- Expense Management Software Market Size and Share

- Why is Custom Expense Management System Development Worthwhile?

- The Types of Expense Management Software

- Cloud-Based System: Flexible and Scalable for Growing Teams

- On-Premise System: Full Control, Higher Responsibility

- Integrated Expense System: One System, Many Functions

- Standalone System: Simple, Purpose-Built, and Easy to Deploy

- Mobile-Optimized Tools – Designed for People on the Move

- Custom-Built System: Tailored to the Way You Work

- Key Features of an Expense Management System You Shouldn’t Skip

- Receipt Tracking That Works in Real Time

- Smarter Expense Entry and Auto-Categorization

- Approval Workflows That Mirror Your Org Chart

- Built-in Compliance with Spending Policies

- Clear, Customizable Reporting and Analytics

- Seamless Integration with Your Financial Stack

- Mobile-First Design for People on the Move

- Security That Goes Beyond the Basics

- Built for Customization and Future Growth

- Fast, Transparent Reimbursement Processing

- How to Design an Intuitive, Engaging Expense Management Platform

- 1. Prioritise Functional Simplicity

- 2. Design with Contextual Intelligence

- 3. Mobile-First, Desktop-Solid

- 4. Make Approvals a Joy, Not a Chore

- 5. Use Visual Hierarchy for Trust and Speed

- 6. Embed Micro-Automations Where it Matters

- 7. Accessibility isn’t Optional

- 8. Design for Trust

- Tech Stack to Make Your Expense Management Software the Go-to Business Platform

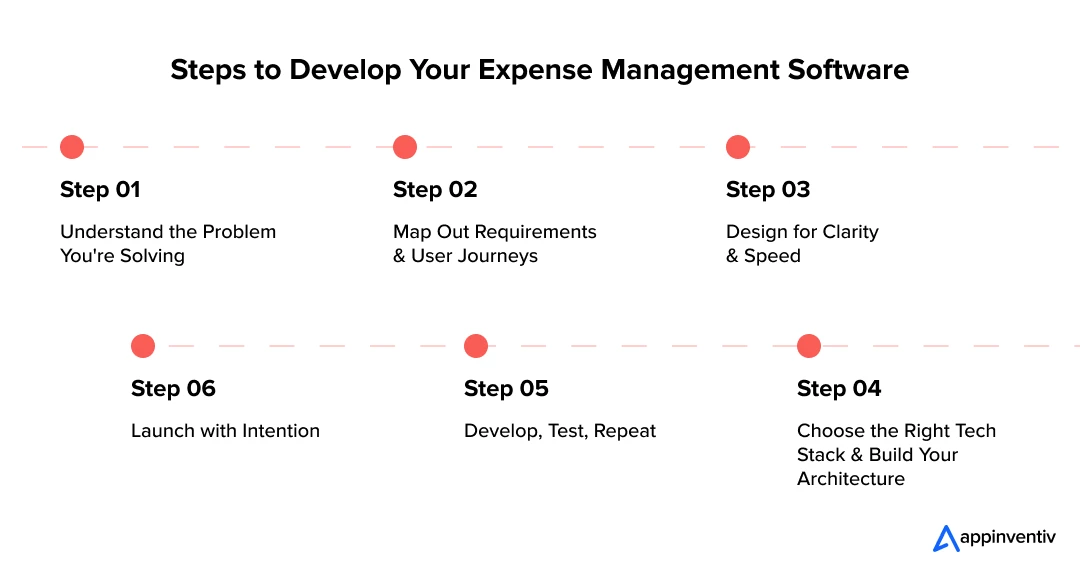

- The Development Process for Turning an Idea Into a Working EMS Platform

- 1. Understand the Problem You're Solving

- 2. Map Out Requirements and User Journeys

- 3. Design for Clarity and Speed

- 4. Choose the Right Tech Stack and Build Your Architecture

- 5. Develop, Test, Repeat

- 6. Launch with Intention

- Cost of Developing an Expense Management Software

- Basic Expense Tracker (MVP-Level)

- Mid-Range Platform with Integrations

- Enterprise-Grade or SaaS-Level Solution

- Cost Factors to Consider

- Development Challenges and How to Navigate Them

- Complex Approval Chains That Don’t Scale Well

- OCR Accuracy for Receipt Scanning

- Integration Pains with Accounting or Payroll Tools

- Balancing Flexibility with Policy Enforcement

- Security and Compliance Expectations

- User Adoption - Especially from Non-Tech Teams

- Feature Creep and Scope Overload

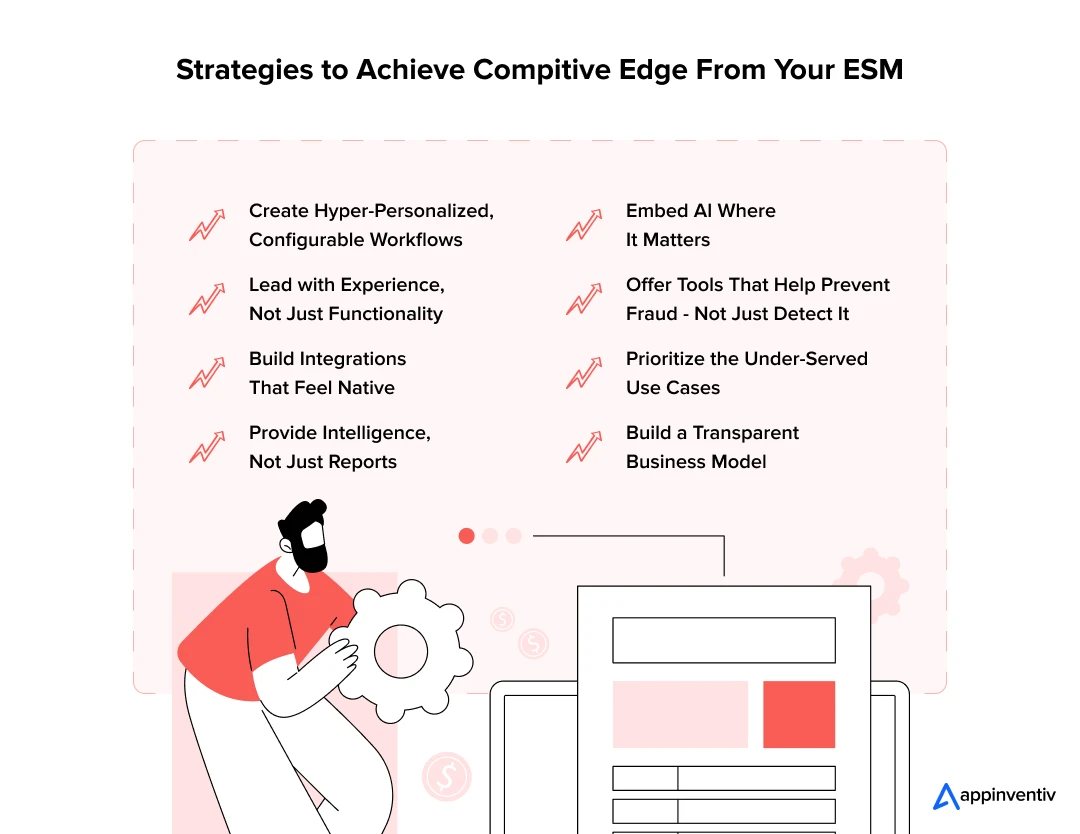

- How to Get a Competitive Edge in the Expense Management Software Market

- Create Hyper-Personalized, Configurable Workflows

- Lead with Experience, Not Just Functionality

- Build Integrations That Feel Native

- Provide Intelligence, Not Just Reports

- Embed AI Where It Matters

- Offer Tools That Help Prevent Fraud - Not Just Detect It

- Prioritize the Under-Served Use Cases

- Build a Transparent Business Model

- How can Appinventiv Help You Build an Expense Management Platform?

- FAQs.

Managing business expenses might seem straightforward until you’re knee-deep in missing receipts, delayed approvals, and end-of-month surprises. For many companies, especially as they grow, the way they track and control spending becomes a major roadblock. Suddenly, it’s not just about logging purchases or categorizing costs anymore; it’s about gaining real-time visibility, staying compliant, and making faster, smarter financial decisions.

Off-the-shelf tools can help to an extent, but they often come with limitations. They’re not always flexible, scalable, or tailored to how your teams operate. That’s where custom expense management system development steps in, not as another tool to maintain, but as a strategic solution designed around your workflows, policies, and goals.

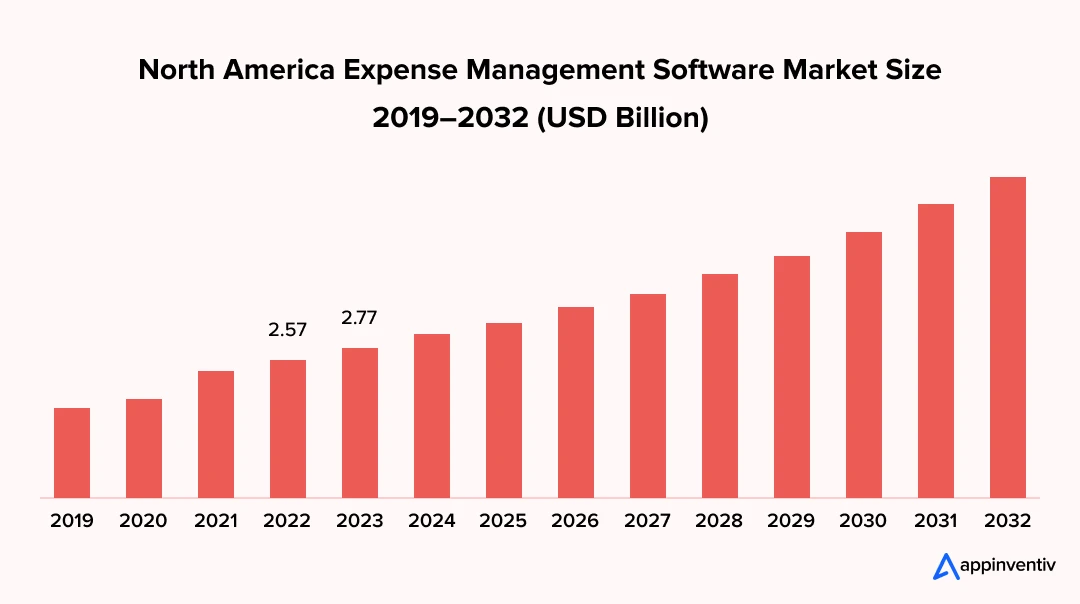

Expense Management Software Market Size and Share

According to the Fortune Business Insights, The global expense management software market size was valued at USD 7.08 billion in 2023. The market is projected to grow from USD 7.64 billion in 2024 to USD 16.48 billion by 2032, exhibiting a CAGR of 10.1% during the forecast period.

Building such a system from the ground up may sound ambitious, but it’s worth it. With the right approach, you can create a platform that automates repetitive tasks, enforces company policies, integrates seamlessly with accounting systems, and delivers powerful insights without the need to chase numbers.

In this article, we’ll break down what it takes when we talk about expense tracking software development that’s not just functional, but future-ready. From the must-have features and backend structure to integrations, security, and user experience – we’re covering it all.

So, if you plan to develop a solution that brings control, clarity, and efficiency to how companies manage expenses, you’re in the right place.

Let’s get started.

Why is Custom Expense Management System Development Worthwhile?

Every business spends, but not every business spends smart. While pre-built expense management tools offer convenience, they often fall short when adapting to specific operational needs. The more your organization scales, the more unique your spending patterns, approval chains, reimbursement rules, and reporting requirements become. At some point, plug-and-play just doesn’t cut it, you need an assistance of custom software development.

- Custom business expense software development fills that gap since it’s built around your workflows, not the other way around. Whether you need multi-level approvals, country-specific tax handling, real-time policy validation, or integrations with tools your teams already use, going custom allows you to make it all work seamlessly.

- Another one of the benefits of expense management system lies in its competitive advantage. When expense data is accurate, accessible, and intelligently organized, decision-making improves. Teams move faster, finance has fewer bottlenecks, and leadership gets the clarity to plan. Plus, automation in business process cuts down manual tasks, reduces errors, and frees up your people to focus on what matters.

- Security, too, is one of the major benefits of expense management software. With custom software, you control how sensitive financial data is stored, shared, and accessed. You’re not relying on a third-party tool with unknown backdoors or rigid data policies. You build your own rules – and own your risk posture.

If there’s anything the benefits of expense management systems tell us, it is that custom-built expense management software isn’t just a nice-to-have; it’s a strategic asset. especially if you’re thinking long-term and want technology that evolves as your business does.

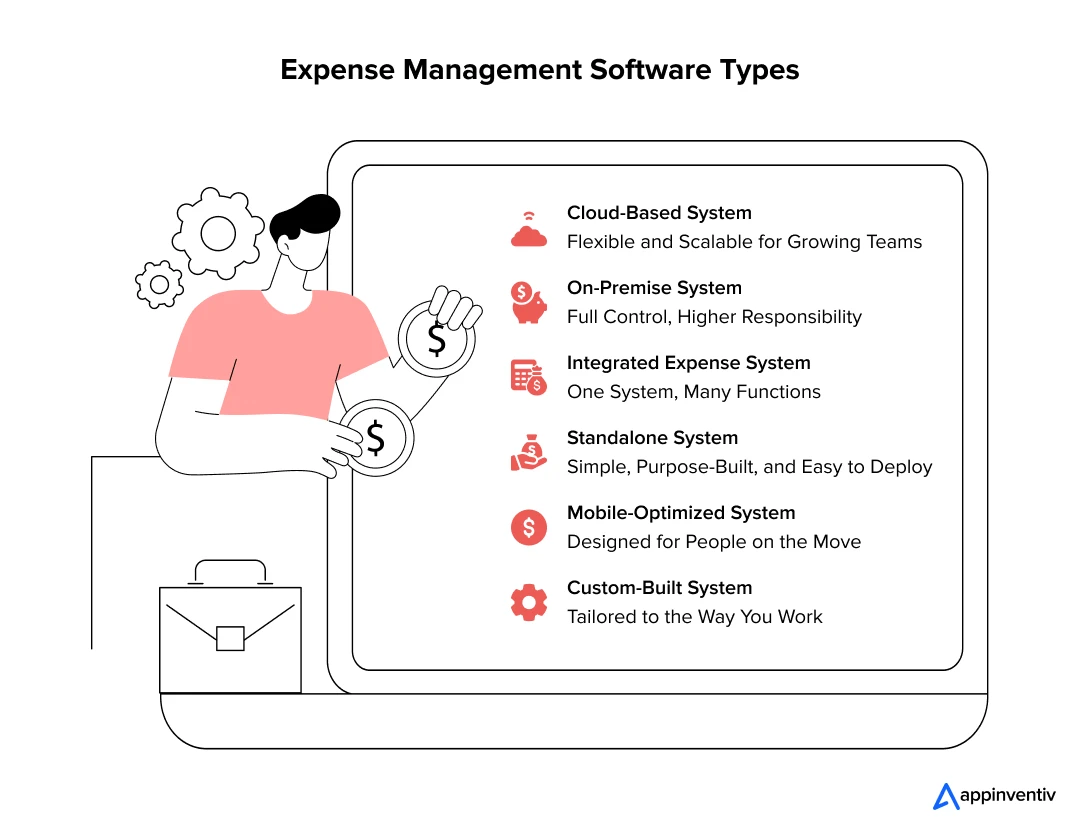

The Types of Expense Management Software

Before jumping into the business expense management software development cost phase, it’s important to consider how your software will be deployed. After all, the type you choose influences everything, from how data flows to how much control you have over customization, scalability, and security.

Let’s break down the main categories and when each makes the most sense.

Cloud-Based System: Flexible and Scalable for Growing Teams

Cloud-based expense management software development hosts the platform online, making it accessible from anywhere. The provider handles updates, backups, and server maintenance, which means less work for your IT team and more uptime for your users.

Use It When:

You need a solution that scales quickly, supports remote or hybrid teams, and doesn’t demand heavy infrastructure investment. This solution is ideal for startups, mid-sized companies, and businesses growing across regions.

On-Premise System: Full Control, Higher Responsibility

On-premise spend management software development efforts are installed on your servers and maintained internally. They give you greater control over data security, custom configurations, and system behavior.

Use It When:

You’re in a highly regulated industry like finance, healthcare, or government, where compliance, internal data handling, and security policies demand tight in-house control. Typically favored by enterprises with dedicated IT teams.

Integrated Expense System: One System, Many Functions

These types of expense management software are part of larger platforms – often bundled into ERP accounting software, or HR software. They streamline expense tracking by syncing it with budgeting, payroll, and reporting functions.

Use It When:

You already use a robust ERP or accounting system and want expense data to flow effortlessly into your financial records without duplicating work. This is common in businesses that prioritize data consistency across departments.

Standalone System: Simple, Purpose-Built, and Easy to Deploy

A standalone custom expense management software development process implies that the software is built for one purpose: managing expenses. These apps are focused, often lightweight, and can be easier to implement and train users on.

Use It When:

You don’t need deep integration with other tools, but want a clean, efficient way to manage spending, approvals, and reports, especially helpful for small businesses or companies piloting a specific workflow.

Mobile-Optimized Tools – Designed for People on the Move

These expense management software development processes are handled with the intent that they should be built for a mobile-first experience, allowing users to capture receipts, log expenses, and submit reports from their phones – no laptop needed.

Use It When:

You’ve got field teams, frequent travelers, or sales reps who must submit expenses from the road. It’s also useful when mobile adoption is high across your organization.

Custom-Built System: Tailored to the Way You Work

Sometimes, none of the pre-built options fit perfectly. Custom expense management software development allows you to design from the ground up, aligning the software with your exact processes, policies, and data flows.

Use It When:

Your workflows are unique, your compliance needs are strict, or you’re building a SaaS product that requires expense management as a core feature. Custom is also a smart play when future flexibility and long-term IP ownership matter.

Each of these different types of expense management software has its place, and often, the right choice comes down to your company’s size, industry, growth stage, and internal capabilities. A lean startup might thrive on a cloud-based mobile tool, while a multinational enterprise may need an integrated or on-premise solution tailored for complex regulations.

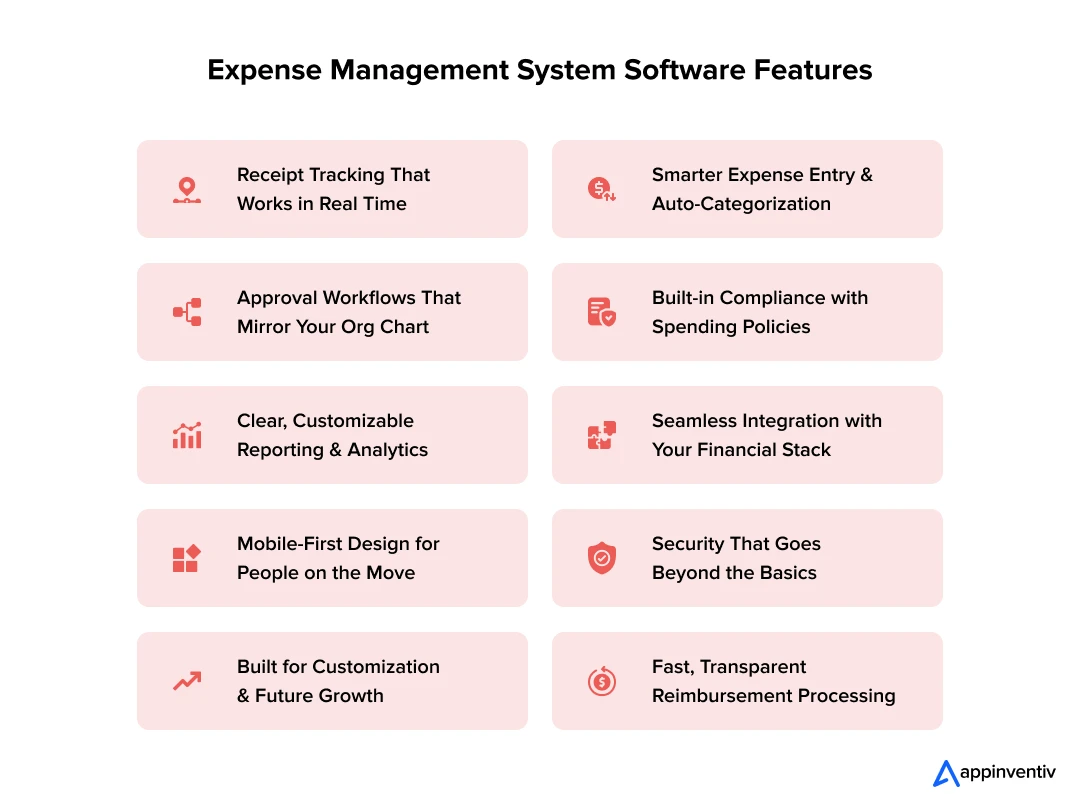

Key Features of an Expense Management System You Shouldn’t Skip

Behind every great expense management software development process is a set of thoughtfully designed features that do more than just track spending; they eliminate friction, enforce rules, and surface insights that help teams spend smarter. Here’s what to include if you want your software to feel modern, useful, and irreplaceable.

Receipt Tracking That Works in Real Time

Users should be able to upload receipts on the spot, by snapping a photo, forwarding an email, or dragging and dropping a file. From there, your software should automatically extract key details like merchant name, date, and amount using OCR (Optical Character Recognition). This reduces the need for manual input and helps ensure every transaction has the necessary documentation, which is crucial for audits and reimbursement.

“Don’t ever let your business get ahead of the financial side of your business. Accounting, accounting, accounting. Know your numbers.”

By Tilman J. Fertitta, CEO of Fertitta Entertainment

Smarter Expense Entry and Auto-Categorization

Rather than forcing users to type in every detail manually, a well-researched expense management software development life cycle should aim to build a product that suggests inputs, remembers frequent vendors, and automatically categorizes entries based on historical data or pre-set rules. This speeds up the submission process while keeping your expense data clean, structured, and easy to analyze. Over time, auto-categorization helps uncover trends and spending patterns that might otherwise stay buried in spreadsheets.

Approval Workflows That Mirror Your Org Chart

Custom approval chains are key, especially when your teams are spread across departments or regions. Through the expense tracking software development efforts, managers should be able to review, comment, approve, or reject expenses within their scope, whether that’s a line item, a report, or a recurring cost. When the system mirrors your internal hierarchy, it keeps accountability clear and decisions transparent, everyone knows who approves what, and nothing slips through the cracks.

Built-in Compliance with Spending Policies

Expense policies are only useful if they’re enforced in the moment, not after reports are submitted. Your business expense software development journey should flag out-of-policy expenses – say, a hotel charge above your travel limit or a missing receipt on a meal claim – before they reach finance. When thresholds are crossed, you can set limits per category, block non-approved vendors, or trigger additional approvals. This keeps teams aligned with company guidelines without needing constant manual oversight.

Clear, Customizable Reporting and Analytics

A well-designed expense Management System development process focusing on dashboards can turn expense data into real-time business insights. You should be able to drill down into who’s spending what, how team budgets are used, and where costs can be trimmed. Flexible reporting helps leaders monitor financial health and make informed decisions, whether by employee, department, project, or vendor. Bonus points if your system supports scheduled exports, visual graphs, or anomaly detection.

Seamless Integration with Your Financial Stack

Your business expense management software development efforts should play nicely with the rest of your ecosystem. That includes syncing with accounting platforms (like QuickBooks or Xero), ERPs, cloud-based payroll software, and banking APIs. When expense entries flow directly into ledgers and reimbursement systems, you cut down on data duplication, reduce errors, and simplify reconciliation. Integration isn’t just a convenience, it connects expenses to the rest of your business operations.

Mobile-First Design for People on the Move

In today’s work environment, not everyone sits at a desk. Your mobile interface should be as powerful and intuitive as the desktop version – if not more so. That means capturing receipts, submitting expenses, approving reports, and checking statuses. A clean, responsive mobile cloud-based expense management software development helps field teams, sales reps, and frequent travelers keep expenses updated in real time, preventing pileups at the end of the month.

Security That Goes Beyond the Basics

Handling financial data means protecting it, for which your system should offer enterprise-grade security: encrypted data transfers, role-based access, audit logs, and compliance standard developments through HIPAA or GDPR Software Development . Users should only see what they’re supposed to, and sensitive information – like personal bank details or salary-linked reimbursements – must be shielded at every level. Ultimately, the more secure your spend management software development is, the higher the chances to earning user trust and minimizing your risk exposure.

Built for Customization and Future Growth

No two teams handle expenses the same way. All the key components of expense management software should let teams configure fields, workflows, approval tiers, and spending categories to match their processes. More importantly, it should be able to scale as your headcount, business units, or international operations expand. A system that grows with you is far more cost-effective than rebuilding from scratch every few years.

Fast, Transparent Reimbursement Processing

After approval, the next thing employees care about is: “When will I get paid?” Implementing expense management software strategically should automate reimbursements, track statuses, and keep employees informed along the way. That includes generating payment files, triggering payouts through integrated finance tools, and sending confirmations. A transparent, quick process boosts employee satisfaction and reduces finance team follow-ups.

Together, these features of an expense management system don’t just make spending management easier, they help turn it into a streamlined, data-rich, and policy-aligned workflow that adds real value to your business. Whether you’re building for a small startup or a large enterprise, this feature set forms your foundation.

How to Design an Intuitive, Engaging Expense Management Platform

Design isn’t just how your product looks – it’s how it feels when people use it. And in the case of expense management software, design decisions directly impact adoption, data accuracy, and even compliance.

The efforts that go behind expense management software development that people don’t just tolerate but rely on daily, you need to blend clarity with utility, and simplicity with depth.

Here’s how:

1. Prioritise Functional Simplicity

Your users aren’t just finance professionals – they’re employees from sales, HR, operations, and field teams. Many of them only open the platform when they need to submit a receipt or check their reimbursement status, making it critical to keep their paths short and clean. So plan out for one-screen submissions, smart defaults, autosaves, and confirmation nudges. Every extra click is a leak in usability.

2. Design with Contextual Intelligence

Make the system smart enough to respond to the user’s intent. If someone selects “Flight” as an expense category, show fields like airline, trip ID, or ticket class. If a user is submitting from abroad, surface exchange rates or per diem calculators can be a crucial add-on in expense management system development. Good design anticipates needs without being overwhelmed with options.

3. Mobile-First, Desktop-Solid

For many users, mobile will be their main touchpoint, so design your app to be fast, minimal, and gesture-friendly. But don’t ignore power users on desktop – finance admins, auditors, and CFOs will need more screen real estate for bulk reviews, multi-entity reports, and complex workflows. Balance both worlds.

4. Make Approvals a Joy, Not a Chore

Approval is often the bottleneck, something which can be used to reduce friction by allowing one-click approvals, email-triggered actions, mobile push notifications, or Slack integrations. During the expense tracking software development highlight what’s important – amount, date, reason – without making them dig through PDFs or attachments.

5. Use Visual Hierarchy for Trust and Speed

Design with visual cues. Use color to indicate status (pending, approved, flagged), icons to guide action, and spacing to reduce cognitive load. Show totals upfront, keep text minimal, and use tooltips where complexity is unavoidable.

6. Embed Micro-Automations Where it Matters

Let the design do the heavy lifting. Autofill recent vendors, pull data from connected cards, pre-suggest categories, and validate entries in real-time. These subtle moments of efficiency are what separate average business expense software development efforts from great ones.

7. Accessibility isn’t Optional

Don’t design only for a certain class of users. Think of color contrast, screen reader compatibility, keyboard-only navigation, and legible fonts. Accessible design makes your software more usable for everyone, and can be the deciding factor in larger enterprise deals.

8. Design for Trust

When people submit financial documents, trust becomes part of your UI. To aid that, avoid cluttered screens, use reassuring language, and show real-time sync statuses. And if something fails, like an upload error – offer clear feedback and simple recovery steps. Ultimately, great design removes doubt at every stage.

At the end of the day, users won’t remember all your features. But they’ll remember whether your platform made their job easier or more frustrating. And that’s exactly what great design gets right.

Tech Stack to Make Your Expense Management Software the Go-to Business Platform

What powers a high-performing expense management system isn’t just smart features – it’s the technology stack behind the scenes. The right tools and frameworks ensure your business expense management software development outcome runs smoothly, scales reliably, and delivers an experience users actually enjoy. And as businesses lean into automation and data intelligence, weaving in next-gen technologies isn’t just a nice-to-have, it’s a competitive edge.

Frontend Frameworks

User experience is everything. A snappy, intuitive interface helps users adopt the platform faster and stick with it.

- React or Vue.js

- Tailwind CSS or Material UI

- TypeScript

Together, these tools help you deliver a seamless experience across web and mobile.

Backend Frameworks

The backend is where all the heavy lifting happens – processing approvals, managing data, enforcing rules.

- Nodejs with Express, or Django (Python)

- PostgreSQL or MongoDB or MySQL

- Redis

- JWT or OAuth 2.0

A modular backend makes your system faster to develop, easier to test, and simpler to maintain over time.

Cloud Infrastructure

Cloud based expense management software development ensures your platform can scale with growing user bases and handle large volumes of data without breaking.

- AWS, Google Cloud, or Azure

- Kubernetes or Docker

- CI/CD pipelines (like GitHub Actions or Jenkins)

This setup not only speeds up development cycles but also strengthens system resilience and uptime.

Mobile Tech Stack

For mobile-first accessibility, consider building with:

- React Native or Flutter

- SQLite or Firebase

- Native integrations with device features (camera, file storage, push notifications)

This approach ensures users can submit expenses, approve requests, or check reports from anywhere.

Next-Gen Tech Stack

Adding future-facing technologies doesn’t just make your software smarter, it makes it irreplaceable.

- AI and Machine Learning: Modern enterprises use NLP and image recognition to auto-categorize expenses, flag policy violations, and extract receipt data with minimal input. Over time, ML models can identify fraud patterns or predict spending trends by department.

- Blockchain: For industries that require high auditability and compliance (like finance or healthcare), blockchain can add a tamper-proof layer to approval and reimbursement trails.

- RPA (Robotic Process Automation): Backed by robotic technology, Robotic Process Automation automates repetitive tasks like syncing expense reports to accounting tools or generating monthly budget summaries.

- Chatbots or Voice Interfaces: Allow users to submit expenses or check reimbursement statuses through Slack, Microsoft Teams, or even voice assistants like Alexa.

These examples of AI integrations push your product beyond basic functionality—turning it into a proactive, insight-driven business partner.

Data Privacy and Compliance Stack

Expense data is sensitive. Your tech stack needs to support full compliance with local and global data regulations.

- SOC 2, HIPAA, GDPR-ready frameworks and cloud tools

- End-to-end encryption, audit logging, and role-based access control

- Periodic security assessments and automated threat detection tools (like AWS GuardDuty or Google Cloud Security Command Center)

A privacy-first foundation not only builds user trust but helps avoid costly legal issues down the road.

When you blend a thoughtful core stack with next-gen tools, you don’t just invest in a SaaS-based spend management software development, you build a system that evolves with your users, integrates effortlessly into their workflows, and quietly solves problems before they become blockers. That’s what it takes to become the go-to business platform for managing expenses.

The Development Process for Turning an Idea Into a Working EMS Platform

Expense management software development life cycle isn’t a sprint – it’s a layered process that moves from problem to product, with multiple checkpoints in between. While the journey can look different depending on your goals (in-house use vs SaaS product), here’s a streamlined blueprint most teams follow:

1. Understand the Problem You’re Solving

Start here. Always. Before jumping into tech stacks or features, define the core problem. Are businesses struggling with manual data entry? Is policy enforcement scattered? Are reimbursement cycles dragging too long?

Talk to real users – employees, finance heads, operations leads. Their daily frictions will shape what you build, how you build it, and why anyone will care.

2. Map Out Requirements and User Journeys

Once the problem’s clear, turn it into a plan. Define what your custom expense management software development process should be today and in the long term.

- Who are your users? (e.g. submitters, approvers, finance teams)

- What are their goals? (e.g. submitting an expense, reviewing reports, enforcing policies)

- What features are essential for your MVP? (e.g. receipt scanning, approval workflows, reporting)

Sketch out user journeys. Think about how someone gets from “uploading a receipt” to “getting reimbursed” – and where things might break along the way.

3. Design for Clarity and Speed

Design is more than visual polish, it’s how users experience your product. Simplicity matters.

- Wireframe your app’s layout and flows

- Prototype and test core interactions

- Make sure key actions are accessible with minimal clicks

Real-world use is messy. People might upload receipts while rushing through an airport or check reimbursement status between meetings. Your design has to make room for those realities.

4. Choose the Right Tech Stack and Build Your Architecture

This is where vision meets infrastructure. Based on the scope of the expense management software development process, choose the frameworks, databases, and services that’ll help you scale without friction.

- Frontend: React or Vue.js for fast, modular interfaces

- Backend: Node.js with Express or Django for robust APIs

- Database: PostgreSQL, MongoDB, or a hybrid model depending on your data needs

- Cloud: AWS, Azure, or GCP for scalable infrastructure

- Integrations: APIs for payroll, accounting, or CRM platforms

- Security: Authentication, encryption, role-based access

Set up clean development environments, CI/CD pipelines, and testing frameworks to keep your team moving efficiently.

5. Develop, Test, Repeat

With your architecture in place, it’s time to start developing and implementing expense management software.

- Break features into manageable sprints

- Write modular, testable code

- Continuously test for bugs, usability issues, and edge cases

- Include real users early – let them click, break, and shape your product

Every cycle of testing improves the user experience. And every round of feedback brings the product closer to the solution you set out to build.

Also Read: Guide For Software Product Development for Businesses

6. Launch with Intention

Don’t rush a full-scale launch. Start small.

- Soft launch with a pilot group

- Monitor usage patterns, user feedback, and bug reports

- Refine the rough edges: UX bottlenecks, approval delays, edge-case bugs

- Prepare onboarding tools – walkthroughs, tooltips, or simple documentation

Only when it works well for a few should you open it up to many and even then & keep iterating.

The expense management software development process isn’t linear, it’s alive. What starts as a feature wishlist quickly becomes a cycle of learning, building, and refining. And that’s what separates the good products from the ones businesses swear by.

Cost of Developing an Expense Management Software

The expense management software development cost depends on how deep you want to go. From lightweight internal tools to full-featured SaaS products, the complexity drives the timeline, team size, and ultimately, the budget.

Here’s a realistic breakdown:

Basic Expense Tracker (MVP-Level)

Estimated Cost: $25,000 – $50,000

This is ideal for startups or companies looking to digitize receipts and streamline basic expense workflows. The feature set that help define the expense management software development cost usually includes:

- Manual entry of expenses

- Receipt uploads (basic file handling)

- Simple approval flows

- Basic user roles

- Exportable reports (CSV, PDF)

Expect a lean team – 1-2 developers, a designer, and a QA resource. Development time: 2–3 months.

Mid-Range Platform with Integrations

Estimated Cost: $50,000 – $100,000

This tier suits companies that want to integrate expense tracking with accounting tools (like QuickBooks, Xero) and automate more of the process. At this price point, the key components of expense management software you will get are:

- OCR-based receipt scanning

- Policy enforcement

- Reimbursement tracking

- Role-based access

- Integration with payroll/accounting

- Mobile-first UI

This level requires more rigorous backend architecture, security protocols, and testing. Timeline: 4-6 months.

Enterprise-Grade or SaaS-Level Solution

Estimated Cost: $100,000 – $300,000+

Designed for scalability and multi-tenant use, this level includes:

- Real-time dashboards and analytics

- Custom workflows per department or client

- AI for policy anomaly detection

- Audit trails and advanced compliance

- Multi-language/currency support

- Full cloud-native infrastructure

- Admin controls and permission layers

- API marketplace or developer support

You’ll need a full product team – backend/frontend devs, DevOps, QA, designers, and likely a product manager. Timeline: 6-12+ months depending on iterations.

Cost Factors to Consider

- Hosting & Infrastructure: Cloud service fees can grow as your user base scales

- Maintenance & Updates: Software maintenance costs cover Bug fixes, feature upgrades, and support cost 15–20% of initial dev cost annually

- Compliance & Security: If you handle sensitive financial data, you’ll need to invest in certifications, audits, and tighter security protocols

- Third-party APIs: OCR, payroll, or analytics tools may charge usage-based fees.

Development Challenges and How to Navigate Them

Building business expense management software might sound straightforward, until you get into the thick of it. Real-world usage brings out edge cases, and even simple workflows can turn complex once scaled.

Here are some common hurdles you’ll likely face when developing or implementing expense management software, along with ways to tackle them head-on.

Complex Approval Chains That Don’t Scale Well

The challenge: Businesses have varied approval structures – some linear, some matrixed, and others entirely custom. What works for a 20-person team may break in a 500-employee org.

The fix: Build a dynamic workflow engine that lets admins configure rules based on amount, department, or geography. Incorporate delegation and escalation paths early in your design.

OCR Accuracy for Receipt Scanning

The challenges of expense management software: Scanning and extracting data from paper receipts is tough. Text might be faded, formats inconsistent, and lighting conditions poor – leading to bad data capture.

The fix: Use a pre-trained OCR engine (like Google Vision or Tesseract) and fine-tune it using real receipt data. Pair OCR with human verification workflows in the early versions to increase accuracy before full automation.

Integration Pains with Accounting or Payroll Tools

The challenge: Each third-party platform (QuickBooks, Xero, ADP) has its own API quirks, versioning rules, and data models. Building one integration doesn’t guarantee the next will be as smooth.

The fix: Create an abstraction layer in your backend to normalize data between your system and external platforms. That way, adding new integrations won’t require major overhauls in logic or UI.

Balancing Flexibility with Policy Enforcement

The challenge: You want users to submit expenses easily – but also need to make sure they don’t break company rules. Going too strict causes friction. Too loose, and finance teams lose control.

The fix: Build real-time policy checks that flag issues without blocking submission. Let users explain exceptions and route these for manual review. Over time, use analytics to refine these rules.

Security and Compliance Expectations

The challenge: You’re handling sensitive financial data – PII, tax IDs, reimbursement details. Breaches aren’t just costly; they kill trust.

The fix: Implement strong encryption (both at rest and in transit), role-based access control, and audit logs. Regularly update libraries, conduct vulnerability scans, and follow compliance frameworks (like SOC 2 or ISO 27001) if you’re targeting enterprise users.

User Adoption – Especially from Non-Tech Teams

The challenge: Even the smartest software fails if employees don’t use it. And many users, especially in field teams, might not be tech-savvy or patient with new tools.

The fix: Prioritize user experience from day one. Offer mobile-first design, tooltips, simple onboarding, and fallback options (like email-based submissions). Add gamification or small nudges to encourage repeat use.

Feature Creep and Scope Overload

The challenges of expense management software: As you start testing, requests come pouring in – more dashboards, new filters, custom workflows. It’s easy to lose focus and stretch your team thin.

The fix: Stick to your problem statement. Build a solid MVP, gather feedback, and prioritize updates based on real usage data, not just loud opinions. A focused tool that works always beats a bloated one that doesn’t.

Every product hits bumps. What matters is how early you see them coming – and how you design your way through. With careful planning and continuous iteration, these expense management software development life cycle challenges become part of your competitive edge.

How to Get a Competitive Edge in the Expense Management Software Market

In a saturated market, building just another use cases of expense management software development won’t cut it. The real win? Building one that teams actually love to use, and finance teams can actually trust. The edge comes not from flashy features alone, but from solving the quiet pains better than anyone else. Here’s how to get there:

Create Hyper-Personalized, Configurable Workflows

What works for a startup won’t fly at an enterprise. Build your software to accommodate the key components of expense management software like dynamic workflows, multiple approval chains, departmental rules, region-based exceptions, without requiring developer’s help. Flexibility becomes your strength when scale enters the picture, especially when weighing the build vs buy software decision as your company grows.

Lead with Experience, Not Just Functionality

Users don’t remember specs; they remember how your software made them feel. Fast load times, clean mobile layouts, one-tap approvals, auto-fill fields – these small things drive adoption. Make the product feel invisible, and it’ll become indispensable.

Build Integrations That Feel Native

Don’t just offer “plug-ins.” Offer workflows. If someone connects their payroll or ERP tool, your system should adapt to how those platforms already behave. Real-time syncing, two-way updates, no duplicated entries, your integrations should feel like an extension, not an add-on.

Provide Intelligence, Not Just Reports

Businesses don’t want rows of numbers – they want answers. Equip your tool with smart analytics that highlight overspending trends, recurring violations, department-wise burn, or even expense patterns by vendors. Enable proactive decisions, not just passive downloads.

Embed AI Where It Matters

Instead of adding AI for buzz, use it to solve real problems, like auto-categorising expenses, flagging anomalies, and even recommending approval actions based on historical patterns. A system that “thinks” makes teams faster without needing to micromanage.

Offer Tools That Help Prevent Fraud – Not Just Detect It

Another powerful way to gain a competitive edge? Build proactive fraud prevention into the core. Here’s how modern platforms do it:

- Real-time policy enforcement: Expenses flagged instantly if they’re out of policy – no waiting for end-of-month audits.

- Duplicate detection: Auto-spot identical receipts submitted across users, trips, or dates.

- AI-based anomaly spotting: Frequent just-under-limit expenses or inconsistent tipping patterns? The system picks up on it.

- Digital audit trails: Every step is logged, from submission to reimbursement. No gaps, no guessing.

- Smart OCR for receipts: Scanned data is verified against claimed amounts, catching image edits or incorrect inputs.

- Granular user analytics: Finance can spot red flags down to individual behaviors: repeat breaches, round-amount abuse, or rule overrides.

Together, these tools don’t just reduce fraud – they help your product earn deep trust with CFOs and compliance heads, a demographic that’s often hard to impress.

Prioritize the Under-Served Use Cases

Want to win loyalty fast? Solve the micro-pains others ignore, like offline functionality for traveling staff, per diem rate calculators for global teams, or flexible mileage tracking. These niche features may not headline your pitch deck, but they’ll headline your retention stats.

Build a Transparent Business Model

Clear, tiered pricing, human onboarding support, and fast-response help should not be treated as extras – they’re expectations. Especially when your buyers are comparing half a dozen tools.

In the end, the competitive edge lies in building a product that doesn’t just manage expenses, but improves trust, reduces risk, and saves time without users even realizing it. That’s how you move from being an “option” to being the solution.

“Control your expenses better than your competition. This is where you can always find the competitive advantage.”

By Sam Walton, Founder of Walmart

How can Appinventiv Help You Build an Expense Management Platform?

At Appinventiv, US leading custom software development firm, we approach every product not just as a set of features to build, but as a business problem to solve. And expense management is one of those areas where we’ve seen too many tools fail – not because they lacked functionality, but because they lacked alignment with real user needs and business workflows.

That’s why we start by understanding your specific goals, processes, and user types before writing a single line of code. We work closely with your internal teams to map out a platform that feels familiar yet powerful – one that simplifies rather than disrupts. With deep experience in fintech-grade architecture, we’ve built solutions that go beyond tracking receipts. From setting up dynamic approval hierarchies to integrating with ERPs, payroll systems, accounting tools, and even banks, we bring in the technical depth that ensures your software is secure, scalable, and ready for growth.

Our design philosophy is grounded in usability. We build for people who may be logging expenses during travel, managing reimbursements in bulk, or analyzing reports for trends. Every flow is optimized for speed and clarity – on both desktop and mobile.

And when it comes to technology, we’re not afraid to push boundaries. We’ve used AI to automate expense categorization, leveraged OCR to extract data from receipts instantly, and embedded machine learning algorithms that flag outlier behavior, reducing the risk of fraud at its root.

Throughout development, our process is agile, transparent, and collaborative. You’ll always have clear visibility into what’s being built and why. And we don’t stop at launch. Our long-term partnerships focus on monitoring user engagement, improving performance, rolling out new features, and ensuring that your platform continues to evolve with your business.

So if you’re looking to partner with a fintech software development company to build an expense management system that people actually use, and that finance teams actually trust, we’re ready to help. From product thinking to deep tech execution, we’re in this with you, every step of the way.

FAQs.

Q. What is expense management software?

A. Expense management software is a digital solution that helps businesses track, process, and control employee expenses. It streamlines everything from capturing receipts and submitting claims to enforcing company policies and generating audit-ready reports. Instead of relying on manual spreadsheets or email-based approvals, an EMS automates the entire workflow – saving time, reducing errors, and improving compliance.

Q. How much does it cost to develop an expense management software?

A. The cost that an expense management software development company charges depends heavily on the scope, features, and scale of the solution. For a basic app with core functionalities like receipt tracking, manual entry, and simple approvals, development might start around $30,000–$50,000.

The expense management software development cost for a mid-tier platform with integrations, analytics, and mobile responsiveness could range between $60,000–$100,000.

For enterprise-grade solutions with AI-powered fraud detection, multi-level access, customization, and real-time syncing, the cost may exceed $150,000. Ultimately, it all comes down to complexity, tech stack, and long-term goals.

Q. How does an EMS improve the visibility of business spending?

A. An EMS brings clarity to company-wide spending by centralizing all expense data in one place. With real-time dashboards, category-wise breakdowns, and detailed reports, finance teams can quickly spot spending trends, identify policy breaches, and make informed budget decisions. Instead of digging through scattered records or waiting for month-end reconciliations, businesses get instant visibility into who’s spending, on what, and how much – across departments, projects, and geographies.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

The ROI of Strategic Insurance Technology Consulting for Legacy Modernization

Key takeaways: Insurance technology consulting delivers ROI only when modernization is tied to real workflows, not system replacement. Most legacy modernization failures stem from weak ROI definition and tracking, not from technology limitations. The strongest returns come from reduced operational friction, faster change cycles, and tighter claims and underwriting control. Delaying modernization incurs hidden costs…

Key Takeaways Use a scorecard-driven RFP and a technical assessment to compare vendors on capability, compliance, and delivery risk. Local partners provide regulatory and cultural alignment; hybrid teams often pair that with offshore cost efficiency. Start with a scoped pilot or MVP, milestone-based contracts, and clear IP/SLAs to reduce procurement risk. Require demonstrable security controls,…

A Strategic Framework for Proof of Concept Software Development

Key takeaways: Most enterprise PoCs fail due to a lack of decision clarity, not technical feasibility or innovation potential. A disciplined PoC framework reduces delivery risk before budgets, teams, and timelines are committed. Enterprise-grade PoCs validate feasibility, compliance, and scale assumptions under realistic operating constraints. Clear success metrics and governance turn PoCs into reliable inputs…