- A Glimpse Into The Santander App: How It's Redefining the Mobile Banking World

- Cost to Build a Mobile Banking App Like Santander

- Understanding the Factors Influencing the Cost to Develop an App Like Santander

- Platform Choice (iOS, Android, or Cross-Platform)

- App Complexity and Features

- Regulatory Compliance

- Security Measures

- User Interface and User Experience (UI/UX) Design

- Backend Development

- Maintenance and Updates

- Marketing and Launch

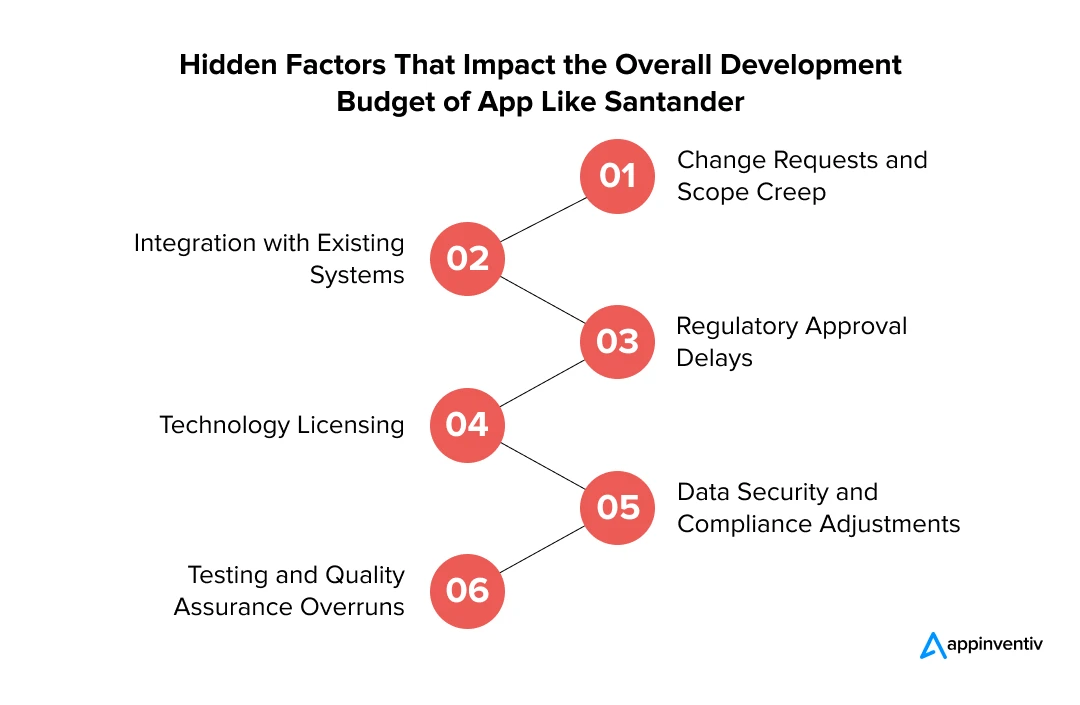

- Hidden Factors Impacting the Cost to Develop an App Like Santander

- Change Requests and Scope Creep

- Integration with Existing Systems

- Regulatory Approval Delays

- Technology Licensing

- Data Security and Compliance Adjustments

- Testing and Quality Assurance Overruns

- How to Optimize the Overall Cost to Develop an App Like Santander

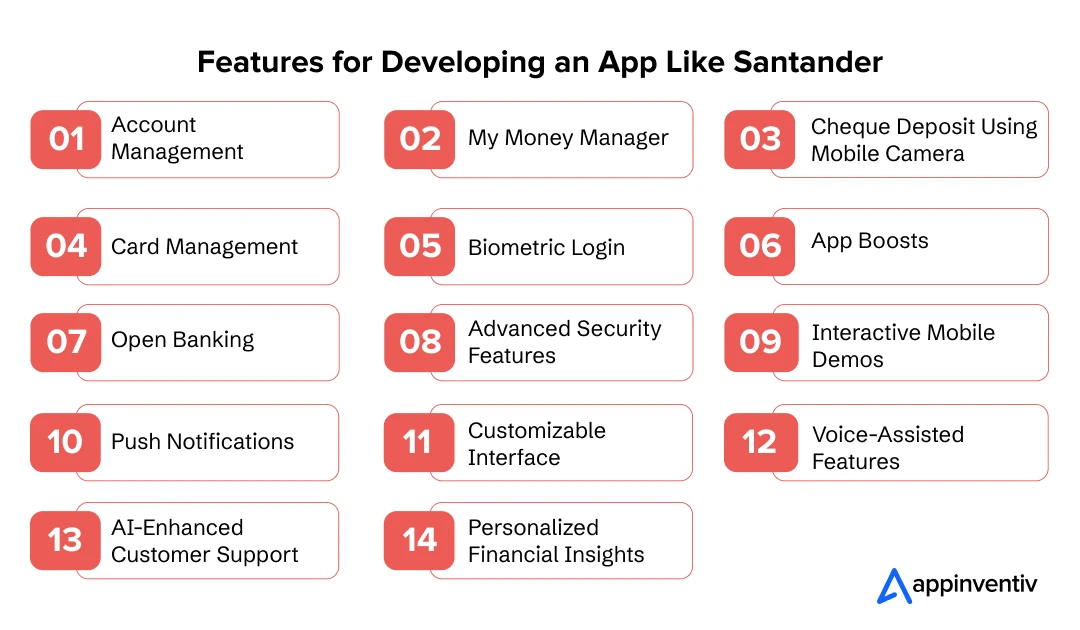

- Features to Develop a Robust Mobile Banking App Like Santander and Even Outgrow It

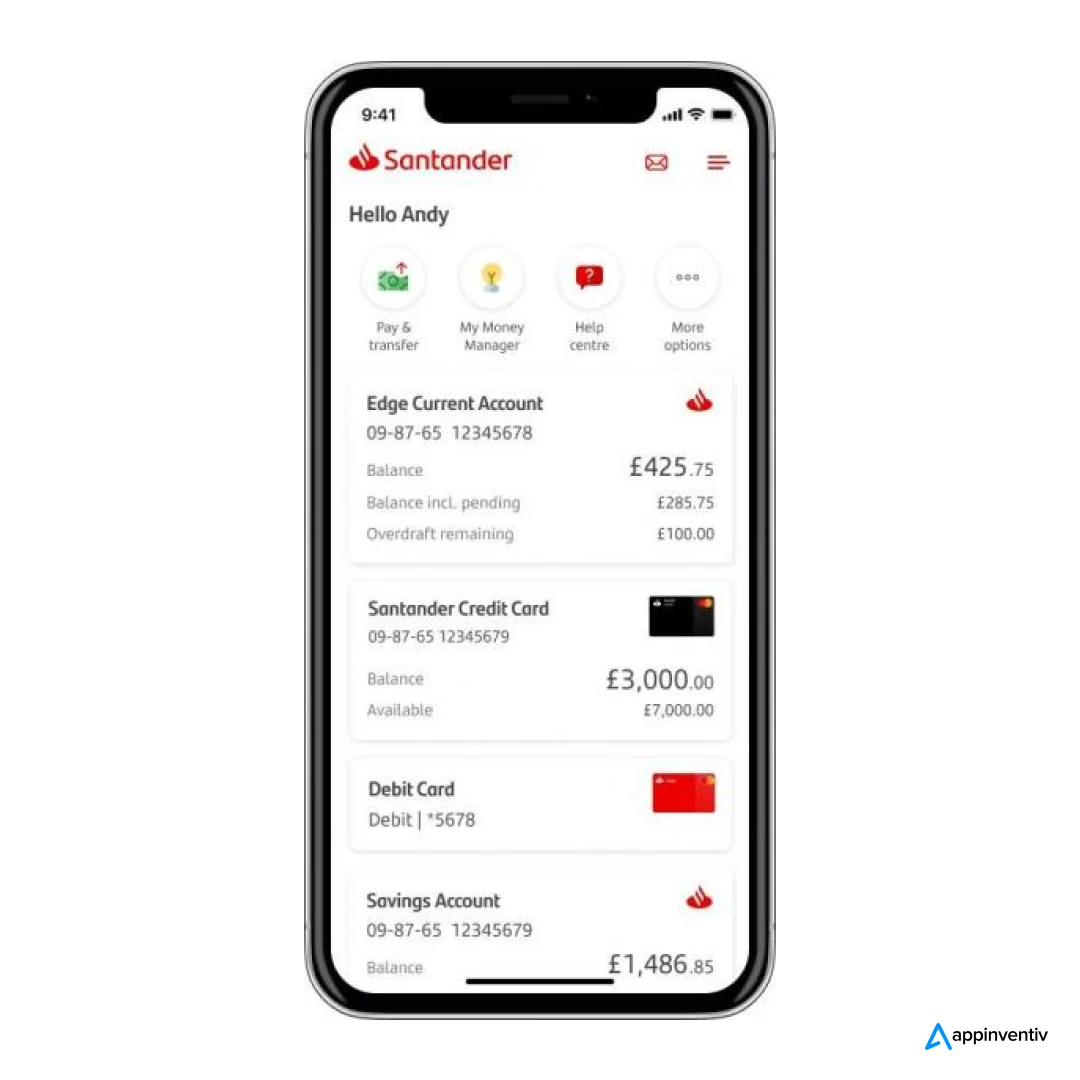

- Account Management

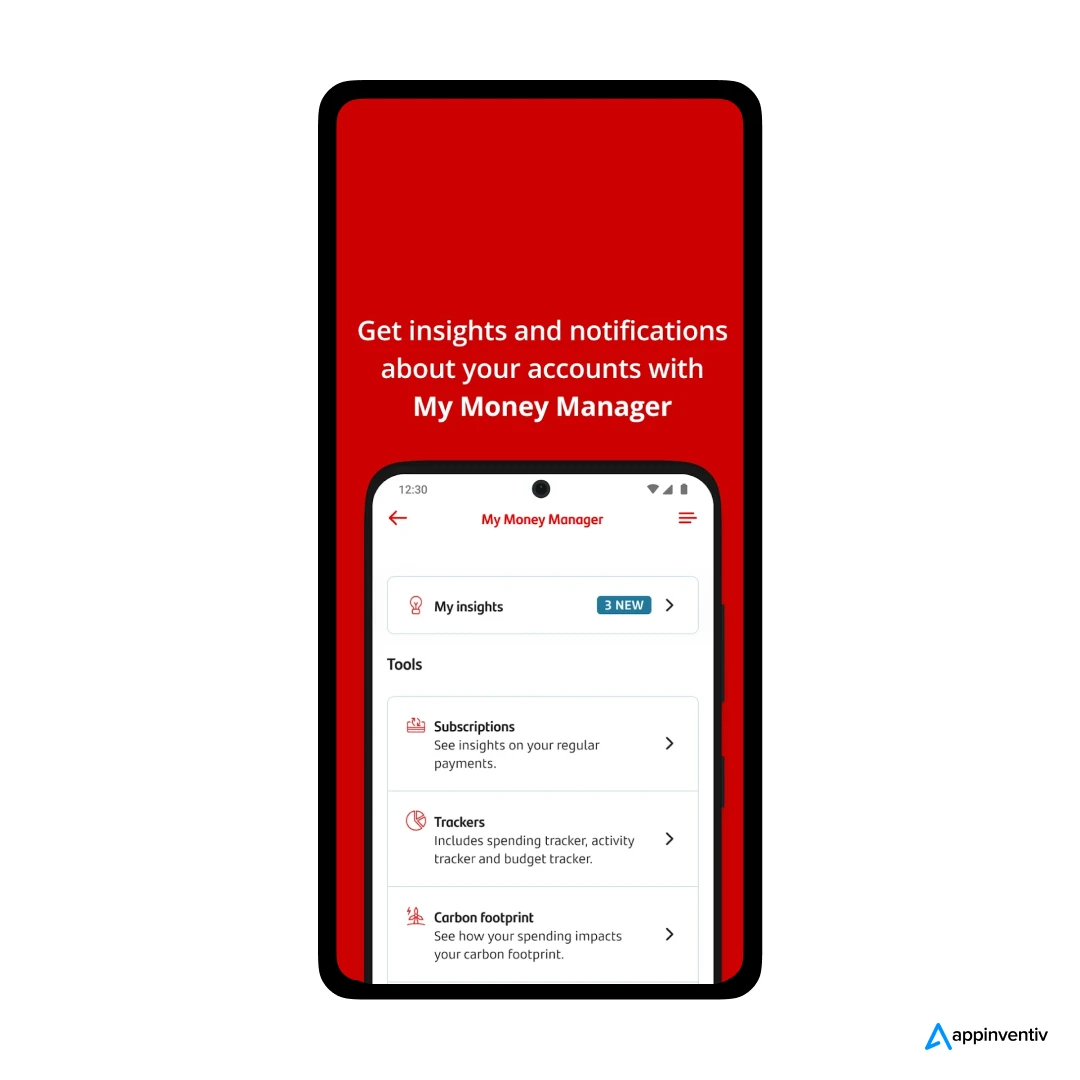

- My Money Manager

- Cheque Deposit Using Mobile Camera

- Card Management

- Biometric Login

- App Boosts

- Open Banking

- Advanced Security Features

- Interactive Mobile Demos

- Push Notifications

- Customizable Interface

- Voice-Assisted Features

- AI-Enhanced Customer Support

- Personalized Financial Insights

- How to Develop an App Like Santander?

- Market Research and Planning

- UI/UX Design

- Choose the Technology Stack

- Development Phase

- Security Measures

- Testing and Quality Assurance

- Deployment

- Marketing and Launch

- Maintenance and Updates

- How Does Mobile Banking Apps Like Santander Make Money?

- Transaction Fees

- Account Management Fees

- Interchange Fees

- Third-Party Service Integration

- Advertisements

- Technology Service Fees

- Why Appinventiv is the Reliable Partner for Developing a Mobile Banking App Like Santander

- FAQs

In a digital age where convenience is king, the race to dominate the mobile banking sector is fierce. As more consumers across the EU and globally ditch traditional banking for the ease of digital transactions, mobile banking apps like Santander have surged to the forefront.

This shift is more than just a trend but a total transformation in how users interact with their finances, offering immediate access and robust security measures that were once unimaginable. The message for businesses is clear: those not investing in this digital revolution may be outpaced by more tech-savvy competitors, and we don’t want that.

The Santander app, in particular, has set a high bar in mobile banking. Known for its comprehensive features and intuitive design, it’s not just keeping pace but defining the direction of the industry. Its success provides a compelling case study for why businesses should consider mobile banking app development. As consumers increasingly value digital banking convenience, the demand for more innovative and user-friendly apps continues to grow, presenting a golden opportunity for businesses ready to step into the development arena.

Understanding the cost to build a mobile banking app like Santander is the first step for businesses ready to take this leap. The budget can range widely, from $40,000 to $300,000 (EUR 38,400 to EUR 288,000) influenced by factors such as the app’s complexity, the platforms it will operate on, compliance needs, and the technological infrastructure required.

This blog will serve as a roadmap for those considering such a venture. We will help you understand what it takes to build a competitive mobile banking app, its essential features, compliance requirements, and monetization strategies. With the right approach, businesses can enter the market and set new standards, ensuring their place in the rapidly evolving world of digital banking.

Let’s build your industry leader together!

A Glimpse Into The Santander App: How It’s Redefining the Mobile Banking World

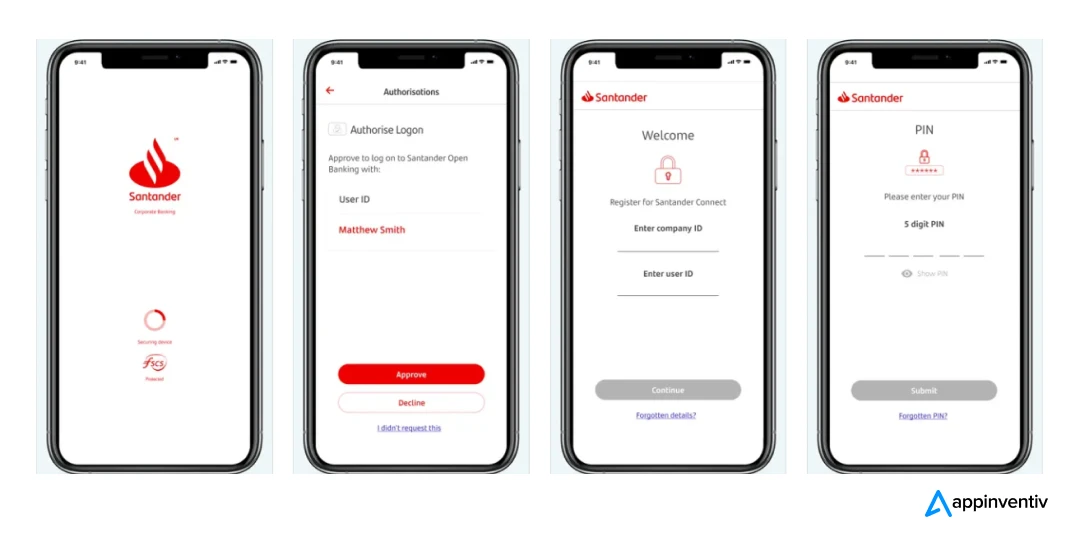

The Santander mobile app represents a leap forward in financial technology, particularly for SME & SOHO customers. Developed as a full-feature native platform for iOS and Android, it gives users instant access to a comprehensive suite of financial tools.

The app facilitates routine transactions and provides working capital and a marketplace to buy and manage products and services. This makes it an invaluable resource for freelancers and micro-businesses, offering an ecosystem brimming with easy solutions and valuable added services.

- One of the key strengths of the Santander app is its user-centric design, which focuses on streamlining and simplifying the banking experience.

- Customers can manage their accounts, apply for loans, and access various financial services with just a few taps.

- The interface is designed to be intuitive, making it accessible even to those who are not tech-savvy.

- This focus on accessibility and functionality sets the Santander app apart in a crowded marketplace, making it a preferred choice for users looking for a reliable and comprehensive banking solution.

The Santander app has had a remarkable impact on the bank’s performance. With over 5 million downloads, it has played a significant role in boosting Santander’s financial results. In 2024, the bank reported an attributable profit of €12,574 million, a 14% increase from the previous year. This growth was supported by strong revenue from global businesses and the addition of eight million new customers, raising the total to 173 million. These figures demonstrate the app’s success and highlight its role in achieving record results for the third year.

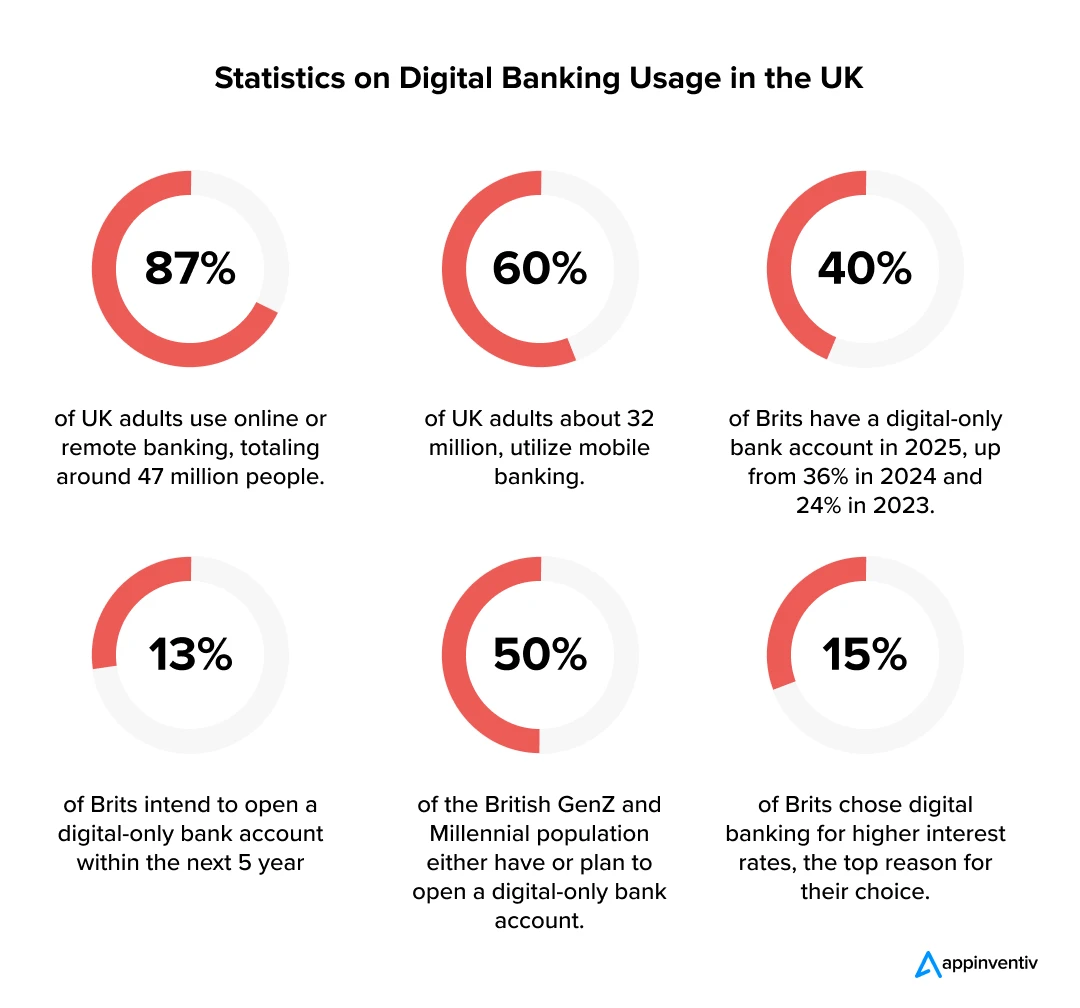

If you are still unsure of why it’s the right time to invest in a mobile banking app for your business, let’s look at the statistics below:

Mobile banking apps are popular among UK users due to their convenience and efficiency. These apps allow users to manage their finances easily from anywhere, with features like instant payments, real-time balance checks, and straightforward money transfers. Moreover, strong cybersecurity measures in these apps ensure that users’ financial data is protected. Users also use the bank’s application to strengthen loyalty towards the bank.

Ready to launch your solution now? Considering all the above details, understanding the financial commitment involved is crucial if you launch a mobile banking app like Santander’s. In the next section, we will dive into the details of mobile banking app development costs, considering various factors influencing the development process and final pricing. This will give you a clearer idea of the investment needed to bring a competitive mobile banking solution to market.

Cost to Build a Mobile Banking App Like Santander

As previously mentioned, the cost to develop a mobile banking app similar to Santander can range from $40,000 to $300,000 (EUR 38,400 to EUR 288,000). However, this is a broad estimate, and the actual cost can vary significantly based on several factors that affect the complexity and scope of the app development.

To get a rough estimate of the cost to develop a mobile banking app, you can use the following formula:

This calculation involves estimating the total number of hours developers will need to build the app and multiplying it by their hourly rate. Considering that the hourly rate can vary widely depending on your development team’s expertise is essential.

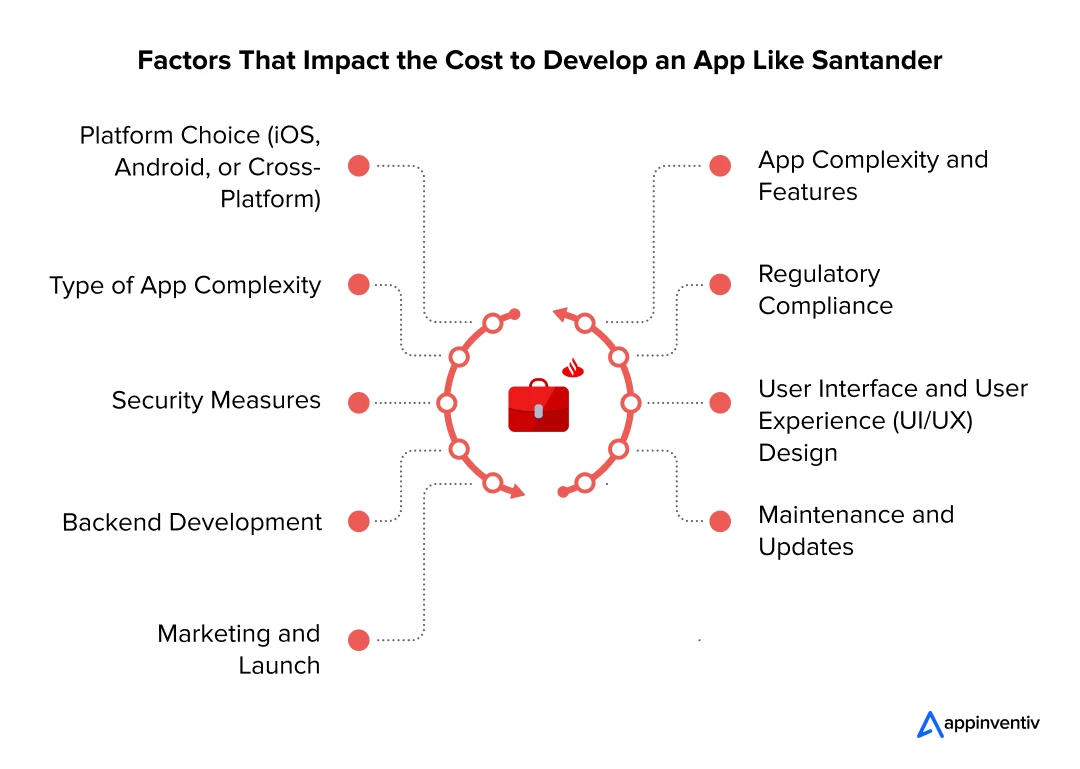

Understanding the Factors Influencing the Cost to Develop an App Like Santander

For businesses planning to develop a mobile banking app, it’s crucial to understand the various factors affecting mobile banking app development cost. Here are some key considerations:

Platform Choice (iOS, Android, or Cross-Platform)

The choice of platform can affect the mobile banking app development cost. Developing natively for iOS or Android might be more expensive than cross-platform solutions, but it often offers better performance and user experience.

App Complexity and Features

The number and complexity of features significantly impact the cost. Basic features like account management and transaction history are less costly than more advanced features like biometric security, AI-based customer support, or integration with other financial services.

| Type of App Complexity | Cost Range | Timeline |

|---|---|---|

| Basic App | $40,000 – $60,000 | 3-6 months |

| Moderate App | $60,000 – $150,000 | 6-12 months |

| Complex App | $150,000 – $300,000 | 12+ months |

Regulatory Compliance

Banking apps must adhere to various regulatory standards, varying by region. Ensuring compliance with these regulations can add to the cost to build a mobile banking app like Santander.

| Standard | Description |

|---|---|

| GDPR | Requires data protection and privacy for individuals within the European Union. |

| PCI DSS | Global standard that mandates secure handling of credit card information to prevent fraud. |

| KYC/AML | Standards for verifying customer identity and monitoring transactions to prevent illegal activities. |

| Secure Electronic Transaction (SET) | Ensures secure and private online financial transactions. |

| Financial Conduct Authority (FCA) Regulations | Protects consumers and enhances market integrity in the UK. |

Security Measures

High-level security features, including encryption, fraud detection algorithms, and secure user authentication, are crucial for banking apps but can be costly to implement.

User Interface and User Experience (UI/UX) Design

A well-designed interface requires skilled designers and can take considerable time to perfect, which adds to the cost.

Backend Development

The complexity of the backend system, which handles data management, security, and integration with other banking systems, can also be a significant factor that affects the mobile banking app development cost.

Maintenance and Updates

Post-launch maintenance and regular updates to ensure the app remains compatible with new operating system versions and hardware add ongoing costs.

Marketing and Launch

Marketing your app and managing its launch can also incur costs, from promotional activities to initial user support.

Considering the factors that affect the mobile banking app development cost, let’s move ahead and look into the breakdown of the overall cost as per the multiple development stages.

| Development Stage | Cost Estimate | Timeline |

|---|---|---|

| 1. Planning and Analysis | $5,000 – $15,000 | 2-4 weeks |

| 2. UI/UX Design | $10,000 – $25,000 | 4-8 weeks |

| 3. Backend Development | $15,000 – $60,000 | 8-16 weeks |

| 4. Frontend Development | $10,000 – $40,000 | 8-16 weeks |

| 5. Security Measures | $10,000 – $30,000 | 4-8 weeks |

| 6. Testing and Deployment | $10,000 – $25,000 | 6-12 weeks |

| 7. Maintenance and Updates | Ongoing costs | Ongoing |

Hidden Factors Impacting the Cost to Develop an App Like Santander

While the direct costs associated with the development stages of a mobile banking app like Santander are significant, hidden factors can also impact the overall cost. These hidden factors often go overlooked in the initial budgeting but can have substantial financial implications as the project progresses. Let’s take a look at them below:

Change Requests and Scope Creep

You might want to add new features or change existing plans during the development process. This can lead to what is known as ‘scope creep,’ where the project grows beyond its original scope. Such expansions can increase the cost to create an app like Santander and delay the project’s timeline as additional resources are needed to accommodate the changes.

Integration with Existing Systems

Integrating the new app with existing banking systems, databases, or third-party services can be more complicated and expensive than anticipated. The compatibility between the latest app and existing systems can greatly affect the effort required to ensure they work seamlessly together, potentially increasing the cost to build a mobile banking app like Santander.

Regulatory Approval Delays

Obtaining the necessary regulatory approvals can take longer than expected. Any delays in the approval process can extend the project timeline and increase the costs to make an app like Santander. You might need to continue consulting with legal and compliance experts longer than planned.

Technology Licensing

Developing a mobile banking app requires specific technologies, often with licensing fees. These charges can be significant depending on the technologies chosen, and in many cases, these fees are recurring, adding to the overall cost to create an app like Santander.

Data Security and Compliance Adjustments

Banking apps must adhere to strict data security and regulatory standards, which can change. Keeping up with these changes might require additional adjustments, involving more work and possibly more money to ensure the app complies with the latest standards.

Testing and Quality Assurance Overruns

Ensuring that the app is secure and functions correctly without any bugs is crucial. However, thorough testing and quality assurance can take more time and resources than initially expected, especially if significant issues are found that need to be resolved, which can push the budget higher.

After looking into the major mobile banking app development cost factors, let’s move ahead and look into how businesses like yours can optimize the overall development budget.

How to Optimize the Overall Cost to Develop an App Like Santander

Optimizing the cost of developing a mobile banking app like Santander is crucial for maintaining budget efficiency and maximizing return on investment. Here’s how businesses can effectively manage the mobile banking app development cost:

| Strategy | How It Helps in Optimizing Costs |

|---|---|

| Outsourcing Development | Leveraging offshore development teams can reduce labor costs due to lower wages in certain countries compared to local rates. |

| Choosing the Right Technology | Selecting the most suitable technology stack that aligns with project requirements can prevent overspending on unnecessary or overly complex tools. |

| Minimizing Feature Set | Launching with a Minimum Viable Product (MVP) that includes only essential features can lower initial costs and allow for iterative development based on user feedback. |

| Efficient Project Management | Strong project management practices ensure the project stays on track, preventing costly overruns due to mismanagement or scope creep. |

| Automated Testing | Automated testing tools can speed up the testing phase, reduce the need for extensive manual testing, and decrease the overall development time cost to build a mobile banking app like Santander. |

| Regular Maintenance Checks | Regular maintenance and updates can prevent costly downtime and the need for extensive overhauls in the future, thus saving money in the long term. |

Features to Develop a Robust Mobile Banking App Like Santander and Even Outgrow It

When aiming to create a mobile banking app as comprehensive and successful as Santander’s, it’s important to integrate essential features that meet the needs of modern users. Here are some key features in the Santander app and additional features that could enhance functionality and user satisfaction.

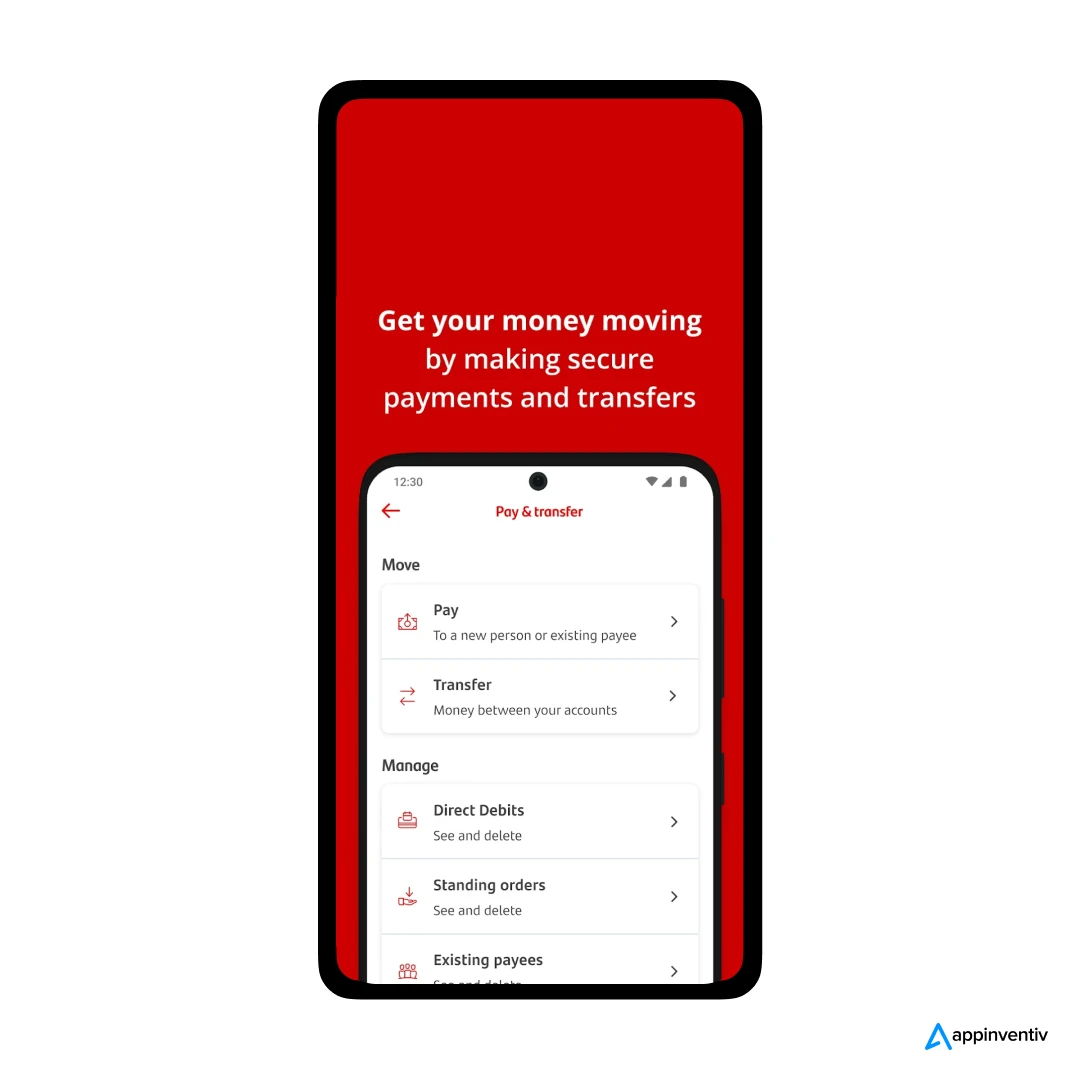

Account Management

Users can easily check their balances, view a list of recent transactions, and manage their accounts efficiently. This includes the ability to pay bills, transfer money, and view detailed reports of their spending.

My Money Manager

This feature provides personalized financial insights based on the user’s spending habits, helping them to manage their finances better. It sends notifications directly to the user’s device, offering timely and relevant financial advice.

Cheque Deposit Using Mobile Camera

Users can deposit cheques by simply taking a photo with their mobile device, making the process quick and convenient without the need to visit a bank branch.

Card Management

This includes the ability to freeze and unfreeze a card, set spending limits, and block certain transactions like international or online payments. It also allows users to report cards as lost or stolen through the app directly.

Biometric Login

For enhanced security, the app supports biometric logins such as fingerprint scanning, Face ID, or Touch ID, ensuring that only the account holder can access the financial details.

App Boosts

This feature offers rewards such as cashback, vouchers, and access to exclusive offers and prize draws, adding an extra incentive for users to engage with the app regularly.

Open Banking

By leveraging Open Banking standards, the app allows users to link and view their external bank accounts within the mobile banking app, providing a comprehensive view of their finances in one place.

Advanced Security Features

Implement robust fraud prevention measures, real-time transaction monitoring, and the ability for users to quickly switch off features or services, providing top-tier security and peace of mind.

Interactive Mobile Demos

Offer step-by-step tutorials within the app to help users understand how to use different features effectively, improving the user experience, especially for those who are less tech-savvy.

Push Notifications

Send real-time alerts for transactions, insights, and reminders for bill payments or other important financial deadlines, keeping users informed at all times.

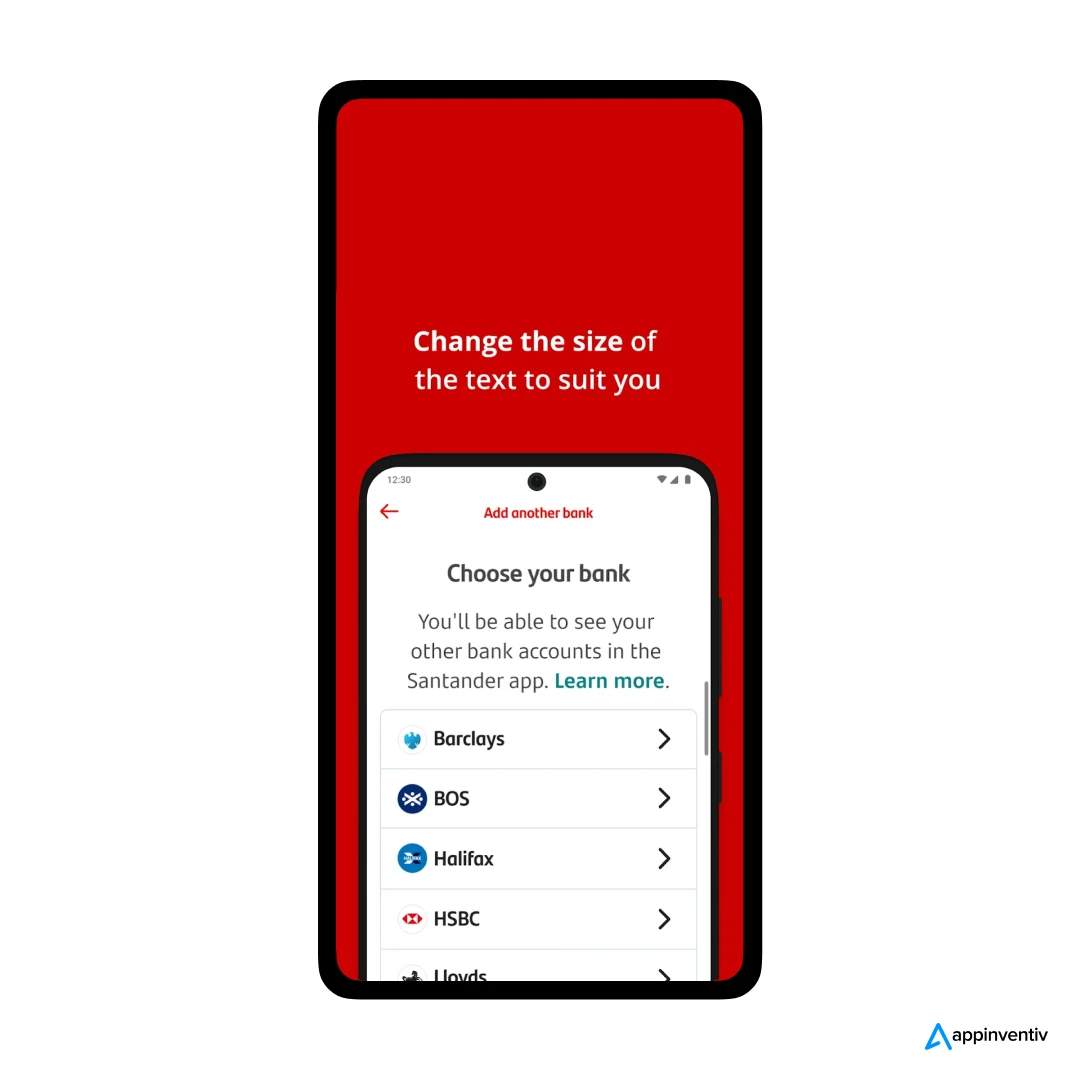

Customizable Interface

Allow users to customize their dashboard and settings, such as text size and app notifications, to suit their preferences, making the app more personal and user-friendly.

Voice-Assisted Features

Integrate voice command capabilities that allow users to perform banking tasks through spoken instructions, enhancing accessibility and convenience for all users.

AI-Enhanced Customer Support

Offers round-the-clock customer service through AI-powered chatbots, capable of resolving a wide range of banking queries quickly and efficiently. Businesses must understand that integrating AI in their app can add to the cost to develop a mobile banking app like Santander.

Personalized Financial Insights

Provides tailored financial advice by analyzing users’ spending habits and economic behavior, helping them to make informed decisions about saving, investing, and budgeting.

After looking into the features of a mobile banking app like Santander, let’s move ahead and understand the process to develop a mobile banking app like Santander

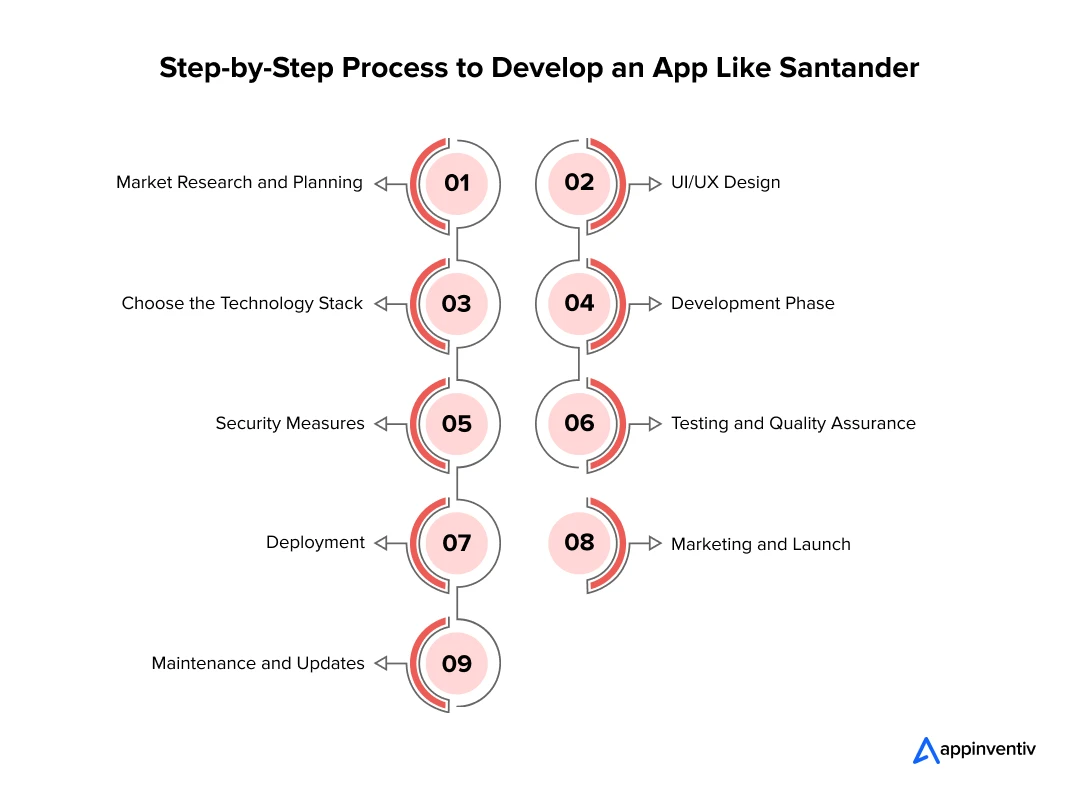

How to Develop an App Like Santander?

Developing a mobile banking app like Santander involves meticulous planning and execution to ensure it meets the high security, functionality, and user experience standards. Here’s a step-by-step guide to the development process:

Market Research and Planning

Begin by conducting thorough market research to understand the needs and preferences of your target audience. This step helps identify the key features that will set your app apart and determine the regulatory requirements for the markets you aim to serve.

UI/UX Design

Design a user interface that is both intuitive and appealing. The user experience should be smooth, with easy navigation and quick access to key features like account management, transactions, and customer support. The design phase should focus on creating a seamless experience on various devices and platforms.

Choose the Technology Stack

Select the appropriate technology stack based on your app’s requirements. This includes deciding between native or cross-platform development and choosing the right back-end technologies that ensure the app’s scalability, security, and performance. Businesses must understand that the cost to build a mobile banking app like Santander can be affected with the technologies they choose for development.

Development Phase

Start the actual coding and development of the app. This phase involves setting up the backend, integrating the front end with the user interface, and ensuring all components work together seamlessly. Regular testing during this phase is crucial to identify and fix any issues early.

Security Measures

Implement top-notch security protocols to protect user data and comply with financial regulations. This includes encryption, secure data storage, fraud detection systems, and communication channels.

Testing and Quality Assurance

Conduct thorough testing, including functional testing, performance testing, security testing, and user acceptance testing (UAT), to ensure the app is robust and user-friendly. Address any issues and ensure the app meets all technical and business requirements.

Deployment

Once testing is complete and the app meets all standards, deploy it to the app stores. Ensure you have a plan for ongoing maintenance and updates based on user feedback and technological advancements.

Marketing and Launch

Develop a strong marketing strategy to launch your app. This should include promotional activities to generate interest before the launch and engagement initiatives to attract and retain users post-launch. This phase of development can also add to the additional cost to develop a mobile banking app like Santander.

Maintenance and Updates

Post-launch, continuously monitor the app’s performance and gather user feedback to make necessary improvements. Regular updates should be planned to add new features, enhance existing ones, and address security issues.

After looking into the overall cost to create an app like Santander, the features required to develop a robust app like that and its development process, let’s move on to understand how an app like Santander makes money.

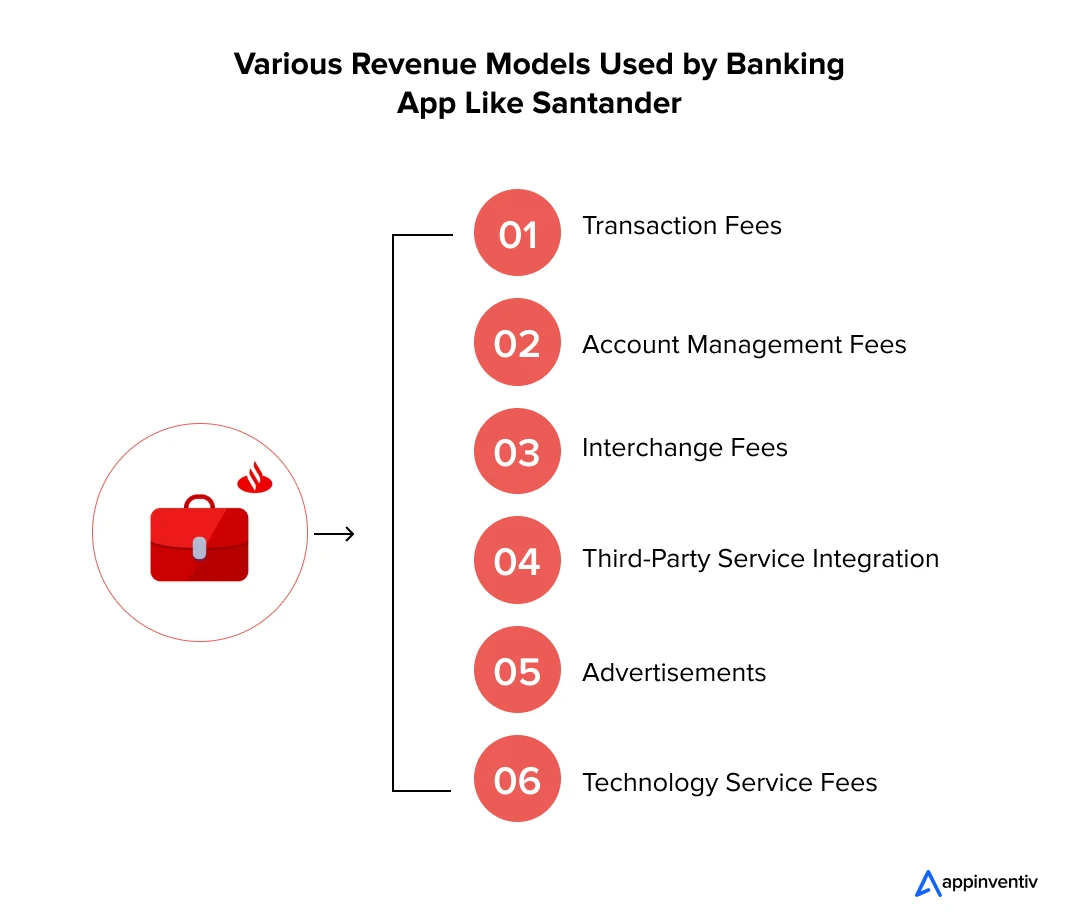

How Does Mobile Banking Apps Like Santander Make Money?

Mobile banking apps like Santander have transformed how users manage their finances, providing convenience and accessibility right at their fingertips. Here’s how these apps generate revenue:

Transaction Fees

Banks often charge fees for certain transactions made through the app, such as wire transfers or currency exchange services. These fees are a direct source of income and are usually specified in the bank’s fee schedule.

Account Management Fees

Some mobile banking apps may offer premium account management services that require a subscription or maintenance fee. These services can include advanced financial planning, personalized investment advice, or higher transaction limits.

Interchange Fees

Every time a customer uses a bank-issued card associated with the app for transactions, the bank earns interchange fees from the merchant.

Third-Party Service Integration

Mobile banking apps can integrate and offer third-party financial services like insurance or investment products. Banks earn commissions for transactions made for these services through their app.

Advertisements

Some banks may choose to display third-party advertisements within their mobile banking app. These ads help in generating ad revenue for the bank.

Technology Service Fees

Banks may charge additional fees for advanced features like budgeting tools or investment platforms integrated within the app.

Why Appinventiv is the Reliable Partner for Developing a Mobile Banking App Like Santander

We hope this blog has helped you understand the complexities and cost to build a mobile banking app like Santander. Partnering with a reliable development firm can significantly streamline this process, ensuring your app meets industry standards and excels in customer satisfaction. Here’s why Appinventiv is the right FinTech app development company in the UK for your project:

- Expertise That Stands Out: We have a proven track record of success, having developed numerous high-performance mobile apps across various sectors, including finance. Our portfolio demonstrates our ability to deliver complex projects with precision and excellence.

- Leading with Innovation: We don’t just build apps; we innovate beyond that. We are known for integrating cutting-edge technologies like AI, blockchain, and IoT to provide functional and forward-thinking solutions that keep our clients ahead in the digital curve.

- Security at Its Core: In mobile banking, security is paramount. We prioritize robust security protocols, ensuring that all applications adhere to the latest security measures to protect sensitive data and comply with international regulatory standards.

- Flexibility and Speed: By adopting an agile development methodology, we ensure that our projects are flexible enough to adapt to changes and efficient enough to deliver on time. This approach minimizes risks and speeds up the time to market, providing a competitive edge.

- Customized to Your Needs: As a leading mobile app development company in the UK, we ensure every project begins with understanding the client’s unique needs. We tailor our solutions to align perfectly with your business goals, ensuring that the final product meets and exceeds your expectations.

- Support Beyond Launch: Our relationship with clients doesn’t end at launch. We provide ongoing support and maintenance, helping keep the app updated with the latest technological advancements and security updates, ensuring smooth operation daily.

- Advanced AI Capabilities: Our experts specialize in incorporating AI-driven features that enhance user engagement and streamline operations in banking apps. From personalized financial advice and fraud detection analytics to automated customer support, our expertise ensures your mobile banking app delivers a smarter, more intuitive UX.

Contact us to transform your mobile banking vision into reality with a state-of-the-art app that sets new standards in the financial industry.

FAQs

Q. How long does it take to build an app like Santander?

A. Building a mobile app typically takes anywhere from several months to over a year, depending on the complexity of the app and the specific features required. For a robust mobile banking app like Santander, you can expect the development process to range from 6 to 12 months as it involves intricate security measures and complex functionalities.

Q. How much does it cost to develop a mobile app like Santander?

A. The cost to build a mobile banking app like Santander can vary widely, ranging from $40,000 to $300,000 or more. Factors influencing the cost include the app’s design complexity, the number of platforms it will run on, the expertise of the development team, and the inclusion of advanced features such as AI and blockchain technologies.

Q. How can businesses ensure quality mobile banking app development while optimizing costs?

A. businesses can partner with experienced development firms like Appinventiv to ensure quality app development while optimizing costs. Such firms leverage efficient project management, embrace agile methodologies, and utilize the latest technologies to deliver high-quality apps. They also focus on building Minimum Viable Products (MVPs) to test the market before fully investing, ensuring that development is cost-effective and aligned with user needs. This strategic approach helps manage the budget without compromising the quality and functionality of the app.

10 Industry-Wise 5G Use Cases Transforming Australian Businesses

Key takeaways: Industry Transformation: 5G is revolutionizing key sectors in Australia, including healthcare, manufacturing, agriculture, and logistics, by enabling real-time data processing, enhanced connectivity, and automation that improve operational efficiency and customer experiences. Enhanced Connectivity for Regional Areas: 5G technology bridges the connectivity gap in remote and regional areas of Australia, supporting industries like agriculture…

How to Build a Secure App in Australia in 2025? All You Need to Know

In today’s hyper-connected world, mobile apps aren’t just conveniences; they are the baseline of modern business. From banking and healthcare to retail and government services, apps power our daily lives. But this digital revolution has a dangerous downside: cyberattacks are escalating alarmingly. More than data exposure, this security breach costs businesses a lot, destroys customer…

How to Build a Ride-Hailing App Like Yango Ride?

Dubai's streets are buzzing with innovation. The city is fast becoming a playground for smart mobility, from AI-driven traffic systems to autonomous taxis. In the middle of it all, the decision to build an app like Yango has brought serious traction, offering seamless, affordable, and tech-savvy transport alternatives. But here’s the thing: success in this…