- What is Embedded Finance for Enterprise?

- How Embedded Finance Partnerships Work

- 1. Digital Platforms – The Customer Frontline

- 2. Financial Institutions – The Regulated Core

- 3. BaaS Providers – The Bridge Between Worlds

- 4. How the Flow Works in Practice

- 5. Partnership Models That Power the Ecosystem

- 6. Drawing the Lines Clearly

- Revolutionizing the Financial Landscape: The Game-Changing Potential of Embedded Finance

- Why is Embedded Finance the Future of Business Growth for Enterprises?

- Influence Growth Trends

- Accelerated Digitalization

- Encouraging Regulatory Environment

- Advancement of Banking as a Service

- Lower Costs

- Growing Consumer Needs

- Key Benefits of Embedded Finance for Enterprises

- Improved Customer Experience

- New Revenue Streams

- Faster Access to Credit

- Increased Customer Retention

- Reduced Operational Costs

- Enhanced Data Insights

- Competitive Advantage

- Key Risks and Considerations in Embedded Finance

- 1. Data Privacy and Security

- 2. The Compliance Burden

- 3. Tech Integration and Reliability

- 4. Brand and Partner Risks

- 5. Operational Complexity

- Embedded Finance for Enterprise Examples

- Embedded Payments

- Embedded Credit

- Embedded Insurance

- Embedded Investments

- Impact Metrics: How Embedded Finance Drives Measurable Results

- 1. Customer Retention and Loyalty

- 2. Higher Lifetime Value (LTV)

- 3. Lower Acquisition and Servicing Costs

- 4. Market Growth Signals the ROI Opportunity

- 5. What These Numbers Mean for Enterprises

- Embedded Finance for Enterprise Use Cases

- Ride Now, Pay Later

- Buy Now, Pay Later

- Insure Seamlessly

- Enterprise Readiness Checklist: Preparing to Launch Embedded Finance

- 1. Evaluate the “Why” Behind Your Move

- 2. Audit Your Data and Infrastructure

- 3. Identify the Right Use Case

- 4. Choose the Right Partner Ecosystem

- 5. Build a Compliance and Governance Framework

- 6. Pilot, Measure, and Scale

- 7. Invest in Communication and Change Management

- 8. Plan for Continuous Optimization

- Future Trends Shaping Embedded Finance for Enterprises

- How can Appinventiv help?

- FAQs

Key Takeaways

- Finance is going where customers already are — inside the apps and tools they use every day.

- Embedded finance turns convenience into ROI, driving higher loyalty, retention, and customer lifetime value.

- Behind every seamless payment lies a network of platforms, banks, and BaaS partners working in sync.

- Compliance and data risks exist, but the right partners turn them into trust and scalability.

- Embedding finance into daily workflows transforms platforms from simple tools into growth engines.

The finance sector is experiencing immense changes with the addition of embedded finance for enterprises. As businesses look to stay ahead of the competition, they integrate financial services into nonfinancial platforms or applications. This practice has recently experienced tremendous growth due to technological advancements and shifts in consumer behavior. Digital transformation has enabled enterprises to provide their customers with a comprehensive one-stop-shop experience by incorporating financial services into existing products or services. This improved ease and convenience makes embedded finance for businesses an appealing solution for companies.

The emergence of embedded finance is transforming lives and businesses around the world. It’s powering a new era of customized, seamless financial services experience integrated with business services and commerce. Most notably, people can now access financial products without ever having to step foot into a traditional bank – all they need to do is log in through their eCommerce or accounting platform.

According to a report the global embedded finance market was estimated at US $146.17 billion in 2025 and is projected to reach US $690.39 billion by 2030, with a compound annual growth rate (CAGR) of 36.4% between 2025 and 2030.

Investors, fintech, banks, payments providers, and software firms have many questions about what embedded finance entails, how to participate, and ultimately – how to win. This article will discuss these topics in detail and provide valuable insight into what it takes to succeed in an embedded-finance revolution.

What is Embedded Finance for Enterprise?

Embedded finance for enterprises is the process of incorporating financial products into digital customer journeys and experiences. This concept has been introduced for a long time, and banks have used private-label credit cards at retail chains, auto loans at dealerships, and sales financing for appliance retailers.

However, the next generation of embedded finance for businesses is so powerful that it’s being integrated into digital interfaces such as shopping carts or accounting software platforms. By embedding embedded financial services into digital products, businesses transform user journeys into complete transactional ecosystems. As a result, customers can now acquire financial services simply as an extension of their nonfinancial journey or experience.

Recent advancements in technology and behavior have enabled the emergence of embedded finance for enterprises. Various forms of digital commerce, software solutions for business management, digitally-native consumers, and open banking mandates have all catalyzed this transformation. This exponential market growth has generated 33% of global card spending is now conducted online (50% in the US).

Small and mid-size enterprises have also seen increased software solutions to manage their businesses. By allowing third parties to access consumers’ banking data and conduct transactions on their behalf, open banking innovation can help create latent demand for embedded finance products.

Superapps are a great example of embedded finance, as they incorporate different financial services into their platform. This provides users with easy access to multiple services in one place and makes their lives simpler and more efficient. WeChat, for instance, is a popular superapp in China with more than one billion users. It went beyond being just a messaging app; WeChat also offers payments, banking, investment options, and insurance – all within the same platform.

How Embedded Finance Partnerships Work

Every smooth “Pay Now” button or instant loan approval hides an entire network of players working quietly in the background. Understanding the roles and responsibilities in embedded finance helps enterprises set clear accountability between banks, BaaS partners, and digital platforms.

As this is never a solo act — it’s a partnership between three core groups: digital platforms, licensed financial institutions, and Banking-as-a-Service (BaaS) providers.

Here’s how they come together to make the magic happen.

1. Digital Platforms – The Customer Frontline

These are the businesses users actually interact with — a SaaS tool, a retail app, or an enterprise marketplace. They own the experience and understand their users’ pain points better than anyone else.

Their job is to make finance invisible. A small business shouldn’t have to leave its accounting dashboard to apply for credit or check payments. The platform handles the journey — the clicks, the design, the communication — while the real financial work happens behind the scenes.

Most platforms aren’t banks, and they don’t want to be. That’s why they rely on partners who handle the licensed side of things.

2. Financial Institutions – The Regulated Core

Banks and NBFCs form the compliant backbone of the system. They bring the licenses, balance sheets, and risk management frameworks that keep everything legal and secure.

They take care of KYC checks, transaction monitoring, and lending compliance. They also carry the ultimate accountability — if something goes wrong with a payment, refund, or loan, the regulator comes to them first.

Think of them as the “anchor tenant” in this ecosystem: steady, regulated, and built to handle scrutiny.

3. BaaS Providers – The Bridge Between Worlds

The middle layer — the one most users never see — belongs to the Banking-as-a-Service provider. They’re the translators who make banks and platforms speak the same language.

They build the APIs, dashboards, and backend plumbing that connect both sides. They handle the heavy lifting of data flow, authentication, and reporting so the platform can focus on the front-end experience.

In short, BaaS providers make it possible for a business that isn’t a bank to act like one — without ever holding a banking license.

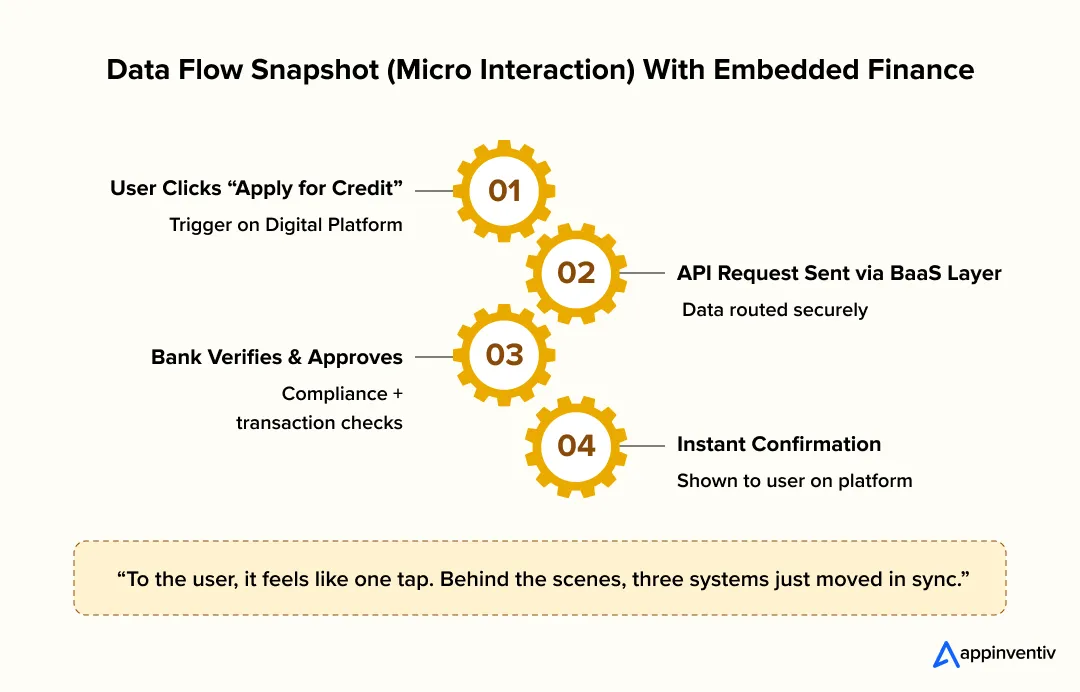

4. How the Flow Works in Practice

Here’s what happens when a customer clicks “Apply for Credit” inside a business platform:

- The request starts on the digital platform.

- The BaaS provider’s API routes that data securely to a financial institution.

- The bank runs checks, approves the transaction, and sends the confirmation back through the same channel.

- The platform updates the user instantly — all in a few seconds.

To the customer, it looks like one smooth experience. But behind that simplicity, three different entities have just collaborated in real time. Different embedded finance operational models define how data, compliance, and revenue sharing are structured.

5. Partnership Models That Power the Ecosystem

Every business can choose how deep it wants to go:

- Simple API model: Quick integration for payments or wallets. The platform uses the BaaS partner’s ready-made modules.

- Co-branded model: The financial product carries both brand names — like “powered by” or “in partnership with.”

- White-label model: The platform runs its own branded financial product, while the bank quietly manages compliance in the background.

Each model changes how revenue is shared, who owns the customer relationship, and how risk is distributed.

6. Drawing the Lines Clearly

In good partnerships, everyone knows their part:

| Function | Digital Platform | BaaS Provider | Financial Institution</th > |

|---|---|---|---|

| Customer Interaction | Full ownership | Backend support | Minimal |

| Compliance | Follows partner protocols | Facilitates data | Holds license |

| Technical Integration | UX + APIs | Builds connectors | Approves systems |

| Risk Handling | Monitors activity | Flags anomalies | Underwrites & reports |

Documenting the roles and responsibilities in embedded finance early prevents compliance confusion and protects brand integrity.

When these roles are defined clearly, things move fast and stay safe. When they aren’t, small mistakes can spiral into big regulatory problems.

The bottom line: Embedded finance works when everyone sticks to what they do best. The platform builds trust with users. The BaaS provider keeps the system connected. The financial institution ensures it’s all above board. When the three move in sync, finance fades into the background — and that’s when it truly works.

Revolutionizing the Financial Landscape: The Game-Changing Potential of Embedded Finance

Current embedded finance trends show that digital integration is reshaping everything from payments to insurance. Leveraging data to refine the value of financial services, this transformative technology could replace or eliminate traditional banks and streamline various complex processes such as international money transfers, vendor payments, and, most significantly, buying insurance and other essential instruments.

According to Grand View Research, the global embedded finance market size was valued at USD 83.32 billion in 2023 and is projected to reach USD 588.49 billion by 2030, growing at a CAGR of 32.8% from 2024 to 2030. This exponential growth reflects the increasing demand for seamless, integrated financial experiences across industries.

The rise of embedded finance is fundamentally changing the way companies and consumers engage with financial products. Instead of relying on traditional banks or external apps, businesses can now offer financial services natively within their own platforms, creating smoother, faster, and more user-friendly customer journeys.

This shift is making financial services more accessible and relevant, directly embedded within the touchpoints where customers already spend their time, whether it’s an eCommerce checkout page, a ride-hailing app, or a small business accounting platform.

The latest embedded financial technologies make it possible to automate transactions, underwriting, and payments securely at scale. As embedded finance becomes mainstream, it’s not just enhancing convenience, it’s setting a new expectation for on-demand financial solutions.

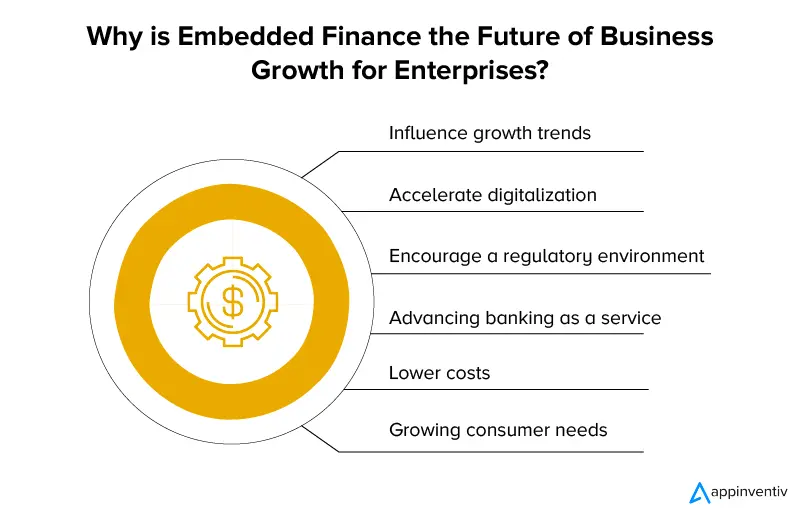

Why is Embedded Finance the Future of Business Growth for Enterprises?

Embedded finance for enterprise plays a crucial role in resolving liquidity issues during these recessionary times. It simplifies obtaining trade credit by making it a natural part of daily business activities. Companies seek to identify and alleviate the primary point for their customers – cash flow management – by incorporating payments and Credit into their automated payable process.

To give one example of enterprise embedded finance strategy, let us suppose a small retail store requires new equipment for its production line. In that case, they can take advantage of embedded financial services to make the payments towards their purchase rather than waiting an extended period while the bank validates a loan. Here are some more use-cases of embedded finance:

Influence Growth Trends

Several forces are pushing embedded finance fintech development in business supply chains. Governments and regulatory bodies are implementing policy initiatives promoting digitalization while banking as a service continues to rise. All these embedded finance in banking trends, taken together, create an environment where embedded finance for businesses can thrive.

Accelerated Digitalization

As organizations look to regain competitive advantage, accelerated digitalization has become a priority. Numerous studies have highlighted a steep increase in the adoption of digital solutions – up to 3-7 years faster than predicted. Companies are investing in technology that enables transformation across core business processes and workflows, from customer experience to supply-chain interactions. With such investments, businesses can increase operational and business agility.

Encouraging Regulatory Environment

Recent efforts by the central regulator and government encourage lenders to go beyond balance sheet-based Credit in providing access to formalized Credit. Due to the lack of available credit data, traditional financial institutions have underserved small and medium enterprises (SMEs).

Innovators of the financial industry are finding creative ways to fill this gap and solve problems like data inequality where alternative sources such as bank accounts, cash flow transactions, invoicing information, social networks, cellular phone records, and psychometrics can be used to assess SMEs’ creditworthiness. Additionally, digitization and growth in digital payments have further facilitated these developments so that liquidity barriers can be eliminated for all businesses and consumers.

Advancement of Banking as a Service

The embedded finance market is quickly moving towards openness and connectivity. Open banking and the development of Banking as a Service (BaaS) are major drivers of embedded finance platforms. Financial institutions now offer BaaS, connecting non-bank companies to their services through application programming interfaces (APIs). For these organizations, BaaS presents a unique opportunity for cost-effective market entry and the potential to earn increased revenue.

[Also Read: How Banking-as-a-Service is enabling financial inclusion for non-bank companies]

Lower Costs

Developing custom software to offer financial services to customers was expensive, so many merchants chose not to pursue it. Not only did they need more resources and knowledge to build out these systems properly, but there were also high upfront implementation costs that caused them to rethink the idea.

Now, however, with embedded finance fintech solutions, companies have access to third-party service providers for API integrations that are much more affordable in comparison. This makes offering their customers banking services easier and more cost-efficient.

Growing Consumer Needs

The continuing rise of embedded finance for enterprises can be attributed to the consumer demand for streamlined customer experiences due in part to the prevalence of financial transactions. This has engendered a new breed of ecosystem companies offering various digital products and services. These firms have become hugely successful and continue to emerge – evidenced by IKEA’s recent 49% acquisition of Ikano Bank – demonstrating that embedded finance remains a key factor in their strategy.

Key Benefits of Embedded Finance for Enterprises

Embedded finance for enterprises is more than just a financial trend—it’s a powerful growth enabler that streamlines processes, boosts customer engagement, and opens up new revenue streams. Let’s explore the key benefits of embedded finance driving its rapid adoption across industries.

Unlocking the Business Advantages of Embedded Finance

- Improved Customer Experience

- New Revenue Streams

- Faster Access to Credit

- Increased Customer Retention

- Reduced Operational Costs

- Enhanced Data Insights

- Competitive Advantage

Improved Customer Experience

Embedded finance makes financial services instantly accessible within the platforms customers already use. This seamless experience eliminates the need to switch apps or visit third-party sites, enhancing convenience and driving customer loyalty.

New Revenue Streams

By offering financial services like payments, credit, or insurance directly within their platforms, businesses can tap into new revenue channels. Companies can earn transaction fees, commissions, or interest spreads while keeping customers within their ecosystem.

Faster Access to Credit

Embedded finance simplifies the credit process by integrating loan and financing options into the customer journey. This allows customers to access financing instantly, improving their purchasing power and reducing delays in decision-making.

Increased Customer Retention

Providing embedded financial services strengthens the customer’s connection to your platform. When payments, financing, and loyalty programs are all accessible in one place, customers are more likely to stay engaged and continue using the service.

Reduced Operational Costs

Thanks to API-based integrations, companies can offer financial services without building expensive in-house systems. This reduces upfront investment and makes it cost-effective to deliver complex financial products.

Enhanced Data Insights

Embedded finance allows businesses to collect and analyze transaction-level customer data. These insights help personalize services, optimize pricing, and tailor financial offerings to better meet customer needs. Leveraging embedded financial technologies also gives enterprises granular data insights for smarter decision-making.

Competitive Advantage

Integrating financial services into your core offering helps differentiate your business from competitors. Enterprises that offer seamless, end-to-end solutions are better positioned to attract, retain, and grow their customer base in an increasingly crowded market.

Key Risks and Considerations in Embedded Finance

Embedded finance sounds effortless when you see it in action — a payment made in one click, a loan approved in seconds, insurance offered right at checkout. Despite its potential, the challenges of embedded finance include compliance overhead, data privacy risks, and integration complexity. For businesses, it’s not just about adding features; it’s about managing risk the way a financial institution would.

Here’s what every enterprise needs to watch out for before diving in:

| Risk Area | What Could Go Wrong | Smart Fix |

|---|---|---|

| 1. Data Privacy & Security | Leaks through APIs or third-party access | Follow GDPR, CCPA, DPDP compliance; encrypt all data; audit regularly |

| 2. Compliance Burden | KYC/AML lapses damage brand reputation | Partner only with licensed institutions and set shared accountability |

| 3. Tech Integration & Reliability | Payment or loan system failure erodes trust | Pilot first, stress-test APIs, prepare fallback systems |

| 4. Brand & Partner Risks | Partner downtime or fraud impacts customer trust | Vet partners for uptime, security, and customer handling |

| 5. Operational Complexity | Fragmented systems cause chaos at scale | Build cross-functional “control tower” for finance, tech, and legal |

1. Data Privacy and Security

Everything runs on data — customer details, transactions, spending habits. And once you bring finance into your platform, you’re handling sensitive information every single day.

The problem? Every extra connection — every API or partner — opens a new door for leaks or misuse.

That’s why enterprises need to treat data protection like part of their brand promise. Follow strict rules under GDPR, CCPA, or India’s DPDP Act, and make data usage crystal clear to customers. People will forgive delays; they won’t forgive broken trust.

2. The Compliance Burden

Banks are built to manage regulations — most tech companies aren’t. But once you embed financial services, you inherit part of that responsibility.

If a partner mishandles KYC, AML checks, or dispute resolution, the damage lands on your brand first.

The fix is simple but non-negotiable: work only with licensed, compliant partners, map out who’s accountable for what, and keep regular audits in place. You can’t outsource reputation.

3. Tech Integration and Reliability

It’s tempting to think of embedded finance as “just another API.” It’s not. When payments fail or balances don’t update, users don’t see a technical glitch — they see a company they can’t rely on.

Before scaling, stress-test everything. Run small pilots. Prepare for outages. Have a backup plan when something breaks. Because it will, and your response will define how trustworthy you look.

4. Brand and Partner Risks

Users don’t separate your platform from the financial service it hosts. If a loan rejection feels unfair or a refund is delayed, you’ll be the one they tag on social media.

Choose your partners carefully. Don’t just look at their API docs — look at how they handle customer complaints, downtime, and data breaches. Your reputation will only ever be as strong as theirs.

5. Operational Complexity

As you scale, things get messy. Multiple APIs, compliance layers, payment gateways — it’s a lot to juggle.

Having a small internal team that connects tech, legal, and finance functions early on can save you chaos later. Think of it as building a control tower before you start flying higher.

Bottom line: Embedded finance can open powerful growth channels, but it also means stepping into a world where small mistakes have big consequences. Managing these challenges of embedded finance demands the same discipline and regulatory rigor as traditional financial institutions.

Embedded Finance for Enterprise Examples

Modern platforms are adopting B2B embedded finance solutions to simplify supplier payments, credit lines, and risk assessment. Here are some of the most common types of embedded finance used in enterprise:

Embedded Payments

Embedded Payments provide the perfect solution for any platform or app that requires seamless payment flow. This financial service was the first to be embedded into nonfinancial product experiences, setting a high standard today; users expect a simple and intuitive payment process with every eCommerce app or SaaS platform they use.

Embedded FinTech payments offer a variety of use cases: video games can facilitate in-game purchases, payroll automation software can automate their operations, educational institutions’ ERPs can benefit from integrated e-wallets and subscription-based payments, and more. Furthermore, many integrated embedded finance Payment systems now allow customers to pay in installments – a feature discussed in the next section.

Embedded Credit

Embedded Credit is a valuable digital financial solution that provides consumers an easy way to take out loans. By incorporating a credit product into nonfinancial digital platforms, customers can apply for, acquire and repay loans immediately instead of needing to leave the platform. An example of this in action is purchasing a kitchen appliance on Amazon with the option to convert it into an EMI during checkout.

Embedded Insurance

Embedded finance for enterprises provides an opportunity to offer third-party insurance solutions with ease. This approach enables companies – like Tesla – to provide auto insurance at the point of sale, either online or in their showrooms. As such, insurance providers have developed embedded financial technologies and APIs that facilitate the integration of insurance solutions into mobile apps, websites, and partner ecosystems.

Companies generally collaborate with external insurers rather than invest significant resources into building comprehensive internal capabilities. However, connecting various traditional insurers can be difficult due to outdated technology stacks. Insurance companies have evolved to overcome this challenge by providing a unified tech stack for easy embedded finance integration.

Embedded Investments

Embedded Investment is a way to integrate stock market investment services into existing platforms. This trend has been led by API-based brokerage firms, which provide microservices such as opening accounts, funding, trading, portfolio management, and market data. Many examples of embedded finance of this Investment are currently available, such as Acorns, which round people’s purchases up and invests the spare change in the stock market.

By using Embedded Investments, investors can manage their investments directly from their platform rather than having to leave to do it. Some companies even allow employees to buy stocks from within their employee portal.

Each of these types of embedded finance serves a unique function depending on the enterprise’s user journey and business model.

Impact Metrics: How Embedded Finance Drives Measurable Results

The real power of embedded finance isn’t just in convenience — it’s in the numbers. Over the past year, the industry has crossed from “emerging trend” to measurable business advantage. The data from various studies makes one thing clear: businesses that invest in a defined enterprise embedded finance strategy see stronger retention and revenue per customer.

1. Customer Retention and Loyalty

Embedded finance makes customers stick around longer.

A report by Solaris Group found that 96% of European businesses plan to roll out embedded banking or payment solutions, mainly to deepen loyalty and reduce churn. When customers can make payments, access credit, or get insurance within the same platform they already use, they’re far less likely to switch providers.

2. Higher Lifetime Value (LTV)

Adding embedded finance features increases what each customer is worth.

SaaS and marketplace platforms offering embedded credit, payments, or insurance see users spending more and engaging more often. Industry estimates for 2025 suggest that platforms integrating financial features see a 2–5 × increase in average revenue per customer, as the platform moves from being a “tool” to being part of the customer’s financial workflow.

3. Lower Acquisition and Servicing Costs

As embedded finance grows, it’s also helping enterprises cut costs where it matters most — acquisition.

With financial services built into everyday platforms, companies no longer have to chase customers across channels. Embedded journeys remove friction, shorten funnels, and drive organic adoption.

Recent analysis from Solaris notes that embedded payment options can reduce acquisition costs by nearly 30%, while increasing the likelihood of repeat transactions by 20–25%.

4. Market Growth Signals the ROI Opportunity

The macro numbers tell the same story at scale.

According to Fintech Futures, the global embedded-finance market is expected to jump from US $146 billion in 2025 to US $690 billion by 2030 — a near 5 × growth in five years.

In the same report it projects a CAGR of 36.4% between 2025 and 2034, driven by enterprise adoption of digital financial services and open-banking APIs.

5. What These Numbers Mean for Enterprises

- +25 % customer retention → deeper loyalty

- 2–5 × LTV → customers spend and engage more

- ≈ 30 % lower CAC → more efficient marketing spend

- 5 × market growth (2025–2030) → strong ROI potential

In short: Embedded finance has moved from buzzword to business driver. The companies embracing it aren’t just modernizing their platforms — they’re rewriting their economics. As 2025 unfolds, the winners will be those who treat embedded finance not as an add-on, but as a growth engine built into the core of their enterprise experience.

Embedded Finance for Enterprise Use Cases

Embedded finance for enterprises has numerous applications, given the prevalence of financial transactions in businesses. Here, we’ll explore the most potent embedded finance use cases in enterprise.

Ride Now, Pay Later

Uber is an excellent example of a company that successfully implemented an embedded finance platform; they’ve revolutionized the taxi industry by digitizing payments, addressing one of the customers’ major pain points.

Their Uber Wallet, Uber Pay, and Uber Cash services are highly successful due to their driver cashback rewards and the ability for passengers to pay for rides later. And they are not alone; procurement and logistics marketplaces are also using B2B embedded finance solutions to enable supplier financing and instant settlements.

Buy Now, Pay Later

Buy Now Pay Later (BNPL) embedded finance models have grown in popularity lately due to their ease of use and accessibility. This payment method allows customers to purchase online or in-store items with minimal interest and monthly installments. Fintech organizations can monetize these transactions by collecting a percentage from merchants’ fees.

An example is Affirm, one of many BNPL providers collaborating with big-name brands such as Walmart and Amazon to offer customers an installment plan with zero-interest rates, depending on the agreement, over a period of 12 months. These B2B embedded finance solutions not only improve liquidity but also build deeper trust across vendor ecosystems.

Insure Seamlessly

The evolution of embedded insurance has been critical in simplifying customer journeys. Thanks to API technology, customers no longer have to engage with dedicated insurance companies or agents when looking for physical or digital coverage. In fact, according to The Evolution of Embedded Finance Report by Salesforce, 35% of general insurance sales are projected to be embedded within five years.

For example, Uber drivers can purchase personal injury and vehicle insurance right through the Uber application; at British Airways, travel cover comes as a package deal when booking your flight. Other industries, such as vehicle rentals, can also benefit from the convenience of embedded insurance — with fewer cart abandonments and higher user satisfaction. These embedded finance use cases in enterprise highlight how financial access can be built directly into customer and supplier journeys.

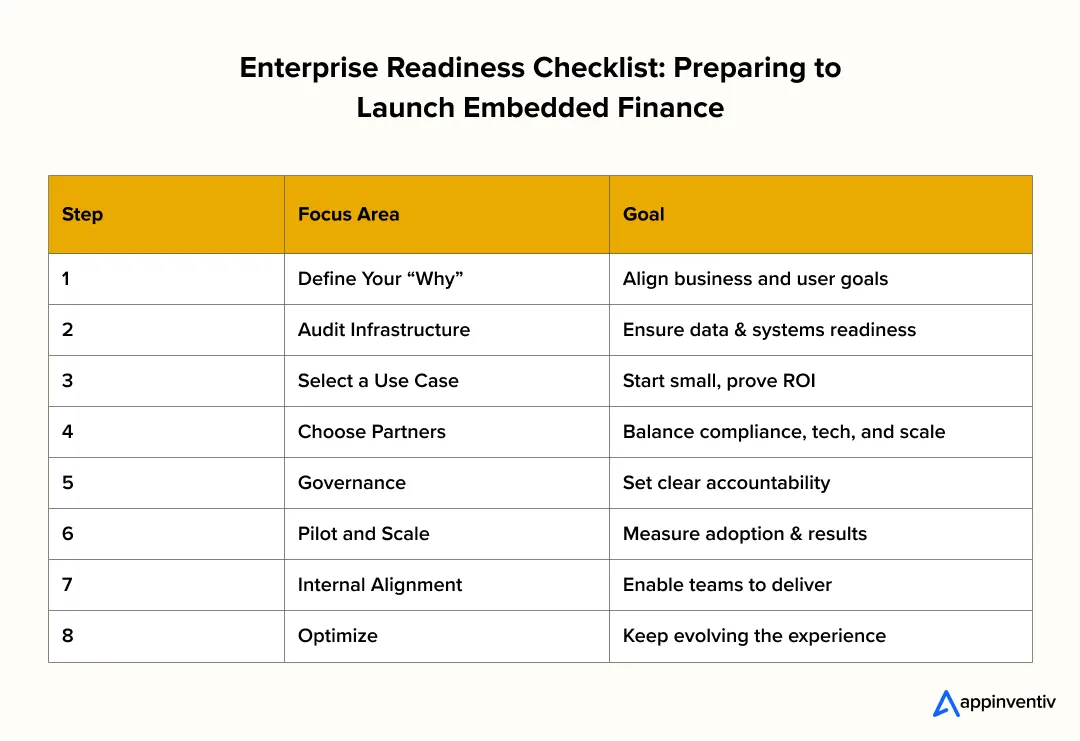

Enterprise Readiness Checklist: Preparing to Launch Embedded Finance

Knowing that embedded finance is the future is one thing. Knowing how to actually implement it inside your business is another.

Building a solid enterprise embedded finance strategy starts with aligning data, partners, and compliance from day one.

Here’s a practical checklist to help you gauge where you stand and what needs to happen before launching your embedded finance initiative.

1. Evaluate the “Why” Behind Your Move

Before you start calling partners or testing APIs, get clear on why you’re embedding finance in the first place.

Ask yourself:

- Is the goal to increase retention or unlock new revenue?

- Are you solving a pain point (like delayed payments or customer drop-offs)?

- Or are you looking to differentiate your product in a competitive market?

Knowing your “why” ensures your financial offering fits naturally into your existing customer experience — not bolted on as a gimmick.

2. Audit Your Data and Infrastructure

One major challenge is integrating embedded finance into legacy systems like CRMs and ERPs without disrupting core workflows. Embedded finance runs on clean, connected data. Before you integrate financial services, check if your current systems can support it.

- Do your CRM, ERP, or billing systems share customer and transaction data in real time?

- Is your API layer ready to connect with third-party partners?

- Are you compliant with data regulations like GDPR, DPDP, or CCPA?

If not, invest in building a secure data infrastructure first — because finance integrations are only as strong as the data they rely on.

3. Identify the Right Use Case

Start small with a pilot before integrating embedded finance into legacy systems enterprise-wide.

Pick one high-impact use case, it can be payments, credit, insurance, or vendor payouts and test it with a small segment of users.

For instance:

- A SaaS company might begin with embedded payments or credit for small business clients.

- A procurement platform might start with supplier financing.

- An ERP vendor might launch embedded payroll or instant vendor payments.

The idea is to launch where finance genuinely improves user experience or operational efficiency, not where it simply sounds trendy.

4. Choose the Right Partner Ecosystem

Partnerships will define your success more than technology will.

You’ll need three reliable players:

- A licensed financial institution (bank, NBFC, or insurer) to ensure compliance and manage risk.

- A Banking-as-a-Service (BaaS) provider to build and maintain the integration layer.

- Internal product and compliance teams who understand both your tech and your customer journey.

When evaluating partners, look for:

- Proven scalability — can they handle enterprise-level volumes?

- Security and regulatory maturity.

- Transparent APIs and documentation.

- Post-integration support — not just onboarding help.

5. Build a Compliance and Governance Framework

Embedded finance blurs lines between industries, which means compliance can’t be an afterthought.

Create a shared governance structure early on. It should clarify:

- Who handles KYC/AML checks.

- How data is stored and shared.

- Who reports to the regulator if something goes wrong.

- How customer disputes are resolved.

This isn’t just about risk mitigation — it’s about trust. Enterprises that handle compliance transparently win long-term customer confidence.

6. Pilot, Measure, and Scale

Don’t go live to everyone on day one.

Run a controlled pilot first — one region, one product, one user group. Track key metrics:

- Adoption rate (how many users try it).

- Retention lift (do they stay longer?).

- Processing time (does it actually save time?).

- Revenue contribution (does it pay for itself?).

Once the data supports your model, scale gradually. Move from one service (say, payments) to adjacent ones (credit or insurance) — building an ecosystem instead of isolated features.

7. Invest in Communication and Change Management

Your customers aren’t the only ones who’ll be learning something new — your internal teams will too.

Train customer support, sales, and product teams to explain and manage the new embedded finance offering confidently.

Internally, position it not as “adding finance” but as enhancing customer experience. When everyone sees the bigger purpose, adoption (and execution) improves.

8. Plan for Continuous Optimization

Embedded finance isn’t a “set-and-forget” initiative. Once live, it needs regular optimization.

Monitor data constantly:

- Which features users actually use.

- Where drop-offs happen.

- What feedback or pain points surface.

This insight helps refine the next version of your product, maybe adding new credit options, smarter underwriting, or personalized insurance. Choosing the right embedded finance operational model determines scalability and compliance alignment during rollout. And the winners in this space are the ones who keep iterating.

Future Trends Shaping Embedded Finance for Enterprises

Leading embedded finance providers are partnering with enterprises to deliver ready-to-deploy BaaS and open-banking capabilities.

If there’s one thing the numbers make clear, it’s that embedded finance isn’t just a trend anymore — it’s becoming the norm. Numbers shared in Fintech Future reports already backs the claim.

And businesses are responding fast. According to Morningstar, 94% of U.S. companies plan to increase their investment in embedded finance this year. They’re not just chasing profits; they’re using finance as a way to build loyalty, simplify customer journeys, and strengthen trust. In today’s world, convenience and personalization have become the real currencies of growth — and embedded finance delivers both.

There’s no denying that the embedded FinTech future holds great promise – not only among providers but also among business leaders and customers alike. Keeping pace with emerging embedded finance trends will define which enterprises stay ahead in this rapidly evolving market.

How can Appinventiv help?

Embedded finance use in business is revolutionizing how companies and lenders conduct business. Digital platforms are transitioning from playing minor roles to becoming major pillars in distributing financial services. As businesses and lenders leverage fintech software development services to adopt embedded finance, they are creating new opportunities for innovation and effectiveness on both sides of the market. Outsourcing these services could give lenders access to a new demographic with more efficient monetization strategies, thus increasing profit margins.

But above all else, consumers have the most to gain from this shift. By digitizing financial services through embedded finance technology, customers can access affordable and tailored services that were once only available under certain conditions or circumstances.

Appinventiv offers top-notch fintech consulting services that can help companies seamlessly integrate enterprise embedded finance strategy into their platforms. Embedded finance for enterprises can streamline your financial operations and take your enterprise to the next level. Contact our experts today to learn more.

It’s an exciting time indeed!

FAQs

Q. What is embedded finance?

A. Embedded finance refers to the integration of financial services such as payments, lending, insurance, and investment options directly into non-financial platforms or applications. It allows users to access financial solutions as part of their regular digital interactions without the need to visit traditional financial institutions or switch between multiple apps. By embedding financial services into everyday platforms, businesses can offer more seamless, convenient, and personalized experiences to their customers.

Q. What Is An Example Of Embedded Finance?

A. Popular embedded finance examples include loan and financing applications that can be integrated into merchant websites at checkout and payment services embedded into social media platforms and messaging apps for easy peer-to-peer embedded finance payments. With embedded finance use in business solutions, users can make purchases or send funds without needing any additional services or websites.

Q. How Does Embedded Finance Differ From Traditional Finance?

A. Embedded finance models are quite distinct from traditional financial models. Instead of the customer directly engaging with financial institutions such as banks, embedded finance services are integrated into existing nonfinancial applications and platforms. Its streamlined and user-friendly structure makes it easy for customers to access financial services without leaving their current context. It can also expand financial inclusion by creating opportunities for underserved or unbanked populations.

Q. What Are The Benefits Of Embedded Finance For Businesses?

A. Embedded finance for enterprises offers a range of advantages as they look to scale and grow. Embedded FinTech allows them to bring financial services into their platforms or apps, generating extra revenue and deeper customer engagement. Additionally, by leveraging customer data insights from financial transactions, enterprises can create unique products and services that meet customers’ needs—helping them build loyalty and retention. In short, embedded finance use in businesses equips them with the tools they need to succeed.

Q. How does embedded finance work?

A. At its core, embedded finance is about bringing financial services to where people already work, shop, or manage their business.

Instead of redirecting users to banks or third-party apps, it lets them handle payments, loans, or insurance right inside their existing platforms — whether that’s an ERP system, marketplace, or SaaS tool.

Behind the scenes, three players make it possible:

- Digital platforms that deliver the front-end experience.

- Banking-as-a-Service (BaaS) providers that connect everything through APIs.

- Licensed financial institutions that ensure compliance and security.

Everyone has clearly defined roles and responsibilities in embedded finance, so money moves safely while the experience feels effortless to the user.

Q. What’s the ROI of implementing embedded finance in a B2B platform?

A. The short answer? It’s substantial.

Enterprises adopting B2B embedded finance solutions often see measurable gains across key metrics:

- Up to 2–5× higher lifetime value (LTV) per customer.

- Roughly 25% improvement in retention as users stay within the same ecosystem.

- Around 30% lower acquisition costs due to fewer drop-offs and faster conversions.

In practical terms, an effective enterprise embedded finance strategy turns financial tools into engagement engines. By keeping transactions inside the platform, you not only increase revenue but also strengthen trust and stickiness among business users.

Q. How does embedded finance impact customer retention and lifetime value in enterprise settings?

A. It changes the relationship completely. When businesses embed payments, credit, or insurance directly into their platform, customers stop seeing it as a separate service — it becomes part of their daily workflow.

That’s why companies using embedded financial technologies often see higher spending, more repeat usage, and stronger loyalty.

The key benefits of embedded finance — ease, speed, and personalization — translate directly into better retention and lifetime value. In short, customers stay longer because the experience simply works better for them.

Q. What regulatory or compliance factors should enterprises consider in embedded finance?

A. Compliance isn’t just paperwork — it’s the foundation of trust. When you start offering financial features, even through partners, you share part of the regulatory responsibility.

Enterprises must follow strict rules around KYC (Know Your Customer), AML (Anti-Money Laundering), and data privacy under frameworks like GDPR or India’s DPDP Act.

The safest path is to work with embedded finance providers and BaaS partners who already hold the required licenses.

Also, define clear roles and responsibilities in embedded finance early — who verifies identities, who stores data, and who handles disputes.

This clarity protects your brand and ensures your embedded finance operational model remains compliant as you scale.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…