- Why Legacy Modernization ROI Is Still Misunderstood in Insurance

- What Strategic Insurance Technology Consulting Actually Changes

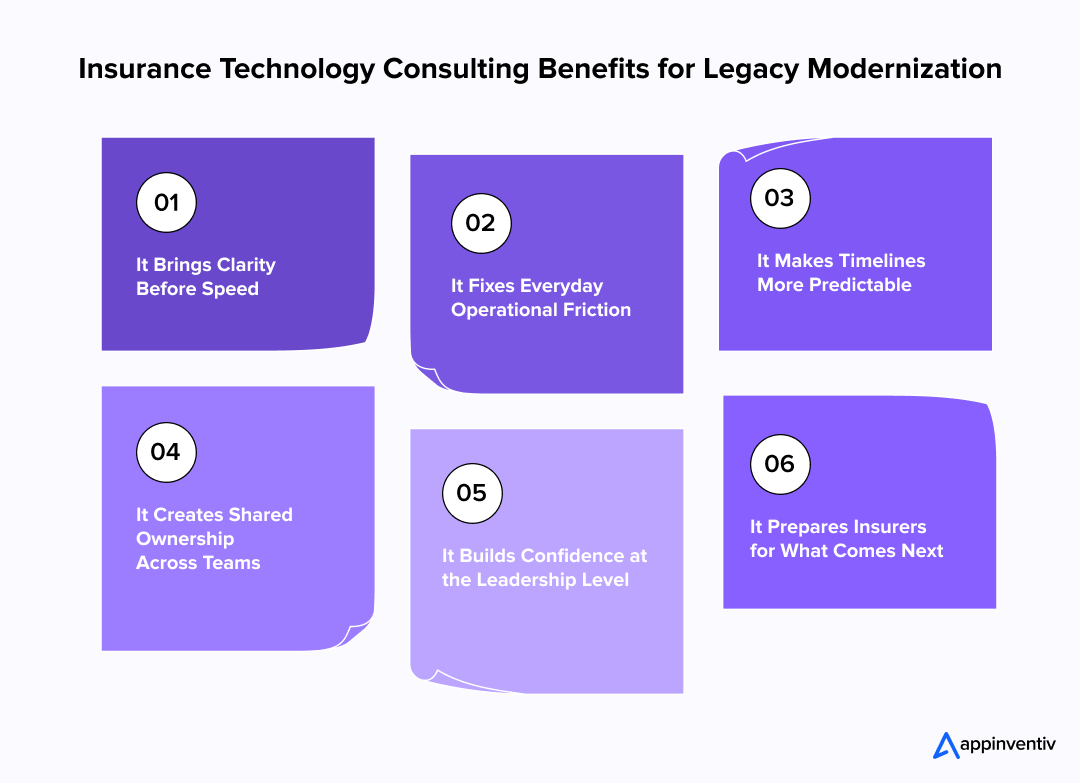

- Insurance Technology Consulting Benefits for Legacy Modernization

- 1. It Brings Clarity Before Speed

- 2. It Fixes Everyday Operational Friction

- 3. It Creates Shared Ownership Across Teams

- 4. It Makes Timelines More Predictable

- 5. It Prepares Insurers for What Comes Next

- 6. It Builds Confidence at the Leadership Level

- The Real Cost of Legacy Systems for Insurers

- Insurance Technology Consulting Use Cases Across The Value Chain

- 1. Fixing Claims Bottlenecks That Slow Everything Else

- 2. Reducing Friction In Underwriting Decisions

- 3. Making Policy Servicing Less Painful

- 4. Unlocking Data That Already Exists

- 5. Stabilizing Operations And Integrations

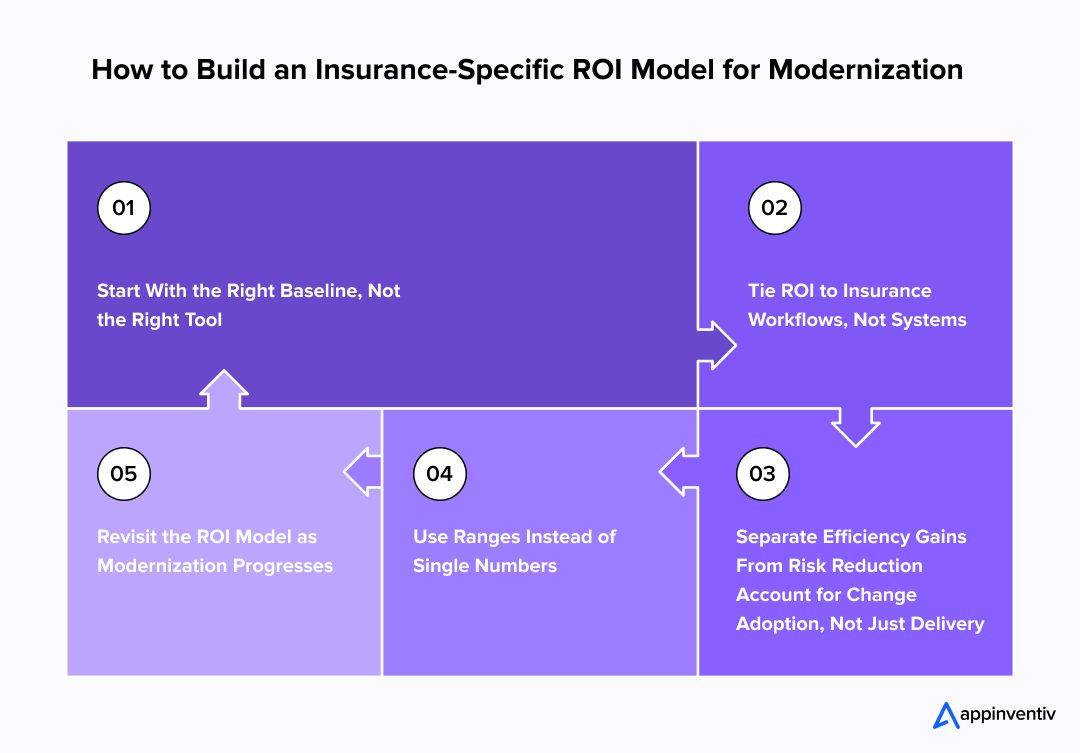

- How to Build an Insurance-Specific ROI Model for Modernization

- 1. Start With The Right Baseline, Not The Right Tool

- 2. Tie ROI To Insurance Workflows, Not Systems

- 3. Separate Efficiency Gains From Risk Reduction

- 4. Account For Change Adoption, Not Just Delivery

- 5. Use Ranges Instead Of Single Numbers

- 6. Revisit The ROI Model As Modernization Progresses

- Core ROI Drivers And Value-Stream Metrics In Insurance Legacy Modernization

- Insurance Technology Consulting Cost: What Insurers Should Expect

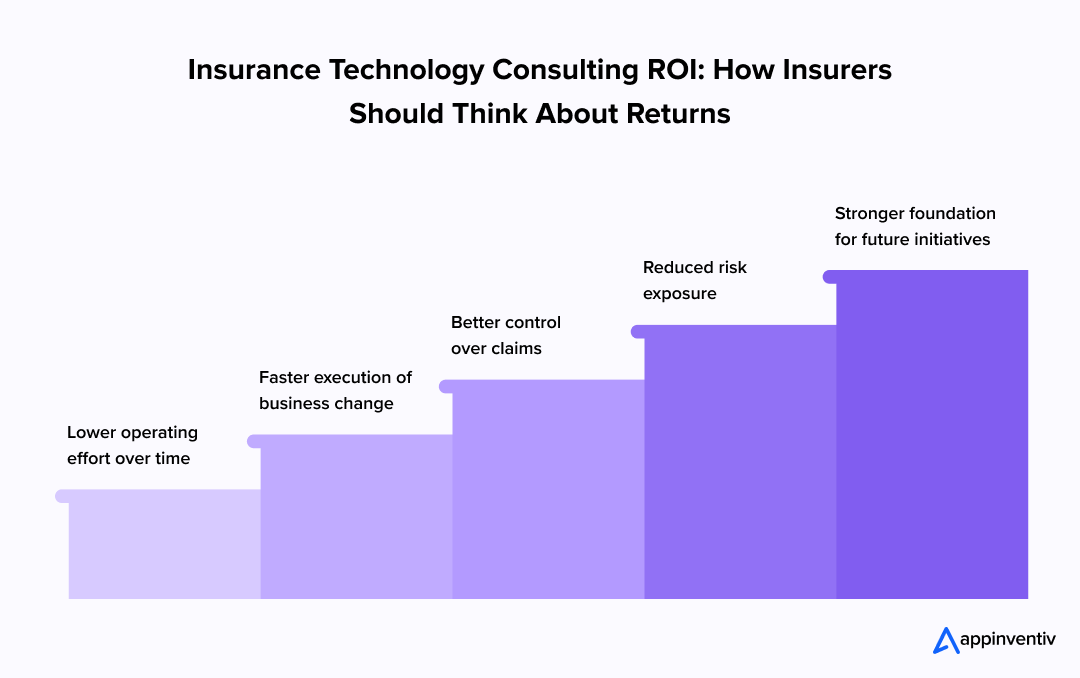

- Insurance Technology Consulting ROI: How Insurers Should Think About Returns

- Risk-Adjusted ROI: Compliance, Resilience, And Operational Stability

- Cost Of Delay: The ROI Lost By Waiting To Modernize

- Common ROI Pitfalls In Insurance Modernization Programs

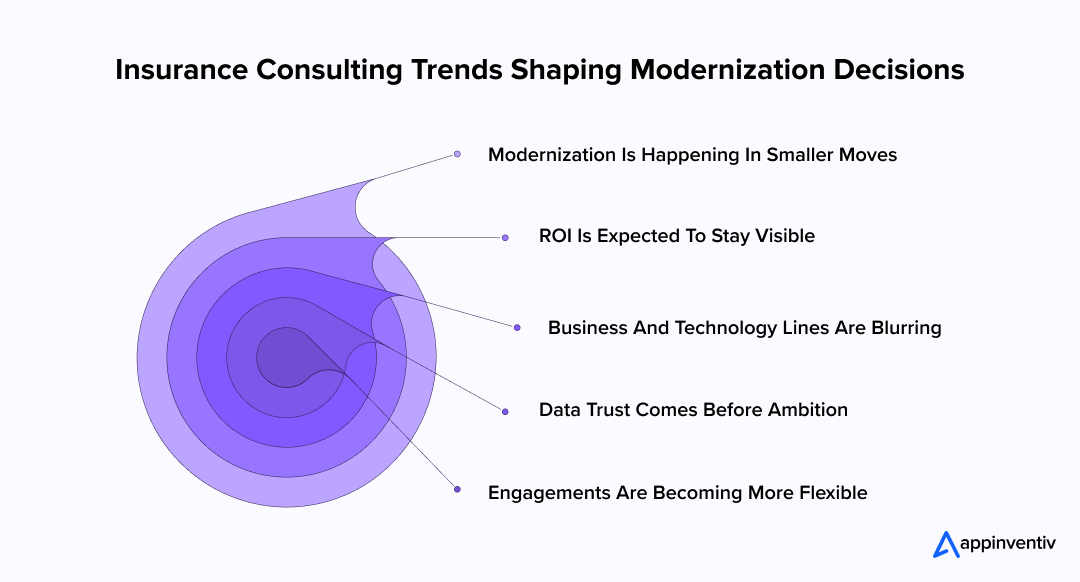

- Insurance Consulting Trends Shaping Modernization Decisions in 2026

- How Appinventiv Helps Insurers Turn Modernization Into Measurable ROI

- FAQs

- Insurance technology consulting delivers ROI only when modernization is tied to real workflows, not system replacement.

- Most legacy modernization failures stem from weak ROI definition and tracking, not from technology limitations.

- The strongest returns come from reduced operational friction, faster change cycles, and tighter claims and underwriting control.

- Delaying modernization incurs hidden costs through ongoing leakage, workarounds, and lost readiness for future initiatives.

- Strategic consulting transforms modernization from a risky IT upgrade into a managed business investment with measurable outcomes.

Most insurance modernization programs do not fail because the technology is wrong. They fail because the business case never becomes real. Leadership signs off on large budgets. Months later, it is still unclear what has improved, what has not, and why. That is why insurance technology consulting has become more than a support role. For many insurers, it is the difference between a costly system upgrade and a transformation that actually pays back.

In practice, insurance IT consulting is often brought in when legacy platforms start slowing everything down. Claims take longer than they should. Underwriters rely on workarounds. Data sits in silos that nobody trusts. Experienced insurance technology consultants help insurers step back and see where money, time, and opportunity are quietly being lost. They also help leaders decide what not to modernize yet, which is just as important.

The strongest technology consulting insurance engagements are not built around tools or platforms. They are built around outcomes. Insurers want to see clear improvements within months, stability within a year, and future growth. The global AI in Insurance market is projected to grow from USD 13.45 billion in 2026 to USD 154.39 billion by 2034. This shows how AI-driven modernization is rapidly transforming the insurance industry, driving efficiency, and creating measurable value in claims, underwriting, and decision-making processes.

In this blog, we break down how insurance consulting drives real ROI in legacy modernization, what benefits and costs insurers should plan for, and how the right approach turns long-term transformation into measurable business results.

AI in insurance will grow from USD 13.45B in 2026 to USD 154.39B by 2034. If ROI isn’t clear, it’s time to reassess.

Why Legacy Modernization ROI Is Still Misunderstood in Insurance

Ask most insurance leaders why legacy modernization feels risky, and the answer is rarely about technology. The real problem is that ROI is often explained in ways that don’t align with how insurance businesses actually operate. Cost savings are described in isolation. Benefits are projected too far out. And the link between systems and day-to-day outcomes stays vague.

This is where many insurance technology consulting engagements begin on the back foot. The business case is written to secure approval, not to guide decisions later. As a result, leadership struggles to track whether modernization is improving claims turnaround, underwriting accuracy, or operational stability. Insurtech consulting teams are then left defending programs that were never grounded in clear value measures to begin with.

There are a few common reasons ROI gets misunderstood across insurance consulting and technology initiatives:

- ROI is framed as IT efficiency, not business performance: Savings are tied to infrastructure or license reduction, while larger gains in claims handling, underwriting speed, and customer service go unmeasured.

- Baseline metrics are unclear or missing: Without clear “before” data, even great improvements are hard to prove. This is a frequent issue flagged by experienced insurance technology consultants.

- Risk reduction is ignored in ROI discussions: Compliance effort, audit exposure, and operational resilience rarely appear in the numbers, even though they matter deeply in regulated insurance environments.

- Benefits are treated as automatic: Many modernization programs assume value will appear once systems go live. In reality, value depends on process change, adoption, and governance. This is where technology consulting adds discipline that internal teams often lack.

Until ROI is defined in a way that reflects how insurers actually make money and manage risk, modernization will continue to feel expensive, slow, and uncertain. That gap is exactly what strong tech consulting for insurance is designed to close.

What Strategic Insurance Technology Consulting Actually Changes

Most insurance modernization efforts do not struggle because the technology is wrong. They struggle because early decisions are made without enough clarity. Priorities keep shifting, teams pull in different directions, and budgets grow while outcomes stay uncertain. This is where Insurtech consulting starts to make a real difference.

In many Insurtech consulting engagements, the first shift is not technical. It is alignment. Claims, underwriting, IT, and compliance teams often see the same systems through very different lenses. Experienced insurance technology consultants help connect those views and transform them into a shared plan based on how the business actually works.

Once that alignment is in place, a few practical changes follow:

- Modernization becomes focused instead of broad: Effort is directed toward the areas that create the most operational strain, reducing risk and keeping progress visible.

- Technology choices reflect real workflows: Technology consulting moves discussions away from abstract architectures toward claims handling, underwriting decisions, and service processes.

- Vendor decisions become more disciplined: Strong insurance software consulting helps insurers evaluate integration effort, long-term cost, and delivery risk before commitments are made.

- Value stays visible after go-live: Through ongoing governance, insurance consulting, and technology teams, expected gains are tracked and protected over time.

At a practical level, Insurtech consulting brings clarity. It turns modernization from a vague transformation goal into a managed business decision with fewer surprises.

Insurance Technology Consulting Benefits for Legacy Modernization

Legacy modernization is often discussed in terms of systems and platforms, but the real benefits show up in how work gets done every day. When consulting is applied thoughtfully, it helps insurers move away from constant firefighting and toward steadier, more predictable operations.

1. It Brings Clarity Before Speed

Most insurers rush into modernization because something feels broken. Consulting helps slow things down just enough to ask the right questions first. Insurance technology advisory brings structure to decisions that are otherwise made under pressure, helping prevent expensive course corrections later.

2. It Fixes Everyday Operational Friction

The biggest wins usually show up in small, daily frustrations. Claims handlers working around system limits. Underwriters juggling spreadsheets. Service teams are switching between screens. Through focused insurtech consulting, these pain points become visible and actionable, not just accepted as “how things work.”

3. It Creates Shared Ownership Across Teams

Modernization often fails when it is entirely an IT effort. Experienced insurance technology consultants help bring business, technology, and compliance teams into the same conversation. When ownership is shared, progress is faster, and resistance is lower. This is a core advantage of strong alignment between insurance consulting and technology.

4. It Makes Timelines More Predictable

Unclear priorities lead to slipping schedules. Technology consulting helps insurers focus first on the areas causing the most operational strain, reducing rework and keeping programs moving at a steady pace.

5. It Prepares Insurers for What Comes Next

Modernization is rarely the end goal. It is a foundation. Good insurance digital transformation consulting ensures systems are ready for data analytics, automation, and AI without forcing insurers to rebuild again in a few years.

6. It Builds Confidence at the Leadership Level

When progress is visible and tied to real outcomes, modernization stops feeling like a risky bet. Clear benefits, measured over time, help leadership stay aligned and committed to long-term change.

At a practical level, the real insurance technology consulting benefits are not about transformation slogans. They lead to smoother operations, clearer decisions, and changes that finally stick.

Also Read: Why Choose Appinventiv for IT Consulting Services

The Real Cost of Legacy Systems for Insurers

Most insurers know their core systems are old. What is less visible is how quietly these systems cost the company every day. The expense is not just license fees or maintenance contracts. It shows up in delays, workarounds, and missed opportunities that rarely make it into formal ROI discussions. This is often the starting point for a serious insurance technology advisory

conversations.

In many insurtech consulting engagements, leaders are surprised by how much operational drag comes from systems that are technically “stable.” Claims are processed, policies are issued, and bills are sent. But everything takes longer than it should, and small changes require disproportionate effort. Over time, this becomes normal, even though it is expensive.

Some of the most common legacy-related costs insurers overlook include:

- Hidden labor costs across teams: Manual reviews, duplicate data entry, spreadsheet tracking, and exception handling quietly absorb thousands of hours. Experienced insurance technology consultants often find that these costs outweigh system maintenance spend.

- Slower response to market and regulatory change: Product updates, pricing changes, or compliance adjustments take months instead of weeks. This delay has a real financial impact, especially in competitive lines of business. This is a frequent trigger for technology consulting initiatives.

- Increased operational risk: Older systems rely on fragile integrations and institutional knowledge. When key people leave or volumes spike, failures become harder to predict and control. This risk is rarely priced in, but it matters deeply in regulated insurance environments.

- Blocked data and analytics potential: Data trapped in legacy platforms limits reporting, automation, and AI adoption. Many insurance consulting and technology programs begin here, simply to make data usable across claims, underwriting, and operations.

- Rising cost of change over time: Each workaround added to a legacy system makes subsequent changes more difficult. What feels manageable today becomes a major constraint a few years later, pushing insurers toward rushed decisions.

The real cost of legacy systems is not one number. It is the cumulative effect of friction, delay, and risk. Strong insurance technology advisory helps insurers surface these costs clearly, which is often the first step toward building a modernization case that leadership can stand behind.

Insurance Technology Consulting Use Cases Across The Value Chain

Most insurers do not wake up wanting a modernization program. They reach that point because certain parts of the business begin to show stress. Claims slow down, and underwriters rely on side tools. Servicing teams spend too much time fixing avoidable errors. Insurance technology advisory usually begins where these issues can no longer be worked around.

1. Fixing Claims Bottlenecks That Slow Everything Else

Claims teams often feel the impact of legacy systems first. Files move, but not smoothly. Manual checks grow over time. Maintaining consistency becomes harder as volumes increase. Through practical insure tech consulting, insurers focus on simplifying workflows, reducing unnecessary handoffs, and supporting adjusters with systems that align with how claims are actually handled.

2. Reducing Friction In Underwriting Decisions

Underwriters rarely complain about a lack of data. They complain about data being hard to access or a lack of trust in it. Pricing changes take too long to appear. Referrals stack up. Insurance technology consultants help clean up these paths so underwriters can focus on risk judgment rather than system navigation.

3. Making Policy Servicing Less Painful

Policy changes are where rigid systems tend to age. Simple endorsements require multiple steps. Errors slip in, and customers feel the delay. With targeted insurance software consulting, insurers improve how policy data moves and how changes are handled, without forcing teams into disruptive full replacements.

4. Unlocking Data That Already Exists

Many insurers are sitting on years of valuable data that is difficult to use. Reports need manual fixes. Teams do not fully trust what they see. Insurance consulting and technology efforts often start by stabilizing data access and improving confidence, laying the groundwork for analytics and automation later.

5. Stabilizing Operations And Integrations

Over time, patches and point solutions create fragile connections within the system. When something breaks, it is hard to trace why. Insurance operations & technology consulting focuses on simplifying these links, reducing support effort, and making day-to-day operations more predictable.

These insurance technology consulting use cases are rarely isolated projects. When approached step by step, they help insurers modernize with less disruption and far more control over outcomes.

How to Build an Insurance-Specific ROI Model for Modernization

Most ROI models fail in insurance because they are too generic. They look neat on paper, but they do not reflect how claims are processed, how underwriting decisions are made, or how regulatory pressure actually shows up in day-to-day work. A usable ROI model needs to start from how the business runs today, not how it should look in theory. This is where Insurance technology advisory and domain-led thinking matter.

1. Start With The Right Baseline, Not The Right Tool

Before discussing any numbers, insurers need clarity on current performance. How long do claims really take end-to-end? Where underwriters rely on manual checks. How often do teams fix the same issue twice? In many insurtech consulting engagements, this baseline work delivers more insight than expected because it exposes hidden effort that never appears in budgets.

2. Tie ROI To Insurance Workflows, Not Systems

A strong ROI model does not measure platform replacement. It measures workflow improvement. Claims cycle time, referral rates, straight-through processing, rework volume, and change turnaround time are far more meaningful than infrastructure metrics. Experienced insurance technology consultants focus ROI discussions on these areas because they connect directly to cost, risk, and customer impact.

3. Separate Efficiency Gains From Risk Reduction

One common mistake is bundling everything into a single savings number. Insurance modernization delivers two different types of value. The first comes from efficiency, such as reduced manual effort or faster processing. The second comes from reduced risk, including fewer audit issues, better controls, and more stable operations. Good technology consulting models keep these benefits distinct so leadership understands what is improving and why.

4. Account For Change Adoption, Not Just Delivery

ROI does not appear the day a system goes live. It shows up when teams actually use it. This is why insurance consulting and technology programs that include adoption planning tend to produce more reliable ROI. Training, process alignment, and governance are not overhead. They are the difference between projected returns and realized returns.

5. Use Ranges Instead Of Single Numbers

Insurance leaders are cautious for a reason. Precise ROI figures often feel unreliable. A better approach is to model conservative, expected, and upside scenarios based on realistic assumptions. Many insurance software consulting teams now recommend this approach because it supports better decisions without overstating certainty.

6. Revisit The ROI Model As Modernization Progresses

An ROI model should evolve. Early phases reveal new data. Some assumptions improve; others need correction. In mature insurance technology consulting services, ROI tracking continues beyond planning and into execution, ensuring value does not fade once delivery pressure takes over.

When built this way, an insurance-specific ROI model becomes a management tool rather than a sales artifact. It helps leaders decide what to modernize first, what to delay, and how to judge progress honestly as change unfolds.

Also Read: Insurance Claims Management Software Development

Validate your assumptions, baselines, and value drivers with an insurance technology advisory grounded in real operating data.

Core ROI Drivers And Value-Stream Metrics In Insurance Legacy Modernization

The strongest ROI from legacy modernization does not come from technology upgrades alone. It comes from removing friction, speeding up change, and tightening control where value is often lost. Insurance tech consulting helps insurers connect these outcomes directly to how work moves through claims, underwriting, and servicing.

The most consistent ROI drivers insurers see include:

- Operating cost reduction and productivity gains: Fewer manual steps, less rework, and cleaner integrations reduce ongoing effort across teams. Through focused insurtech consulting, these gains are made visible and measurable.

- Faster product and pricing changes: Shorter change cycles improve time-to-market and reduce the hidden cost of delays. This is a growing focus in technology consulting programs.

- Revenue protection in claims and underwriting: Better decision support and consistency reduces leakage and margin erosion. Many insurance technology consultants prioritize stabilizing outcomes before pursuing growth.

ROI becomes credible when it is measured where work actually happens:

- Claims metrics such as cycle time, exception rates, and leakage trends

- Underwriting and policy metrics, including quote-to-bind speed, referral volume, and rework

- Billing and servicing indicators like correction rates, turnaround time, and contact volumes

When these value-stream metrics are tracked alongside modernization efforts, ROI becomes more than theoretical. It becomes a practical view of progress that leadership can trust. That is where insurance techn consulting delivers its real impact.

Insurance Technology Consulting Cost: What Insurers Should Expect

Cost is often the most sensitive part of any modernization discussion. Not because insurers resist investment, but because past programs have made it difficult to trust estimates. Insurance technology consulting costs are rarely flat fees. It depends on scope clarity, organizational complexity, and the level of uncertainty at the start.

In most insurtech consulting engagements, consulting spend reflects the depth of work required, not just the duration. For focused strategy or assessment-led engagements, costs typically start at around $40,000. Broader, multi-phase consulting programs that cover roadmap definition, vendor evaluation, and value governance can reach $400,000 or more, especially in large or highly regulated insurance environments.

Several factors tend to push consulting costs higher or lower:

- Clarity of objectives at the outset: When modernization goals are well defined, consulting effort stays contained. Vague objectives often lead to extended discovery and higher cost, a pattern familiar to many insurance technology consultants.

- Complexity of legacy systems and data: Heavily customized platforms and fragmented data increase assessment and planning effort. In such cases, technology consulting often prioritizes risk reduction before acceleration.

- Number of business areas involved: Engagements spanning claims, underwriting, servicing, and compliance require more coordination. Strong insurance consulting and technology alignment early on usually lowers total program cost later.

- Engagement model and expected outcomes: Short diagnostic engagements cost less upfront, while longer strategic partnerships cost more initially but often prevent expensive downstream rework. This is where insurance consulting engagement models make a real difference.

- Expectation of measurable ROI: When insurers require ongoing value tracking, governance, and reporting, consulting cost increases slightly, but ROI leakage drops significantly. Many insurance tech consulting services now include this as standard.

In practice, the right question is not whether insurance tech consulting costs $40,000 or $400,000. The real question is whether that investment reduces uncertainty, shortens time-to-value, and avoids mistakes that cost far more later.

Insurance Technology Consulting ROI: How Insurers Should Think About Returns

ROI in insurance modernization is rarely immediate, and it is almost never clean. The mistake many insurers make is finding a single payoff number too early. Real returns from insurance tech consulting emerge gradually across operations, risk control, and decision speed when ROI is framed only as short-term cost savings, much of the value is missed.

In most insurtech consulting programs, the first returns are operational, not financial. Teams spend less time fixing issues. Changes move faster, and errors are minimized. These shifts may look small in isolation, but together they create a measurable impact over time. Experienced insurance technology consultants focus on making these gains visible and traceable, so ROI does not get lost in day-to-day noise.

Insurers typically see ROI across a few consistent areas:

- Lower operating effort over time: Reduced manual handling, fewer exceptions, and cleaner workflows lead to steady cost reduction. This is one of the most reliable outcomes of strong technology consulting.

- Faster execution of business change: Pricing updates, product changes, and regulatory adjustments move faster once legacy constraints are reduced. Speed here often translates directly into financial benefit.

- Better control over claims and underwriting outcomes: Improved consistency and decision support help limit leakage and reduce rework. Many insurance consulting and technology engagements tie ROI directly to these improvements.

- Reduced risk exposure: More stable systems and clearer controls lower the likelihood of outages, audit findings, and compliance failures. This risk reduction is a key but often undervalued part of insurance tech consulting ROI.

- Stronger foundation for future initiatives: Modernized platforms make analytics, automation, and AI adoption easier later. While harder to price upfront, this readiness often determines long-term competitiveness.

The most successful insurers do not treat ROI as a one-time calculation. They revisit it as systems change and benefits accumulate. When approached this way, insurance tech consulting delivers returns that are sustained, defensible, and aligned with how insurance businesses actually operate.

Risk-Adjusted ROI: Compliance, Resilience, And Operational Stability

For many insurers, the strongest ROI case is not built solely on growth. It is built on risk. Regulators expect tighter controls. Customers expect uninterrupted service. Boards want fewer surprises. This is where insurance tech consulting shifts the conversation from efficiency to resilience.

In many insurtech consulting engagements, risk is addressed only after an incident occurs. Strategic consulting shifts that thinking earlier, helping insurers factor risk reduction into ROI before disruptions, audits, or regulatory gaps surface.

Risk-adjusted ROI usually shows up in a few practical ways:

- Lower compliance effort and audit friction: Legacy systems often require manual controls and workarounds to meet regulatory needs. Through structured insurance consulting and technology programs, controls become embedded in workflows, reducing audit preparation time and stress.

- Improved system stability and resilience: Fragile integrations and undocumented dependencies increase the chance of failure. Technology consulting focuses on simplifying architectures and reducing single points of failure, which lowers operational risk over time.

- Reduced exposure to outages and service disruption: Downtime in insurance affects claims, customer trust, and regulatory confidence. Experienced insurance technology consultants help insurers assess where failures are most likely and address them before they become incidents.

- Clearer accountability for risk ownership: When responsibility is shared across business and technology teams, risks are surfaced earlier. This shared model is a key outcome of strong insurance operations & technology consulting.

- More predictable regulatory change management: Modernized systems make it easier to adapt to new rules without major rework. This flexibility often becomes a quiet but powerful ROI driver.

Risk-adjusted ROI is harder to sell because it focuses on what does not happen. No outages, no audit escalations and no emergency fixes. But over time, these avoided costs add up. Strong insurance tech solutions consulting helps insurers recognize that stability and compliance are not side benefits. They are core returns on modernization investment.

Cost Of Delay: The ROI Lost By Waiting To Modernize

Most insurers do not say no to modernization. They say not now. Other priorities take over, and systems that are “good enough” stay in place longer than planned. Over time, that delay becomes costly, even though it rarely shows up as a single problem. This is often when insurance tech solutions consulting is brought in to explain what waiting has already cost the business.

In insurtech consulting reviews, the impact of delays typically manifests as ongoing friction rather than failure. Teams work around limitations. Manual effort increases. Small inefficiencies repeat every day and quietly compound.

Common costs insurers absorb by waiting include:

- Continued claims and underwriting leakage: Manual checks and slow decision paths stay in place longer than necessary. Many insurance technology consultants find these losses add up faster than expected.

- Slower response to change: Pricing updates, product launches, and regulatory adjustments take longer to implement, a frequent trigger for technology consulting engagements.

- Growing reliance on workarounds: Temporary fixes become permanent, increasing future modernization efforts. This pattern is common across insurance consulting and technology programs.

- Limited readiness for future initiatives: Analytics, insurance automation, and AI remain difficult to adopt despite core constraints.

The cost of delay is rarely obvious upfront. It shows up gradually, through lost time and missed opportunity. Strong insurance tech solutions consulting helps insurers recognize these costs early, before modernization becomes a forced decision.

Common ROI Pitfalls In Insurance Modernization Programs

Most modernization programs in insurance do not fail outright. They started drifting. ROI looks reasonable at approval time, but slowly becomes harder to explain as delivery progresses. In many cases, the problem is not the technology. It is how value was defined, tracked, or protected along the way. This is a pattern seen repeatedly in insurance tech solutions consulting and insurance IT consulting reviews.

Some pitfalls keep popping up.

- Treating ROI as a one-time business case: Many programs calculate ROI upfront and never revisit it. As priorities change and scope shifts, the original assumptions quietly break. Experienced insurance technology consultants keep ROI alive throughout the program, not just at kickoff.

- Overstating efficiency gains and understating change effort: Savings are often projected without fully accounting for training, process redesign, and adoption time. When teams struggle to adjust, returns are delayed or diluted. This is a common gap in weak technology consulting insurance approaches.

- Blurring efficiency gains with risk reduction: Cost savings and risk reduction are valuable, but they are not the same. When these are merged into a single number, leadership loses clarity on what is actually improving. Strong insurance consulting and technology programs keep them separate and transparent.

- Measuring systems instead of workflows: ROI tied to platforms or modules rarely resonates. Value appears in claims cycle time, underwriting consistency, and servicing effort. Insurance software consulting that ignores workflow-level metrics often struggles to defend outcomes.

- Losing ownership after go-live: Once systems are live, attention moves on. Without clear accountability, expected benefits fade into the background of normal operations. Many insurance technology consulting services now include post-launch value tracking to prevent this drop-off.

- Ignoring the cost of delay during execution: Even after modernization starts, slow decisions and prolonged debates erode ROI. Delays during delivery can be just as damaging as delays before the program begins.

Avoiding these pitfalls does not require perfection. It requires discipline, honest measurement, and willingness to adjust when reality differs from plan. That is where mature insurance tech solutions consulting adds the most value, not by promising flawless execution, but by keeping ROI grounded and defensible as modernization unfolds.

Insurance Consulting Trends Shaping Modernization Decisions in 2026

If you listen closely to insurance leaders today, the frustration is clear. They are done with long programs that promise transformation but leave them explaining delays and shifting outcomes. What they want now is progress that feels steady, defensible, and under control. That shift is quietly changing how insurance tech solutions consulting and insurance IT consulting are being used.

A few patterns keep coming up in real conversations:

- Modernization is happening in smaller moves: Instead of betting everything on one large replacement, insurers are breaking change into manageable pieces. Through technology consulting insurance, teams focus on fixing what hurts most first, then build from there.

- ROI is expected to stay visible: Leaders no longer accept ROI as a slide in the approval deck. They want to see how value is showing up months after go-live. Many insurance technology consultants are now expected to stay involved long enough to help make that visible.

- Business and technology lines are blurring: Claims, underwriting, operations, and IT are increasingly part of the same discussion. This reflects a broader shift toward insurance consulting and technology working together rather than in parallel.

- Data trust comes before ambition: Insurers are learning that advanced tools do not help if the data underneath is unreliable. As a result, insurance digital transformation consulting often starts by improving access, data quality, and confidence in the data.

- Engagements are becoming more flexible: Rigid scopes are giving way to insurance consulting engagement models that allow priorities to change as teams learn more about what actually works.

Together, these insurance consulting trends point to a simpler expectation. Insurers want consulting that helps them move forward without losing control. That is the direction insurance tech solutions consulting is moving in.

Work with insurance technology consultants who align strategy, execution, and ROI accountability from day one.

How Appinventiv Helps Insurers Turn Modernization Into Measurable ROI

Modernizing legacy systems is rarely about finding better technology. It is about making fewer wrong decisions along the way. This is where Appinventiv typically gets involved. Insurers usually come under pressure from multiple sides: aging platforms, regulatory demands, and teams already stretched thin. The role Appinventiv plays is to slow things down just enough to make smart calls early, then move forward with clarity instead of guesswork. The work blends insurance tech solutions consulting with delivery, so strategy does not stay theoretical.

What makes that practical is experience at scale. Appinventiv has delivered 2000+ strategy and transformation projects, provides 24/7 advisory support, and works across 8+ global consulting partnerships. That exposure matters because most modernization risks are not unique. They repeat. Missed baselines, over-scoped programs, weak adoption. Having transformed 500+ legacy processes, the team first focuses on where operations are under strain and where value is quietly leaking before recommending change.

Just as important, Appinventiv does not abandon strategy and move away. The same teams stay involved as systems are built and adopted, which keeps ROI expectations grounded in reality. For insurers relying on insurance software development services, this continuity helps ensure modernization supports compliance, stability, and future growth, not just delivery milestones.

If you are planning legacy modernization and want a clearer view of ROI, risk, and sequencing, connect with Appinventiv to explore a value-led consulting and delivery approach.

FAQs

Q. How much does insurance technology consulting cost?

A. The cost of insurance tech solutions consulting depends on how focused or broad the engagement is. Smaller advisory or assessment-led work often starts around $40,000. Larger programs that include roadmap design, governance, and ongoing advisory can reach $400,000. In most cases, the cost reflects the amount of uncertainty that needs to be removed upfront, rather than just the time spent.

Q. How is insurance technology consulting different from insurance IT consulting?

A. The difference usually comes down to intent. Insurance IT consulting is often brought in to implement or support systems. Insurance tech solutions consulting looks at bigger questions. First, what should change, in what order, and why. It ties technology decisions to business outcomes, risk, and ROI. Many insurers use both, but for different reasons.

Q. Can insurance technology consultants improve claims automation?

A. Yes, but only when automation is applied thoughtfully. Insurance technology consultants usually start by understanding how claims are actually handled today, where judgment is needed, and where manual work adds no value. In common Insurance tech solutions consulting use cases, automation works best when it supports adjusters rather than replacing them outright.

Q. How does insurance technology consulting support regulatory compliance?

A. Compliance improves when systems are designed to support it, not when teams rely on manual checks. Insurance industry technology consulting helps insurers build controls directly into workflows, making audits easier and changes easier to manage. This approach is common in insurance operations & technology consulting, especially in heavily regulated environments.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Key Takeaways Use a scorecard-driven RFP and a technical assessment to compare vendors on capability, compliance, and delivery risk. Local partners provide regulatory and cultural alignment; hybrid teams often pair that with offshore cost efficiency. Start with a scoped pilot or MVP, milestone-based contracts, and clear IP/SLAs to reduce procurement risk. Require demonstrable security controls,…

A Strategic Framework for Proof of Concept Software Development

Key takeaways: Most enterprise PoCs fail due to a lack of decision clarity, not technical feasibility or innovation potential. A disciplined PoC framework reduces delivery risk before budgets, teams, and timelines are committed. Enterprise-grade PoCs validate feasibility, compliance, and scale assumptions under realistic operating constraints. Clear success metrics and governance turn PoCs into reliable inputs…

Top UK Software Development Trends Shaping 2026: Insights for Business Leaders

Key takeaways: 2026 is about fixing friction, not chasing trends. UK software teams are prioritising reliability, clarity, and systems that are easier to change over flashy new tooling. AI is becoming background support, not the main act. Its value shows up in routine work like testing, reviews, and documentation, while people still make decisions. Architecture…