- The Growing Threat Landscape

- What is the Underlying Problem of Fraud Detection in Insurance Space?

- How is Technology Helping Solve the Bottlenecks?

- AI and Big Data - The New Fraud Detection Standard

- Predictive Analytics - Staying Ahead of Fraudsters

- What Should be the Implementation Roadmap for Building AI Fraud Detection in Insurance

- Navigating Challenges of AI in Insurance Claim Fraud Detection

- What are the Future Trends in Insurance Fraud Detection?

- What Makes Appinventiv the Right Fraud Detection Partner

- Conclusion

- FAQs

Key takeaways:

- Fraud drains billions each year and AI helps insurers stop the losses faster.

- Traditional fraud checks are slow while adaptive analytics keep pace with modern schemes.

- Real time detection prevents fake claims before payouts are made.

- Predictive scoring reduces fraud losses by up to 40%.

- Smarter systems speed up approvals for genuine customers.

- NLP, blockchain and federated learning are shaping the future of fraud prevention.

Insurance claim fraud detection has long been viewed as a necessary but reactive measure – something insurers do to plug financial leaks. But in today’s market, it’s becoming a strategic differentiator.

The scale of the problem is hard to ignore: According to the FBI, the insurance industry in the US consists of over 7000 companies that collectively received over $1 trillion annually in premiums. The FBI also estimates the total cost of insurance fraud (non-health insurance) to be more than $40 billion annually. For global players like AXA, State Farm, and Aviva, that translates into billions in losses that could have been reinvested into innovation, customer experience, or market expansion.

The real challenge? Fraud detection in insurance claims is no longer just about catching suspicious activity – it’s about staying ahead of increasingly sophisticated schemes. Manual audits, rules-based systems, and outdated software can’t keep pace with fraud rings that adapt in real time. And with the acceleration of digital claims processes, insurers are exposed to entirely new fraud vectors, making it clear that automated insurance claim fraud detection is not optional, it’s critical.

Enter AI fraud detection in insurance and machine learning in insurance fraud detection – two technologies changing the game by moving fraud prevention from “cleaning up after the fact” to staying one step ahead. When insurance fraud analytics is combined with fraud detection analytics in insurance, patterns start to appear that might otherwise stay hidden. Odd claim activity can be flagged before a payout is even processed, and, in some cases, the system can spot warning signs of fraud before the attempt is fully in motion.

The impact isn’t theoretical. Insurers that have leaned into AI-powered insurance fraud detection are already reporting noticeable wins: losses cut down, claims getting cleared in record time, and a bump in customer trust because honest claims aren’t stuck in limbo.

For CXOs, the question has shifted. It’s no longer “Should we explore AI?” but “How quickly can we implement it?” The rest of this article will explore proven machine learning techniques for insurance claim fraud detection, the role of data analytics in insurance fraud detection, and practical steps to implement AI fraud detection in insurance – along with case studies, emerging trends, and the measurable benefits of AI & big data in detecting insurance fraud that make it a boardroom priority.

The Growing Threat Landscape

If you still picture insurance fraud as a handful of opportunists padding claims, think again. Fraud is a structural problem that now exacts a multi-billion dollar toll on the economy: the Coalition Against Insurance Fraud estimates losses in the United States of roughly $308 billion every year. At the same time, industry bodies estimate that roughly 10% of property-casualty claims can contain some element of fraud, a percentage that translates into meaningful erosion of margins and rising premiums for honest customers.

What makes the threat more dangerous today is how fraud has evolved alongside digitization. Criminals use synthetic identities, forged documentation and automated channels to scale attacks and camouflage them among millions of legitimate transactions – techniques described in recent analyses of synthetic-identity and digital-fraud trends.

That evolution exposes a set of persistent challenges faced in insurance claim fraud detection: massive and noisy datasets; fraud patterns that adapt faster than static rules; and detection needs that cross claims, underwriting and customer-onboarding systems. Analysts and consultancies are clear that legacy, rules-based controls and manual review workflows are simply not enough – insurers must move to analytics and AI that detect subtle, emerging signals across large data flows.

Finally, the scale problem makes manual approaches painfully inefficient. Investigative resources are finite, and labor-intensive reviews slow settlements and add operational cost; meanwhile, bad actors iterate quickly, exploiting gaps between business lines and exploiting identity and data weaknesses that standard checks miss. Recent industry studies underline that addressing fraud today requires consolidated identity intelligence, cross-channel telemetry, and automated analytics capable of both flagging and prioritizing cases for investigation.

What is the Underlying Problem of Fraud Detection in Insurance Space?

At its heart, fraud detection in insurance claims is about spotting and stopping false or inflated claims before any money leaves the insurer’s hands. In theory, the mission is simple – block fraud, safeguard revenue, but in practice, it’s a lot messier. Fraud takes many shapes: staged car crashes, altered medical files, padded repair estimates, or even made-up policyholders. Each blends in just enough with legitimate claims to make detection tricky without the right mix of tools and expertise.

For years, insurers have leaned on tried-and-tested methods & techniques of insurance fraud detection, such as:

- Manual audits – carefully checking claims one by one to find inconsistencies in paperwork, timelines, or policy details.

- Rules-based systems – setting predefined triggers, like unusually high claim amounts or suspicious timing, to flag cases for further review.

- Red-flag checks – applying industry-known warning signs, like repeated claims from the same customer or mismatched witness statements.

For years, the Methods & Techniques of Insurance Fraud Detection we’ve known – manual checks, rigid rules, and those familiar red-flag lists did their job well enough. But lately, the cracks have started showing. Manual reviews tend to drag on for days, sometimes weeks, burning through staff hours and still missing things. Moreover, rules-based systems have become too easy to crack, leading to a situation where the red flags everyone relies on trip over an honest claimant while real threats slip away.

Meanwhile, the people on the other side are also not standing still. Some of these networks are running like international businesses – sharing stolen data, swapping playbooks, and using tech that’s just as sophisticated as anything in a legitimate claims department. They’ll stage an accident in one country, process it through a contact in another, and cash out before the paperwork even hits someone’s desk.

For fighting that insurers will have to move toward adaptive, intelligence-driven tools for fraud detection in insurance claims – systems that learn, anticipate, and respond, whether that’s through AI, predictive analytics, or a blend of both.

Also Read: How AI Agents Are Revolutionizing Fraud Detection in Financial Services

How is Technology Helping Solve the Bottlenecks?

The contest between insurers and fraudsters has never been more intense. Manual processes and rigid rules once acted as the industry’s shield, but those defenses are now paper-thin against the complexity of modern schemes. In this environment, automated insurance claim fraud detection has stepped forward as more than just a tool, it’s a strategic shift.

Rather than waiting for a suspicious claim to crawl through an investigator’s desk, these systems work continuously in the background, scanning vast streams of data so that questionable activity surfaces almost instantly. Stopping a false payout before it happens is no longer a rare win, it’s becoming standard practice for those who deploy it well.

At the heart of this change sits machine learning in financial fraud detection. Unlike static pre-decided rules, these models look for obvious red flags and also dig into the historical claims data, unusual spikes in activities, and even notice if a repair shop is submitting similar invoices across multiple policies. Through this, over time, the system becomes sharper at recognizing the difference in subtle signs of fraud and the harmless acts of legitimate customers. This feedback loop also leads to significantly less false alarms and focused investigations, saving both time and money.

[Also Read: Financial Fraud Detection Using Machine Learning: A Comprehensive Guide]

Layered over this is the discipline of Insurance fraud analytics. Think of it as the methodical side of fraud prevention, the number crunching, the predictive modelling, the visual mapping of patterns that might otherwise be missed.

In practice, fraud detection analytics in insurance can reveal that a claimant has filed three similar losses in two years, or that repair estimates far exceed regional averages. It can even confirm whether the timestamp and GPS data in an accident photo align with the details in the claim. These aren’t just interesting insights; they’re the breadcrumbs that lead straight to fraudulent intent.

The role of data analytics in insurance fraud detection has only grown in a market where a lot of information is digital. Claims records, customer emails, call transcripts, social media clues, and even IoT data from connected vehicles or home devices can be collated in one single view, which when analysed, the unified picture doesn’t just point out things that are suspicious, it also tells investigators where to focus first, ensuring that resources are used where they matter most. A real-world example: an auto insurer used analytics to uncover a fraud network tied to staged accidents, boosting subrogation recovery by $1 million in just one month – and reaching $12 million within six months.

For CXOs, the strategic value of a technology specialising in fraud detection in insurance claims is clear: it delivers faster decisions, reduces operational costs, and provides a scalable defense against increasingly organized fraud networks – all while enhancing the customer experience for legitimate claimants.

AI and Big Data – The New Fraud Detection Standard

Across the insurance world, AI fraud detection in insurance is moving from an experimental tool to an everyday necessity. Claims teams now have access to technologies that not only speed up the review process but also catch things a human eye might miss.

For example, NLP can help them read through claim documents in seconds, highlighting any unusual phrases, inconsistent timelines, or suspicious medical terminology, while computer vision checks photos and videos for signs of tampering – flagging, like a submitted vehicle damage image being from an online stock library.

Here, NLP works by converting free-text documents into structured tokens, then applying semantic analysis to detect contradictions (e.g., accident time not matching medical treatment notes). Computer vision, on the other hand, uses convolutional neural networks (CNNs) trained on millions of labeled images to distinguish genuine crash damage from stock or AI-generated images, pixel by pixel. Following this, predictive scoring then connects these threads, giving investigators a clear “fraud likelihood” rating before their money leaves the company.

Machine learning techniques for insurance claim fraud detection form the backbone of this change. With supervised learning, models are trained using thousands of past claims – both legitimate and fraudulent, until they can spot patterns on their own. These models rely on labeled datasets, often enhanced by feature engineering, for example, combining claim amount, claimant history, and repair shop frequency into vectors that algorithms like gradient boosting or random forests can evaluate.

Unsupervised learning digs deeper, scanning for anomalies that don’t fit expected behavior. Here, clustering methods such as DBSCAN or k-means can detect outliers, for example, a body shop that files twice as many high-value claims as its peers in the same region.

Deep learning takes it further, combining many data points – claim history, repair shop records, even social media mentions, to uncover fraud that might otherwise slip through. In practice, deep neural networks can correlate unstructured data (images, text, geolocation) with structured claim attributes, revealing fraud rings that might involve multiple actors across different channels.

The benefits of AI & Big Data in detecting insurance fraud are already showing up in quarterly reports: fewer false alarms, more fraudulent cases intercepted early, and measurable cost savings from shorter investigation times.

Plenty of insurers are already reaping the rewards. Ping An, one of China’s largest insurers, uses AI image analysis to verify auto damage and can approve simple claims in minutes. Lemonade, the AI-first insurance company, also runs behavioral analytics with its fraud checks, enabling small claims to be settled instantly while questionable cases go straight to a human-led team. In Lemonade’s case, behavior models capture micro-patterns – such as the time a customer takes to submit answers or whether wording matches known fraud templates – to detect intent beyond the surface data. These examples make one thing clear – AI and big data aren’t replacing investigators; they are making them more effective.

Also Read: AI in Insurance – How is Artificial Intelligence Impacting the Insurance Industry?

Predictive Analytics – Staying Ahead of Fraudsters

In the fight against fraud, reacting after a suspicious claim appears is no longer enough. Predictive analytics for insurance fraud detection flips that approach, spotting potential problems before a payout ever happens. By combining historical claim data, customer profiles, and external datasets such as repair shop performance or regional accident statistics, insurers can generate a fraud risk score the moment a claim is filed. For example, a leading P&C insurer saw a 23% reduction in detected fraud and saved 12.38% in claim costs after deploying predictive analytics.

Typically, these scores are generated by regression or ensemble models that weigh hundreds of variables in real time, for instance, comparing a claimant’s billing codes with regional averages or benchmarking repair times against historical baselines.

This proactive stance means investigators can focus resources on the riskiest cases first. The results speak for themselves: industry studies show that predictive analytics can cut fraudulent payouts by up to 40%, while reducing the time spent on low-risk claims.

In one well-known case, a large US health insurer used predictive modeling to flag suspicious billing patterns from certain clinics. Within the first year, the program saved over $12 million and shortened investigation times by nearly 30%. Similarly, a global insurer using real-time AI scoring – like Progressive, Allstate, and Zurich, saw up to 35% fewer false positives and prevented over $30 million in fraudulent payouts annually.

The return on investment in automated insurance claim fraud detection is clear. The technology doesn’t just spot fraud, it continuously learns. Each closed investigation (whether confirmed fraud or cleared) feeds back into the models, sharpening their accuracy over time. This creates a compounding advantage: the longer the system runs, the harder it becomes for fraudsters to game it.

By embedding predictive analytics into the broader framework of insurance claim fraud detection, companies not only protect revenue but also improve the customer experience – legitimate claims move faster, and policyholders spend less time stuck in red tape. For fraudsters, it’s a tougher environment than ever; for insurers, it’s a decisive advantage.

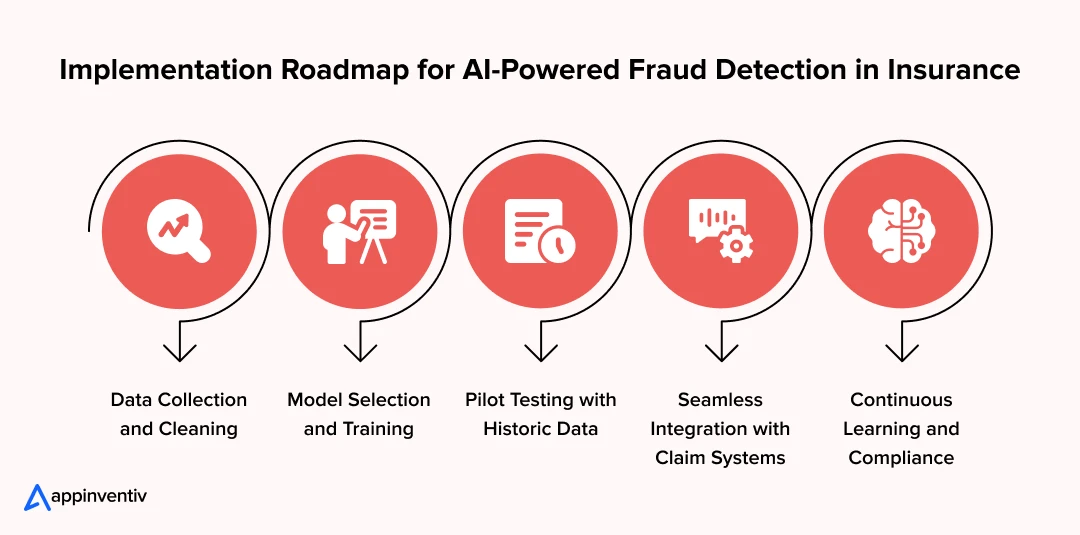

What Should be the Implementation Roadmap for Building AI Fraud Detection in Insurance

Rolling out AI fraud detection in insurance isn’t just about building software, it’s a structured journey that blends technology, data, and compliance into a single, effective system.

1. Data Gathering & Cleaning

The foundation of any insurance fraud detection software development project is data. Insurers need to collect diverse datasets – policyholder records, historical claims, payment histories, and even third-party reports. This data must be cleaned to remove duplicates, errors, and incomplete entries, ensuring that the algorithms work with accurate information from day one.

2. Model Selection & Training

Choosing the correct model would depend heavily on the type of fraud that is being targeted. Supervised learning works well for known fraud patterns, while unsupervised learning detects anomalies that haven’t been flagged before. In more complex cases, deep learning can be incorporated to manage unstructured inputs like images or videos. The training phase of AI fraud detection in insurance uses historic claims to teach the system what fraudulent and legitimate cases look like.

3. Pilot Testing with Historic Data

Before going live, insurers must run the models against the consumer’s past claims to see how accurately they detect fraud. This stage fine-tunes thresholds, minimizes false positives, and ensures the tool aligns with real-world scenarios.

4. Integration with Claim Systems

For insurance claim fraud detection to work seamlessly, AI systems should integrate directly into existing claim management platforms. This would allow real-time scoring, automated flagging, and instant routing of suspicious cases to investigators – without slowing down the process to get legitimate claims.

5. Continuous Learning Loops

Fraud tactics evolve but so should the detection systems. Continuous learning loops can feed newly resolved cases back into the model, thus improving system accuracy over time. Incorporating regular updates here also ensures compliance with regional data privacy and insurance regulations.

Off-the-shelf tools are rarely able to address specific fraud risks of a complex market or even meet generic industry-specific rules. By investing in custom-built insurance fraud analytics software that is designed for the insurer’s workflows and legal requirements, companies can not only strengthen their defense systems but also future-proof the fraud prevention strategy they have built.

Also Read: Fraud Detection Software Development: A Complete Guide

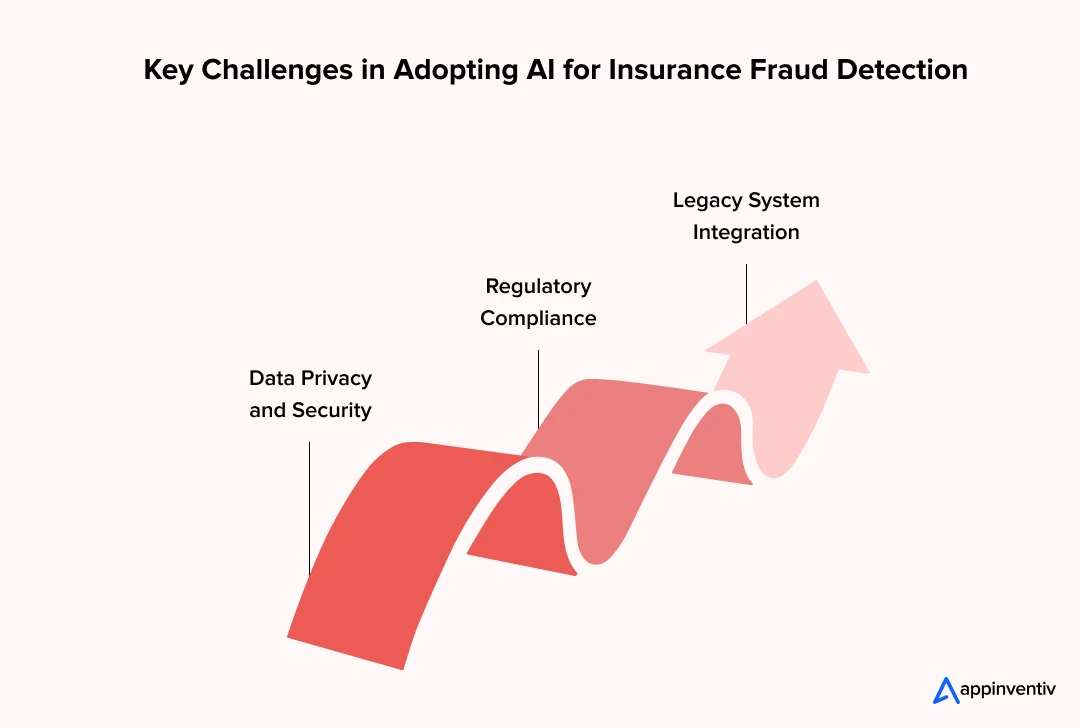

Navigating Challenges of AI in Insurance Claim Fraud Detection

AI can be a powerful tool for spotting fraudulent insurance claims, but getting it right takes more than plugging in an algorithm. There are real-world hurdles that insurers have to consider before they can reap the end-to-end benefits.

1. Data Privacy & Security

Effective fraud detection is highly dependent on rich, detailed datasets. In insurance, however, most of this information is highly confidential – names, health histories, financial details, plus laws like GDPR and HIPAA strictly govern how the data must be stored, processed, and shared. Mishandling them can bring forth hefty penalties and a serious loss of consumer confidence.

How to tackle it: Partner with providers that have shown a track record in secure insurance fraud detection software. Look for the level of encryption they offer at every stage, strength of access controls, and an airtight compliance with relevant privacy regulations.

2. Regulatory Compliance

Every country, and sometimes even each state – has its own insurance rules. A tool that fits one jurisdiction may need major changes to operate legally elsewhere. Falling short here isn’t just a technical setback; it can result in fines or even losing the license to operate.

How to tackle it: Work with AI services and solutions specialists who build compliance into the core system. This means transparent decision-making, built-in audit logs, and a framework that can adapt to local regulations.

3. Legacy System Integration

Many insurers still run claims systems built years before AI became a consideration. Integrating modern fraud detection analytics into these platforms can be tricky, leading to delays or limited automation.

How to tackle it: The right partner can integrate AI tools into existing environments without forcing a costly rebuild, connecting old systems to new intelligence smoothly.

By addressing these issues head-on, insurers can avoid missteps and move speedily toward reliable AI-powered fraud detection.

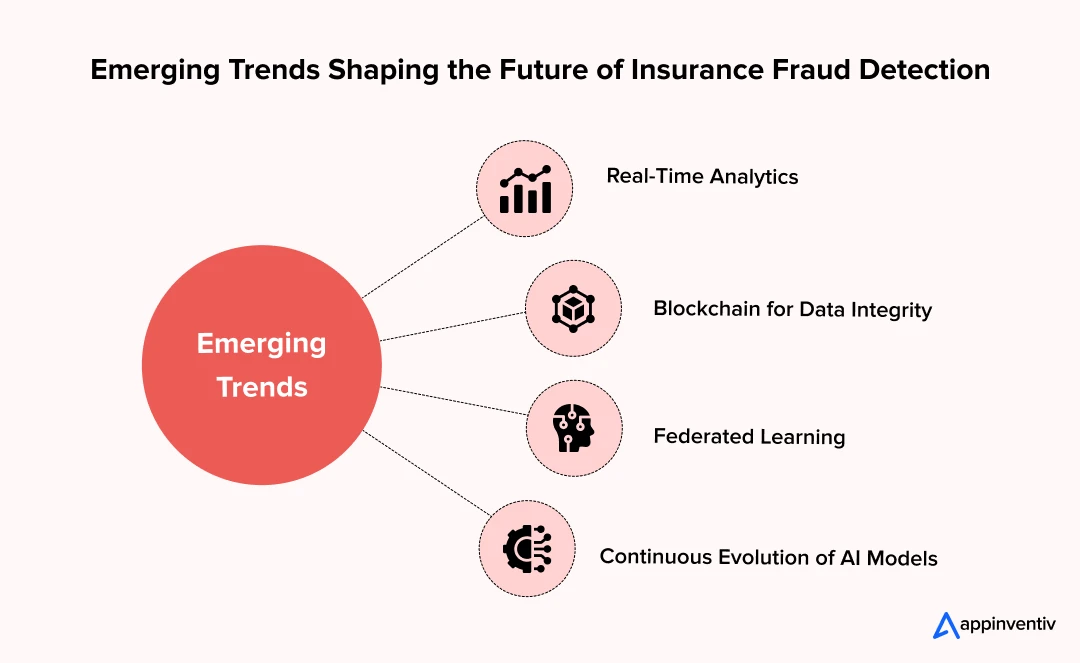

What are the Future Trends in Insurance Fraud Detection?

Insurance fraud is never a static problem, it changes shape almost in the same pace as the tools designed to stop it. In recent years, fraud rings have moved beyond forged papers and staged accidents, leaning on deepfakes, synthetic identities, and AI-generated documents to slip past the older detection systems. That means the technology on the insurer’s side has to move just as quick, if not faster.

1. Real-Time Analytics

Traditionally, many fraud cases were spotted only after a claim had been processed and paid. That’s changing. With AI working alongside streaming analytics, insurers can now flag a suspicious claim while it’s still in the submission phase – cutting losses and speeding up the decision process.

2. Blockchain for Data Integrity

Blockchain in insurance offers a tamper-proof record in every step of the claim handling process. When combined with claim fraud detection tools, it gives adjusters an unalterable audit trail that makes document tampering or backdating practically impossible.

3. Federated Learning

One of the big barriers to stronger fraud analytics is that insurers can’t simply pool all their customer data due to privacy laws. Federated learning sidesteps that problem. It allows companies to train AI models on shared learnings without swapping sensitive personal records, so the whole industry benefits from improved detection accuracy.

4. Continuous Evolution of AI Models

Fraud tactics evolve through small, almost invisible ways. If AI models aren’t updated constantly, they risk falling behind. The next generation of AI-powered insurance fraud detection will focus on algorithms that adapt on the fly, picking up early signs of new schemes before they spread.

The insurers that adopt these tools early won’t just cut down on fraud, they will also be able to process genuine claims faster, keeping customers happier and strengthening their reputation in a crowded market.

What Makes Appinventiv the Right Fraud Detection Partner

Fighting fraud in the modern insurance world takes more than buying a ready-made tool. It requires a partner who understands both the intricate nature of insurance claim fraud detection and the speed at which new threats appear.

At Appinventiv, we combine proven expertise in insurance software development, particularly with advanced AI engineering and a strong focus on compliance with global data protection rules. Our platforms are designed to be effective from day one, yet agile enough to evolve alongside shifting fraud patterns.

Over the last five years, Appinventiv has partnered with more than 07 global insurers, including several enterprise-grade and digital-first insurance startups – delivering fraud detection systems that have collectively prevented over $30M in fraudulent payouts.

Our collaborations with top insurers have enabled us to:

- Build end-to-end fraud detection systems that merges AI, Big Data, and predictive analytics.

- Integrate with current claims workflows to avoid operational-level slowdowns and lags.

- Deploy compliance-ready solutions that meet both regional and international regulations.

- Set up continuous learning processes so detection accuracy keeps improving.

One such deployment for a European health insurer reduced false positives by 28% within six months, while another project with an Asia-based auto insurer cut claim leakage by nearly 18% in the first year.

When insurers choose to partner with us in early phases, they are able to weave in AI-driven fraud prevention directly into their core operations instead of adding it as a quick, but glitchy, fix later – a proactive move that leads to a quicker return on investment, less claim leakage, and a stronger position in an increasingly competitive market.

Beyond deployments, Appinventiv contributes to the Insurtech ecosystem by publishing insights from anonymized fraud detection datasets and working with regulatory bodies to align AI-driven fraud solutions with GDPR, HIPAA, and emerging AI governance standards.

Conclusion

For today’s CXOs in the insurance space, one truth stands out – fraud detection is no longer something to deal with later. The reach, speed, and complexity of modern scams call for equally advanced defenses. Embracing AI-powered insurance claim fraud detection is not just about adopting new tech; it’s about putting in place a strategic safeguard for your revenue, reputation, and customer relationships.

A strong path forward would merge well-structured data practices with custom-built insurance fraud detection software development. With the help of a right setup, insurers can stay ahead of all the fast-changing fraud patterns, work efficiently, and meet strict compliance standards without slowing down their operations speed.

This is the moment to assess how well your current systems protect you and how far AI can push that protection. Taking the first step today can help lay the groundwork for a fraud prevention framework that is engineered to last.

Discover our AI-driven insurance development services and learn how Appinventiv can help you deliver a tailored, compliance-ready platform designed around your business needs. Connect with us.

FAQs

Q. How is insurance fraud detected?

A. A lot of the time, it starts with something feeling “off.” Maybe the claim comes in right after the policy starts, or the story changes each time it’s told. Sometimes the paperwork doesn’t match – dates, names, or even the way a document looks. Investigators also check for repetitions – same person’s name or address being shown up in other fraudulent cases. Basically, it is a mix of instinct, experience, and tech tools that spot red flags.

Q. How can AI & big data help detect and prevent insurance claim fraud?

A. AI runs through years of claim records in seconds, comparing details and looking for anything odd, like a repair bill that’s way higher than normal for that kind of damage. Big data makes sure the AI has enough real-world examples to work from. Together, they can catch things that a human might miss, and do it before the claim is paid.

Q. What are the key elements of insurance claim fraud detection?

A. Key elements of insurance claim fraud detection:

- Solid, reliable information to start with – bad data leads to bad results

- Tools that can spot small changes or unusual activity

- Cross-checking with past cases and outside records

- People who know how to read between the lines and dig deeper when something looks strange

Q. How do insurers know when it’s the right time to invest in AI-driven fraud detection?

A. You usually feel it before you see it on paper. Claims start slipping through, your investigators are buried in false alarms, and customers are frustrated because their valid claims are stuck in review. When the team spends more time sorting noise than catching actual fraud, that’s when most insurers start saying, “Okay, we need smarter tools.” AI steps in right at that pain point.

Q. What should I look for in a fraud detection technology partner?

A. The technology definitely matters, but the partner behind it matters even more. You would want someone who knows your industry rules inside out – compliance, data protection, every part of it. Also, the system has to fit into your existing workflows without slowing everyone down. And one big thing: it shouldn’t just work on today’s fraud tricks, but learn as new patterns pop up. Bottom line – pick a partner who can prove real ROI, not just demo slides.

Q. How quickly can a fraud detection system show results?

A. Depends on your setup, but most insurers I’ve seen notice small wins pretty early – like risky claims being flagged within weeks. Bigger payoffs, like a drop in leakage or faster overall processing, usually show up in a few months. By the end of the first year, if the system’s learning well, you’ll start seeing numbers that justify the investment.

Q. Is AI replacing human investigators in fraud detection?

A. No, and honestly, it shouldn’t. AI is brilliant at crunching through huge piles of claims data and spotting things humans would miss. But it cannot understand intent or context in a way an investigator will be able to. The best way forward would be to use AI to find the right cases fast, and then letting people do what they do best – dig deep, connect the dots, and make the final call.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

AI Fraud Detection in Australia: Use Cases, Compliance Considerations, and Implementation Roadmap

Key takeaways: AI Fraud Detection in Australia is moving from static rule engines to real-time behavioural risk intelligence embedded directly into payment and identity flows. AI for financial fraud detection helps reduce false positives, accelerate response time, and protecting revenue without increasing customer friction. Australian institutions must align AI deployments with APRA CPS 234, ASIC…

Agentic RAG Implementation in Enterprises - Use Cases, Challenges, ROI

Key Highlights Agentic RAG improves decision accuracy while maintaining compliance, governance visibility, and enterprise data traceability. Enterprises deploying AI agents report strong ROI as operational efficiency and knowledge accessibility steadily improve. Hybrid retrieval plus agent reasoning enables scalable AI workflows across complex enterprise systems and datasets. Governance, observability, and security architecture determine whether enterprise AI…

Key takeaways: AI reconciliation for enterprise finance is helping finance teams maintain control despite growing transaction complexity. AI-powered financial reconciliation solutions surfaces mismatches early, improving visibility and reducing close-cycle pressure. Hybrid reconciliation logic combining rules and AI improves accuracy while preserving audit transparency. Real-time financial reconciliation strengthens compliance readiness and reduces manual intervention. Successful adoption…