- How Billing Automation Software Solve the Manual Billing System Problems?

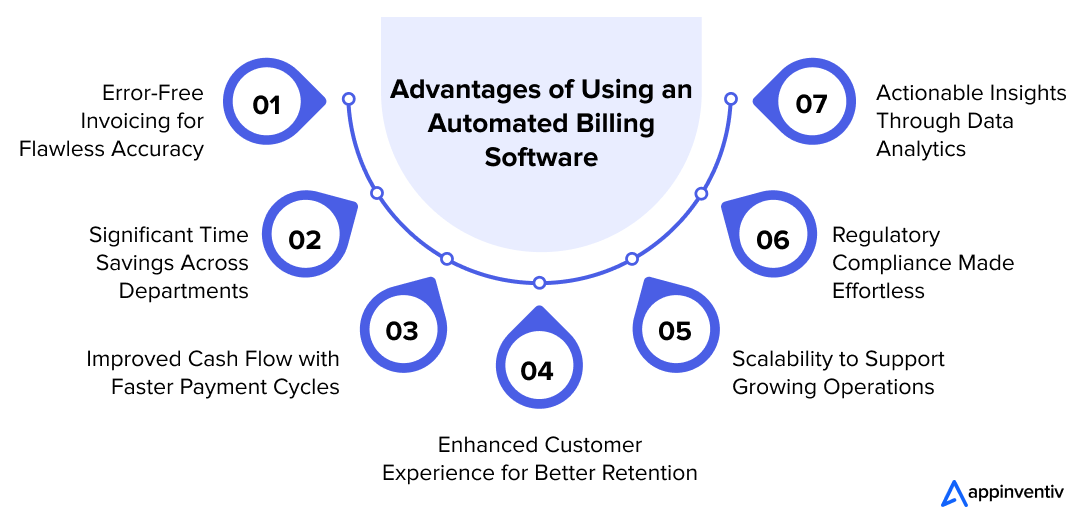

- Benefits of Using an Automated Billing Software

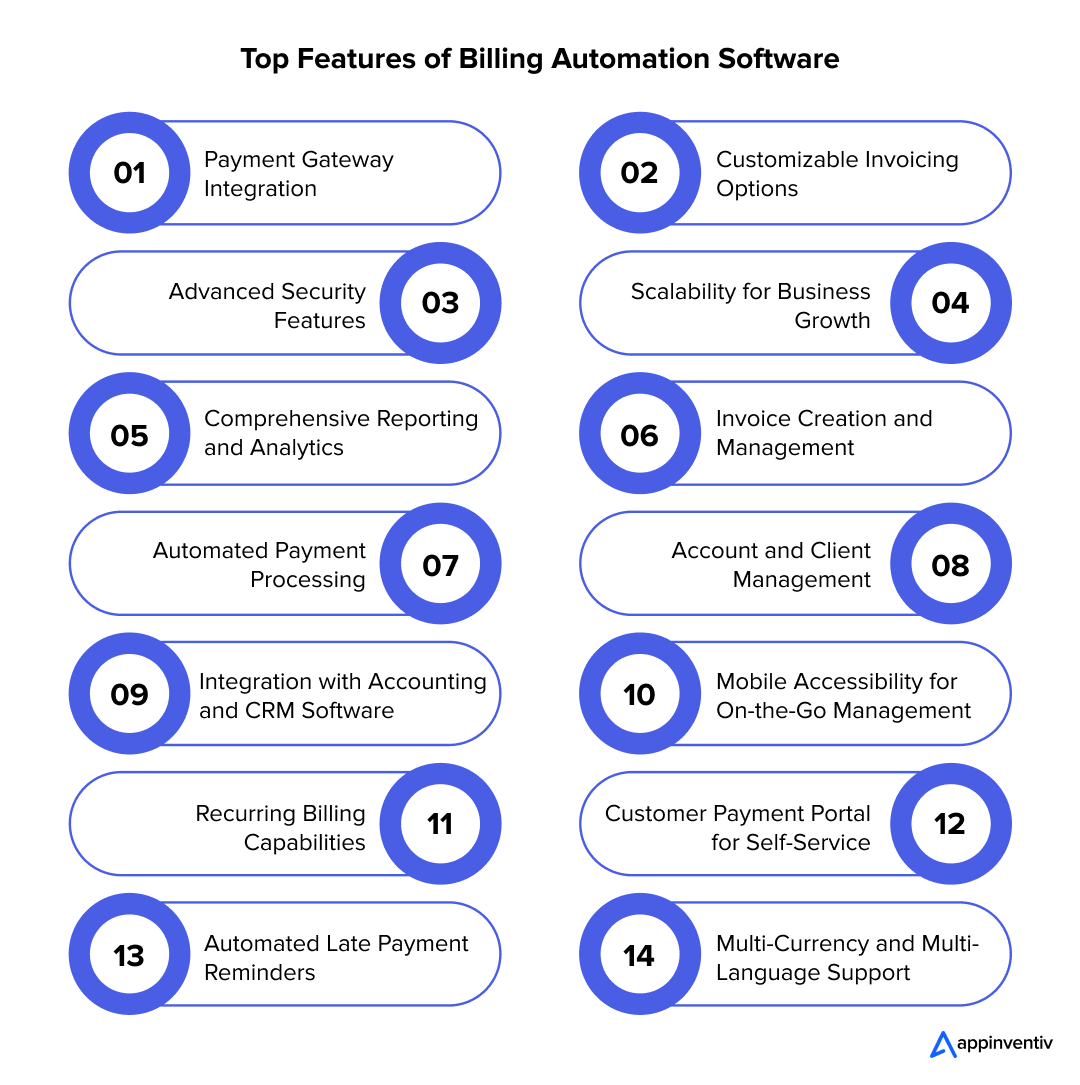

- Key Features of Billing Automation Software

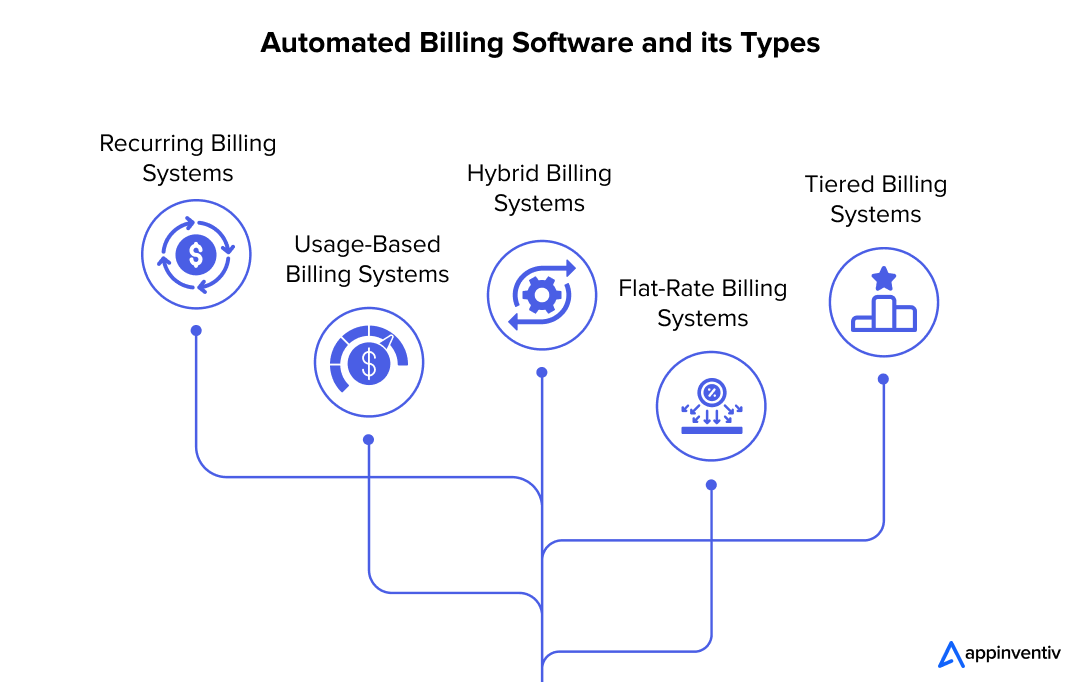

- Types of Automated Billing Software

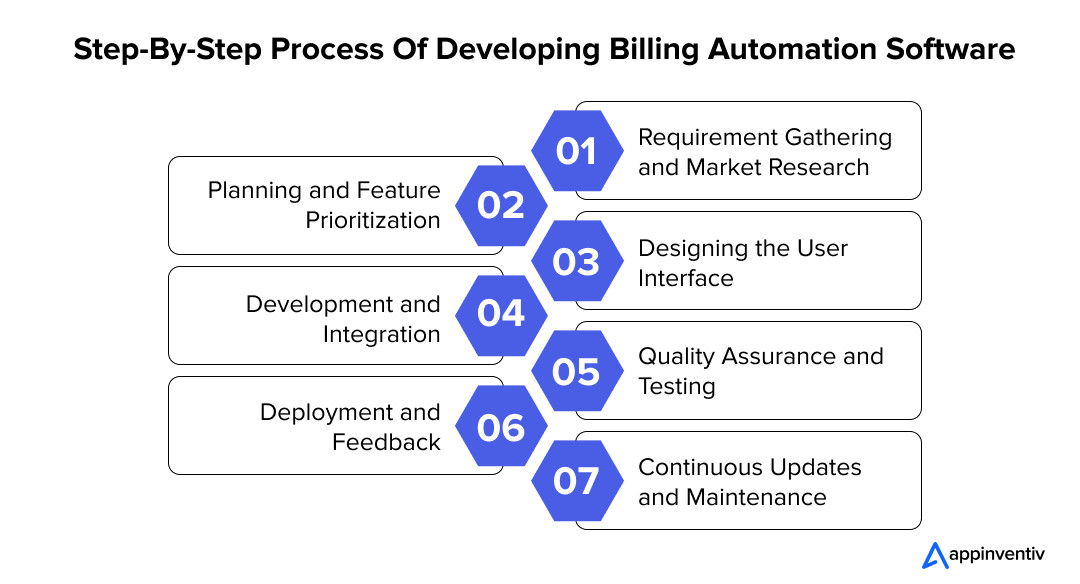

- Development Process for Billing Automation Software

- Development Costs of Billing Automation Software

- Seamless Implementation of Billing Automation Software: Key Steps and Pitfalls to Avoid

- Pitfalls to Avoid During the Implementation of Billing Automation Software

- How to Make a Future-Ready Platform

- How Can Appinventiv Help?

- FAQs.

A mid-sized retail company loses thousands of dollars monthly due to billing errors and delayed payments. The finance team spends hours manually generating invoices, tracking overdue payments, and reconciling accounts – all while dealing with frustrated customers over discrepancies. As the company expands, the inefficiencies of its manual billing system become glaringly apparent, hindering growth and customer satisfaction.

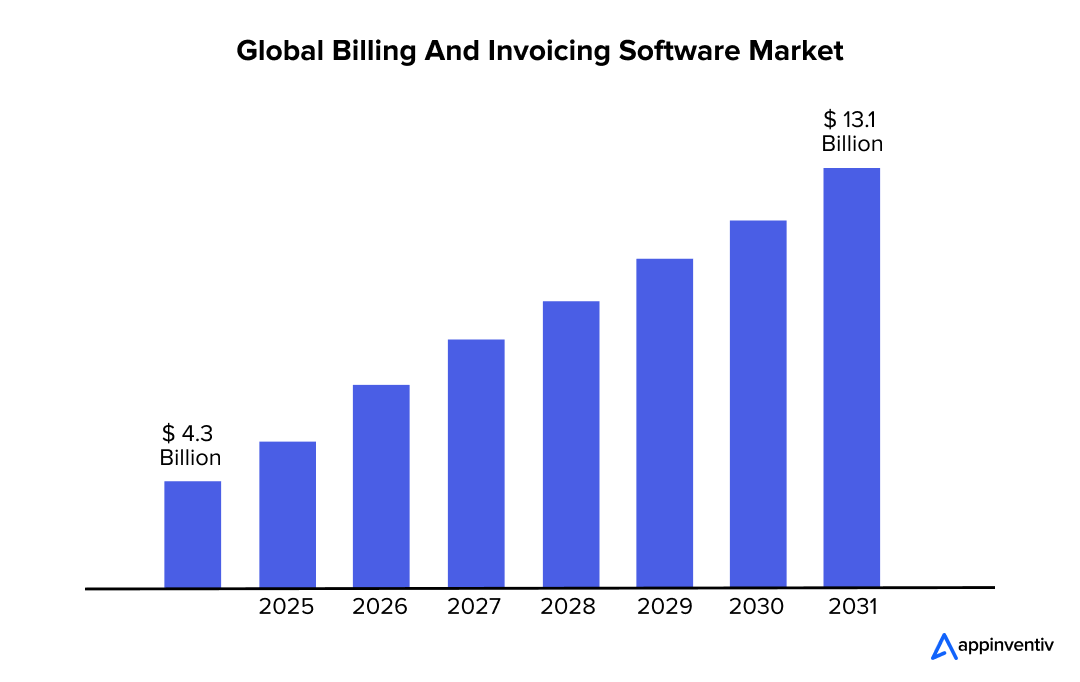

This is where billing automation software development steps in – a transformative solution that modernizes financial operations, eliminates errors, and saves time. For businesses striving to scale while ensuring seamless customer experiences, billing automation is no longer optional; it’s essential.

In this article, we will discuss multiple facets of automated billing software development, starting with the need for automation.

How Billing Automation Software Solve the Manual Billing System Problems?

Manual billing systems can cripple businesses in several ways, especially as operations grow in scale and complexity. Some of the key business-impacting key issues include:

- Human Error: Typos, missed payments, and incorrect amounts are all too common in manual processes.

- Time-Intensive Tasks: Creating invoices and following up on payments drains time and resources.

- Delayed Cash Flow: Payment delays caused by inefficient billing practices can lead to cash flow problems.

- Customer Dissatisfaction: Incorrect invoices and lack of payment flexibility frustrate customers, affecting retention.

- Lack of Scalability: Manual systems fail to keep pace with growing businesses, leading to bottlenecks and inefficiencies.

Automated billing systems development addresses these issues by streamlining invoicing, automating payment processes, and improving accuracy. Moreover, it ensures faster cash flow, enhanced customer experiences, and operational scalability.

But are these reasons enough for businesses to invest in automated billing app development? Well, let’s give you some more reasons for the impact of automated billing software.

Benefits of Using an Automated Billing Software

Billing automation software is not just a technological upgrade; it’s a strategic enabler that reshapes financial operations and enhances business efficiency. Let’s explore the extensive impact of automated billing software in greater detail:

1. Error-Free Invoicing for Flawless Accuracy

Manual billing processes are inherently prone to human error. A misplaced decimal point or an overlooked entry can cause significant financial discrepancies and damage client relationships. One key benefit of automated billing software is that it ensures that calculations, tax rates, and charges are applied precisely, drastically reducing errors.

2. Significant Time Savings Across Departments

Automating routine tasks, such as invoice generation, B2B SaaS subscription billing, payment reminders, and account reconciliation, liberates valuable time for finance teams. Instead of wrestling with spreadsheets, teams can focus on strategic initiatives, such as financial planning and customer engagement.

3. Improved Cash Flow with Faster Payment Cycles

Another benefit of automated billing software is automating invoice delivery and providing online payment options, which can shorten payment cycles and improve cash flow. Additionally, features like computerized reminders for late payments ensure that companies maintain healthy accounts receivable.

4. Enhanced Customer Experience for Better Retention

Customers value transparency and convenience. Implementing billing automation software enables businesses to offer user-friendly self-service portals where clients can view invoices, make payments, and track billing history. This not only enhances satisfaction but also fosters long-term loyalty.

5. Scalability to Support Growing Operations

As businesses grow, manual billing systems can become a bottleneck. Automated billing software is inherently scalable and capable of handling increased invoice volumes, multiple currencies, and complex billing models without compromising efficiency.

6. Regulatory Compliance Made Effortless

Staying compliant with local and international tax regulations is critical to financial operations. Automated invoice software development ensures that all invoices adhere to the latest compliance standards, mitigating the risk of costly fines or legal complications.

7. Actionable Insights Through Data Analytics

Integrating billing automation software with built-in reporting and analytics tools gives businesses valuable insights into payment trends, revenue streams, and customer behaviors. These insights empower businesses to make informed decisions and optimize financial strategies.

Integrating billing automation software powered by the most comprehensive feature set will allow you to see these benefits as the outcome of your billing automation software development process investment.

Knowing those features will help you develop a useful product and prepare your app for the future.

Key Features of Billing Automation Software

Recurring billing automation software development has robust features to streamline and enhance financial processes. Ultimately, each feature plays a vital role in ensuring efficiency, accuracy, and scalability:

1. Payment Gateway Integration

Seamless integration with multiple payment gateways, such as PayPal, Stripe, and Razorpay, ensures a smooth transaction process. This versatility allows businesses to cater to customer preferences, reducing payment delays.

2. Customizable Invoicing Options

Another key billing automation software feature is the ability for businesses to design invoices to align with their branding, including logos, colors, and personalized notes. This feature adds a professional touch to invoices while enhancing brand identity.

3. Advanced Security Features

Billing systems often handle sensitive customer data, making robust security essential. Billing automation software features like end-to-end encryption, fraud detection algorithms, and secure login protocols safeguard against unauthorized access and cyber threats.

4. Scalability for Business Growth

Whether billing a handful of clients or managing thousands of transactions, automated billing software solutions scale effortlessly. They support large invoice volumes, diverse customer bases, and international billing requirements.

5. Comprehensive Reporting and Analytics

Detailed dashboards and analytics tools provide insights into payment cycles, overdue accounts, and revenue trends. By integrating billing automation software with these reports, businesses can identify bottlenecks and optimize their billing processes.

6. Invoice Creation and Management

Automatically generate error-free invoices based on predefined templates. Billing automation software features such as bulk invoicing and scheduled invoice delivery simplify complex billing tasks, saving hours of manual work.

7. Automated Payment Processing

From recurring billing to instant payment confirmations, automated processing eliminates delays and manual intervention. Businesses can ensure faster cash flow and reduce dependency on follow-ups by focusing on this functionality as part of the billing automation software development process.

8. Account and Client Management

Centralized management of customer accounts and payment histories improves record-keeping. Detailed customer profiles help businesses track outstanding balances, purchase patterns, and payment preferences.

9. Integration with Accounting and CRM Software

Automated billing software development powered by seamless integration with CRM software like QuickBooks, Xero, or Salesforce ensures that all financial data is synchronized. This reduces redundancy, improves collaboration, and simplifies tax filings.

10. Mobile Accessibility for On-the-Go Management

A mobile-responsive automated billing software enables business owners and finance teams to manage invoices, approve payments, and monitor billing activities from anywhere, ensuring operational continuity.

11. Recurring Billing Capabilities

This feature automates billing for recurring charges, which is perfect for subscription-based businesses. It ensures consistency in invoicing and reduces the risk of missed payments.

12. Customer Payment Portal for Self-Service

Customers can access a dedicated portal to view their invoices, pay online, and track transaction history. This part of the automated billing software solutions can empower clients and minimize back-and-forth communications.

13. Automated Late Payment Reminders

Configurable reminders ensure that customers are notified of overdue payments without manual follow-ups. This often overlooked part of the automated billing systems development process can reduce delays and improve cash flow.

14. Multi-Currency and Multi-Language Support

Essential for global businesses, this feature allows invoices to be generated in various currencies and languages, catering to diverse customer bases.

These features collectively ensure that billing automation software is not just a financial tool but a strategic asset that drives operational excellence. By implementing billing automation software with these powerful features, businesses can overcome the inefficiencies of manual billing systems, reduce errors, and enhance customer satisfaction.

However, not all automated billing software solutions are created equal, and choosing the right system depends on your business model’s unique needs, transaction volumes, and customer preferences.

Understanding the different types of automated billing software available in the market is crucial to ensure your solution aligns seamlessly with your operational requirements and future scalability goals. Each type is designed to cater to specific billing scenarios, offering tailored functionalities to suit diverse industries and business processes.

Types of Automated Billing Software

Billing automation systems are not one-size-fits-all. Depending on the nature of your business, different models cater to specific needs. Here’s a comprehensive look at the major types of automated billing software:

1. Recurring Billing Systems

Recurring billing automation software development is ideal for subscription-based businesses. It automates the process of invoicing and charging customers at regular intervals. These systems are common in industries like SaaS, telecom, and streaming services. Key features include automated reminders, adjustable billing cycles, and integration with payment gateways for seamless transactions.

2. Usage-Based Billing Systems

Usage-based automated invoice software development charges customers based on the actual consumption of services or products. These systems, often used by utilities, cloud service providers, and IoT-based companies, require robust analytics to track usage and ensure accurate invoicing. Advanced algorithms calculate rates dynamically, creating transparency and trust between businesses and their clients.

3. Hybrid Billing Systems

Hybrid systems combine recurring and usage-based billing elements and offer flexibility for businesses with diverse revenue streams. For instance, a SaaS company might charge a base subscription fee while billing customers for additional services based on usage. This billing automation software development effort often results in a versatile system that caters to businesses with complex billing structures.

4. Flat-Rate Billing Systems

Flat-rate automated billing software development leads to systems that charge customers a fixed fee for services over a defined period. These are common in industries where simplicity and predictability are priorities, such as gym memberships or content subscriptions.

5. Tiered Billing Systems

Tiered systems offer pricing models based on different usage levels or features. Customers can select the plan that best suits their needs, making this system highly popular among SaaS and cloud-based companies.

The first step toward streamlining your financial operations is choosing the type of automated billing systems development you want to invest in.

Once you’ve identified the system that aligns with your business needs, the next crucial phase is its development. Building and integrating billing automation software requires careful planning, a clear understanding of your operational workflows, and the integration of advanced technologies to future-proof the solution.

Let’s explore the billing automation software development process that ensures your billing software is efficient, scalable, and tailored to your unique business goals.

Development Process for Billing Automation Software

The billing automation software development process often requires a structured approach to ensure reliability and scalability. Here’s a step-by-step to the development journey:

1. Requirement Gathering and Market Research

Identify your business and customer’s specific needs. Research competitors to understand industry standards, compliance requirements, and customer expectations.

2. Planning and Feature Prioritization

Define the core features based on business objectives and customer pain points. In this part of the automated invoice software development journey, you should prioritize features like payment gateway integration, automated invoicing, and reporting tools to address immediate needs while allowing for scalability.

3. Designing the User Interface

Create intuitive interfaces that enhance user experiences. A clean, mobile-responsive design ensures accessibility across devices, making it easier for businesses and customers to interact with the platform.

4. Development and Integration

Use a tech stack that supports scalability and security. At this stage of recurring billing automation software development, ensuring seamless integration with existing systems, such as accounting software, CRMs, and payment gateways, is critical.

5. Quality Assurance and Testing

Conduct thorough testing to identify bugs and ensure the software operates flawlessly under different conditions. We recommend testing for performance, security, and compliance to mitigate risks.

6. Deployment and Feedback

Launch the software in stages, starting with a pilot program. Gather user feedback to refine the automated billing app development process before a full-scale rollout.

7. Continuous Updates and Maintenance

Update the software regularly to incorporate new features, fix bugs, and ensure compatibility with emerging technologies and regulations.

While the development process outlines the steps needed to create functional and efficient billing automation software, it’s important to understand how each phase contributes to the overall development costs. Moreover, factors such as the complexity of features, the choice of technology stack, and the level of customization required can significantly influence the budget.

For example, developing utility billing software with AI-driven analytics to predict usage patterns can increase development time and cost but offers greater value through better forecasting and customer engagement. On the other hand, building a smart metering platform that integrates blockchain for secure energy transactions would also require higher investment due to added technical complexity. Similarly, integrating with existing enterprise systems and ensuring compliance with industry regulations can also add to the overall billing automation software development costs.

Let’s briefly examine the investments the billing automation platform owners will need to make to create a powerful, scalable product.

Development Costs of Billing Automation Software

The cost of developing billing automation software depends on various factors, including the complexity of features, team size, and region. Here’s a rough estimate:

- Basic Software: $20,000 – $50,000, requiring 300-500 development hours.

- Mid-Range Software: $50,000 – $100,000, requiring 500-800 development hours.

- Enterprise-Grade Software: $100,000+, with over 1,000 development hours.

Other billing automation software development cost considerations include licensing fees for third-party integrations, cloud storage expenses, and ongoing maintenance costs.

Also Read: How Much Does it Cost to Build a Custom Billing Software?

Understanding the billing automation software development costs is just the beginning. The true value lies in how effectively the software is implemented within your business operations. Proper planning ensures a smooth transition, avoiding disruptions while maximizing ROI.

Focus on aligning the software with your existing processes and systems, ensuring that both technical teams and end-users are prepared for the change. Let’s discuss the process and roadblocks of implementing billing automation software.

Seamless Implementation of Billing Automation Software: Key Steps and Pitfalls to Avoid

In addition to automated billing software development, implementing billing automation software within your existing system can be a transformative move for your business, but it requires a strategic approach. From system audits to user training, every step plays a crucial role in ensuring a smooth transition.

Below, we explore the detailed steps involved in integrating billing automation software into your existing operations, potential challenges, and how to avoid them.

1. Comprehensive System Audit

Before implementing a new system, start with a comprehensive audit of your existing billing infrastructure. This involves identifying gaps, inefficiencies, and pain points within the current processes.

A detailed audit at the automated billing systems development stage will also help assess the compatibility of existing tools like ERP and CRM systems with the new software. Moreover, this step provides valuable insights into the data and workflows that need to be carried over to the new system, ensuring no disruptions during the migration.

2. Secure Data Migration

The next critical phase is data migration. Vast amounts of historical data must be moved precisely from legacy systems to the new platform. Billing data such as invoices, payment history, customer records, and transaction details must be migrated without any loss or corruption of information.

A phased migration approach should be followed, with data integrity and security tested at each stage. At this stage of the automated billing app development journey, automated tools can help streamline the process, ensuring that data is accurately transferred and properly mapped into the new system.

3. Seamless Integration with Legacy Systems

Integration is often the most challenging part of implementing billing automation. The new software must work harmoniously with your existing systems, such as CRM platforms, accounting software, and ERP solutions.

It’s essential to ensure that these systems can exchange data in real-time and function seamlessly together. During this step, you may need to build custom APIs or connectors to facilitate communication between different systems, especially if you have older platforms that require special handling.

4. Thorough Testing for Consistent Performance

Once integration is complete, extensive testing is required to ensure the system functions as expected. Testing should include various scenarios such as payment processing, invoice generation, reporting, and system scalability. It’s also vital to verify compliance with industry regulations during this phase.

Testing will help identify potential bugs, slow performance, and user experience challenges at this automated invoice software development and implementation phase. Regular feedback from organizational stakeholders will help optimize the system before full deployment.

5. Staff Training

Even the most robust billing automation software will be ineffective if the team isn’t trained to use it efficiently. Proper training ensures that employees can manage the software and troubleshoot minor issues.

Comprehensive training sessions tailored to different teams, whether for the finance department handling payments or customer service teams managing billing inquiries, are important. Additionally, ongoing support should be part of the recurring billing automation software development journey to address any questions that may arise as users familiarize themselves with the platform.

Pitfalls to Avoid During the Implementation of Billing Automation Software

While implementation can bring substantial improvements, organizations often face several challenges in automated billing implementation. Here are some common pitfalls to avoid during the integration of billing automation software:

1. Data Inconsistencies: Ensuring Clean Data Migration

One of the most common challenges in automated billing implementation is data inconsistency. Migrating historical billing data from one system to another poses a risk of incomplete or inaccurate information, leading to billing errors and customer dissatisfaction.

Solution: To avoid this, you should perform data cleansing before migration – removing duplicates, correcting errors, and validating customer records to ensure data integrity. It’s crucial to involve a data expert to ensure all records are correctly mapped and synchronized in the new system.

2. Integration Hurdles with Legacy Systems

Many businesses use a mix of old and new technologies, and integrating billing automation software development with legacy systems can be tricky. The risk is that new software might not communicate well with your older systems, leading to data silos, manual interventions, and inefficient workflows.

Solution: To mitigate this risk, choose billing automation software with flexible integration options and open APIs. Additionally, working with experienced developers to build custom connectors can ensure a smooth integration process.

3. Resistance to Change: Overcoming Organizational Pushback

Implementing new software can often face resistance from employees accustomed to legacy systems or manual processes. This resistance can lead to suboptimal use of the new system, hindering its full potential.

Solution: Overcoming this requires a strategic change management plan, which includes clear communication about the new system’s benefits and ongoing support throughout the transition period. Including key stakeholders in the decision-making process is also important to make them champions of the change.

4. Lack of Post-Implementation Support

Even after deployment, the success of all automated billing software development efforts will rely on continuous monitoring and support. The software can quickly become outdated or encounter bugs and security vulnerabilities without ongoing maintenance and updates.

Solution: To prevent this, ensure that your chosen billing automation software provider offers reliable post-implementation support. Regular software updates, user training refreshers, and a support team to resolve issues will help keep the system functioning optimally.

5. Failing to Future-Proof the System

Billing needs to evolve, and businesses must prepare for future growth. Failing to choose a scalable solution or anticipate upcoming regulatory changes can make the software obsolete within a few years.

Solution: Ensure that the selected billing automation system offers the flexibility to scale as your business grows and supports integration with emerging technologies and future payment methods. This foresight will save you time and money in the long run, preventing costly system overhauls later.

By carefully planning to address these challenges in automated billing implementation, businesses can successfully integrate billing automation systems that will streamline operations and drive long-term growth. Approaching the process systematically is critical to maximizing the benefits of automation and ensuring the software’s success.

Once automated billing systems’ development and implementation challenges are addressed, the focus should shift toward future-proofing your billing automation platform. As businesses grow and technologies evolve, adapting to emerging needs becomes essential.

This is where our team of payment software development experts believe ensuring flexibility, scalability, and readiness for integration with advanced technologies like AI and machine learning can position your platform as a long-term asset.

How to Make a Future-Ready Platform

Your billing automation software must embrace future-ready technologies to stay ahead in the competitive landscape. In our decade-long experience as a reliable and tech-first fintech software development company, here are some technologies we have seen impacting the billing automation software space.

1. AI and Machine Learning Integration: Use AI to predict payment patterns, flag anomalies, and enhance decision-making.

2. Blockchain for Transparency: Leverage blockchain to ensure tamper-proof invoicing and secure transaction tracking.

3. Cloud-Based Solutions: Cloud infrastructure ensures scalability and remote accessibility.

4. IoT Compatibility: With the rise of connected devices, ensure your platform can handle IoT-driven billing models.

5. Globalization Support: Incorporate multi-currency and multi-language features to cater to global markets.

Staying aligned with the latest automated billing software trends ensures your platform remains relevant in a fast-changing market. From AI-powered insights and blockchain integration to subscription-based billing and predictive analytics, these innovations transform how businesses manage their financial workflows.

At Appinventiv, we understand the importance of building a future-ready platform that incorporates cutting-edge trends and aligns with your unique business goals. By leveraging our expertise, you can create a scalable and secure billing automation solution that streamlines operations and positions your business for long-term success.

But at this point, I am sure you must be wondering how we can help you in your journey. Well, here’s how.

How Can Appinventiv Help?

As the top fintech software development company, Appinventiv specializes in billing automation software development and payment software development services for businesses across industries. With expertise in fintech software development, we combine cutting-edge technologies like AI, blockchain, and cloud computing to create secure, scalable, and future-ready platforms.

Our team takes a consultative approach, understanding your unique needs and delivering solutions that integrate seamlessly with your existing systems. From designing user-centric interfaces to ensuring compliance with global standards, Appinventiv is your trusted partner in digital transformation.

Whether you’re a startup or an established enterprise, investing in billing automation is a strategic decision that promises long-term returns. Partner with us to build tailored software to your needs and embrace the future of financial operations.

FAQs.

Q. What is automated billing software?

A. Automated billing software is a digital tool designed to streamline billing by automating tasks like invoice generation, payment reminders, and transaction tracking. It eliminates manual errors, reduces administrative workload, and ensures faster payment cycles. These systems are equipped with features like recurring billing, customizable templates, tax calculations, and real-time reporting, making them ideal for businesses aiming to improve financial efficiency.

Q. How does an automated billing software work?

A. Automated billing software integrates with your business’s existing systems to manage billing tasks seamlessly. Once set up, the software can automatically generate invoices based on predefined parameters such as usage, subscription plans, or one-time purchases. It can also send invoices to customers, track payments, and send automated reminders for overdue accounts. Advanced systems may also offer analytics to provide insights into payment trends and cash flow. This entire process minimizes manual intervention while improving accuracy and speed.

Q. What types of businesses use automated billing software?

A. Automated billing software is versatile and caters to a wide range of industries, including:

- SaaS Companies: For managing recurring subscriptions and tiered pricing.

- E-commerce Platforms: To automate customer billing and manage payment gateways.

- Utilities and Telecom: This is for usage-based billing and invoicing.

- Healthcare Providers: For managing patient invoices and insurance claims.

- Freelancers and Small Businesses: This tracks payments and automates recurring invoices.

Automated billing software can benefit businesses with frequent billing, recurring payments, or complex invoicing structures.

Q. What are some prominent examples of automated billing systems?

A. Prominent examples of automated billing software include:

- Zoho Subscriptions: Ideal for subscription-based businesses with customizable features.

- Chargebee: Known for its scalability and integration options.

- QuickBooks: Popular for small businesses and freelancers, offering easy invoicing and payment tracking.

- Stripe Billing: Perfect for managing recurring billing and subscription models.

- FreshBooks: User-friendly and great for automating invoices and expense tracking.

These tools are widely used across industries to simplify billing processes and enhance financial management.

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…

How to Approach Currency Converter App Development?

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool. With global transactions becoming the norm and forex markets fluctuating…