva, Dropbox |

| Ad-Supported Hosting |

Best Ad Platforms: Google AdMob, Facebook Audience Network |

As the app scales with more users and transactions, additional resources are required to maintain efficiency and uptime. The expenses of hosting infrastructure grow proportionally with user engagement and transaction volumes. This increases the overall cost to build a digital wallet app like Payit in the UAE.

App Promotion & Marketing

Payit continuously invests in strategic marketing initiatives to drive adoption and maintain user engagement, including social media promotions, paid advertising campaigns, and influencer partnerships. App Store Optimization (ASO) and search engine optimization (SEO) are crucial for improving visibility and ranking in app stores.

Additionally, promotional offers, referral programs, and customer retention strategies require sustained financial investment. Acquiring and retaining users becomes significantly more challenging without an effective marketing plan.

Legal & Licensing Fees

As a financial service provider in the UAE, Payit must comply with regulatory requirements such as PCI DSS, AML, and KYC to ensure security and legal adherence. Securing and renewing necessary financial licenses involves substantial legal expenses, including regulatory filings and compliance audits.

Regular legal consultations are required to stay aligned with evolving financial laws and prevent potential penalties. These ongoing digital wallet app development costs are crucial for maintaining operational legitimacy and building user trust.

Ways to Optimize App Development Costs for a Digital Wallet Like Payit

Reducing the cost of digital wallet mobile app development in Abu Dhabi without compromising quality requires strategic planning. Let’s look at some effective cost-saving strategies that can help optimize the costs incurred.

Launching an MVP for Quick Market Validation

Building a Minimum Viable Product (MVP) with core digital wallet functionalities, such as secure money transfers, account authentication, and transaction tracking, helps minimize upfront costs. This approach allows real users to interact with the app early, providing valuable feedback before scaling up with advanced features. It ensures an efficient e-wallet app development in Abu Dhabi while validating its viability in the market.

Prioritizing Core Payment Functionalities Initially

Focusing on fundamental digital payment features, such as peer-to-peer transfers, bill payments, and merchant transactions, helps avoid unnecessary costs in making an app like Payit in the initial phase. Instead of adding complex features too soon, concentrating on essential financial services ensures a smooth and reliable user experience. Additional enhancements can be introduced gradually based on customer behavior and demand.

Leveraging Cross-Platform Development for Cost Savings

Utilizing cross-platform frameworks like Flutter or React Native allows for simultaneous deployment on both iOS and Android using a single codebase. This approach significantly reduces the cost of digital wallet app development in Dubai, accelerates time-to-market, and streamlines future updates.

| Optimizing App Development Costs with Cross-Platform Development | |

|---|---|

| Cost Efficiency | The single codebase approach optimizes development costs. |

| Faster Time-to-Market | Shareable code and pre-built UI components accelerate the development process. |

| Consistent Performance | Cross-platform development ensures near-native performance with optimized rendering engines. |

| Streamlined Updates | Single updates for both platforms; OTA updates enable quick deployment. |

| Security & Compliance | Ensures quick encryption, authentication, and regulatory compliance. |

A unified development strategy ensures consistent performance across different devices while maintaining security and compliance with financial regulations.

Steps to Develop a Digital Wallet App Like Payit

The process to develop a digital banking app like Payit involves multiple stages, each crucial for ensuring functionality, security, and user satisfaction. From initial planning to final deployment, every step plays a key role in shaping a successful and competitive app. Let’s have a look at those.

Conduct Market Research and Identify User Needs

Begin with in-depth market research to analyze user preferences, competitor offerings, and emerging trends in the digital payment ecosystem. Understanding customer pain points and expectations helps design a solution that meets market demands.

This step provides valuable insights into the features, user experience, and technological advancements required for a competitive edge. A well-researched approach minimizes risks, ensures higher adoption rates, and improves the app’s chances of success.

Define Core Features and Functionalities

Identify the must-have features such as P2P transactions, bill payments, mobile top-ups, QR code payments, and cross-border remittances. Additional functionalities like AI-driven fraud detection, transaction history insights, and reward programs can enhance user engagement.

Prioritizing features ensures an efficient development process without unnecessary expenses. A well-balanced feature set provides the app meets user needs without over-complicating the experience.

Design an Intuitive UI/UX for Seamless User Experience

A digital wallet app must have a clean, intuitive, and user-friendly interface. The design should prioritize smooth onboarding, easy navigation, and secure transaction flows. Wireframing allows for refining the user experience before moving into full-scale development. A well-designed app enhances user satisfaction and encourages repeat usage.

However, it is also crucial to consider the cost to build an e-wallet app in the UAE while deciding on the intricacies of the UI/UX of the app.

Implement Advanced Security Measures

Security is a top priority for digital payment solutions. Integrate end-to-end encryption, biometric authentication, tokenization, and AI-driven fraud detection to protect user data and transactions. Compliance with financial security standards is essential to build trust and prevent cyber threats. Strong security measures ensure the app remains resilient against fraud and cyberattacks.

However, any advanced security measures can amp up the cost to build an e-wallet app in the UAE, bolstering the safety of the application even more.

Develop the App with Secure and Scalable Architecture

The digital wallet app development phase involves coding the front-end and back-end while ensuring seamless API integrations with banking systems, payment gateways, and third-party services. A well-structured architecture ensures security, scalability, and efficient transaction processing.

Businesses should optimize app performance, implement encryption protocols, and ensure smooth data synchronization. A solid development approach lays the foundation for a reliable and high-performing digital wallet app.

Conduct Rigorous Testing for a Bug-Free Experience

Thorough app testing ensures the app functions flawlessly across different devices, operating systems, and user scenarios. Various testing methods, including functional, security, performance, and usability testing, help identify and resolve bugs before launch.

Load testing ensures the app can handle high transaction volumes, while penetration testing enhances security against cyber threats. A robust testing strategy guarantees a seamless and secure user experience.

Launch the App with a Strong Marketing Strategy

Deploy the app on Google Play or the Apple App Store while adhering to platform-specific policies. A well-planned marketing campaign, including social media promotions, influencer collaborations, referral programs, and digital ads, helps drive user adoption and engagement from day one. A strong launch strategy helps build momentum and attract early adopters.

Maintain, Update, and Scale the App for Long-Term Success

Post-launch, continuous monitoring is essential to identify performance bottlenecks, security vulnerabilities, and user feedback. Regular updates with new features, bug fixes, and compliance upgrades ensure a competitive edge and long-term success in the digital payments. A proactive approach to updates keeps the app relevant and ahead of competitors.

Ways to Build a Superior Digital Wallet App than Payit

To make an app like Payit requires a strategic approach that enhances usability, security, and overall functionality. By identifying gaps in existing solutions and leveraging advanced technologies, you can build a more efficient and customer-centric app. Here’s how you can build a Payit-like app that sets it apart from competitors.

Enhanced UI/UX Design

A well-designed digital wallet should provide users with a seamless, intuitive, and visually appealing interface that enhances accessibility for all demographics. Implementing features like dark mode, voice-assisted commands, and one-tap transactions can significantly improve user engagement.

Ensuring a responsive and adaptive design across various devices enhances the user experience. Additionally, offering customization options, such as personalized dashboards and transaction categories, can create a more user-centric digital payment experience.

Utilization of Advanced Features

To surpass Payit, incorporating AI-powered financial insights, automated budget tracking, and real-time spending analysis can greatly enhance user convenience. Supporting multi-currency transactions with automatic currency conversion will expand the app’s global usability.

Strengthening security with biometric authentication and behavioral fraud detection ensures safer transactions. Moreover, integrating advanced payment methods, such as NFC tap-to-pay, QR code scanning, and voice-activated payments, will provide users with faster and more versatile payment options.

Implementation of Advanced Technologies

Leveraging blockchain technology enhances transaction security and transparency, aligning with the UAE’s push for digital transformation and fraud prevention. AI-driven fraud detection continuously monitors transactions, identifying risks in real-time to ensure secure digital payments.

The cloud-based infrastructure supports high-speed processing and scalability, catering to the growing demand for seamless financial services in the region. Additionally, machine learning enables personalized cashback rewards, predictive financial insights, and tailored recommendations, enhancing user engagement in the UAE’s competitive FinTech landscape.

Build a secure, scalable wallet app like Payit—trusted, feature-rich, and future-ready.

How Payit App Generates Revenue: Key Monetization Strategies

Payit generates revenue by facilitating digital payments for government services. Below are the primary monetization strategies used by the platform, which will also further influence the cost to build a digital wallet app like Payit in the UAE:

Transaction Processing Fees

Payit charges a service or convenience fee on transactions made through its platform. A percentage-based or fixed fee is applied when users pay for government-related services like taxes, permits, and utility bills.

Government Service Contracts

The platform partners with government agencies to digitize payment processing and administrative workflows. Payit earns revenue by providing its SaaS-based solutions, enabling agencies to streamline operations and improve public service efficiency.

Funding & Expansion Strategy

With over $267 million in funding from investors like Macquarie Group and Insight Partners, Payit continues to enhance its platform, expand its services, and strengthen its presence in the digital government payments space.

Value-Added Services (VAS)

Payit provides premium services such as real-time payment analytics, automated compliance reporting, and advanced integrations with legacy systems for an additional fee. These services enhance operational efficiency for government agencies by reducing manual processes and ensuring regulatory compliance.

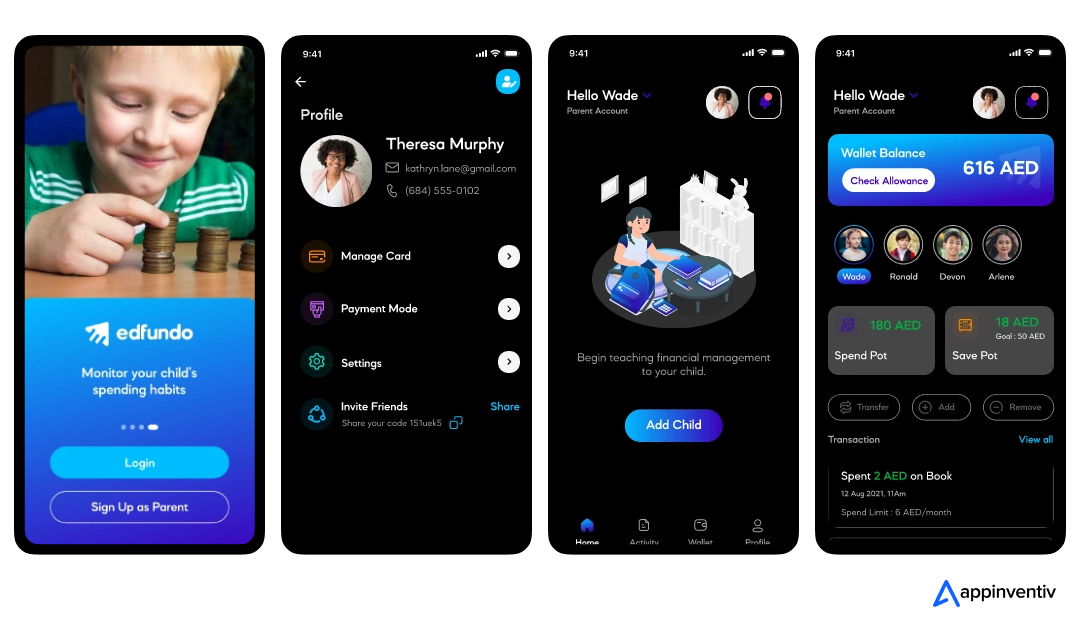

Develop a Seamless Digital Wallet App Inspired by Payit with Appinventiv UAE

The UAE is at the forefront of the digital wallet revolution, driven by government-backed FinTech initiatives, a booming digital economy, and increasing consumer demand for fast, secure, and intelligent payment solutions. As businesses embrace this transformation, the need for AI-powered, compliant, and future-proof digital wallets has never been greater. Appinventiv UAE helps enterprises and startups seize this opportunity by building scalable, secure, and user-centric FinTech applications.

For instance, we collaborated with EdFundo to develop a comprehensive financial literacy app in the UAE featuring personalized learning, real-time goal tracking, and a seamless user experience. The app includes AI-powered spending insights, parental controls, and gamified learning to make money management engaging.

Our efforts resulted in a 40% increase in user retention and a 30% boost in financial confidence, solidifying EdFundo as a trusted financial education platform.

We also built a smart budget management platform called Mudra, empowering users with real-time financial tracking, and an AI-powered banking solution was developed for a global financial institution to enhance digital banking. Additionally, we’ve built P2P lending platforms, DeFi applications, and enterprise-grade FinTech ecosystems for various businesses that successfully reshaped the financial landscape.

If you’re looking to create a market-leading digital wallet app, then trusting a leading mobile apps development company in Dubai, UAE like Appinventiv would be a fruitful decision. With a user-first approach and scalable architecture, we help businesses create innovative, high-performing FinTech applications that drive growth and customer trust.

Contact our FinTech experts to build a highly intuitive and carefully crafted digital wallet app like Payit.

FAQs

Q. How much does it cost to build an e-wallet app like Payit?

A. The cost to build a digital wallet app like Payit in the UAE ranges between AED 90,000 to AED 550,000 ($50,000 to $300,000), depending on features, security, integrations, and compliance. A basic MVP ranges from AED 90,000 to AED 370,000 ($25,000 to $100,000), while a feature-rich solution with AI, blockchain security, and multi-currency support can exceed AED 550,000 ($300,000+).

Additional maintenance, cloud hosting, and compliance updates expenses may add AED 36,700 to AED 183,500 ($10,000 to $50,000) annually.

Q. How long does it take to develop a digital wallet app?

A. The app development timeline depends on the scope and complexity of the app. A basic version (MVP) can be built in 3-6 months, while a fully scalable digital wallet with advanced security features and seamless integrations may take 9-12 months. Additional time for compliance approvals, rigorous testing, and user onboarding enhancements may be required.

Q. What should I consider when choosing a digital wallet app development company in the UAE?

A. When selecting a digital wallet app development company in the UAE, consider:

- Expertise in FinTech and payment solutions tailored to UAE’s market needs

- In-depth knowledge of UAE’s regulatory and compliance standards

- A proven portfolio of successful digital wallet projects

- Technical proficiency in AI, blockchain, cybersecurity, and payment integrations

- A user-centric design approach ensuring seamless scalability and high engagement

- Strong client reviews and a solid track record in delivering secure financial solutions

Q. How can I optimize digital wallet app development costs?

A. To keep in check the cost to build a digital wallet app like Payit in the UAE while meeting the market needs, here’s what you need to consider:

- Building an MVP first: Focus on essential features and expand as demand grows

- Using third-party APIs: Reduce development time and costs by integrating existing payment solutions

- Ensuring early compliance: Adhere to UAE Central Bank regulations from the start to avoid costly revisions

- Partnering with an experienced FinTech development team: Choose a company with expertise in UAE’s financial ecosystem for efficient, scalable solutions

- Optimizing cloud infrastructure: Adopt a modular architecture to enhance performance and facilitate future upgrades

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does It Cost to Build a Crypto Exchange App Like BitOasis in the UAE?

Key takeaways: The cost to build a crypto exchange app in the UAE ranges from $50,000 to $200,000. UAE regulations (VARA and Central Bank) impact development costs due to compliance needs. Advanced features like AI fraud detection increase development costs. The UAE crypto market is expected to grow significantly, offering huge potential. MVP and cross-platform…

How Much Does It Cost to Build An App Like Kayo Sports in Australia?

Key takeaways: Wide Cost Range: Developing a Kayo Sports-like app in Australia can cost between AUD 45,000 (MVP) and over AUD 750,000 for a full-featured, scalable platform. Feature Complexity Impacts Budget: High-end features, such as multi-view streaming, AI personalization, and multi-device support, significantly increase development costs. Ongoing Hidden Costs: Content licensing, cloud infrastructure, compliance, and…

How Much Does It Cost To Build An App in Singapore?

Key takeaways: Mobile app development costs in Singapore range from SGD 40,000 to over SGD 530,000, depending on complexity, platform, and features. Basic apps start at: SGD 40,000. High-end apps using advanced technologies like AI or blockchain can exceed SGD 530,000. Key factors such as platform selection (iOS, Android, Cross-Platform), app complexity (basic, medium, high),…