- The Hidden Cost of Fragmented Mining Finance Systems

- Regulatory and Tax Compliance Requirements Addressed by Mining Accounting Software in Australia

- Why and How Embedded Compliance Supports ROI

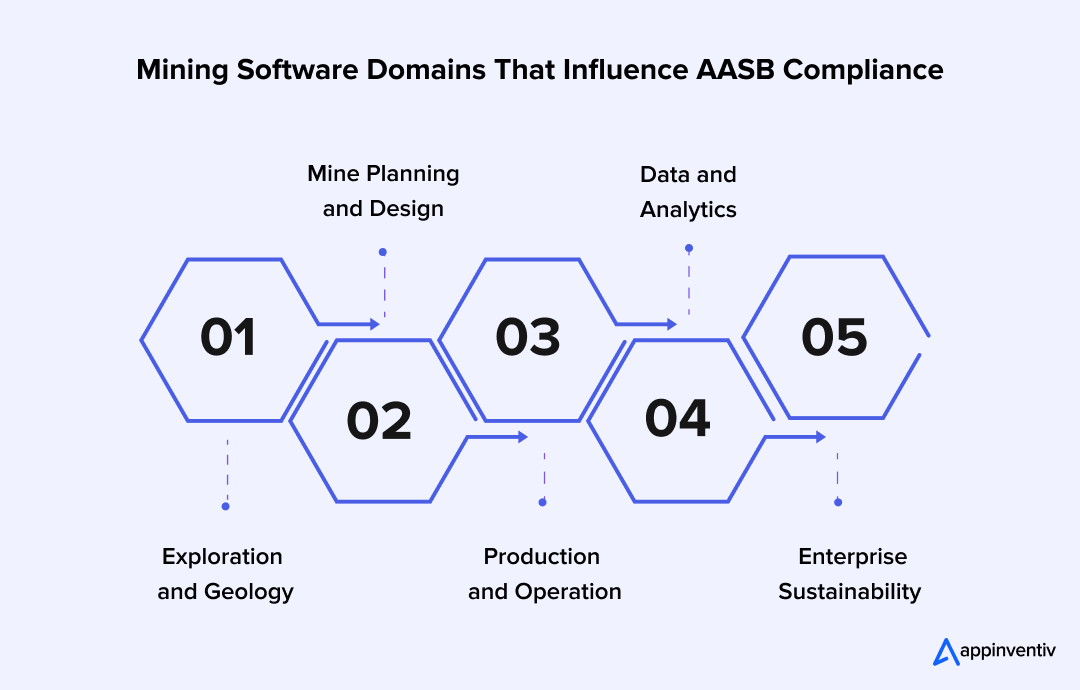

- Mining Software Domains That Directly Influence AASB Compliance and Financial Control

- Exploration and Geology

- Mine Planning and Design

- Production and Operations

- Data and Analytics

- Enterprise Sustainability and Closure

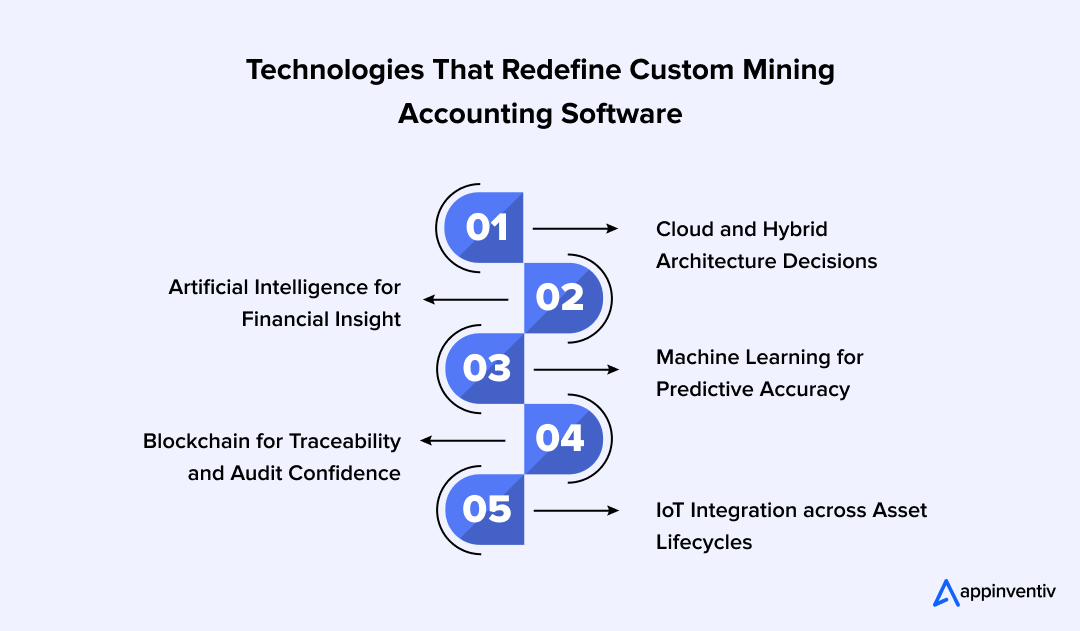

- Core Technologies Shaping Modern Accounting Software Development for Mining in Australia

- Cloud and Hybrid Architecture Decisions

- Artificial Intelligence for Financial Insight

- Machine Learning for Predictive Accuracy

- Blockchain for Traceability and Audit Confidence

- IoT Integration across Asset Lifecycles

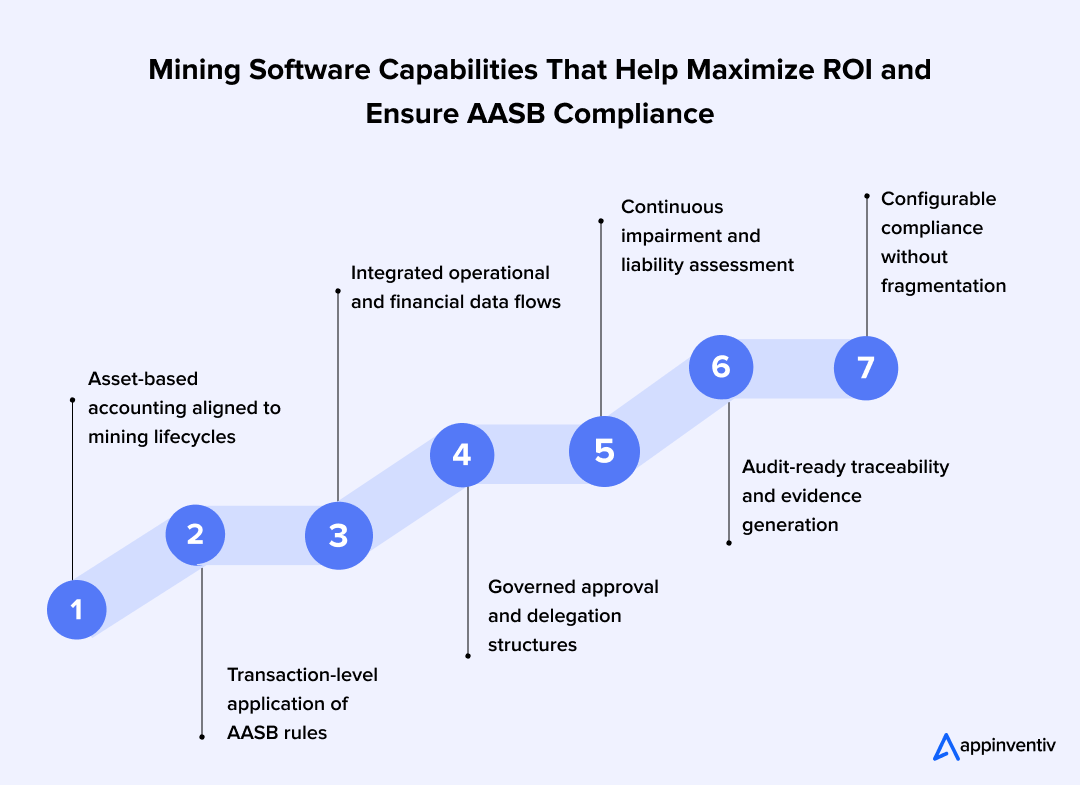

- Accounting Software Capabilities for the Mining Industry That Help Maximize ROI

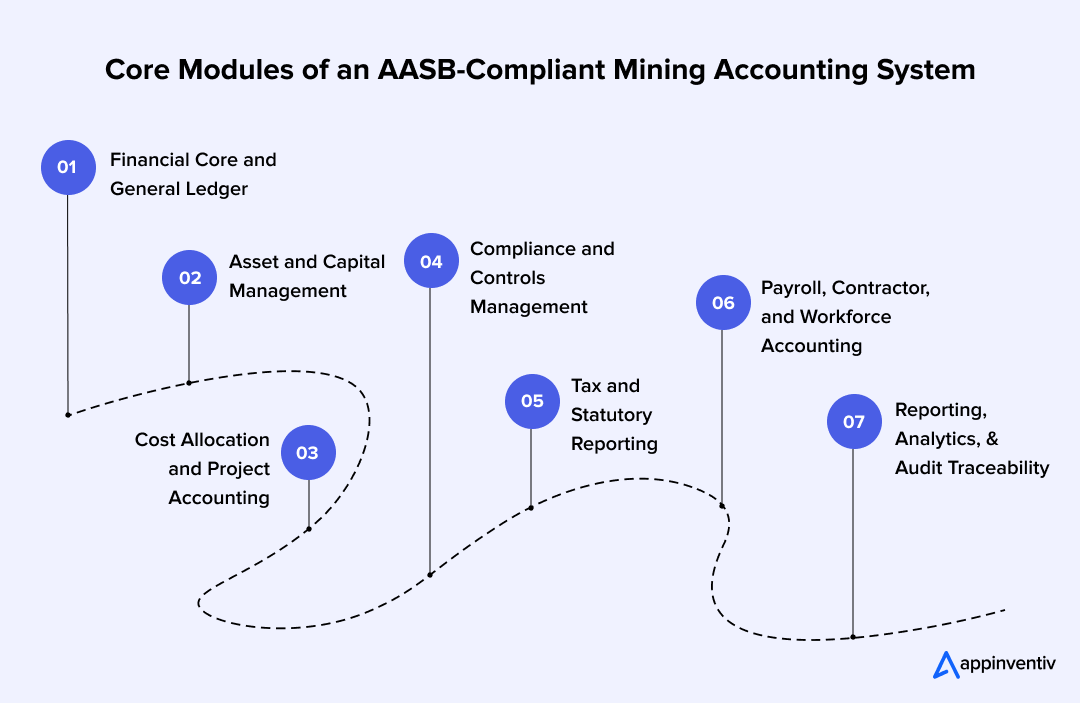

- Core System Modules That Enable AASB-Compliant Mining Accounting

- Financial Core and General Ledger

- Asset and Capital Management

- Cost Allocation and Project Accounting

- Compliance and Controls Management

- Payroll, Contractor, and Workforce Accounting

- Tax and Statutory Reporting

- Reporting, Analytics, and Audit Traceability

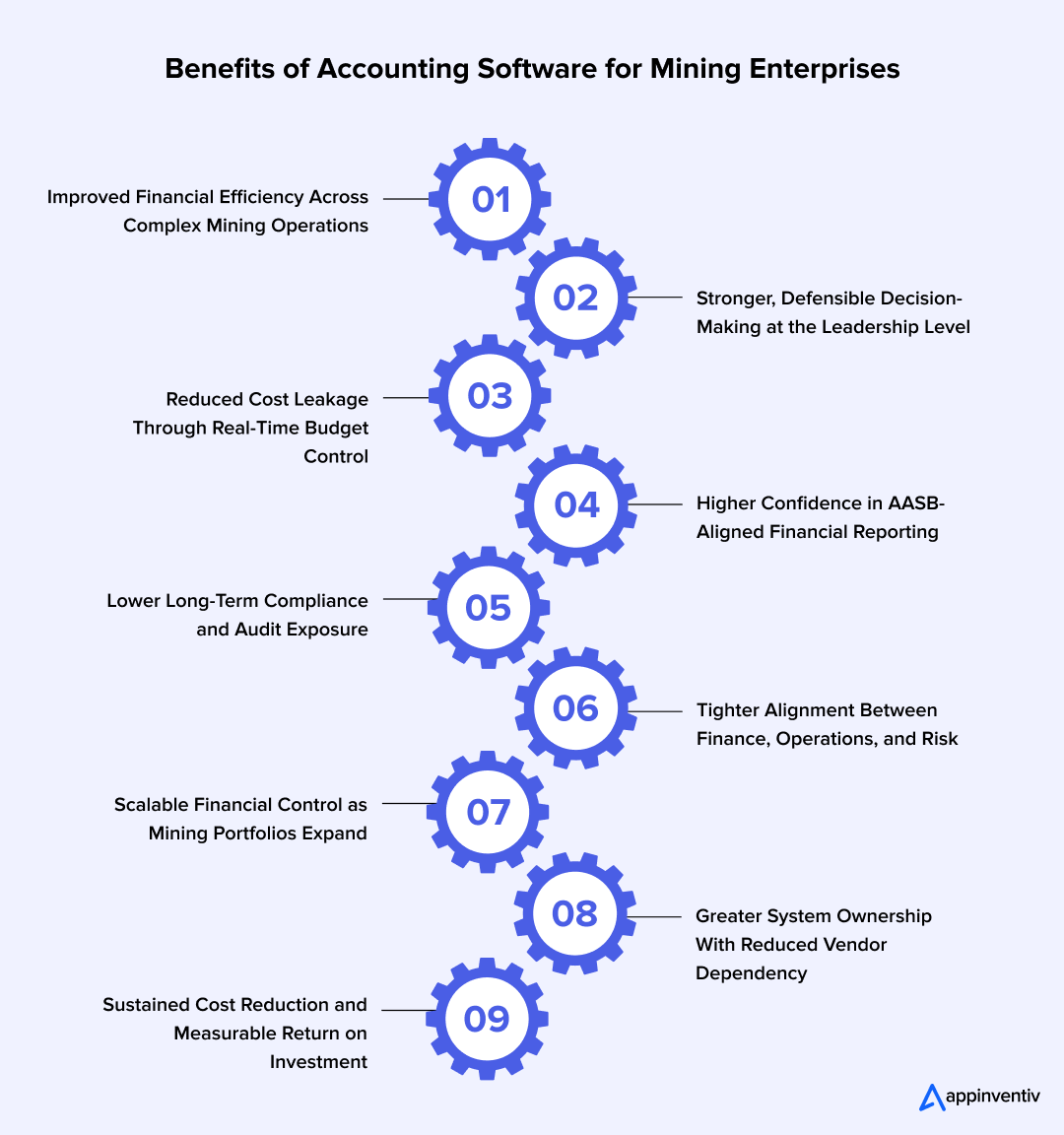

- Key Benefits of Accounting Software for Australian Mining Enterprises

- Improved Financial Efficiency Across Complex Operations

- Stronger, Defensible Decision-Making At Leadership Level

- Reduced Cost Leakage And Tighter Budget Control

- Higher Confidence In Compliance-Regulated Reporting

- Lower Long-Term Compliance And Audit Risk

- Better Alignment Between Finance, Operations, and Risk

- Improved Scalability As Operations Grow or Diversify

- Greater Ownership and Reduced Vendor Dependency

- Cost Reduction and Measurable ROI

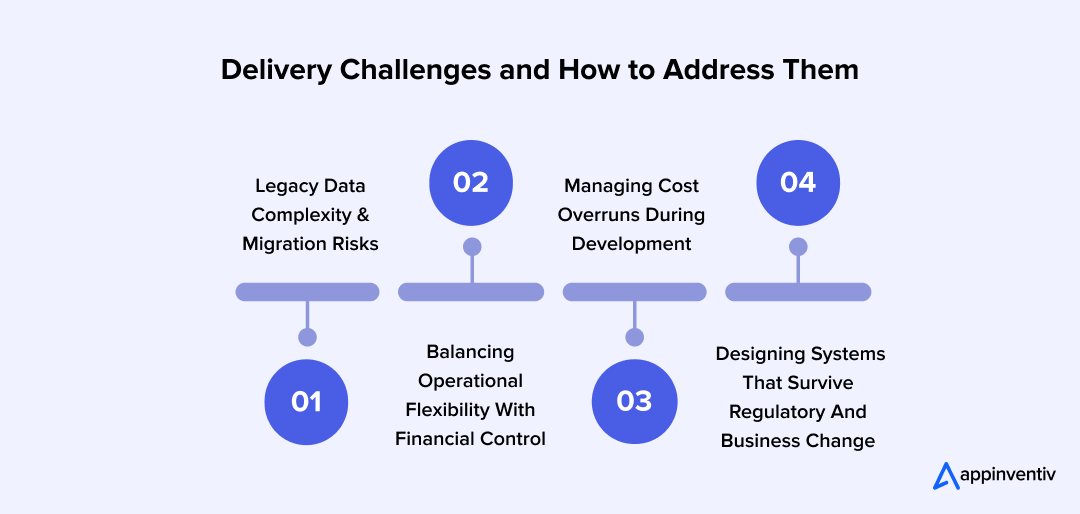

- Common Challenges in Mining Accounting Software Development and How They Are Addressed in Australia

- Legacy Data Complexity and Migration Risk

- Balancing Operational Flexibility With Financial Control

- Managing Cost Overruns During Development

- Designing Systems That Withstand Regulatory And Business Change

- Accounting Software Integration Complexities with Existing Mining Platforms

- How Much Does It Cost to Build Mining Software in Australia?

- What Influences Cost in Australian Mining Projects

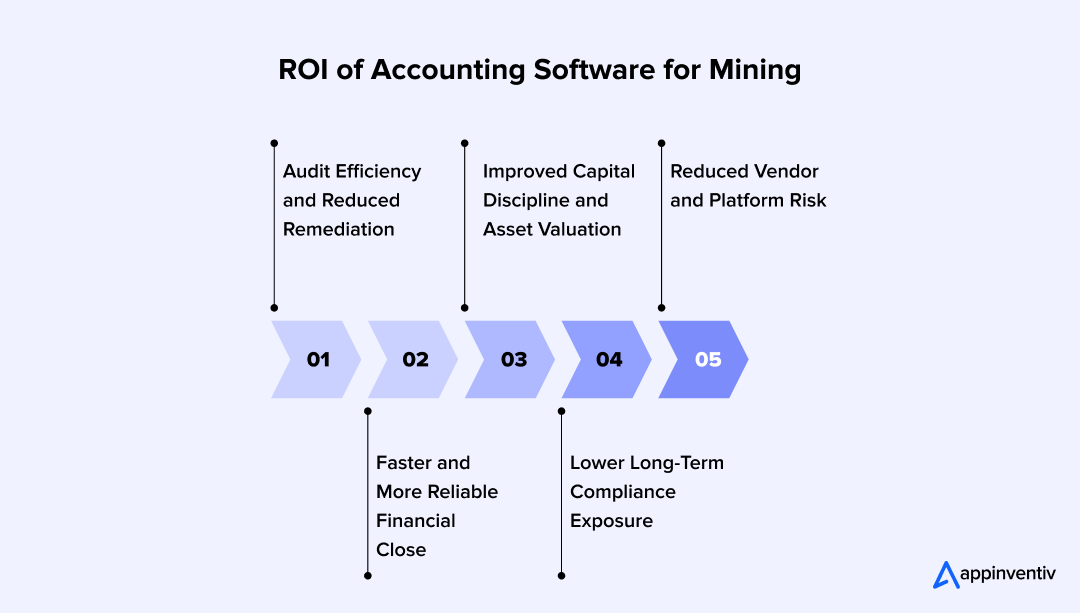

- Evaluating Cost Through An ROI Lens: How Australian Mining Enterprises Measure Real Return

- Audit Efficiency and Reduced Remediation

- Faster and More Reliable Financial Close

- Improved Capital Discipline and Asset Valuation

- Lower Long-Term Compliance Exposure

- Reduced Vendor and Platform Risk

- How Appinventiv Supports Mining Software Initiatives in Australia

- Our Approach for Mining Software Project in Australia

- Our Australian Delivery Footprint and Indicators

- Business Impact Achieved through Governance-Led Delivery

- FAQs

Key takeaways:

- Accounting software in Australian mining is no longer a back-office tool. When built correctly, it becomes core governance infrastructure that enforces AASB compliance at source and reduces long-term financial exposure.

- Asset-centric, modular system design is critical for scalability. Mining accounting platforms must align with long-life assets, evolving mine plans, and regulatory change without forcing costly system rewrites.

- Australian mining enterprises see returns through defensible asset valuation, reduced compliance risk, and lower long-term platform dependency.

- The cost to build an accounting management system for mining in Australia ranges between AUD 70,000 and AUD 700,000 or more.

Australian mining businesses are not struggling because they lack data. They are struggling because the data they rely on was never designed to withstand modern financial scrutiny.

Across iron ore, coal, lithium, and critical minerals, financial teams are required to reconcile figures produced by systems built for operational throughput rather than financial accountability. Production platforms record volumes. Asset systems monitor utilisation. Payroll systems manage complex, site-based workforces. Accounting platforms are then left to consolidate these inputs retrospectively, often under compressed reporting timelines and heightened audit pressure.

This disconnect is no longer sustainable.

As projects scale, joint ventures expand, and capital structures become more complex, the gap between operational reality and financial reporting widens. Businesses encounter the impact first through delayed closes, prolonged audit discussions, and increasing scrutiny around provisioning accuracy and asset valuation.

This is where accounting software development for mining in Australia becomes less about efficiency and more about financial control, risk containment, and compliance adherence. This blog examines how mining management software development in Australia is evolving in response and helps enterprises improve AASB compliance, reduce audit risk, and strengthen ROI.

Assess AASB exposure, system gaps, and long-term ownership risk before committing to development.

The Hidden Cost of Fragmented Mining Finance Systems

Mining leaders often underestimate how quickly financial exposure compounds when systems are not architected together.

- Exploration costs capitalised incorrectly can distort asset values for years.

- Rehabilitation provisions misaligned with operational data create balance sheet volatility.

- Contractor and payroll misclassification across sites introduces tax and compliance risk.

- Delayed cost visibility leads to reactive rather than controlled decision-making.

- ASX/ASIC reporting misalignment leads to inconsistent Mineral Resources and Ore Reserves disclosures, increasing investor risk and regulatory exposure.

These issues rarely trigger immediate failure. They surface during audits, refinancing, acquisitions, or regulatory review. By then, remediation is expensive, time-consuming, and highly visible.

This is why mining software development programs that treat accounting as a downstream function consistently fail to deliver enterprise-grade outcomes.

Accounting software for mining must sit at the core, not the edge.

Regulatory and Tax Compliance Requirements Addressed by Mining Accounting Software in Australia

For Australian mining enterprises, regulatory and tax compliance shapes financial certainty as much as statutory obligation. These requirements influence cash flow timing, asset valuation, audit exposure, and long-term governance risk. Modern mining accounting software embeds compliance logic directly into financial workflows, reducing reliance on manual reconciliation and post-period correction.

When compliance is system-driven, organisations reduce regulatory friction while improving reporting accuracy and financial predictability.

Core Australian compliance areas supported by mining accounting platforms:

| Compliance Area | How Mining Accounting Software Supports Compliance |

|---|---|

| AASB (Australian Accounting Standards Board) | Applies AASB-aligned treatment to capitalisation, depreciation, impairment, rehabilitation provisions, and lease accounting at transaction level, supporting consistent valuation and audit defensibility. |

| GST | Automates correct GST treatment across exploration spend, capital assets, contractor invoices, and inter-entity transactions, reducing adjustment risk during audit and BAS preparation. |

| BAS Reporting | Consolidates GST, PAYG withholding, and related reportable amounts into structured BAS-ready outputs, improving submission accuracy and reducing reconciliation effort each reporting cycle. |

| Superannuation | Aligns superannuation accruals and payments with complex workforce models, including contractors and site-based employees, ensuring accurate liabilities and compliant reporting. |

| Payroll Tax | Tracks payroll exposure across states and operating sites, supporting accurate calculation and reporting in jurisdictions with differing thresholds, rates, and grouping rules. |

| Royalties | Connects production volumes, commodity pricing, and contractual terms directly to royalty calculations, improving accuracy, traceability, and state-based reporting confidence. |

| ASIC (Corporate Reporting & Oversight) | Supports ASIC-aligned financial reporting through consistent asset valuation, impairment recognition, and disclosure-ready audit trails. |

| Mining Rehabilitation & Closure Obligations | Maintains continuous measurement and adjustment of rehabilitation liabilities in line with operational change, supporting consistent disclosure and long-term provisioning accuracy. |

Why and How Embedded Compliance Supports ROI

Regulatory, tax, and accounting obligations represent ongoing operational costs and risks for mining enterprises. When handled manually, they introduce variability into cash-flow forecasting, increase audit remediation effort, and divert finance teams from higher-value analysis.

Mining accounting software that embeds industry-specific compliance into transaction processing stabilises reporting outcomes, reduces rework, and lowers the cumulative cost of compliance over time.

This directly reinforces the core objective of accounting software development for mining in Australia: maximising ROI while maintaining consistent, defensible adherence to regulatory and reporting requirements.

Also Read: How to Develop Risk Management Software in Australia?

Mining Software Domains That Directly Influence AASB Compliance and Financial Control

Mining management software development in Australia spans several operational domains that directly shape how costs, assets, and liabilities are recognised under AASB. When these domains connect into the accounting layer by design, financial control is enforced at source rather than corrected during reporting. The following domains illustrate where mining software most directly influences compliance strength, audit defensibility, and ROI.

Exploration and Geology

Early-stage expenditure decisions influence balance sheets for years. AASB-compliant accounting software distinguishes exploration, evaluation, and development costs, establishes clear transition points, and supports defensible impairment assessments. Weak control at this stage commonly results in audit findings and later financial restatements.

Mine Planning and Design

Long-term mine plans shape asset lives, depreciation profiles, and capital allocation timing under AASB standards. Integrated accounting platforms remain synchronised with evolving mine plans, ensuring depreciation and valuation assumptions reflect operational reality rather than static financial models.

Production and Operations

Accurate financial reporting depends on reliable alignment between production data and accounting. Integration between mining ERP accounting software and finance platforms enables consistent cost-per-tonne calculation, inventory valuation, and site-level profitability reporting aligned with AASB expectations at the executive and audit levels.

Data and Analytics

AASB compliance increasingly relies on forward-looking judgement. Predictive cash-flow analysis, impairment testing, and liability forecasting draw from structured, traceable financial data. Mining accounting software aggregates operational and financial inputs to support defensible assumptions rather than spreadsheet-driven estimates.

Enterprise Sustainability and Closure

Rehabilitation and closure obligations represent material liabilities under AASB. Accounting systems support continuous measurement, adjustment, and disclosure as operational conditions change. Transparent lifecycle tracking reduces provisioning volatility and audit challenge over time.

Core Technologies Shaping Modern Accounting Software Development for Mining in Australia

Technology decisions in mining accounting systems are rarely about novelty. They are about endurance. Systems are expected to operate reliably across asset lifecycles that can exceed twenty or thirty years, while remaining adaptable to regulatory change, operational scale, and evolving reporting expectations. The technologies outlined below show how modern mining accounting platforms sustain financial control, audit defensibility, and scalability across Australian mining environments.

Cloud and Hybrid Architecture Decisions

Cloud adoption in mining accounting centres on operational continuity rather than transformation narratives. Hybrid architectures provide control over latency, data residency, and system resilience while supporting scale across remote and centralised operations. This balance allows financial platforms to evolve without disrupting audit integrity.

Artificial Intelligence for Financial Insight

AI in mining for Australian businesses improves forecasting, anomaly detection, and cost pattern recognition. Without accounting governance, it introduces risk. Mature AASB compliant accounting platforms for mining embed AI outputs into controlled financial workflows rather than standalone dashboards.

Machine Learning for Predictive Accuracy

ML models learn from historical operational and financial data to improve accuracy over time. In accounting systems for mining, this supports more reliable cost projections, maintenance-driven asset valuation, and early warning signals for financial risk.

Blockchain for Traceability and Audit Confidence

Blockchain adds value where transaction integrity and traceability are critical. In mining accounting, it supports joint venture accounting, asset transfers, and long-lived contract validation by providing immutable records that auditors can independently verify.

IoT Integration across Asset Lifecycles

IoT sensor data feeds directly into asset and maintenance records, tightening the link between physical utilisation and financial treatment. When integrated with accounting platforms, this alignment improves depreciation accuracy and lifecycle cost visibility across long-life mining assets.

Selecting the right tech stack used for mining software development is not a technology decision alone. It directly affects audit confidence, upgrade flexibility, and long-term cost of ownership.

Accounting Software Capabilities for the Mining Industry That Help Maximize ROI

In Australian mining environments, accounting software contributes to ROI when it embeds AASB-aligned financial control into daily operations rather than relying on post-period correction. The capabilities below show how modern mining accounting platforms reduce compliance friction while improving financial efficiency and decision confidence.

Asset-based accounting aligned to mining lifecycles

Accounting platforms structure financial treatment around assets rather than generic ledgers. Capitalisation, depreciation, impairment, and rehabilitation provisioning remain aligned with asset lifecycle events, improving valuation accuracy and reducing audit remediation across long-life mining projects.

Transaction-level application of AASB rules

Financial logic applies at the point where costs and revenues enter the system. Exploration expenditure, lease treatment, and cost allocation follow AASB alignment automatically, limiting manual adjustment and shortening reporting cycles.

Integrated operational and financial data flows

Production, maintenance, and workforce data feed directly into accounting records. This integration improves cost-per-tonne accuracy, inventory valuation, and site-level profitability reporting while supporting consistent AASB treatment across assets and locations.

Governed approval and delegation structures

Approval frameworks mirror financial authority and accountability models. Capital movements, provisioning updates, and material adjustments follow controlled workflows, preserving audit traceability and strengthening governance oversight.

Continuous impairment and liability assessment

Asset values and rehabilitation obligations update as operational conditions evolve. This capability supports timely impairment recognition and stabilises balance sheet reporting under volatile market conditions.

Audit-ready traceability and evidence generation

Under this capability, every financial outcome remains traceable to its operational source. System-generated audit trails reduce evidence preparation effort and lower the ongoing cost of compliance.

Configurable compliance without fragmentation

Accounting platforms adapt to regulatory and operational change through governed configuration. This preserves reporting consistency while protecting long-term system ownership and ROI.

While the above listed capabilities explain how accounting software development for mining in Australia delivers measurable ROI, the modules below show how those controls are structured and sustained within the platform.

Core System Modules That Enable AASB-Compliant Mining Accounting

Enterprise mining accounting platforms are typically organised into tightly governed modules rather than broad, generic feature sets. Each module plays a specific role in enforcing compliance, controlling financial risk, and supporting long-term ROI. Here are some core system modules that enable AASB compliance in mining accounting platforms:

Financial Core and General Ledger

Acts as the system of record for all financial activity. This module applies AASB-aligned accounting logic at the transaction level, ensuring consistent treatment of costs, revenues, assets, and liabilities across reporting periods.

Asset and Capital Management

This feature manages capitalisation, depreciation, impairment, and asset lifecycle tracking. Direct alignment with mine plans and operational inputs improves valuation accuracy and reduces audit challenge over long-life assets.

Cost Allocation and Project Accounting

Allocates costs across sites, activities, and projects in real time. This module improves margin visibility, supports defensible capital treatment, and reduces post-period adjustment driven by misclassification.

Compliance and Controls Management

Embeds AASB rules, approval workflows, segregation of duties, and validation checks directly into financial processes. This reduces reliance on manual controls and supports audit-ready reporting.

Payroll, Contractor, and Workforce Accounting

This is one of the most integral features for mining accounting software that handles complex workforce arrangements common in Australian mining. This includes site-based payroll, contractor costs, superannuation, and payroll tax exposure across jurisdictions.

Tax and Statutory Reporting

Supports GST, BAS, payroll tax, royalties, and related statutory outputs through structured, system-generated reporting. This module stabilises compliance outcomes and reduces reconciliation effort.

Reporting, Analytics, and Audit Traceability

Reporting and big data analytics provide controlled financial reporting, scenario analysis, and end-to-end traceability from operational input to financial statements. Audit evidence remains system-generated and defensible.

Why Modular Structure Matters for ROI and Compliance

A modular architecture allows mining enterprises to scale, adapt to regulatory change, and onboard new assets without destabilising the financial core. Each module reinforces AASB compliance while reducing operational friction, making ROI a function of control and predictability rather than volume of automation.

Key Benefits of Accounting Software for Australian Mining Enterprises

The value of enterprise-grade mining accounting platforms is realised through outcomes that combine financial control with AASB-aligned reporting. When accounting software development for mining in Australia embeds compliance into system behaviour, operational efficiency and return on investment improve together rather than in isolation. The benefits of using software for mining operations mentioned below reflect where this alignment creates measurable value:

Improved Financial Efficiency Across Complex Operations

Integrated accounting platforms reduce reconciliation effort because AASB treatment is applied at the point of transaction rather than during period-end correction. Automated cost capture, capitalisation logic, and depreciation workflows shorten close cycles while preserving reporting accuracy. Finance teams spend less time resolving classification issues and more time analysing performance.

Stronger, Defensible Decision-Making At Leadership Level

When financial data reflects operational reality and consistent AASB treatment, leadership decisions improve. Executives gain confidence in capital allocation, project viability, and cost control because figures are timely, traceable, and supported by auditable assumptions. This strengthens board-level accountability and reduces challenge during review cycles.

Reduced Cost Leakage And Tighter Budget Control

Real-time cost allocation across activities and locations highlights overruns before they affect asset valuation or capital treatment. Early visibility supports corrective action within reporting periods rather than retrospective adjustment. Over time, this discipline improves margin stability and cost predictability under AASB reporting requirements.

Higher Confidence In Compliance-Regulated Reporting

Mining software designed to ensure compliance applies accounting logic consistently across assets, sites, and projects. Embedded controls and audit trails reduce reliance on manual adjustments, lowering the risk of restatements, audit findings, and regulatory scrutiny.

Lower Long-Term Compliance And Audit Risk

Mining compliance software development that embeds regulatory logic into transaction flows simplifies audits by generating system-based evidence. This reduces remediation effort, external advisory reliance, and management distraction during reporting periods, directly lowering the cost of compliance.

Better Alignment Between Finance, Operations, and Risk

Accounting platforms act as a convergence point for operational, safety, and risk data. When the financial impact of incidents, downtime, or compliance events is visible early, leadership manages exposure proactively rather than through post-period explanation.

Improved Scalability As Operations Grow or Diversify

As mining portfolios expand across sites, commodities, or jurisdictions, accounting complexity increases rapidly. Scalable platforms maintain consistent AASB treatment without fundamental redesign, protecting prior investment and supporting long-term growth strategies.

Greater Ownership and Reduced Vendor Dependency

Custom-built platforms designed for Australian mining realities reduce reliance on heavily customised third-party systems. This improves upgrade flexibility, lowers vendor risk, and preserves control over financial logic and reporting outcomes.

Cost Reduction and Measurable ROI

The benefits of using software for mining operations compound over time. Reduced audit remediation, faster and more predictable closes, improved cost discipline, and lower compliance overhead translate directly into ROI that extends beyond the initial development investment.

Taken together, these benefits explain why Australian mining leaders increasingly view accounting platforms as governance infrastructure rather than back-office tools. When compliance is enforced through system design, accounting software becomes a driver of financial control, audit confidence, and sustained enterprise value.

Design an AASB-aligned accounting platform built for Australian mining operations, scale, and audit certainty.

Common Challenges in Mining Accounting Software Development and How They Are Addressed in Australia

Enterprise mining organisations across Australia face a consistent set of challenges when modernising accounting platforms. These issues are rarely technical in isolation. They sit at the intersection of governance, finance, and operational reality. Digital engineering service providers that specialise in mining software development approach these challenges through design discipline rather than feature expansion.

Legacy Data Complexity and Migration Risk

Challenge

Most mining operators manage historical data across ERPs, site systems, and spreadsheets accumulated over decades. This data often reflects outdated accounting treatments that no longer align with current AASB expectations. Poorly planned migration introduces audit risk and disrupts reporting continuity.

Solution

Effective custom software development companies treat migration as a financial assurance exercise. They cleanse and rationalise data before movement, align historical classifications to current accounting rules, and phase migrations around reporting cycles. This approach protects audit integrity while minimising operational disruption.

Balancing Operational Flexibility With Financial Control

Challenge

Operations teams prioritise speed and autonomy, while finance teams require consistency and control. Platforms that lean too heavily in either direction encourage workarounds and undermine governance.

Solution

Well-designed mining management software development in Australia uses configurable workflows. These workflows allow site-level flexibility within clearly defined financial boundaries, ensuring operational efficiency without compromising control.

Managing Cost Overruns During Development

Challenge

Development costs escalate when platforms attempt to solve every operational and compliance requirement simultaneously. Undefined scope and unclear financial ownership create delivery risk.

Solution

Experienced digital engineering teams define a stable financial core first. They deliver additional capabilities in modules, tied to measurable outcomes and audit checkpoints. This structure keeps mining management software development costs in Australia predictable and defensible.

Designing Systems That Withstand Regulatory And Business Change

Challenge

AASB standards evolve, ownership structures change, and commodity cycles shift priorities. Rigid platforms struggle to adapt without costly redevelopment.

Solution

Custom mining compliance software development relies on modular architectures and configurable compliance logic. This allows systems to evolve alongside regulatory and business change without destabilising the financial core.

Addressing these challenges requires more than technical capability. It requires delivery teams that understand mining operations, regulatory context, and enterprise governance expectations within Australia.

You may like reading: How to Hire Software Developers in Australia | A Complete Guide

Accounting Software Integration Complexities with Existing Mining Platforms

Mining operations are supported by a set of deeply embedded platforms covering ERP, maintenance, fleet, planning, and production systems. These platforms act as systems of record for valuation, cost control, and regulatory reporting. Any modern mining finance or AI platform must integrate with this existing landscape rather than attempt replacement.

The table below highlights commonly used incumbent systems and the integration considerations they introduce.

| Legacy Platform | Primary Purpose in Mining Operations | Key Integration Considerations |

|---|---|---|

| SAP for Mining (ECC / S/4HANA) | Core ERP system of record for finance, capital projects, fixed assets, procurement, rehabilitation provisions, and statutory reporting. | Requires strict master data alignment (cost centres, WBS, asset classes), transaction-level traceability, and audit-ready integrations rather than simple API connectivity. |

| Oracle ERP / Microsoft Dynamics 365 Finance | Enterprise financial management for general ledger, projects, assets, and multi-entity accounting in mining groups. | Integration complexity centres on inter-entity structures, project accounting, and consistent valuation logic across sites and jurisdictions. |

| SAP Plant Maintenance (PM) | Maintenance planning, work orders, shutdown management, and asset lifecycle tracking linked to operational reliability. | Needs tight synchronisation with finance for capitalisation vs OPEX treatment, parts consumption, and asset-level cost attribution. |

| Pronto Xi | ERP and asset management platform commonly used by mid-tier mining and mining services organisations in Australia. | Often heavily customised; integration typically involves controlled batch feeds and careful handling of legacy data structures. |

| Modular Mining DISPATCH | Fleet management and dispatch system capturing production cycles, utilisation, payload, and delays in real time. | High-frequency event data requires event-driven ingestion and aggregation before linking to production reporting and cost visibility. |

| Caterpillar MineStar | Fleet monitoring, equipment health, autonomy, and operational optimisation for Caterpillar-heavy sites. | Integration must handle large telemetry volumes while maintaining equipment, operator, and production context across systems. |

| AVEVA PI System | Industrial data historian storing time-series operational and process data from plants and mine sites. | Typically acts as the operational truth layer; integration involves curated replication into enterprise analytics while preserving OT–IT segregation. |

| Deswik | Mine planning, scheduling, and optimisation for underground and open-cut operations. | Outputs are often file- and model-based; integration focuses on aligning planning assumptions with production actuals and financial models. |

| GEOVIA Surpac | Geological modelling, resource estimation, and mine design used by geology and planning teams. | Requires governed data pipelines to ensure resource and reserve assumptions remain consistent with reporting and disclosure inputs. |

The real work isn’t replacing legacy systems; it’s teaching them to speak the same language through seamless integration of accounting software.

How Much Does It Cost to Build Mining Software in Australia?

The cost to build mining software for Australian businesses reflects governance depth rather than surface-level functionality. Enterprises should expect investment to scale with integration complexity, compliance requirements, and long-term ownership expectations.

For most Australian mining organisations, the cost of accounting software development for mining in Australia typically ranges from AUD 70,000 to AUD 700,000 or more, depending on scope and maturity.

Here is an estimated timeline and cost range of accounting software development for mining, based on different project complexities:

| Platform Complexity | Estimated Cost (AUD) | Typical Timeline |

|---|---|---|

| Basic | 70,000 – 100,000 | 3–4 months |

| Mid-level | 100,000 – 160,000 | 4–7 months |

| Advanced | 160,000 – 300,000 | 7–12 months |

| Enterprise-grade | 300,000-700,000+ | 12–18 months |

What Influences Cost in Australian Mining Projects

Several factors consistently shape mining management software development cost in Australia:

- Number of operational and financial systems requiring integration

• Depth of AASB-aligned accounting logic

• Complexity of asset structures and joint venture models

• Payroll, contractor, and site-based workforce requirements

• Security controls, audit logging, and access governance

• Expectations around scalability and long-term platform ownership

In short, projects focused purely on reporting remain at the lower end of the range. Platforms designed for enterprise-grade financial governance and audit resilience move toward higher investment levels.

Also Read: Cost to Build an Accounting Software Like Xero in Australia

Get a clear view of development cost, compliance depth, and ROI timelines for Australian mining operations.

Evaluating Cost Through An ROI Lens: How Australian Mining Enterprises Measure Real Return

Return on investment from mining accounting platforms does not come from automation alone. Australian enterprises measure ROI through control, predictability, and reduced exposure rather than headline efficiency metrics.

In Australian mining, ROI is realised when AASB compliance is embedded into accounting workflows, reducing rework, limiting valuation volatility, and lowering the cumulative cost of audit, advisory, and regulatory response. Some measurable ROI outcomes include:

Audit Efficiency and Reduced Remediation

Platforms designed with embedded controls materially reduce audit effort. Evidence is system-generated, traceable, and consistent across reporting periods. This shortens audit cycles, lowers remediation costs, and reduces management distraction during statutory reporting.

Faster and More Reliable Financial Close

Integrated accounting platforms reduce reconciliation delays between operations and finance. Faster closes improve executive visibility and allow leadership teams to act on current data rather than lagging indicators.

Improved Capital Discipline and Asset Valuation

When asset data, mine plans, and financial models stay aligned, capital allocation decisions become more defensible. This reduces impairment surprises and supports long-term project confidence, particularly during commodity price volatility.

Lower Long-Term Compliance Exposure

Embedded AASB logic and governance controls reduce the risk of restatements, regulatory intervention, and qualified audit outcomes. Over time, this lowers the cost of compliance rather than simply managing it.

Reduced Vendor and Platform Risk

Custom-built platforms designed for Australian mining realities reduce dependency on heavily customised third-party tools. This improves upgrade flexibility, lowers long-term operating cost, and strengthens ownership of financial logic.

For most enterprises, these benefits outweigh development cost within the first two to three reporting cycles, particularly when audit and compliance savings are considered.

How Appinventiv Supports Mining Software Initiatives in Australia

Large-scale mining platforms rarely succeed through generic delivery models. They require a trusted technology service provider that understands how financial governance, compliance, and operational realities intersect in Australian enterprises.

Appinventiv has been operating for more than a decade as a digital engineering partner that designs and develops custom mining platforms with long-term ownership, audit readiness, and scalability in mind. The focus stays on execution depth rather than surface-level functionality.

Our Approach for Mining Software Project in Australia

- Consulting services aligned to mining realities: We begin every engagement by assessing financial controls, operational data flows, and AASB exposure across mining operations. Our tech consultants define architectural priorities and delivery boundaries before any build decisions are made.

- Tailored solutions for mining: Our mining software developers in Australia design software around asset lifecycles, site-based operations, and complex cost structures common in Australian mining. We avoid generic templates, so platforms align with real operational and reporting conditions.

- Seamless integration with existing systems: Our engineers integrate new accounting platforms with existing ERP, payroll, safety, and operational systems. We preserve data consistency and audit traceability without disrupting live operations.

- Ongoing support and controlled evolution: Our teams provide post-launch support focused on regulatory change, operational scale, and platform stability. We manage updates through governed processes that protect financial integrity and long-term ownership.

The following case study illustrates how these principles translate into practical outcomes within a complex Australian mining environment.

Client’s challenge: A multi-site Australian mining company faced extended month-end close cycles, inconsistent AASB treatment across assets, and high audit remediation effort driven by fragmented systems.

Our approach: We conducted a governance-led assessment to identify gaps between operational data and accounting controls. Our team designed and implemented a custom accounting platform built on asset-centric models, real-time cost allocation, and embedded compliance logic. We integrated the platform with existing ERP and cloud-based payroll systems to stabilise reporting without disrupting live operations.

Measured outcomes?

- Reduced month-end close timelines by 29% within the first reporting year

- Lowered audit remediation effort by 26% through system-driven controls

- Improved site-level cost visibility across production and maintenance activities

- Achieved consistent AASB-aligned reporting across joint ventures

Our Australian Delivery Footprint and Indicators

Across Australia and the broader APAC region, our delivery model reflects sustained enterprise engagement rather than short-term projects. The footprint built over time reflects sustained collaboration with large organisations. This scale and continuity are evident across delivery outcomes, industry coverage, and regional presence, which include:

- 250+ Digital Assets Deployed in Australia

- 96% Client Retention Rate

- 35+ Industries Digitally Transformed

- 10+ Years of Experience in APAC Delivery

- 5+ Agile Delivery Centers Across Australia

- Ranked among APAC’s High-Growth Companies by Statista and Financial Times for two consecutive years

Business Impact Achieved through Governance-Led Delivery

Mining platforms succeed when they improve control without disrupting operations. Appinventiv’s delivery outcomes in Melbourne, Sydney, Perth and other regions of Australia consistently align with this principle.

- 99.50% Security Compliance SLA alignment with ISO standards

- 35% Average Efficiency Gains across Australian enterprises

These outcomes stem from system design choices that prioritise auditability, regulatory alignment, and operational fit, ensuring platforms remain resilient as enterprises scale and compliance expectations evolve.

So, if your organisation is planning accounting software development for mining in Australia, get in touch with us, and we will help you with the next step, which is a governance and architecture assessment. This clarifies risk, cost, and ROI before any development commitment is made.

FAQs

Q. What is the cost to develop a mining management software in Australia?

A. The cost of accounting software development for mining in Australia typically ranges between AUD 70,000 and AUD 700,000 or more, depending on system scope, compliance depth, number of integrations, and asset complexity.

Platforms built for full financial governance and AASB alignment sit toward the higher end of this range.

Q. Can mining software integrate with the systems we already use?

A. Yes. Custom mining platforms are designed to integrate with existing mining ERP software, payroll systems, safety platforms, and operational tools. Secure integration layers allow data exchange without replacing stable systems or disrupting live operations.

Q. What is the importance of AASB compliance for mining software development?

A. The Australian Accounting Standards Board (AASB) sets the framework for accounting standards in Australia. These standards are crucial for ensuring transparency, accuracy, and consistency in financial reporting, especially for industries like mining that involve complex project costs, revenue generation, and regulatory scrutiny.

For mining companies operating across jurisdictions such as Western Australia and Queensland, these standards directly influence how costs, assets, and liabilities are recognised and defended. These standards cover a broad range of areas that directly affect how mining businesses must handle:

- Asset capitalisation across long project lifecycles

- Impairment testing under commodity price volatility

- Rehabilitation and closure provisions

- Lease accounting for equipment-heavy operations

- Revenue recognition across complex offtake arrangements

Q. How long does it take to build mining software in Australia?

A. The timelines for mining software development vary by complexity. For instance:

Basic platforms typically take 3–4 months, while enterprise-grade systems with deep compliance, asset modelling, and integrations usually require 12–18 months. Delivery timelines are often aligned to reporting and audit cycles.

Q. Can mining accounting software scale as operations expand?

A. Yes. Enterprise platforms are designed to scale across new sites, assets, and joint ventures without requiring structural redesign. Modular architectures support growth while preserving financial control and audit integrity.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

The ROI of Strategic Insurance Technology Consulting for Legacy Modernization

Key takeaways: Insurance technology consulting delivers ROI only when modernization is tied to real workflows, not system replacement. Most legacy modernization failures stem from weak ROI definition and tracking, not from technology limitations. The strongest returns come from reduced operational friction, faster change cycles, and tighter claims and underwriting control. Delaying modernization incurs hidden costs…

Key Takeaways Use a scorecard-driven RFP and a technical assessment to compare vendors on capability, compliance, and delivery risk. Local partners provide regulatory and cultural alignment; hybrid teams often pair that with offshore cost efficiency. Start with a scoped pilot or MVP, milestone-based contracts, and clear IP/SLAs to reduce procurement risk. Require demonstrable security controls,…

A Strategic Framework for Proof of Concept Software Development

Key takeaways: Most enterprise PoCs fail due to a lack of decision clarity, not technical feasibility or innovation potential. A disciplined PoC framework reduces delivery risk before budgets, teams, and timelines are committed. Enterprise-grade PoCs validate feasibility, compliance, and scale assumptions under realistic operating constraints. Clear success metrics and governance turn PoCs into reliable inputs…