- Understanding the UAE Wealth Management Market

- Steps to Build an AI-White-label Platform for Wealth Management in the UAE

- 1. Begin With a Deep Understanding of Your Clients and Goals

- 2. Anchor the Project in UAE Regulatory Requirements

- 3. Choose a White-label Framework That Can Scale With You

- 4. Use AI Where It Truly Improves Outcomes

- 5. Build a User Experience Designed for the UAE Market

- 6. Ensure Integrations Are Seamless and Secure

- 7. Test Thoroughly for Compliance, Accuracy, and Performance

- 8. Roll Out in Measured Phases

- 9. Continue Evolving the Platform Post-launch

- Technical Considerations for White-label Wealth Platforms

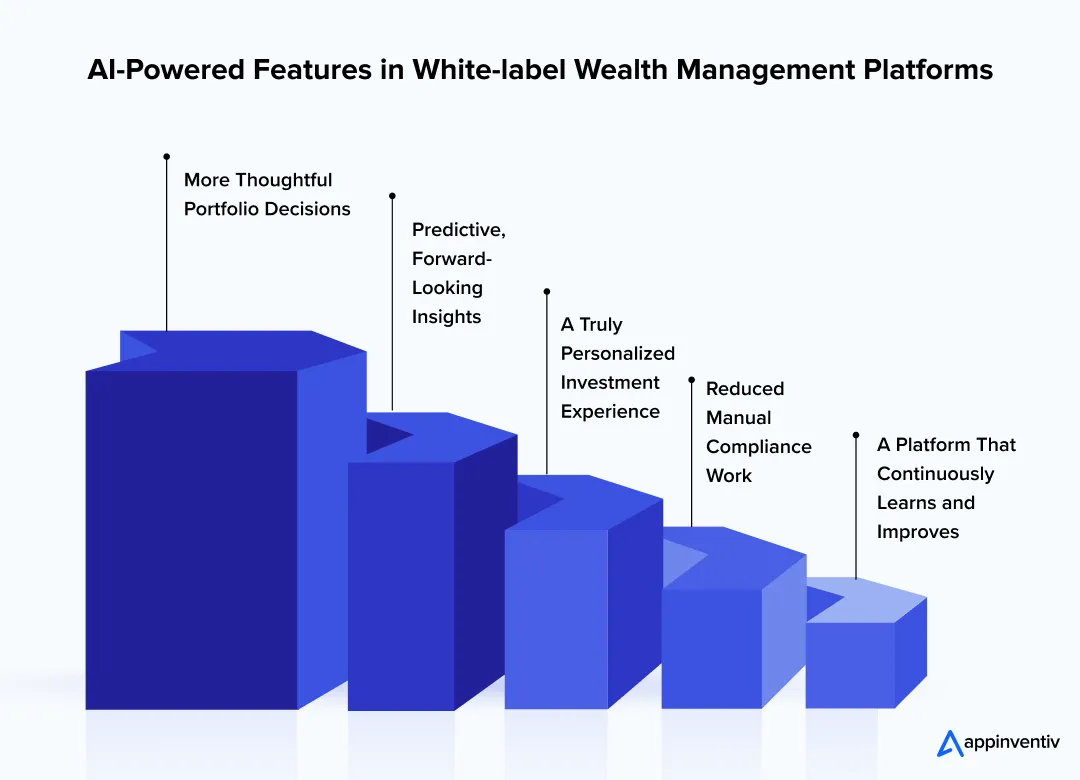

- AI-Powered Features in White-label Wealth Management Platforms

- Cost to Build an AI-Powered White-label Wealth Management Platform in the UAE

- How AI is Enhancing Wealth Management in the UAE

- How to Overcome the Challenges of Building an AI-Powered White-label Platform in the UAE

- How to Choose the Right Partner for Your AI-Powered Wealth Management Platform

- How Appinventiv Can Help in Building an AI-Powered Whitelabel Platform for Wealth Management in the UAE

- FAQs

- AI-driven wealth platforms are becoming the new standard in the UAE, as investors expect personalization, speed, and real-time insights.

- White-label solutions reduce time-to-market, offering a customizable foundation aligned with UAE regulations and investor needs.

- AI unlocks smarter portfolio decisions, proactive risk management, and automation, enhancing both advisor productivity and client experience.

- Building the right platform requires strong compliance, secure integrations, and UAE-specific localization across languages, currencies, and asset classes.

- Partnering with an experienced UAE-based development team ensures a smoother build, stronger AI implementation, and long-term scalability.

Financial institutions looking to build an AI wealth management platform in the UAE are no longer evaluating software features alone. In 2026, the real challenge is engineering intelligence that operates within sovereign data boundaries, explains every decision to regulators, and performs under real-time market pressure.

For banks, family offices, and wealth firms operating in DIFC and ADGM, wealth platforms are now treated as regulated financial infrastructure. This shift is driving demand for AI-powered, white-label wealth platforms that combine explainable intelligence, zero-trust security, and UAE-resident cloud architectures from day one.

But the real shift is happening beneath the surface. Executives are realizing that the future belongs to platforms powered by intelligence, not interfaces. From automated portfolio decisions to real-time risk insights, AI has become the backbone of next-generation wealth services.

This guide walks you through how to build a white-label wealth management platform in the UAE that you can rely on, highlighting what matters most in AI-powered wealth management platform development and what it takes to get it right in one of the world’s most dynamic financial hubs.

Move beyond basic digital tools and create an AI-powered experience that feels personal, intelligent, and UAE-ready.

Understanding the UAE Wealth Management Market

The UAE is experiencing one of the fastest surges in private wealth globally. A recent Khaleej Times report highlights that the UAE is now home to 240,343 millionaires holding a combined USD 785 billion in wealth- growth fueled by investor-friendly policies, global relocations, and a fast-maturing financial ecosystem.

For financial institutions, this shift signals a massive opportunity to build digital-first offerings, especially white-label wealth management platforms that UAE clients can trust for secure, compliant, and personalized investment experiences. It also explains the rising demand for modern wealth management software in the UAE that blends automation with advisory depth — from wealth management CRM software to wealth management accounting software that supports complex portfolios. Much of this momentum is being driven by the rise of AI in wealth management in the UAE, where clients now expect intelligent and proactive digital support.

What’s shaping investor expectations:

- A rapidly growing HNWI segment looking for smarter, mobile-first wealth tools.

- Hybrid advisory is becoming the norm, with investors open to digital management but expecting human reassurance.

- Offshore diversification trends are increasing demand for multi-currency, multi-market software for wealth management.

As investor profiles evolve, firms that invest early in AI-ready, customizable platforms, especially those aligned with AI wealthtech platform development and next-gen wealth management custom software, will be better positioned to capture the next decade of growth.

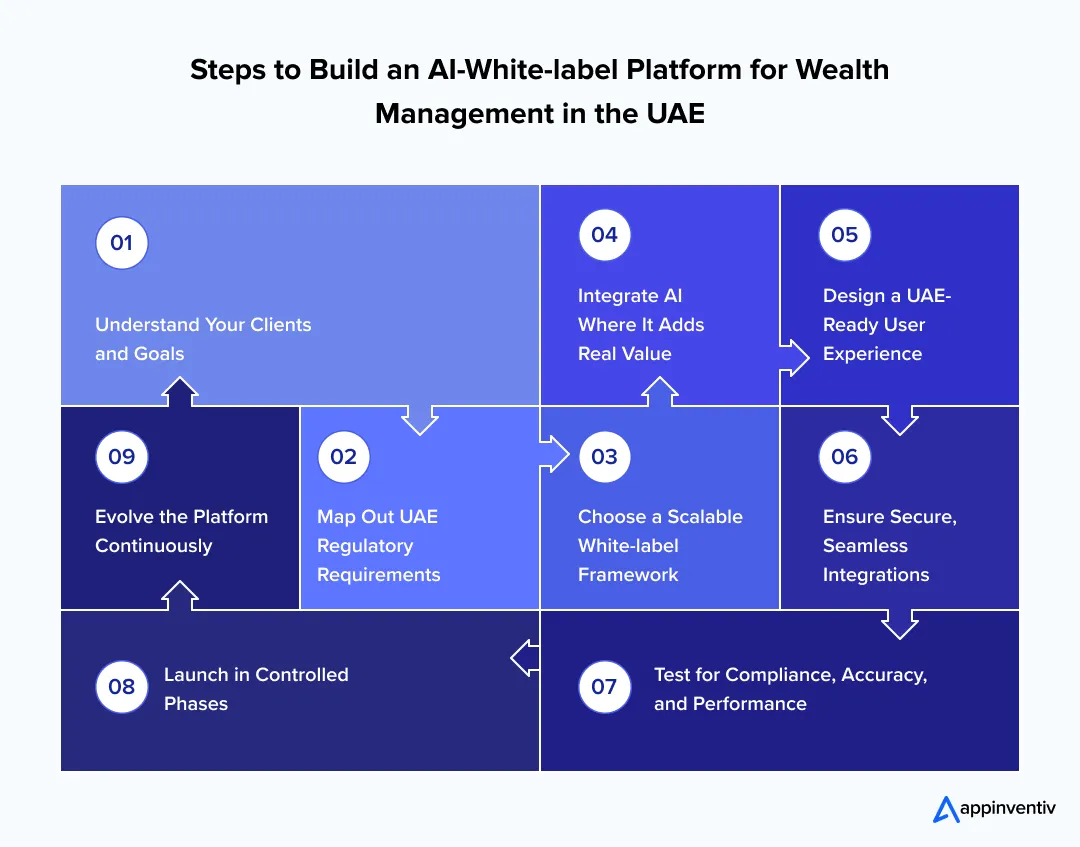

Steps to Build an AI-White-label Platform for Wealth Management in the UAE

Creating a modern wealth platform in the UAE is more than selecting technology components. It’s a strategic effort shaped by regulation, investor expectations, and the growing shift toward data-driven advisory. Whether your goal is to build an AI wealth management platform in the UAE that institutions can trust or to accelerate delivery through a ready-made framework, the process works best when the approach is clear.

These steps reflect the core framework followed globally and align closely with the practical steps to develop white-label wealth management software suited for UAE institutions.

1. Begin With a Deep Understanding of Your Clients and Goals

Every successful platform starts with clarity. Identify the segments you plan to serve — from first-time investors to high-net-worth families. Each group expects a different level of personalization, reporting, and advisory support.

When this foundation is strong, the rest of the development becomes far more focused and meaningful.

2. Anchor the Project in UAE Regulatory Requirements

The UAE’s financial ecosystem is well-regulated, and understanding those rules early prevents complications later. DIFC, ADGM, and AML/KYC frameworks influence how onboarding, reporting, and data handling must work.

Addressing these requirements upfront gives your platform long-term stability and builds credibility with clients and regulators alike.

3. Choose a White-label Framework That Can Scale With You

A strong white-label foundation lets you move faster while still shaping the platform around your brand and client needs. Look for solutions that support:

- Modular, adaptable components

- Clean API integrations

- Multi-asset, multi-currency capability

- Embedded compliance workflows

- Enterprise-level security

This is the backbone of a white-label wealth management platform in UAE institutions, which can refine and evolve over time.

4. Use AI Where It Truly Improves Outcomes

AI should enhance decision-making, not complicate it. The most valuable capabilities tend to be those that strengthen investment management or reduce operational load, such as:

- Risk profiling

- Predictive portfolio signals

- Automated rebalancing

- Real-time advisory support

- Intelligent workflow automation

These elements are central to modern AI-powered wealth management platform development and increasingly expected by sophisticated clients.

5. Build a User Experience Designed for the UAE Market

The UAE’s investor base is diverse, digitally mature, and sensitive to ease of use. A strong platform typically includes:

- Arabic and English language options

- AED alongside global currencies

- Regional investment options like Sukuk and real estate funds

- UX flows that reflect local communication preferences and privacy expectations

A localized experience creates early trust, something technology alone cannot achieve.

6. Ensure Integrations Are Seamless and Secure

Behind every reliable wealth platform is a network of integrations that quietly keep everything running. This includes CRM implementation, custodians, market data streams, core banking systems, and identity verification tools.

Strong integration design ensures your platform feels consistent, accurate, and resilient, the core of secure wealth management platform development.

7. Test Thoroughly for Compliance, Accuracy, and Performance

Testing must validate more than functionality. It should confirm that AI logic is sound, transactions are traceable, audit trails are complete, and the platform performs reliably under pressure.

This is key to meeting UAE financial regulations for wealth platforms and maintaining investor confidence.

8. Roll Out in Measured Phases

A controlled launch gives your team room to observe how clients and advisors actually engage with the platform. Early insights help refine the experience, adjust AI recommendations, and strengthen operational readiness before a full-scale launch.

9. Continue Evolving the Platform Post-launch

Wealth management is dynamic, and AI models improve only when they are continuously monitored and refined. Track how clients use the platform, which features drive engagement, and where decision-making can be strengthened.

Continuous improvement is what keeps your offering competitive in a fast-moving market.

Technical Considerations for White-label Wealth Platforms

Building a strong wealth platform isn’t just about good design or smart features. The real test lies in how well the system behaves behind the scenes, how it handles data, integrates with existing infrastructure, and scales without friction.

Whether you’re aiming to build an AI wealth management platform that UAE institutions can depend on or planning a quick rollout using a ready-made framework, the technical foundation will determine how far the platform can grow, especially as wealth management software development demands evolve. A critical part of that foundation is choosing the right tech stack for AI wealth management solutions that can scale with evolving client needs.

AI Wealth Architecture for UAE-Grade Platforms

Modern AI wealth platforms in the UAE are increasingly built on Agentic RAG (Retrieval-Augmented Generation) architectures rather than generic AI models.

Instead of relying on open-ended LLM responses, enterprise-grade platforms use:

- RAG pipelines connected to proprietary research, compliance policies, and portfolio rules

- Vector databases such as Pinecone or Milvus to semantically search investor notes, market intelligence, and audit records

- Bounded AI agents that generate recommendations only within DIFC and ADGM-compliant decision frameworks

- A Modular and Scalable Architecture

A white-label platform should grow with your business. Choose an architecture built on modular components, where new features, from advisory tools to reporting dashboards, can be added without disrupting the core system. This flexibility also supports long-term innovation, especially as AI-driven use cases expand. This same architectural flexibility also strengthens the groundwork for advanced portfolio management software development.

- Seamless Integration With Financial Ecosystems

Wealth platforms don’t operate in isolation. They must connect cleanly with CRMs, custodians, market data providers, core banking systems, and identity verification tools. Strong APIs and integration layers ensure the platform feels cohesive and reliable, essential for any whitelabel wealth management platform that UAE firms plan to launch.

- Embedding AI Responsibly and Effectively

AI is now a cornerstone of modern wealth technology, but it must be integrated thoughtfully. For successful AI-powered wealth management platform development, focus on areas where AI genuinely improves outcomes:

- Automated suitability checks

- Dynamic risk scoring

- Predictive analytics

- Intelligent rebalancing

- Advisor support tools

The goal is to blend automation with human judgment, not replace it.

- Multi-currency and Multi-asset Capability

The UAE’s investor base is global, and your platform should reflect that. Ensure support for AED alongside foreign currencies and a range of asset classes- equities, fixed income, Sukuk, ETFs, real estate, and private market investments.

This level of flexibility aligns with the expectations of both expatriates and local investors. Multi-asset support helps platforms serve everything from retail investors to users needing family wealth management software capabilities.

- Enterprise-grade Security and Data Protection

Investors trust platforms that protect their data. Encryption, multi-factor authentication, audit trails, and secure cloud hosting aren’t optional; they’re fundamental. These measures form the backbone of secure wealth management platform development, especially when handling sensitive financial profiles and investment histories.

- Compliance Tools Built Into the System

Compliance isn’t a separate module. It’s something the entire platform must support. Build automated KYC/AML workflows, record-keeping, flagging systems, and reporting tools that align with UAE financial regulations for wealth platforms. This reduces operational overhead and ensures consistent regulatory alignment.

- Performance and Reliability Under Market Volatility

Wealth platforms face peak demand during turbulent markets. Stress test the system to ensure it can handle trading spikes, large inflows or outflows, and heavy reporting loads. A platform that performs well under pressure quickly earns user trust.

- Cloud-first Infrastructure for Agility

Cloud infrastructure provides speed, resilience, and easier integration with modern fintech tools. It also enables rapid updates, essential for maintaining a competitive white-label wealth management software that UAE institutions can rely on.

Get expert support to design, integrate, and launch with confidence.

AI-Powered Features in White-label Wealth Management Platforms

AI is reshaping what investors expect from digital wealth tools. Instead of static charts and generic recommendations, clients want platforms that genuinely understand their goals and respond to market shifts in real time. When you invest in AI-powered wealth management platform development, you’re essentially building a system that gets smarter with every interaction. Let’s learn how AI Elevates a White-label Wealth Platform:

- More thoughtful portfolio decisions: AI can study market movements, risk levels, and client preferences faster than any manual process. This allows the platform to suggest timely adjustments or even automate routine rebalancing, giving investors a sense of confidence and control.

- Insights that look ahead, not backward: Predictive analytics help advisors and clients stay ahead of market developments. Instead of reacting to changes, they can plan better — a capability that’s increasingly valued by the UAE’s globally invested clients.

- A genuinely personalized experience: AI doesn’t just segment clients; it learns how each person behaves financially. This leads to investment journeys that feel tailored, relevant, and far more engaging than traditional one-size-fits-all recommendations.

- Less manual effort on compliance: AI can support KYC/AML checks, monitor unusual activity, and maintain audit-ready logs. It reduces repetitive work for teams while improving accuracy across compliance workflows.

- A platform that improves over time: Every interaction, a trade, a portfolio change, a question, helps the system refine its recommendations. This steady learning makes the platform more intuitive, more helpful, and more aligned with client expectations.

These AI capabilities turn a standard solution into a whitelabel wealth management platform in the UAE, which institutions can proudly offer- one that feels modern, responsive, and built for long-term trust. Together, these capabilities highlight the key features of AI-powered wealth management apps that investors now expect as standard. As AI matures, these platforms will increasingly resemble intelligent digital wealth management software that adapts to each investor’s financial journey.

Cost to Build an AI-Powered White-label Wealth Management Platform in the UAE

The cost of creating an AI-driven wealth platform can look very different depending on what you want the platform to achieve. Some institutions want a clean, ready-to-launch white-label wealth management platform that UAE clients can start using quickly. Others want to build an AI wealth management platform in the UAE that investors will rely on for intelligent guidance, predictive insights, and automated decision-making.

Because of these differences, most projects tend to fall somewhere between $40,000 and $400,000 (AED 147,000 to AED 1.47 million). This range aligns with the typical cost to build an AI wealth management platform in the UAE markets, depending on AI depth and compliance needs.

AI Wealth Management Platform Pricing Tiers (UAE Market)

Here’s a simplified breakdown that helps decision-makers quickly understand what each investment level delivers.

| Tier | Ideal For | What You Get | Estimated Cost |

|---|---|---|---|

| Essential | Startups & small wealth firms | Core white-label setup, basic portfolio tools, KYC/AML | ~$40,000 (~AED 147,000) |

| Advanced AI | Mid-size institutions | Predictive analytics, risk scoring, bilingual UX, core integrations | $120,000–$220,000 (AED 441,000–808,000) |

| Fully Customized AI | Banks & large wealth managers | Full robo-advisory, automation, Shariah workflows, high scalability |

In practice, the platforms that combine intelligence, personalization, and compliance tend to require a higher upfront investment, but they also deliver the strongest long-term value. Institutions that take this route often see faster advisor workflows, stronger client engagement, and a more competitive digital presence. And with demand rising for a smarter wealth management digital platform in the UAE, investors can trust that this investment quickly becomes part of a broader growth strategy rather than a technical expense.

How AI is Enhancing Wealth Management in the UAE

AI is changing the way wealth is managed in the UAE in a very real, everyday way. Clients aren’t just looking for digital access anymore; they want guidance that feels timely, relevant, and tailored to the decisions they’re trying to make. This shift is why so many firms are beginning to explore AI-powered wealth management platform development as a core part of their strategy, not only to enhance advisory workflows but to modernize legacy wealth management investment software that can no longer keep up with investor expectations.

Here’s what we’re seeing on the ground:

- Clients make decisions with more clarity: AI brings together signals from the market, a client’s past behavior, and their current goals. Instead of staring at charts and guessing, advisors and investors get a clearer sense of what might come next — something any serious wealth management digital platform in the UAE audience expects today. This shift is also accelerating the adoption of every modern digital investment platform that UAE investors rely on for real-time guidance.

- The experience starts to feel more personal: People respond to advice that reflects how they think and what they want, not a generic profile type. AI helps create that level of understanding by learning from small, repeated interactions. Over time, the platform starts speaking the investor’s language.

- Risk doesn’t catch people off guard as easily: Whether markets move slowly or swing suddenly, AI notices the patterns early. It highlights issues long before they turn into real problems, which is especially important for clients managing assets across multiple regions.

- Advisors finally get space to focus on real conversations: A lot of repetitive work, monitoring portfolios, running reports, and checking thresholds, can be automated through AI automation for wealth management. It frees teams to spend more time on strategy, planning, and client relationships.

- Compliance becomes part of the flow, not a separate chore: With DIFC and ADGM setting a high bar, AI helps track activity, spot anything unusual, and keep records clean. It makes compliance work feel far less heavy and a lot more reliable.

Many institutions are now turning to AI consulting in Dubai to navigate this shift, not because they lack technical talent, but because the stakes are high and they want to build something that lasts. Getting the right guidance early often saves months of rework later.

How to Overcome the Challenges of Building an AI-Powered White-label Platform in the UAE

Building an AI-driven wealth platform in the UAE is exciting, but it isn’t simple. Regulations are strict, clients expect polished experiences, and AI adds a layer of complexity that needs thoughtful planning, especially when the platform must outperform traditional wealth management accounting software and modern digital tools investors already rely on.

Whether your goal is to develop whitelabel wealth management software in the UAE investors can trust or create a fully custom system, the challenges are real, but manageable with the right approach. These are some of the most common challenges in developing wealth management platforms that UAE institutions encounter as they scale:

- Getting Compliance Right From the Start

DIFC and ADGM have clear expectations, and the safest path is to build compliance into the core of your platform. Automated KYC/AML checks, clean audit trails, and workflows aligned with UAE financial regulations for wealth platforms reduce risk and save a lot of rework later.

- Using AI Where It Truly Helps

AI can easily overwhelm a system if it’s added everywhere. Focus on the features that matter most: smarter risk scoring, better predictions, and meaningful automation. This keeps your AI-powered wealth management platform development practical and easy for clients to adopt.

- Making Integrations Smooth and Reliable

Wealth platforms rely on a network of systems: core banking, CRMs, market data, and more. Strong APIs and staged integration testing help avoid disruptions and make your whitelabel wealth management platform in the UAE rollout far smoother.

- Designing With UAE Investors in Mind

Investors here appreciate platforms that reflect their world. Arabic and English support, AED and global currencies, and Shariah-compliant flows make the experience feel built for them, not repurposed from elsewhere.

- Protecting Data Without Compromising Performance

Wealth data is sensitive, and AI models rely on it. Secure infrastructure, encryption, and careful access controls keep the platform safe while still giving clients the speed and reliability they expect.

Many institutions now work with AI consultants in Dubai to navigate these challenges with clarity, avoid costly missteps, and build platforms that are both compliant and future-ready.

How to Choose the Right Partner for Your AI-Powered Wealth Management Platform

Choosing the right partner for your wealth platform isn’t just a procurement decision; it shapes the entire future of the product. You want a team that understands technology, regulation, and how investors in the UAE actually think.

Whether you’re aiming to build an AI wealth management platform in the UAE that clients can trust or expand through a white-label wealth management platform in the UAE approach, the right partner should bring clarity and confidence to every step.

What really matters when choosing a partner:

- Real experience in wealthtech: They should understand the rhythm of portfolio management, investor behavior, and how advisors actually use these tools day-to-day.

- Strong, practical AI skills: Look for teams who know how to use AI to solve real problems, predicting trends, automating routine tasks, improving decisions, not just talk about it. That’s the backbone of any solid AI-powered wealth management platform development effort.

- Knowledge of the UAE market: DIFC, ADGM, Shariah-compliant flows, local investor expectations, these aren’t optional details. They define how the platform must function.

- Comfort with complex integrations: Your partner should be able to connect the platform to core banking, custodians, CRMs, and data feeds without turning it into a long, painful process.

- A partnership mindset: You want a team that works with you, challenges your thinking, and helps shape the product, not a team that simply ticks tasks off a list.

More and more financial institutions are also turning to consulting services in the UAE to validate decisions early, reduce risk, and ensure the final platform is built for long-term growth rather than short-term delivery. This is especially important as demand for modern wealth management software in Dubai continues to accelerate.

Build a platform that advisors trust and clients enjoy using.

How Appinventiv Can Help in Building an AI-Powered Whitelabel Platform for Wealth Management in the UAE

When financial institutions in the UAE look for a technology partner, they’re not just searching for engineers. They need a team that understands regulation, investor behavior, and the realities of building AI-powered platforms in a fast-moving market. As a Custom Software Development Company in Dubai, Appinventiv has been helping organizations bridge that gap, combining deep technical expertise with a practical understanding of how wealth platforms need to operate in the region.

Our experience in the Middle East comes from scale and consistency: 1,000+ digital projects delivered and a 95% client satisfaction rate. Those numbers reflect the trust we’ve earned by building products that work in the real world. For Edfundo, we created a financial literacy app designed for young users and parents who wanted a safe, guided way to manage money. For Slice, we helped shape a real-estate investment platform that made fractional investing intuitive, opening the door to an asset class previously out of reach for many.

This combination of expertise, reliability, and local understanding is what we bring to wealthtech. Our delivery frameworks are backed by SOC 2 Type II and ISO 27001 certifications, ensuring enterprise-grade security, audit readiness, and data protection standards expected by UAE banks and financial institutions.

Whether you’re upgrading older wealth management investment software or building an AI-enabled platform from the ground up, our Dubai-based teams work closely with you, aligning strategy, design, compliance, and engineering so the final product feels tailored, secure, and ready for long-term growth. Let’s connect!

FAQs

Q. How do you ensure data security for financial apps in the UAE?

A. Data security in UAE financial apps relies on encrypted infrastructure, secure cloud hosting, strict access controls, and adherence to DIFC/ADGM guidelines. For AI-driven and digital wealth management software, regular audits and AI-model monitoring strengthen overall protection.

Q. What is a white-label wealth management platform, and how does it work?

A. A whitelabel wealth management platform is a ready-made system that financial institutions can brand, customize, and launch quickly. It includes essential tools for advisory, portfolio tracking, and compliance, making it ideal for firms wanting to build wealth management services software without starting from scratch.

Q. Which regulations apply to digital wealth platforms in the UAE?

A. Most platforms must comply with DIFC and ADGM frameworks, UAE Central Bank guidelines, and KYC/AML requirements. This applies to both wealth management software Dubai deployments and AI-enabled advisory tools, including robo-advisors.

Q. Does Appinventiv build white-label wealth management software in the UAE?

A. Yes. Appinventiv has experience building custom and white-label wealth management platforms that UAE institutions rely on, covering AI features, compliance, integrations, and UAE-specific investor workflows.

Q. Is robo-advisory compliant in the UAE?

A. Yes, robo-advisory is permitted and regulated under DIFC and ADGM rules. Firms must maintain transparency, risk profiling, and suitability checks — key components of compliant robo-advisory platform development.

Q. How can Appinventiv help develop AI wealth management platforms?

A. Appinventiv supports institutions with end-to-end strategy, design, engineering, and compliance for AI wealth management platform development. This includes AI modeling, integrations, UX, and building solutions that align with UAE regulations and investor expectations.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

The ROI of Strategic Insurance Technology Consulting for Legacy Modernization

Key takeaways: Insurance technology consulting delivers ROI only when modernization is tied to real workflows, not system replacement. Most legacy modernization failures stem from weak ROI definition and tracking, not from technology limitations. The strongest returns come from reduced operational friction, faster change cycles, and tighter claims and underwriting control. Delaying modernization incurs hidden costs…

Key Takeaways Use a scorecard-driven RFP and a technical assessment to compare vendors on capability, compliance, and delivery risk. Local partners provide regulatory and cultural alignment; hybrid teams often pair that with offshore cost efficiency. Start with a scoped pilot or MVP, milestone-based contracts, and clear IP/SLAs to reduce procurement risk. Require demonstrable security controls,…

A Strategic Framework for Proof of Concept Software Development

Key takeaways: Most enterprise PoCs fail due to a lack of decision clarity, not technical feasibility or innovation potential. A disciplined PoC framework reduces delivery risk before budgets, teams, and timelines are committed. Enterprise-grade PoCs validate feasibility, compliance, and scale assumptions under realistic operating constraints. Clear success metrics and governance turn PoCs into reliable inputs…